QUOTE(Hansel @ Nov 25 2019, 12:49 AM)

By the way, I appreciated your challenge and reminder that I was dead-wrong.

I accepted it gracefully, but you must also accept that I corrected my error early before you opened your mouth. So,...in answer to your unnecessary repeats abt checking, pausing and thinking, let me say

I have done so BEFORE you opened your gap.You have nothing else to say except to ask me to check, pause and think !

Let me see if you have other similar things to utter after this.

Give you a mirror to reflect.

You reply to someone with 30Million .......

QUOTE(Hansel @ Nov 22 2019, 01:00 PM)

the Passive Income portion truely made many people speechless.

the passive income ------- SGD40K PER MONTH. AND THIS IS PASSIVE INCOME.

Everybody would be impressed. The important point here is the Income-type, let's just

limit ourselves to regulated and known income to authorities. Shadow economy income may catch more,...

If yours is Active Income,... then err,... it's not really a big deal,.... but Passive Income ?????

What is the size of your portfolio ? Do you have a blog that charts out your investment journey please ?

I'm sure even fund managers would like to learn from you !!!

SGD40K equates PER MONTH equates to SGD480K PER YEAR. THIS IS A VERY STRONG ACHIEVEMENT.

I'll add the advice that you'll have to keep up your knowledge on investments so that you can continue to generate those Passive Income CONSISTENTLY FOR THE REST OF YOUR LIVES.

,... I almost forgot this VERY IMPORTANT PART : I THINK YOU CAN'T STOP WORKING. BECAUSE YOU NEED THE IMAGE.

you dont believe people can make passive income $40k a month

must doubt it-----say may be his active income? ,

ask what income type is that?regulated or not?.

Want to see his portfolio and blog..

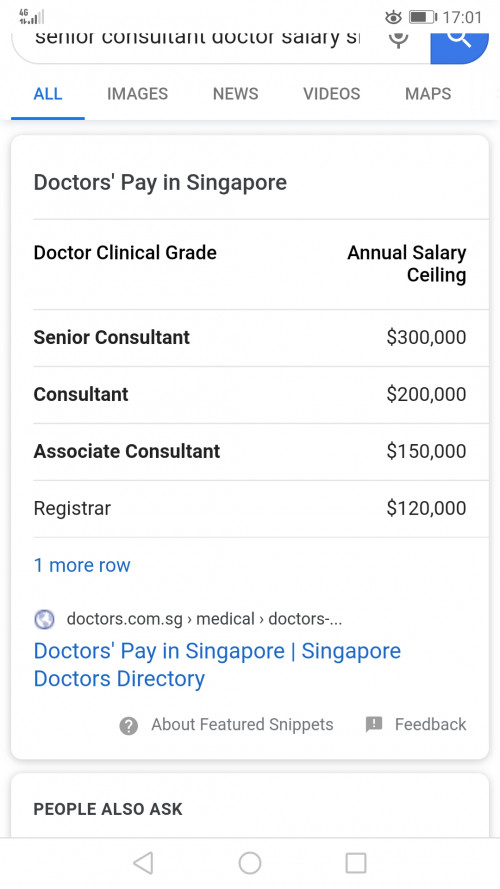

For someone acting like investment expert i expect you to know the simple fact

if one has $30 Million, even with 0 investment knowledge, simply dump the money in bank

with a meagre 1.6% return already can make that $40k passive income a month!

As usual chest-thumping your investment prowess, lecture a specialist Dr with S$30Million and passive income 40k a month on how to live do not splurge , how to invest and said he cant stop working........Hilarious to say the least!

And when people do not want to learn from you, you get annoyed....

Nov 25 2019, 12:42 AM

Nov 25 2019, 12:42 AM

Quote

Quote

0.0378sec

0.0378sec

0.31

0.31

6 queries

6 queries

GZIP Disabled

GZIP Disabled