QUOTE(alexkos @ Dec 17 2019, 11:31 AM)

Bro..make sure u make up ur mind on asset allocation

Equity: fixed income ratio

Dun all in sp500 ya.

U can use captrader for maximized saving for now.

If u do lumpsum 100k, then ikbr

Thanks for the quick response.

I got more than SGD 150k locked in CPF (EFP in SG) that I am forced to contribute 37% monthly (20% from me & 17% from company) as long as I am drawing salary (until 55 years old). I am not optimizing that part yet, will look into that after taking care of the cash portion.

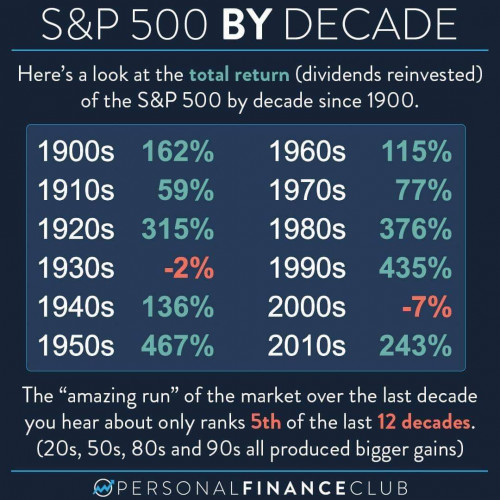

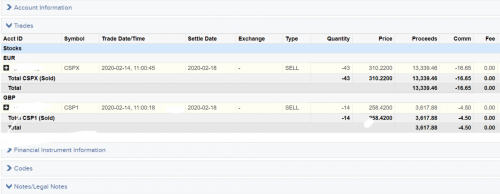

I am treating the CPF as my bond bucket of the total portfolio as it's pretty safe. I also have some money in StashAway, sort of "local fund". Plus being exposed to FIRE and "A simple path to wealth" recently, the idea to dump most of the money into low cost index fund resonate with me and that's what I am going to execute. And that complete my 3 fund portfolio.

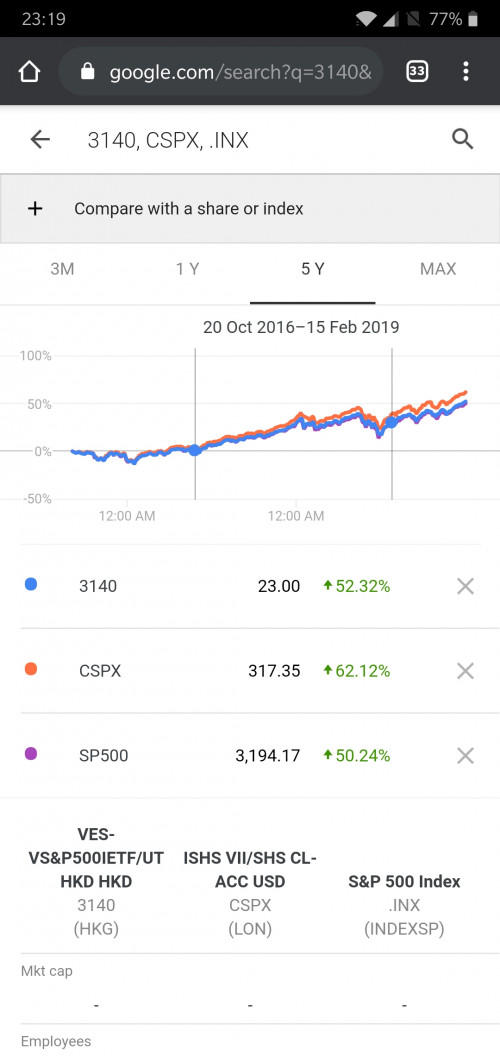

I know that using captrader is cheaper for one-off, but I am thinking to go with IBKR only as having multiple accounts as transferring assets between account will be more complex later, and I prefer to keep things simple. Furthermore, I should be reaching USD 100k in portfolio size in 6 months, that why I am thinking to time it right so I can avoid the inactive fee.

Dec 13 2019, 11:34 AM

Dec 13 2019, 11:34 AM

Quote

Quote

0.0483sec

0.0483sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled