Hmm but the news are prompting that Cathie may face hardship next year due to the current takeover battle, a bit uncertain, however, I lean towards the positive side of Cathie staying but not guarantee though.

Also, would like to ask sifus about S&P 500 ETFs.

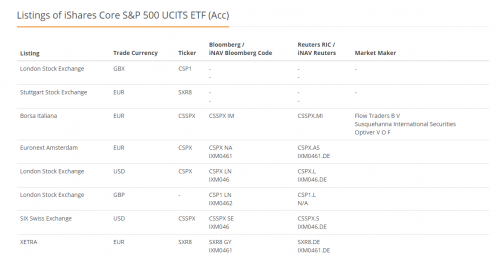

Is there any reason not to consider ETFs like VTI/VOO from Vanguard. Assuming for 10 years long hold, the returns are almost the same, but the tracking error from Vanguard ETF is slightly better. The fees charged on Vanguard is 0.03% compared to 0.07% on CSPX.

Below are the data collected:

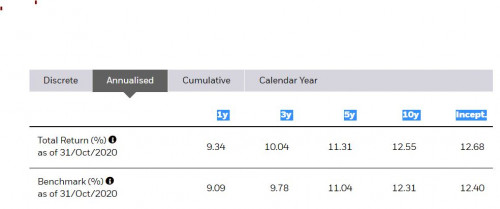

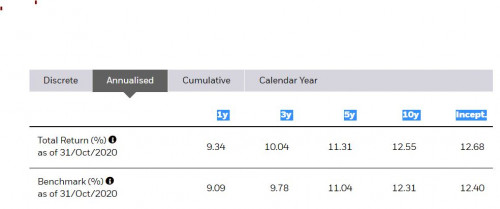

For iShare:

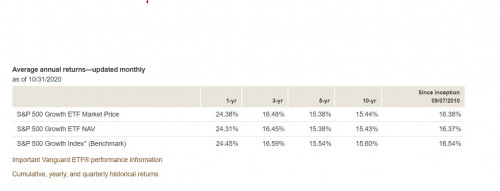

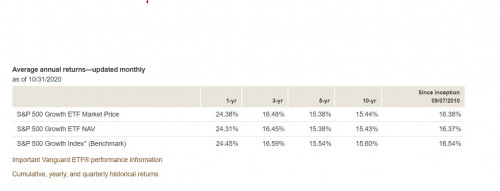

For VOO:

Also, while researching about VOO, I stumbled upon VOOG which offers better performance and looks promising albeit with the higher fees of 1.00% p.a.

VOOG:

Any thoughts on the above?

For VOOG, its 0.1% p.a, sorry for the wrong data !

Also, I understand about the whole 15% dividend vs 30% dividend withholding tax, just curious to know, is it because of this that most do not choose US-domiciled ETF?

Oct 27 2020, 11:39 PM

Oct 27 2020, 11:39 PM

Quote

Quote

0.0301sec

0.0301sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled