QUOTE(virtualgay @ Feb 2 2024, 03:39 PM)

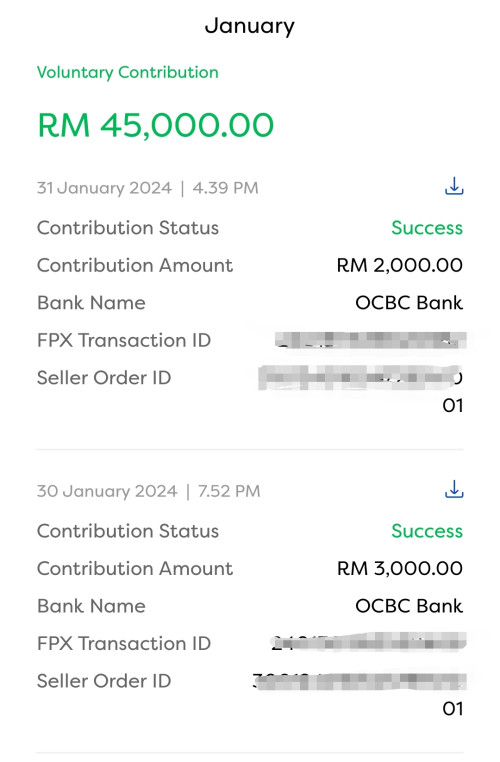

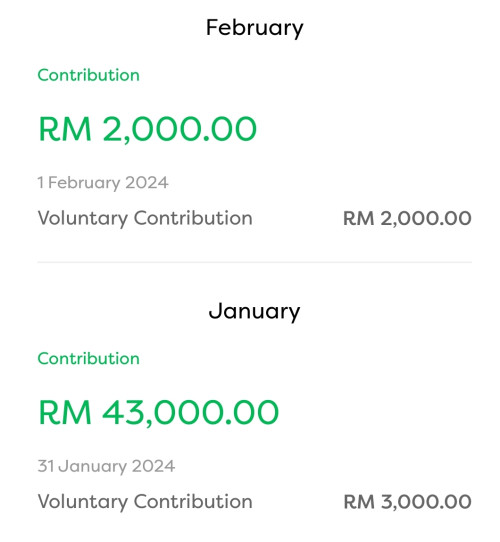

thanks for answering my not so stupid question of potong more than 13%. As my age is catching up i am slowly moving my FD and ASM into EPF.

2024 - 51 years old to max RM100k as not going to renew my FD but anything mature will go into EPF an continue to buy ASM for any left over. Will no longer be keeping FD anymore this year

2025 - 52 years old to start selling my ASM and move to EPF and will also MAX out 100k and this is where i will start to ask HR to deduct 25% of my salary to EPF

2026 - 53 years old continue to sell ASM and Max out 100k and increase EPF contribution to 35% and by my own calculation this is the year where i should hit RM1.0 Million. If anything emergency i still can withdraw from EPF for anything about 1.0M and sell more ASM if needed

2027 - 54 years old, continue to sell ASM and max out 100k and continue with 35% of salary deduction

2028 - 55 years old is when i retire and i dont think i will have income and i should be sitting with about 1.3 milion to live out whatever life i have and if company dont fire me i will still work and accumulate EPF. this is the year also my housing loan should be cleared.

i did not make it in life and i dont think 1.3 million is going to make me rich, all i am hoping for is that it can last me for 25 years assuming that i live till 80 years old

1.3million with assumption of 5.5% dividend i will have about 6k per month to support my family. good luck to me

i am hoping to get up to 1.5M to 2M if possible but i dont think is possible

RM 1.3 mil is not to shabby. Keep in EPF and can get 5% div, already more than RM5k+ per month.Not rich, but if no debt, got one house to live and no dependants, can live comfortably. Make sure you got medical insurance covered or else it will eat your savings fast. And don't be greedy and join investment scams like TriumpFX.

QUOTE(virtualgay @ Feb 2 2024, 04:11 PM)

anyone here know how is life when stop working? I am a little scare... is just 4 years away...

Lepak at lowyat.net everyday like me, waiting to die.

Feb 2 2024, 11:09 AM

Feb 2 2024, 11:09 AM

Quote

Quote

0.0239sec

0.0239sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled