QUOTE(cybpsych @ Jul 14 2025, 04:38 PM)

https://www.usvisascheduling.com/but after I checked, they only accept mastercard.

Credit Cards UOB Credit Cards v9, Ex citi read post 2

|

|

Jul 14 2025, 06:05 PM Jul 14 2025, 06:05 PM

|

Senior Member

4,507 posts Joined: Aug 2005 From: Klang/Shah Alam |

QUOTE(cybpsych @ Jul 14 2025, 04:38 PM) https://www.usvisascheduling.com/but after I checked, they only accept mastercard. |

|

|

|

|

|

Jul 14 2025, 08:59 PM Jul 14 2025, 08:59 PM

Show posts by this member only | IPv6 | Post

#14862

|

Senior Member

3,733 posts Joined: Apr 2010 |

QUOTE(lovelyuser @ Jul 10 2025, 11:19 AM) Currently holding VISA Infinite (min 120k annual income requirement), applying for PRVI Miles Elite (min 100k annual income requirement). Borang B then they are come back to ask for more document I.e full set of SSM I lazy to layan ady just stay with premiermiles elite jerI can predict their reply: diff department, diff credit access mechanism bla bla bla Let me try submit Borang B then try apply the card with new Borang B |

|

|

Jul 14 2025, 10:26 PM Jul 14 2025, 10:26 PM

|

Junior Member

57 posts Joined: Dec 2021 |

I want to apply to increase credit limit on my One card.

When i received the new card, they gave me RM69k credit limit. Then i called to reduce it to 10k. After 2 months of usage, I request to increase my limit to 30k, but they rejected. Anyone know whether it is possible to appeal? |

|

|

Jul 14 2025, 10:29 PM Jul 14 2025, 10:29 PM

|

Senior Member

7,558 posts Joined: May 2012 |

QUOTE(Bonjitettei @ Jul 14 2025, 10:26 PM) I want to apply to increase credit limit on my One card. wait 6 month before apply again. u do too short period.When i received the new card, they gave me RM69k credit limit. Then i called to reduce it to 10k. After 2 months of usage, I request to increase my limit to 30k, but they rejected. Anyone know whether it is possible to appeal? |

|

|

Jul 14 2025, 10:31 PM Jul 14 2025, 10:31 PM

|

Senior Member

6,012 posts Joined: Feb 2007 |

QUOTE(Bonjitettei @ Jul 14 2025, 10:26 PM) I want to apply to increase credit limit on my One card. Wait for 6 months, then request for increase.When i received the new card, they gave me RM69k credit limit. Then i called to reduce it to 10k. After 2 months of usage, I request to increase my limit to 30k, but they rejected. Anyone know whether it is possible to appeal? if you always max out your cl every months, they will have your spending pattern, then will adjust accordingly. 2 months is too short. My Amex is 5K SGD initially, i have 2 card and after few months with them my CL reach 30-40% they request me to submit 3 months payslip with guaranteed cl increase to 10K. |

|

|

Jul 15 2025, 01:46 AM Jul 15 2025, 01:46 AM

Show posts by this member only | IPv6 | Post

#14866

|

Senior Member

1,588 posts Joined: Oct 2010 |

QUOTE(gilabola @ Jul 14 2025, 10:28 AM) UOB seems to have changed airport lounge access for Visa Infinite ans Prvilige Elite cars. No more access to lounges in KLIA2 and no more access for supplementary card holder Yup got the message today.https://www.uob.com.my/personal/announcement.page Im wondering if its time to start shopping for other cards as usually card benefits get reduced over time |

|

|

|

|

|

Jul 15 2025, 08:52 AM Jul 15 2025, 08:52 AM

|

Senior Member

5,535 posts Joined: Aug 2011 |

Almost all credit cards are simultaneously downgrading benefits this time. Anything causing it?

|

|

|

Jul 15 2025, 10:11 AM Jul 15 2025, 10:11 AM

|

Senior Member

1,682 posts Joined: Jan 2007 From: Kuala Lumpur |

QUOTE(contestchris @ Jul 15 2025, 08:52 AM) Some said due to 2014 Payment Card Reform Framework to focused on interchange fees, cost-effectiveness of payment cards, and promoting competition among payment card providers.also bank cannot earn from AF, interest charge for 0%, e wallet qr payment national wide use and so on |

|

|

Jul 15 2025, 11:20 AM Jul 15 2025, 11:20 AM

|

Senior Member

3,789 posts Joined: Aug 2007 |

QUOTE(iXora.ix @ Jul 15 2025, 10:11 AM) Some said due to 2014 Payment Card Reform Framework to focused on interchange fees, cost-effectiveness of payment cards, and promoting competition among payment card providers. The Payment Card Reform Framework is issued in 2014. All its provisions came into effect on 1 July 2015. Why only 2025, which is 10 years later? We are seeing huge shifts now for most credit cards. also bank cannot earn from AF, interest charge for 0%, e wallet qr payment national wide use and so on I don't know the correlation; maybe it does have some impact, but I would reckon rising SST and the cost of living would have a more significant impact. iXora.ix liked this post

|

|

|

Jul 15 2025, 11:33 AM Jul 15 2025, 11:33 AM

|

Senior Member

3,305 posts Joined: Dec 2012 |

Just call to cancel the UOB card and PRVI Miles Elite sup card after benefits revision. Different card, different date of SST/Annual Fee.

Everytime have to call and ask for waiver/rebate . Give up |

|

|

Jul 15 2025, 01:06 PM Jul 15 2025, 01:06 PM

Show posts by this member only | IPv6 | Post

#14871

|

Junior Member

85 posts Joined: Jul 2018 |

the PME Grab ride home RM80 , condition of using the cards 3 times oversea , does online purchase from foreign website 3 times eligible for the spend ?

|

|

|

Jul 15 2025, 02:29 PM Jul 15 2025, 02:29 PM

Show posts by this member only | IPv6 | Post

#14872

|

Senior Member

2,378 posts Joined: Dec 2005 |

|

|

|

Jul 15 2025, 04:23 PM Jul 15 2025, 04:23 PM

Show posts by this member only | IPv6 | Post

#14873

|

Junior Member

140 posts Joined: Dec 2004 From: In bed. |

QUOTE(fuzzy @ Jul 14 2025, 02:03 PM) Yeah i saw this yesterday and I'm quite irritated by it. One of the reasons i stayed with my PRV MILES card was cos i travel 3 - 4 times a year, my company books Air Asia so i use the lounge at Terminal 2. I called them up to confirm this, and they said yes. Thankfully still can use for my trip next week. Might think about transferring to another bank after this. |

|

|

|

|

|

Jul 15 2025, 04:32 PM Jul 15 2025, 04:32 PM

|

Senior Member

7,558 posts Joined: May 2012 |

|

|

|

Jul 16 2025, 02:09 PM Jul 16 2025, 02:09 PM

|

Senior Member

2,634 posts Joined: Jun 2009 |

UOB One Card

Good day, do i miss somethings? Close balance RM964.60 Grab use 101x2 = get 0.40? Grocery 18 = get 0.04? Petrol 47.40+44.60 = get 0.18? Dinning 165 = get 0.55? to get 10%, not over RM800 only? |

|

|

Jul 16 2025, 02:13 PM Jul 16 2025, 02:13 PM

|

Senior Member

3,832 posts Joined: Oct 2011 |

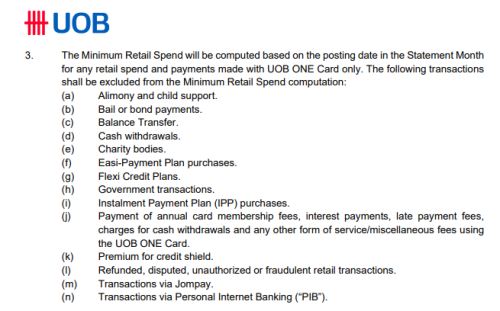

QUOTE(Wolgie @ Jul 16 2025, 02:09 PM) UOB One Card Perhaps some of the transactions are excluded from the minimum retail spend.Good day, do i miss somethings? Close balance RM964.60 Grab use 101x2 = get 0.40? Grocery 18 = get 0.04? Petrol 47.40+44.60 = get 0.18? Dinning 165 = get 0.55? to get 10%, not over RM800 only? |

|

|

Jul 16 2025, 02:17 PM Jul 16 2025, 02:17 PM

|

Senior Member

1,701 posts Joined: Feb 2011 |

|

|

|

Jul 16 2025, 02:29 PM Jul 16 2025, 02:29 PM

|

All Stars

65,278 posts Joined: Jan 2003 |

QUOTE(Wolgie @ Jul 16 2025, 02:09 PM) UOB One Card 1. check transaction posting?Good day, do i miss somethings? Close balance RM964.60 Grab use 101x2 = get 0.40? Grocery 18 = get 0.04? Petrol 47.40+44.60 = get 0.18? Dinning 165 = get 0.55? to get 10%, not over RM800 only? 2. Grocery where? 3. why didnt you share how much cb you gotten? |

|

|

Jul 16 2025, 04:13 PM Jul 16 2025, 04:13 PM

|

Senior Member

4,195 posts Joined: Sep 2012 |

QUOTE(Wolgie @ Jul 16 2025, 02:09 PM) UOB One Card I presume your cc is UOB One Classic, not UOB One Platinum (which min retail spend is RM1500).Good day, do i miss somethings? Close balance RM964.60 Grab use 101x2 = get 0.40? Grocery 18 = get 0.04? Petrol 47.40+44.60 = get 0.18? Dinning 165 = get 0.55? to get 10%, not over RM800 only? Does RM964.60 include anything in the following list?  |

|

|

Jul 16 2025, 06:23 PM Jul 16 2025, 06:23 PM

Show posts by this member only | IPv6 | Post

#14880

|

Senior Member

2,634 posts Joined: Jun 2009 |

QUOTE(poweredbydiscuz @ Jul 16 2025, 02:13 PM) Got one bt is 83.33, if my 964 deducted 833, still over 800QUOTE(cclim2011 @ Jul 16 2025, 02:17 PM) noQUOTE(cybpsych @ Jul 16 2025, 02:29 PM) 1. check transaction posting? 2. Grocery where? 3. why didnt you share how much cb you gotten? Get ??? That is what I get. Example reload grab 200, but not get 10% QUOTE(nexus2238 @ Jul 16 2025, 04:13 PM) I presume your cc is UOB One Classic, not UOB One Platinum (which min retail spend is RM1500). Is reload grab wallet consider mins spend? Does RM964.60 include anything in the following list?  Only this I can think of it. Because my first time reload 2x time. All other spend is normal transaction at shop, mcd, and petrol. Very simple. |

| Change to: |  0.0245sec 0.0245sec

0.48 0.48

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 11:35 AM |