Outline ·

[ Standard ] ·

Linear+

EPF - self contribution, need advise

|

poweredbydiscuz

|

Sep 13 2024, 02:09 PM Sep 13 2024, 02:09 PM

|

|

QUOTE(Omgf @ Sep 13 2024, 02:02 PM) Got the JPN Maklumat Kandungan CIP paper only. But macam for traveling purpose? Not sure about that but should be ok i guess. Bring that paper to EPF counter along with IC and bank statement to activate online/app withdrawal. But better confirm with EPF live chat agent online first before going. This post has been edited by poweredbydiscuz: Sep 13 2024, 02:11 PM |

|

|

|

|

|

poweredbydiscuz

|

Oct 1 2024, 09:16 AM Oct 1 2024, 09:16 AM

|

|

QUOTE(MGM @ Oct 1 2024, 09:07 AM) And if u r contributing EPF from employment can request company to max their contribution instead of 13%. This is on top of the 100k self contribution. U can then use your cash for expenses. QUOTE(Prometric @ Oct 1 2024, 09:13 AM) Yea i think my employer contribution is already at max Not employer contribution, but employee contribution. |

|

|

|

|

|

poweredbydiscuz

|

Oct 21 2024, 03:52 PM Oct 21 2024, 03:52 PM

|

|

QUOTE(langstrasse @ Oct 21 2024, 03:14 PM) Hi all Can retirees (age 70+) self contribute to EPF and withdraw at any time? Self-contribute only for below 75 y/o. Withdraw anytime. Dividend given until 100 y/o. |

|

|

|

|

|

poweredbydiscuz

|

Oct 21 2024, 05:01 PM Oct 21 2024, 05:01 PM

|

|

QUOTE(langstrasse @ Oct 21 2024, 04:50 PM) Thanks a lot I found this on the EPF website but couldn’t find the part about interest paid until age 100. If it’s possible to share the link on this I’d really appreciate it! https://www.kwsp.gov.my/en/member/savings/self-contribution |

|

|

|

|

|

poweredbydiscuz

|

Nov 4 2024, 09:13 AM Nov 4 2024, 09:13 AM

|

|

QUOTE(leanman @ Nov 4 2024, 09:05 AM) why not end of December, at least you will get full 12 months why not end of November, you will get 12 + 1 month. |

|

|

|

|

|

poweredbydiscuz

|

Nov 6 2024, 07:40 PM Nov 6 2024, 07:40 PM

|

|

QUOTE(GravityFi3ld @ Nov 6 2024, 05:08 PM) neat! thank you for explaining, appreciate it   oh man, my math is not mathing  Are the $242 (11%) and $286 (13%) derived from 2,200(or 2,220?), which in turn is derived from the base wage 2,000 + 220?  but generally get the gist of it tho, thanks again  From RM2194 in his example. x + 13% of x = RM2480 x = ~RM2194 This post has been edited by poweredbydiscuz: Nov 6 2024, 08:05 PM |

|

|

|

|

|

poweredbydiscuz

|

Nov 29 2024, 01:22 PM Nov 29 2024, 01:22 PM

|

|

QUOTE(ky118 @ Nov 29 2024, 01:11 PM) Is the above true? According to EPF, the interest is calculated on daily basis so you will not lose one month of interest. Once the top up amount appear in your EPF account, the interest will start to count from that day onwards.The bolded part is wrong. You will only get one day interest for the month of contribution. |

|

|

|

|

|

poweredbydiscuz

|

Nov 29 2024, 01:28 PM Nov 29 2024, 01:28 PM

|

|

QUOTE(ky118 @ Nov 29 2024, 01:25 PM) I went to EPF and was given the information by the counter staff. May I know your source of information? EPF Dividend FAQ no. 8. |

|

|

|

|

|

poweredbydiscuz

|

Jan 3 2025, 10:19 AM Jan 3 2025, 10:19 AM

|

|

QUOTE(touristking @ Jan 3 2025, 10:11 AM) The maximum is RM 100K, right? I saw many post saying it is RM 60K Last time 60k, then increased to 100k since last year. |

|

|

|

|

|

poweredbydiscuz

|

Feb 7 2025, 08:39 AM Feb 7 2025, 08:39 AM

|

|

QUOTE(Singh_Kalan @ Feb 7 2025, 08:37 AM) I sense that EPF is strictening the withdrawal rule gradually. The 1 million withdrawal threshold is being gradually increased to 1.3 milion in 2028. Worry the full withdrawal age of 55 may also be increase soonJust a matter of time. |

|

|

|

|

|

poweredbydiscuz

|

Feb 24 2025, 01:47 PM Feb 24 2025, 01:47 PM

|

|

Better make self-contribution earlier for this month in case the portal suddenly goes "under maintenance".

|

|

|

|

|

|

poweredbydiscuz

|

Mar 21 2025, 08:29 AM Mar 21 2025, 08:29 AM

|

|

QUOTE(MUM @ Mar 21 2025, 08:18 AM) I read a few forumers posted they did that, but not 100% of salary as some % of their salaries are required for mandatory deduction, like socso, eis, pcb, kwsp, etc etc. If I can remembered it correctly, I think they did it to about 60-80% of their salary After deduct everything means 100% net salary lo. |

|

|

|

|

|

poweredbydiscuz

|

Apr 22 2025, 10:54 AM Apr 22 2025, 10:54 AM

|

|

QUOTE(romuluz777 @ Apr 22 2025, 10:50 AM) Just transferred 1K from Acct 3 to Acc1, its almost instantaneous. So far so good. Just curious, why transfer to Acc 1 instead of Acc 2? |

|

|

|

|

|

poweredbydiscuz

|

Apr 22 2025, 11:09 AM Apr 22 2025, 11:09 AM

|

|

QUOTE(romuluz777 @ Apr 22 2025, 11:00 AM) Doesn't make a difference to me, as I can access the funds due to the >RM1.1m balance. Withdraws will deplete the Acc 2 first tho. Unless the Acc 1 alone is already >RM1m then yeah there's no difference. |

|

|

|

|

|

poweredbydiscuz

|

Sep 26 2025, 08:55 AM Sep 26 2025, 08:55 AM

|

|

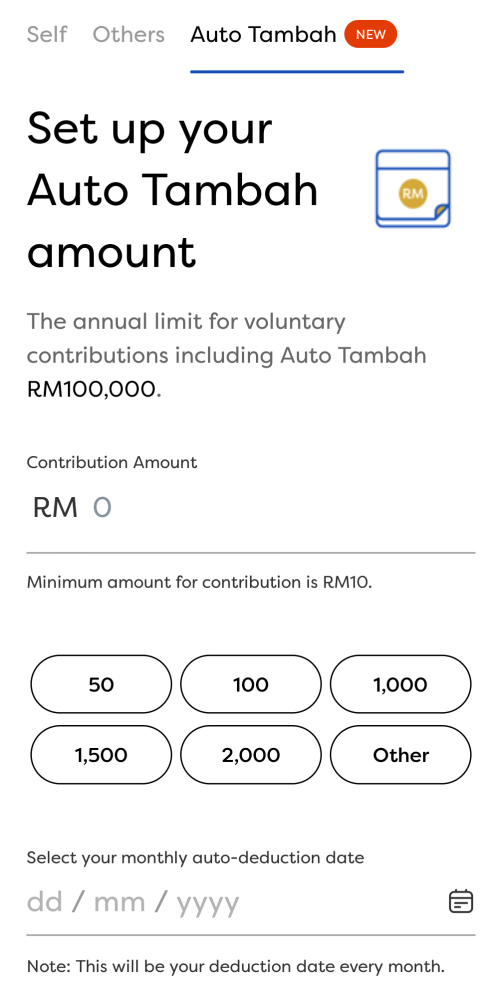

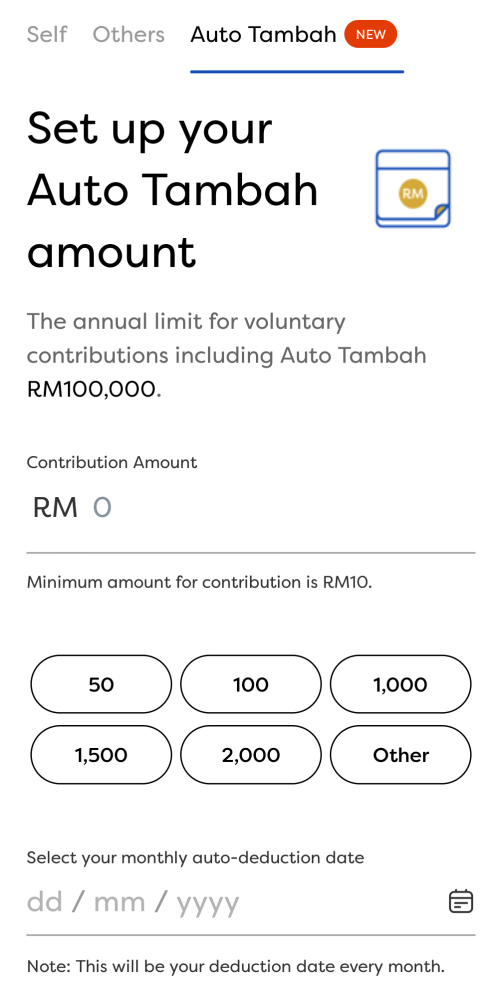

Doing self contribution just now and saw this new auto tambah feature in the app.  |

|

|

|

|

Sep 13 2024, 02:09 PM

Sep 13 2024, 02:09 PM

Quote

Quote

0.0244sec

0.0244sec

0.61

0.61

7 queries

7 queries

GZIP Disabled

GZIP Disabled