Outline ·

[ Standard ] ·

Linear+

[DIY] S&P 500 Index w/ 0.07% Annual Fee, Buy the best companies in the world

|

TSalexkos

|

Oct 19 2020, 08:31 PM Oct 19 2020, 08:31 PM

|

|

QUOTE(zodiacyi @ Oct 19 2020, 07:39 PM) Hi all, Newbie here. I have searched endlessly but could not found the answer I want. One question for fellow Sifus, - SXR8 and CSPX, what the heck are the differences between both? Are they same same or same same but different? Please enlighten me, thanks y'all!!!! sama je. see u got luck today. ayam advice u hoot cspx |

|

|

|

|

|

zodiacyi

|

Oct 20 2020, 12:32 AM Oct 20 2020, 12:32 AM

|

New Member

|

QUOTE(alexkos @ Oct 19 2020, 08:31 PM) sama je. see u got luck today. ayam advice u hoot cspx Hi Alex, thanks a lot! So no difference in term of fee as well right for both? |

|

|

|

|

|

Ramjade

|

Oct 20 2020, 12:58 AM Oct 20 2020, 12:58 AM

|

|

QUOTE(zodiacyi @ Oct 20 2020, 12:32 AM) Hi Alex, thanks a lot! So no difference in term of fee as well right for both? If you are planning on doing index, buy the best. ARKK/W with CXSE. |

|

|

|

|

|

zodiacyi

|

Oct 20 2020, 01:39 AM Oct 20 2020, 01:39 AM

|

New Member

|

QUOTE(Ramjade @ Oct 20 2020, 12:58 AM) If you are planning on doing index, buy the best. ARKK/W with CXSE. Thanks for the suggestion. Notice the expense ratio relatively higher than that of CSPX though. Am currently heavily invested in SAMY. Looking for DIY ETF investment with lower fee. |

|

|

|

|

|

Ramjade

|

Oct 20 2020, 07:33 AM Oct 20 2020, 07:33 AM

|

|

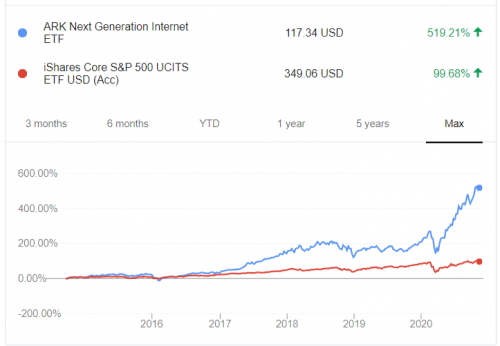

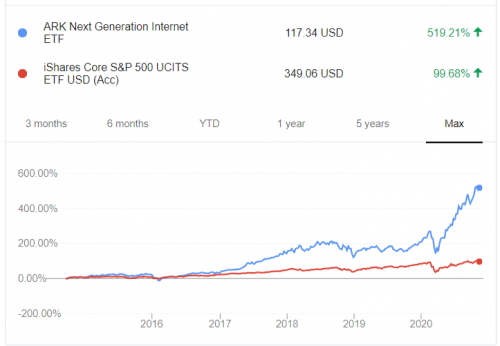

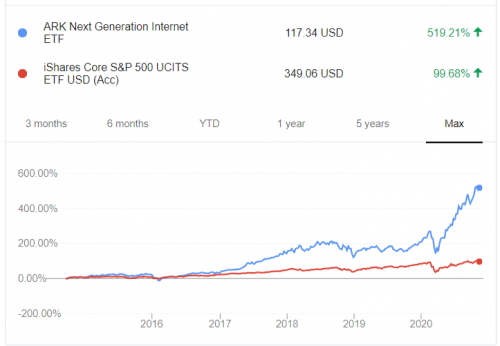

QUOTE(zodiacyi @ Oct 20 2020, 01:39 AM) Thanks for the suggestion. Notice the expense ratio relatively higher than that of CSPX though. Am currently heavily invested in SAMY. Looking for DIY ETF investment with lower fee. How much your s&p500 can give? Average 8%. Arkk/arkw is about 30-50% a year. The increase in expense ratio is worth it. If you want to do DIY, get rid of stashaway. Don't keep both. |

|

|

|

|

|

TSalexkos

|

Oct 20 2020, 08:06 AM Oct 20 2020, 08:06 AM

|

|

QUOTE(Ramjade @ Oct 20 2020, 12:58 AM) If you are planning on doing index, buy the best. ARKK/W with CXSE. Apa tu? Genger than sp500? |

|

|

|

|

|

zerolord

|

Oct 23 2020, 08:00 PM Oct 23 2020, 08:00 PM

|

Getting Started

|

QUOTE(alexkos @ Oct 20 2020, 08:06 AM) Apa tu? Genger than sp500? much genger  |

|

|

|

|

|

TSalexkos

|

Oct 23 2020, 08:22 PM Oct 23 2020, 08:22 PM

|

|

QUOTE(zerolord @ Oct 23 2020, 08:00 PM) much genger  wah...huat liao lo....how do i sign up?  |

|

|

|

|

|

Ramjade

|

Oct 23 2020, 08:44 PM Oct 23 2020, 08:44 PM

|

|

QUOTE(alexkos @ Oct 23 2020, 08:22 PM) wah...huat liao lo....how do i sign up?  Ark is an ETF. You can pick arkk or arkw. Pick whichever you you want. S&P500 is old school business. |

|

|

|

|

|

zerolord

|

Oct 24 2020, 05:49 PM Oct 24 2020, 05:49 PM

|

Getting Started

|

QUOTE(alexkos @ Oct 23 2020, 08:22 PM) wah...huat liao lo....how do i sign up?  It's actively manage, expense ratio much higher, might not go well with your philosophy https://www.bloomberg.com/quote/ARKK:UShttps://www.bloomberg.com/quote/ARKW:US |

|

|

|

|

|

TSalexkos

|

Oct 24 2020, 06:34 PM Oct 24 2020, 06:34 PM

|

|

QUOTE(zerolord @ Oct 24 2020, 05:49 PM) It's actively manage, expense ratio much higher, might not go well with your philosophy https://www.bloomberg.com/quote/ARKK:UShttps://www.bloomberg.com/quote/ARKW:USThey say higher return oh....hehe |

|

|

|

|

|

Ramjade

|

Oct 24 2020, 06:36 PM Oct 24 2020, 06:36 PM

|

|

QUOTE(zerolord @ Oct 24 2020, 05:49 PM) It's actively manage, expense ratio much higher, might not go well with your philosophy https://www.bloomberg.com/quote/ARKK:UShttps://www.bloomberg.com/quote/ARKW:USQUOTE(alexkos @ Oct 24 2020, 06:34 PM) They say higher return oh....hehe Some things are worth paying for. |

|

|

|

|

|

zerolord

|

Oct 24 2020, 08:16 PM Oct 24 2020, 08:16 PM

|

Getting Started

|

QUOTE(alexkos @ Oct 24 2020, 06:34 PM) They say higher return oh....hehe switching your SXR8 to ARKK or ARKW? |

|

|

|

|

|

Syncing

|

Oct 25 2020, 11:57 PM Oct 25 2020, 11:57 PM

|

Getting Started

|

QUOTE(Ramjade @ Oct 20 2020, 07:33 AM) How much your s&p500 can give? Average 8%. Arkk/arkw is about 30-50% a year. The increase in expense ratio is worth it. If you want to do DIY, get rid of stashaway. Don't keep both. Interested that you mention ARK, saw it mentioned a few times on reddit. Anyways, I am currently investing through IBKR/TSG UCITS etfs. Any disadvantages in directly buying this NYSE ETF? I'm aware of the higher dividend withholding tax, but any issues in funding in USD to buy them as well? |

|

|

|

|

|

Ziet Inv

|

Oct 26 2020, 12:19 AM Oct 26 2020, 12:19 AM

|

|

Considering ARKW and XLY too!

|

|

|

|

|

|

Ramjade

|

Oct 26 2020, 01:13 AM Oct 26 2020, 01:13 AM

|

|

QUOTE(Syncing @ Oct 25 2020, 11:57 PM) Interested that you mention ARK, saw it mentioned a few times on reddit. Anyways, I am currently investing through IBKR/TSG UCITS etfs. Any disadvantages in directly buying this NYSE ETF? I'm aware of the higher dividend withholding tax, but any issues in funding in USD to buy them as well? Ark doesn't even pay doc dividend cause majority of the companies inside ark are not making money. Something to think about.  This post has been edited by Ramjade: Oct 26 2020, 01:05 PM This post has been edited by Ramjade: Oct 26 2020, 01:05 PM |

|

|

|

|

|

TSalexkos

|

Oct 26 2020, 12:19 PM Oct 26 2020, 12:19 PM

|

|

Nvm janji moar money....all in x3 margin sell car sell house...

Hehe...warren buffett also lose me

|

|

|

|

|

|

Julian2103

|

Oct 26 2020, 10:43 PM Oct 26 2020, 10:43 PM

|

Getting Started

|

Hi guys, ima little confused. I’ve signed up for both instarem and ts global as per the front page. But from reading further, it’s also advisable to get a Singaporean bank account? Can I just fund my account using instarem/bigpay and withdraw next time to my Maybank?

|

|

|

|

|

|

ProxMatoR

|

Oct 26 2020, 10:45 PM Oct 26 2020, 10:45 PM

|

|

QUOTE(Julian2103 @ Oct 26 2020, 10:43 PM) Hi guys, ima little confused. I’ve signed up for both instarem and ts global as per the front page. But from reading further, it’s also advisable to get a Singaporean bank account? Can I just fund my account using instarem/bigpay and withdraw next time to my Maybank? yes you can. with SG account just give you extra savings. that's it.  |

|

|

|

|

|

Julian2103

|

Oct 26 2020, 10:47 PM Oct 26 2020, 10:47 PM

|

Getting Started

|

QUOTE(ProxMatoR @ Oct 26 2020, 10:45 PM) yes you can. with SG account just give you extra savings. that's it.  I see, can you ELI5 how that saves me more money? And also one more question, why is it recommended to transfer 7-8k one shot instead of lower amounts for the first go? |

|

|

|

|

Oct 19 2020, 08:31 PM

Oct 19 2020, 08:31 PM

Quote

Quote

0.0288sec

0.0288sec

1.05

1.05

6 queries

6 queries

GZIP Disabled

GZIP Disabled