QUOTE(svefz @ Jul 26 2019, 05:23 PM)

Q3 How do I qualify for Auto Balance Conversion?

A3 You are eligible for this program if you meet all the criteria listed below:

A Malaysian nationality;

Annual income equal or less than RM60,000 (as per your records with CIMB);

Did not make full payment for credit card outstanding balance for the past 12 months;

Over the past 12 months your average credit card(s) repayment is not more than 10% of your total outstanding balances.

Q4 How do I enroll for the Auto Balance Conversion?

A4 You will be automatically enrolled into the program upon meeting the eligibility criteria every 12 months stated on Q3.

You can find the answer from here

Yup. Got it, as per my post above.A3 You are eligible for this program if you meet all the criteria listed below:

A Malaysian nationality;

Annual income equal or less than RM60,000 (as per your records with CIMB);

Did not make full payment for credit card outstanding balance for the past 12 months;

Over the past 12 months your average credit card(s) repayment is not more than 10% of your total outstanding balances.

Q4 How do I enroll for the Auto Balance Conversion?

A4 You will be automatically enrolled into the program upon meeting the eligibility criteria every 12 months stated on Q3.

You can find the answer from here

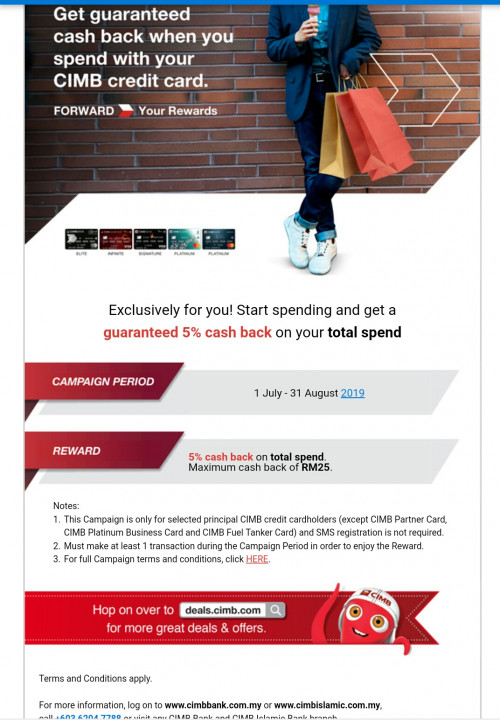

For those wanting more info, here's the

T&C

I got into a panic prematurely. Apparently if you don't fit the bill, you won't be offered, as per T&C

QUOTE

Cardholder Eligibility

4. To be eligible to participate in the Programme, the:-

i.Cardholder must be a Malaysian having an annual income of not exceeding RM60,000 (as per the latest verified income in CIMB’s record);

ii.Cardholder’s average payment ratio for the previous 12 months does not exceed 10% (i.e. for the past 12 months he has made an average repayment of 10% or less of his outstanding balances);

iii.Cardholder is a consistent revolver over the past 12 months(i.e. the Cardholder has not made any full payment of his statement balance over the past 12 months); and

iv.Cardholder’s card account is current and not delinquent.

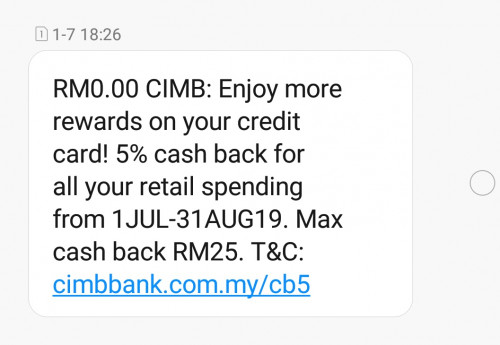

5. A Cardholder will be assessed by CIMB on his eligibility sevendaysbefore his Card statement cycle date. If a Cardholder is assessed to be an Eligible Cardholder, CIMB will send him a short message service (“SMS”), notifying him of his eligibility and unless the Cardholder chooses to opt out, CIMB will automatically enroll the Cardholder into the Programme which will take effect the following month.

6.Cardholders may opt-out from the Programme by contacting CIMB Call Centre at +603 6204 7788.

EDIT: Damn formatting always run4. To be eligible to participate in the Programme, the:-

i.Cardholder must be a Malaysian having an annual income of not exceeding RM60,000 (as per the latest verified income in CIMB’s record);

ii.Cardholder’s average payment ratio for the previous 12 months does not exceed 10% (i.e. for the past 12 months he has made an average repayment of 10% or less of his outstanding balances);

iii.Cardholder is a consistent revolver over the past 12 months(i.e. the Cardholder has not made any full payment of his statement balance over the past 12 months); and

iv.Cardholder’s card account is current and not delinquent.

5. A Cardholder will be assessed by CIMB on his eligibility sevendaysbefore his Card statement cycle date. If a Cardholder is assessed to be an Eligible Cardholder, CIMB will send him a short message service (“SMS”), notifying him of his eligibility and unless the Cardholder chooses to opt out, CIMB will automatically enroll the Cardholder into the Programme which will take effect the following month.

6.Cardholders may opt-out from the Programme by contacting CIMB Call Centre at +603 6204 7788.

This post has been edited by marquis: Jul 26 2019, 05:30 PM

Jul 26 2019, 05:27 PM

Jul 26 2019, 05:27 PM

Quote

Quote

0.0242sec

0.0242sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled