Outline ·

[ Standard ] ·

Linear+

EPF - self contribution, need advise

|

poweredbydiscuz

|

Feb 28 2023, 04:13 PM Feb 28 2023, 04:13 PM

|

|

QUOTE(ronnie @ Feb 28 2023, 03:58 PM) Do you mean : RM4k for EPF contribution employment RM3k for life insurance RM3k for EPF self-contribution [NEW 2023] Total = RM10k tax relief ? RM4k for EPF contribution employment RM3k for life insurance + EPF self-contribution Total = up to RM7k tax relief |

|

|

|

|

|

poweredbydiscuz

|

Feb 28 2023, 04:16 PM Feb 28 2023, 04:16 PM

|

|

QUOTE(ronnie @ Feb 28 2023, 04:15 PM) that means no difference lah... aiyo... i thought got extra RM3k to claim in 2023 . The Govt would increase higher limit TAX Relief for EPF, Insurance la No difference if your life insurance already max rm3k. For me, my life insurance is less than rm2k, so my epf self-contribution can get tax relief. This post has been edited by poweredbydiscuz: Feb 28 2023, 04:18 PM |

|

|

|

|

|

poweredbydiscuz

|

Mar 2 2023, 01:15 PM Mar 2 2023, 01:15 PM

|

|

QUOTE(Jack&Guild @ Mar 2 2023, 12:58 PM) Previous few years gomen servant (pencen) not allowed to claim exemption for epf self contribution at all. Does this new tnc allows gomen servant to claim epf exemption for YA2023? Based on kwsp website, they say "This initiative can be enjoyed by all workers, both in the formal or informal sector, who make voluntary contributions to the EPF." Not sure they include gomen servants or not. https://www.kwsp.gov.my/en/web/guest/w/budg...-infrastructure |

|

|

|

|

|

poweredbydiscuz

|

Mar 29 2023, 08:21 PM Mar 29 2023, 08:21 PM

|

|

QUOTE(nexona88 @ Mar 29 2023, 08:05 PM) Don't think would change overnight... Why not at SSPN??? Interest is much higher? |

|

|

|

|

|

poweredbydiscuz

|

Mar 29 2023, 08:33 PM Mar 29 2023, 08:33 PM

|

|

QUOTE(nexona88 @ Mar 29 2023, 08:26 PM) Yes... Better park at SSPN if children education purposes... EPF okay. But only account 2 can withdraw for education purposes.... Not everyone have 1mil above 😅 He clearly said >1 mil tho. |

|

|

|

|

|

poweredbydiscuz

|

Mar 31 2023, 05:06 PM Mar 31 2023, 05:06 PM

|

|

QUOTE(wongmunkeong @ Mar 31 2023, 03:55 PM) the withdrawn amount - EPF took out from which account? ie. ac1 or ac2 OR 70%/30% from ac1/ac2  From acc 2 & if insufficient from acc 1. |

|

|

|

|

|

poweredbydiscuz

|

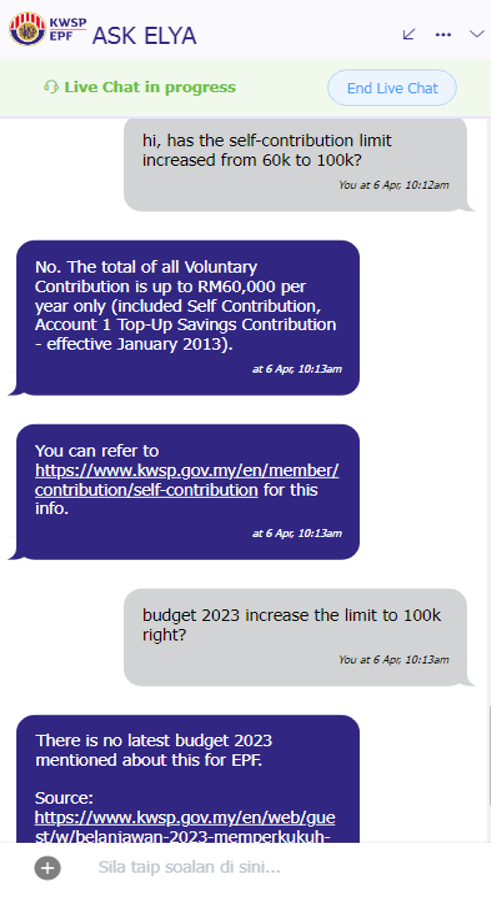

Apr 6 2023, 10:18 AM Apr 6 2023, 10:18 AM

|

|

|

|

|

|

|

|

poweredbydiscuz

|

Apr 6 2023, 10:32 AM Apr 6 2023, 10:32 AM

|

|

QUOTE(nexona88 @ Apr 6 2023, 10:29 AM) Need to wait I guess... This chatbot always use textbook reply one.... Not really accurate.... It's a real person. But ya i guess they also haven't receive any confirmation from pihak atasan. |

|

|

|

|

|

poweredbydiscuz

|

Apr 6 2023, 10:37 AM Apr 6 2023, 10:37 AM

|

|

QUOTE(nexona88 @ Apr 6 2023, 10:35 AM) Real person?? Seriously 🤔🧐 Anyway... Want accurate... Talk to actual person... Called their center.... Talk directly to get information 🙏 Just type live chat or live agent then they will assign a real person to chat with you. |

|

|

|

|

|

poweredbydiscuz

|

Apr 10 2023, 07:57 AM Apr 10 2023, 07:57 AM

|

|

QUOTE(imceobichi @ Apr 10 2023, 07:53 AM) To all eagerly waiting for 100k contribution limit, how much extra do you plan to contribute? The way I see it here, quite a few forummers blow like they have rm 1mil in the sideline waiting to deposit into epf account Or if your parent is >55y/o, you can "borrow" their epf account. |

|

|

|

|

|

poweredbydiscuz

|

Apr 12 2023, 11:22 AM Apr 12 2023, 11:22 AM

|

|

QUOTE(brandonkl @ Apr 12 2023, 11:11 AM) So say if I have RM100k to self contribute, I will still gain dividen if I contribute RM100k in April (Apr to Dec dividen) vs December (1 mth dividen)? If you contribute in April, you will get May to Dec dividend. |

|

|

|

|

|

poweredbydiscuz

|

Apr 25 2023, 06:01 PM Apr 25 2023, 06:01 PM

|

|

QUOTE(nexona88 @ Apr 25 2023, 05:51 PM) don't know when the new limit... some says already implemented but I see in apps still the old 60k  seriously... really fishy... what they waiting for.... even dewan negara approved.... Musim raya.. Sabar ya.. |

|

|

|

|

|

poweredbydiscuz

|

Apr 26 2023, 09:18 AM Apr 26 2023, 09:18 AM

|

|

QUOTE(strawsticks @ Apr 26 2023, 12:12 AM) Hello, I'm new to this thread. Can i ask if this is official info? I always thought EPF dividend is calculated by number of days. If it's true they only calculate from 1 day before last date of the month, then there is no point for me to self contribute early of the month? I have been self contributing early in the month like 1st or 2nd days... so based on your info, i rugi like 28 days of interest that i could have earn from the bank 😅 Here's the official dividend calculation. https://www.kwsp.gov.my/en/about-epf/resources/faqMember - Overview > How is the EPF dividend rate calculated? The dividend is calculated based on the “Modified Aggregate Daily Balance”. Contributions for a particular month will be eligible for dividend based on the last day of the contribution month until 31st December 2022. |

|

|

|

|

|

poweredbydiscuz

|

Apr 26 2023, 12:25 PM Apr 26 2023, 12:25 PM

|

|

QUOTE(Super2047 @ Apr 26 2023, 10:42 AM) Say if we have a total of RM1.5M in EPF (Acc1 RM1.1M, Acc2 400k), can we withdraw all RM500K or just the RM400k in Acc2? Age below 55. RM400k from acc2 + RM100k from acc1 |

|

|

|

|

|

poweredbydiscuz

|

Apr 26 2023, 01:28 PM Apr 26 2023, 01:28 PM

|

|

QUOTE(romuluz777 @ Apr 26 2023, 01:19 PM) You can withdraw any amount above RM 1 million, which in this case its RM 500K. It doesn't matter whether it comes from Acct 1 or 2.It matters for future withdrawal. |

|

|

|

|

|

poweredbydiscuz

|

Apr 26 2023, 01:31 PM Apr 26 2023, 01:31 PM

|

|

QUOTE(Super2047 @ Apr 26 2023, 01:29 PM) If the full RM500k can be withdrawn from acc1, then your acc2 will still have RM400k, which you have many options to withdraw it. |

|

|

|

|

|

poweredbydiscuz

|

Apr 27 2023, 07:38 AM Apr 27 2023, 07:38 AM

|

|

QUOTE(xander2k8 @ Apr 26 2023, 06:24 PM) Or those curious cats 🤦♀️ Those already reach more than 1million won’t not be bothered where the money is withdraw from which account so as long as they are able to withdraw to the sum they want 🤦♀️ QUOTE(romuluz777 @ Apr 26 2023, 07:17 PM) Exactly, and those who are concerned about which account it comes from are the lesser sub-1M folks who need to watch out for every cent that can be squeezed out from their EPF accounts. QUOTE(xander2k8 @ Apr 26 2023, 07:26 PM) If they have it already they won’t be asking but will withdraw 1st rather than asking 🤦♀️ as those asking mostly are curious cats not eligible That’s why those folks are most curious when we all know that once have a million you will start withdrawing even without asking because they know that are able to do it for countless times in the future Just sharing the info. Some may find it useful. No need so butthurt about it. Cheers. |

|

|

|

|

|

poweredbydiscuz

|

Jun 6 2023, 10:32 AM Jun 6 2023, 10:32 AM

|

|

For epf mobile app self contribution, is it ok if the EPF account and FPX bank account are different name?

|

|

|

|

|

|

poweredbydiscuz

|

Jun 8 2023, 08:27 AM Jun 8 2023, 08:27 AM

|

|

QUOTE(low yat 82 @ Jun 8 2023, 07:47 AM) sorry new in here. can use desktop for self contribution or not a. means this self contribution can b done adhoc n no need deduct from salary la ? Online banking website - yes. I-Akaun website - no. |

|

|

|

|

|

poweredbydiscuz

|

Jun 13 2023, 08:42 AM Jun 13 2023, 08:42 AM

|

|

QUOTE(ronnie @ Jun 12 2023, 06:15 PM) So at age 55, Akaun 1 + Akaun 2 becomes Akaun 55 Any topup from age 55 onwards starts a new Akaun Emas, which can start withdraw after age 60 Yup. QUOTE(tropik @ Jun 13 2023, 12:34 AM) Guys, you got me thinking if its possible to use elder's name to put in the self contribution, with the benefit that the amount can be taken out any time? Yes. QUOTE(tropik @ Jun 13 2023, 12:34 AM) The interest for the self contribution is calculated daily or monthly right? Calculated daily starting from the last day of the contribution month. |

|

|

|

|

Feb 28 2023, 04:13 PM

Feb 28 2023, 04:13 PM

Quote

Quote

0.0246sec

0.0246sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled