QUOTE(dwRK @ Feb 20 2020, 07:25 PM)

you've trailing stop loss since 2016?[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

|

|

Feb 20 2020, 07:30 PM Feb 20 2020, 07:30 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

|

|

|

|

|

|

Feb 20 2020, 07:48 PM Feb 20 2020, 07:48 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

Peter lynch : far more money has been lost in _____ finish the sentence

This post has been edited by alexkos: Feb 20 2020, 07:48 PM |

|

|

Feb 20 2020, 07:50 PM Feb 20 2020, 07:50 PM

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Feb 20 2020, 07:57 PM Feb 20 2020, 07:57 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

QUOTE(dwRK @ Feb 20 2020, 07:50 PM) question, if you have a stock that pays no dividend like Amazon, would you use a stop loss?because if it goes down and you didn't lock your profit, then really rugi, no? and no dividend somemore. |

|

|

Feb 20 2020, 08:23 PM Feb 20 2020, 08:23 PM

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(moosset @ Feb 20 2020, 07:57 PM) question, if you have a stock that pays no dividend like Amazon, would you use a stop loss? sure. do whatever for a good night's sleep manbecause if it goes down and you didn't lock your profit, then really rugi, no? and no dividend somemore. you can also buy puts to hedge or short futures |

|

|

Feb 20 2020, 08:37 PM Feb 20 2020, 08:37 PM

Show posts by this member only | IPv6 | Post

#786

|

All Stars

24,358 posts Joined: Feb 2011 |

QUOTE(dwRK @ Feb 20 2020, 07:50 PM) Same here. Can't wait for recession. My cash getting too big. QUOTE(moosset @ Feb 20 2020, 07:57 PM) question, if you have a stock that pays no dividend like Amazon, would you use a stop loss? I will just add more.because if it goes down and you didn't lock your profit, then really rugi, no? and no dividend somemore. |

|

|

|

|

|

Feb 20 2020, 08:38 PM Feb 20 2020, 08:38 PM

Show posts by this member only | IPv6 | Post

#787

|

All Stars

24,358 posts Joined: Feb 2011 |

QUOTE(dwRK @ Feb 20 2020, 07:50 PM) Same here. Can't wait for recession. My cash getting too big. QUOTE(moosset @ Feb 20 2020, 07:57 PM) question, if you have a stock that pays no dividend like Amazon, would you use a stop loss? I will just add more.because if it goes down and you didn't lock your profit, then really rugi, no? and no dividend somemore. |

|

|

Feb 20 2020, 08:39 PM Feb 20 2020, 08:39 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

QUOTE(dwRK @ Feb 20 2020, 08:23 PM) not sure what makes me sleep better. QUOTE(Ramjade @ Feb 20 2020, 08:37 PM) true, however, wouldn't it be better to have the trailing stop loss activated, auto liquidate your position and buy again at the bottom? |

|

|

Feb 20 2020, 09:08 PM Feb 20 2020, 09:08 PM

Show posts by this member only | IPv6 | Post

#789

|

All Stars

24,358 posts Joined: Feb 2011 |

QUOTE(moosset @ Feb 20 2020, 08:39 PM) not sure what makes me sleep better. You need to find your own style. Don't follow people. true, however, wouldn't it be better to have the trailing stop loss activated, auto liquidate your position and buy again at the bottom? You can never catch bottom. This post has been edited by Ramjade: Feb 20 2020, 09:09 PM |

|

|

Feb 23 2020, 03:42 PM Feb 23 2020, 03:42 PM

|

Senior Member

1,042 posts Joined: Jan 2003 |

Warren B's annual letter to shareholders: https://berkshirehathaway.com/letters/2019ltr.pdf

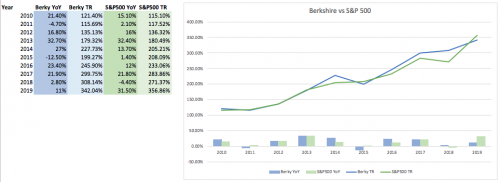

10 years Berky vs S&P500 (Berky trails due to index's mad bull last year):  This post has been edited by roarus: Feb 23 2020, 03:43 PM |

|

|

Feb 24 2020, 05:25 PM Feb 24 2020, 05:25 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

is it time to top up now?

|

|

|

Feb 24 2020, 05:42 PM Feb 24 2020, 05:42 PM

Show posts by this member only | IPv6 | Post

#792

|

All Stars

24,358 posts Joined: Feb 2011 |

|

|

|

Feb 24 2020, 06:01 PM Feb 24 2020, 06:01 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

|

|

|

|

|

|

Feb 24 2020, 06:09 PM Feb 24 2020, 06:09 PM

|

All Stars

24,358 posts Joined: Feb 2011 |

|

|

|

Feb 24 2020, 06:11 PM Feb 24 2020, 06:11 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

After 20% then how? In 50% first?

|

|

|

Feb 24 2020, 07:41 PM Feb 24 2020, 07:41 PM

|

Junior Member

54 posts Joined: Mar 2005 |

Stay the course no matter what

|

|

|

Feb 24 2020, 08:15 PM Feb 24 2020, 08:15 PM

|

Junior Member

54 posts Joined: Mar 2005 |

I have a question, just found out FZROX with 0% expenses ratio, but there's two draw back:

1. US domicile, 30% WHT 2. Dividend once per year Maybe there's a Ireland domicile version of it I haven't discover? |

|

|

Feb 24 2020, 08:37 PM Feb 24 2020, 08:37 PM

|

Senior Member

1,042 posts Joined: Jan 2003 |

QUOTE(zerolord @ Feb 24 2020, 08:15 PM) I have a question, just found out FZROX with 0% expenses ratio, but there's two draw back: FZROX's almost identical twin mutual fund is Vanguard's VTSAX, which has an ETF equivalent VTI tracking U.S. all cap index.1. US domicile, 30% WHT 2. Dividend once per year Maybe there's a Ireland domicile version of it I haven't discover? From there you can probably mix and match an Irish domiciled S&P500 ETF (~80%) with a Mid/Small Cap ETF (~20%). Smaller investment amount, just go with S&P500 alone as you'd be dragged by transaction fees to maintain 2 funds. |

|

|

Feb 25 2020, 10:49 AM Feb 25 2020, 10:49 AM

|

Junior Member

54 posts Joined: Mar 2005 |

QUOTE(roarus @ Feb 24 2020, 08:37 PM) FZROX's almost identical twin mutual fund is Vanguard's VTSAX, which has an ETF equivalent VTI tracking U.S. all cap index. that's true...I allocated my money for 80% CSPX and 20% EIMI in previous month and regretted immediately after seeing the charges for each...From there you can probably mix and match an Irish domiciled S&P500 ETF (~80%) with a Mid/Small Cap ETF (~20%). Smaller investment amount, just go with S&P500 alone as you'd be dragged by transaction fees to maintain 2 funds. |

|

|

Feb 28 2020, 06:02 PM Feb 28 2020, 06:02 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

prepare for trouble and make it double?

time to double your investment? |

| Change to: |  0.0263sec 0.0263sec

0.55 0.55

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 10:29 AM |