Outline ·

[ Standard ] ·

Linear+

EPF - self contribution, need advise

|

poweredbydiscuz

|

Feb 6 2024, 01:33 PM Feb 6 2024, 01:33 PM

|

|

QUOTE(gamenoob @ Feb 6 2024, 01:27 PM) I also confused can't find the info on what the max employee contribution can go for... some mentioned full, some say 20%, 19%..... check kwsp site also no such info... Same reason why you can't find the info about what's the maximum amount of money one can have in his/her epf account in the website. Because there's none. |

|

|

|

|

|

poweredbydiscuz

|

Feb 8 2024, 08:43 AM Feb 8 2024, 08:43 AM

|

|

QUOTE(magika @ Feb 7 2024, 09:59 PM) Just for info purposes. If you contribute to i-saraan and you can be sure if the funds are not kicked back to your bank account in about 30 days, then can confirm you are qualfied. Contribute 10k to i-saraan for my missus account beginning of January, and the total contribution was refunded today . The fund is from your own bank or your missus bank? |

|

|

|

|

|

poweredbydiscuz

|

Feb 8 2024, 04:51 PM Feb 8 2024, 04:51 PM

|

|

QUOTE(nexona88 @ Feb 8 2024, 09:32 AM) Thanks... Now I know... The age limit thingy is based on the year you're Born not the month of your Born.... Example even your birthday is November.... January already not qualified for i-saraan contribution 🙏 Hmm... Then the self contribution age limit (75 y/o) is based on date of birth or just the year? From what I know the withdrawal age (50/55/60 y/o) is based on the date of birth. This post has been edited by poweredbydiscuz: Feb 8 2024, 04:54 PM |

|

|

|

|

|

poweredbydiscuz

|

Feb 12 2024, 12:26 PM Feb 12 2024, 12:26 PM

|

|

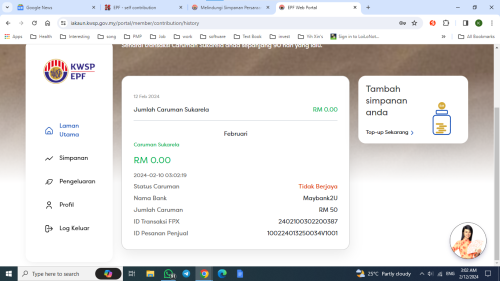

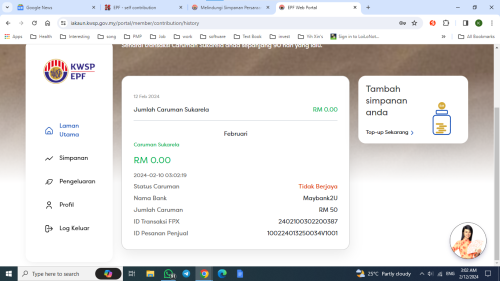

QUOTE(gedebe @ Feb 12 2024, 03:04 AM)  I've deposited rm100 from M2U selecting i-saraan but end up above? The weird part is you deposit rm100 but it shows rm50 instead. |

|

|

|

|

|

poweredbydiscuz

|

Feb 26 2024, 03:27 PM Feb 26 2024, 03:27 PM

|

|

This year still have tax relief for self-contribution?

|

|

|

|

|

|

poweredbydiscuz

|

Feb 26 2024, 05:07 PM Feb 26 2024, 05:07 PM

|

|

QUOTE(ronnie @ Feb 26 2024, 04:58 PM) YA2023 added self contribution RM4000 (i.e. taken same as employee contribution's RM4000 pool) I mean YA2024. EPF self contribution + life insurance = RM3k max tax relief. Still have? |

|

|

|

|

|

poweredbydiscuz

|

Feb 29 2024, 09:23 AM Feb 29 2024, 09:23 AM

|

|

QUOTE(e46 @ Feb 28 2024, 10:38 PM) errr depends, sometimes more and sometimes less, its my own company anyway  tax part was painful thou... but i got another payroll in HKG with better tax  Since it's your own company, why wanna declare such high salary and subject yourself to unavoidable high tax? This post has been edited by poweredbydiscuz: Feb 29 2024, 09:23 AM |

|

|

|

|

|

poweredbydiscuz

|

Mar 11 2024, 11:16 AM Mar 11 2024, 11:16 AM

|

|

QUOTE(virtualgay @ Mar 11 2024, 11:09 AM) today if we continue self contribute but suddenly let just say i yet to reach 55 (i am 51 this year and total EPF <RM1 Million) and i got retrench due company decision, can i ask for all the money that i self contribute back? » Click to show Spoiler - click again to hide... «

i guess the best approach is account 3 saja...

so sometimes we cannot think that everyone has a job and want to withdraw money to buy luxury / non necessity item, there are desparate time as well so for now i am all for account 3 - those need it take it, those dont need it ignore it

anything could happen to me with my age 51 years old and company keep taking about retrench and i damn scare i will kena, a few of my cube mates dah kena and they payout is 1 year 1 month maximum 12 months saja

i work this company 17 years so not worth for me la... rugi 5 bulan if i kena!

Of course cannot. But in your case after age 50 y/o can apply for one time withdraw (acc 2). This post has been edited by poweredbydiscuz: Mar 11 2024, 11:20 AM |

|

|

|

|

|

poweredbydiscuz

|

Mar 11 2024, 01:00 PM Mar 11 2024, 01:00 PM

|

|

QUOTE(lowyat101 @ Mar 11 2024, 12:47 PM) assuming withdraw until account 2 is depleted but account 1 still got more than 1 mil, can still withdraw from account 1 right? thanks Can. |

|

|

|

|

|

poweredbydiscuz

|

Mar 20 2024, 08:20 AM Mar 20 2024, 08:20 AM

|

|

QUOTE(Ayambetul @ Mar 20 2024, 12:14 AM) If i put in 10k in December, then withdraw at july. Will the 10k still enjoy the annual dividend for period of 6 month by prorated basis? 1 day dividend in Dec + 6 months dividend Jan-Jun + few days dividend in Jul up until withdrawal day. |

|

|

|

|

|

poweredbydiscuz

|

Mar 20 2024, 09:06 AM Mar 20 2024, 09:06 AM

|

|

QUOTE(dwRK @ Mar 20 2024, 09:01 AM) first time counter for thumb print and bank account verification only lah... withdraw any amount also can... me withdraw rm50... funny story... when i told counter lady withdraw 50... she then started intro monthly standing order blah blah blah... i got so confused... then realize she tot i wanna withdraw 50k... lol... My first withdrawal got cents cents some more. Just to make the balance a nice round number lol. |

|

|

|

|

|

poweredbydiscuz

|

Apr 26 2024, 10:26 AM Apr 26 2024, 10:26 AM

|

|

QUOTE(nexona88 @ Apr 26 2024, 10:23 AM) Today you deposit Monday only refected... Should done yesterday, Thursday... Then Saturday refected already 🙏 Any difference? |

|

|

|

|

|

poweredbydiscuz

|

Apr 30 2024, 01:04 PM Apr 30 2024, 01:04 PM

|

|

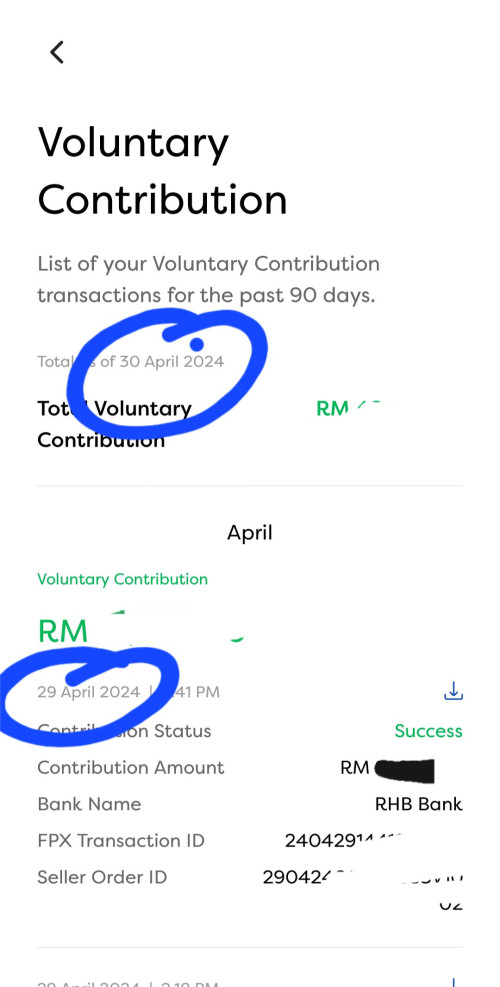

QUOTE(hoohs @ Apr 30 2024, 12:42 PM) Hi How do we check if it is reflected? I transferred yesterday 29Apr via app+FPX. Today I check the app, under Voluntary Contribution tab, is is shown transferred. I thought someone here said it will take about T+2? » Click to show Spoiler - click again to hide... « They mean reflected on the total saving balance (Savings > View Details). This post has been edited by poweredbydiscuz: Apr 30 2024, 01:05 PM |

|

|

|

|

|

poweredbydiscuz

|

Jun 25 2024, 09:55 AM Jun 25 2024, 09:55 AM

|

|

QUOTE(virtualgay @ Jun 25 2024, 09:42 AM) i thought this thread kena tutup... mana tahu active lagi self contribution goes to account 3 - 10%, u wont feel worry that by 2025 they give lower tier dividend for account 3? or we have to go with the thinking that - dont worry something u cannot control If you worry, you can withdraw acc3 and recontribute again few rounds to keep it minimum. This may consume the yearly quota tho. In future should be able to auto transfer from acc3 to acc1/2. This post has been edited by poweredbydiscuz: Jun 25 2024, 09:59 AM |

|

|

|

|

|

poweredbydiscuz

|

Jul 27 2024, 07:46 AM Jul 27 2024, 07:46 AM

|

|

QUOTE(theevilman1909 @ Jul 26 2024, 04:45 PM) just fill up form at EPF office lorh simple as that https://www.kwsp.gov.my/documents/20119/443...4df40f3?previewdon't waste time print. ask them form, fill up & send to counter  Some people seriously too free nothing better to do. This post has been edited by poweredbydiscuz: Jul 27 2024, 07:46 AM |

|

|

|

|

|

poweredbydiscuz

|

Aug 13 2024, 04:37 PM Aug 13 2024, 04:37 PM

|

|

QUOTE(terrytong99 @ Aug 13 2024, 04:22 PM) Hi all sifu, want to check, if l perform self contribution, proportion will be 70% to Acc 1, 20% to Acc 2 & 10% to Acc 3? 75% to Acc 1, 15% to Acc 2 & 10% to Acc 3 |

|

|

|

|

|

poweredbydiscuz

|

Aug 15 2024, 01:13 PM Aug 15 2024, 01:13 PM

|

|

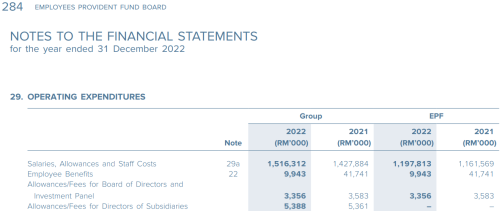

QUOTE(ronnie @ Aug 15 2024, 09:56 AM) EPF officer won't get the civil servant pay hike and bonus announce ? Their salary is paid by EPF from our EPF fund, not by government.  |

|

|

|

|

|

poweredbydiscuz

|

Aug 15 2024, 01:19 PM Aug 15 2024, 01:19 PM

|

|

QUOTE(leanman @ Aug 15 2024, 01:16 PM) yeah but its still under the influential of MOF in term of many things. I'm replying to that specific post about their salary. |

|

|

|

|

|

poweredbydiscuz

|

Aug 28 2024, 01:04 PM Aug 28 2024, 01:04 PM

|

|

QUOTE(lowyat101 @ Aug 28 2024, 01:00 PM) Hi, wanna ask about the Account 3. From my understanding, for now we can use it as a contingency fund right? Meaning that let's say now I need some cash due to emergency, I can just withdraw it and later after few days when I get the fund back, I can just self-contribute it back right? Provided that I haven't exceeded the yearly self-contribution limit. Thanks Yes but take note that when you self-contribute it back later, it won't 100% go back to Account 3 but follow 75:15:10 ratio. |

|

|

|

|

|

poweredbydiscuz

|

Sep 13 2024, 01:57 PM Sep 13 2024, 01:57 PM

|

|

QUOTE(Omgf @ Sep 13 2024, 01:42 PM) If elder parents fingerprint not working (due to aging/chemical effect), how to withdraw the EPF? Did you bring them to JPN to update the fingerprint? |

|

|

|

|

Feb 6 2024, 01:33 PM

Feb 6 2024, 01:33 PM

Quote

Quote

0.0243sec

0.0243sec

0.71

0.71

7 queries

7 queries

GZIP Disabled

GZIP Disabled