QUOTE(talexeh @ Mar 4 2019, 10:17 PM)

I thought the "fraudulent" withdrawal happened at a CIMB ATM as quoted below?

How come it turned out to be Seven Bank which I believe is located in Japan?

Hmm... I don't think you're up to anything mischievous but your posts have been contradicting some of your earlier posts. You mentioned below that it was your brother's account instead of your mom's?

Sorry, I tend to get mixed up with names and finer details as I reported the incident here while I was waiting for CS to reply me, while panicking my head off that my account had been compromised. My purpose is to candidly share my experience (as best as I remember) and the gist of the story remains unchanged.

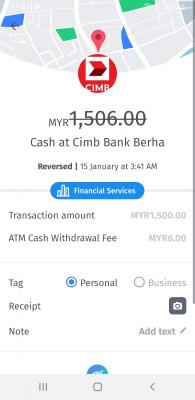

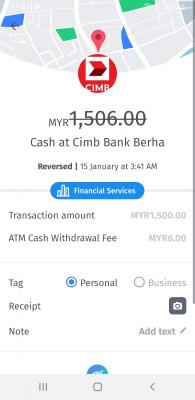

Just to clarify, the first (actual) transaction is "CIMB Bank Berhad", and the second "reversal" is "Southern Bank Berhad" (which I have never heard of).

Edit: Ugh. Sorry, first transaction is Southern second is CIMB. See screenshots. I seriously get very confused telling this story as the names of the banks aren't the main issue. I don't know how the two are related, but CS gave me some explanation about "CIMB brand machine can be different from processing bank". Again this is as best as I remember as it was on the phone, so don't quote me on it. But the important point was that she said it was traceable as one and the same transaction, but just double reported.

Re my BP account, the card is "locked" to my

brother's account as this was the first top up since the "new rule". However, the card was also registered in

both mine and my mum's accounts (as I had topped up both prior to the "new rule") and

needed to be removed from ALL accounts in order for mine to be enabled. Again, sorry for discrepancies in details, but doesn't change the gist of it. My purpose is to share the info, but not the whole long grandma story.

This post has been edited by lilsunflower: Mar 4 2019, 11:43 PM Attached thumbnail(s)

Jan 16 2019, 02:19 PM

Jan 16 2019, 02:19 PM

Quote

Quote

0.0579sec

0.0579sec

0.75

0.75

7 queries

7 queries

GZIP Disabled

GZIP Disabled