Outline ·

[ Standard ] ·

Linear+

Investors Club V10, Previously known as Traders Kopitiam

|

Cubalagi

|

Nov 5 2019, 07:58 PM Nov 5 2019, 07:58 PM

|

|

QUOTE(moosset @ Nov 5 2019, 07:07 PM) thanks! It is as I suspected. the Ireland domiciled ETF is not a kind of cross-listing, right? How does it move in relation to the US S&P500 ETF? The Ireland S&P500 ones are more like the HK Vanguard S&P500. A separate fund that invest in US listed S&P500 stocks. But pricing will behave similar concept like the Singapore. Market makers are usually the same international brokers. Only that there is a time overlap. Say u are trading the Ireland etf in LSE, London is 4-5 hours ahead of NY. So when London open, NY is still closed. But halfway, NY will open. Anyway, my view is these ETF are just wrappers of the same chocolate. Selection of the chocolate is more important, rather than the best wrapper. Oh.. Want to add.. How much chocolate want to eat n when to eat also very important too.. N whether to eat nasi lemak, dim sum, peking duck.. 😆 This post has been edited by Cubalagi: Nov 5 2019, 08:57 PM |

|

|

|

|

|

moosset

|

Nov 5 2019, 09:38 PM Nov 5 2019, 09:38 PM

|

|

QUOTE(Cubalagi @ Nov 5 2019, 07:58 PM) The Ireland S&P500 ones are more like the HK Vanguard S&P500. A separate fund that invest in US listed S&P500 stocks. But pricing will behave similar concept like the Singapore. Market makers are usually the same international brokers. Only that there is a time overlap. Say u are trading the Ireland etf in LSE, London is 4-5 hours ahead of NY. So when London open, NY is still closed. But halfway, NY will open. I see. When they are not overlap, the price is quite stagnant with a small fluctuation. Maybe a bit of arbitrage opportunity? QUOTE(Cubalagi @ Nov 5 2019, 07:58 PM) Anyway, my view is these ETF are just wrappers of the same chocolate. Selection of the chocolate is more important, rather than the best wrapper. Oh.. Want to add.. How much chocolate want to eat n when to eat also very important too.. N whether to eat nasi lemak, dim sum, peking duck.. 😆 yes, you're right. My money comes in EUR & SGD, so I was wondering if I should avoid converting to USD (avoid losing on currency exchange). |

|

|

|

|

|

Cubalagi

|

Nov 6 2019, 12:56 PM Nov 6 2019, 12:56 PM

|

|

QUOTE(moosset @ Nov 5 2019, 09:38 PM) I see. When they are not overlap, the price is quite stagnant with a small fluctuation. Maybe a bit of arbitrage opportunity? yes, you're right. My money comes in EUR & SGD, so I was wondering if I should avoid converting to USD (avoid losing on currency exchange). Sometimes u might get lucky n get Etf at a nice discount to NAV, esp the less liquid ones. Always good to look out for the iNAV (sometimes called IOPV) when buying an ETF. Eg 3115 HK ishares HSI ETF https://www.blackrock.com/hk/en/products/28...-index-etf-fundScroll down the page to find the estimated NAV As at 1.25pm the NAV is HKD102.4 N then check the bid n ask on trading platform/exchange Bid: HKD102.3 Ask:HKD102.7 No discounts there N yes, forex costs n taxes are things to consider. That's why my dividend/interest hunting ground is so far Malaysia/Singapore only. If I go to other markets (now easy with many ETFs everywhere), I only look for capital gain, dividend if any just a bonus. Edited to include link This post has been edited by Cubalagi: Nov 6 2019, 01:27 PM |

|

|

|

|

|

Cubalagi

|

Nov 6 2019, 04:58 PM Nov 6 2019, 04:58 PM

|

|

QUOTE(moosset @ Nov 5 2019, 09:38 PM) My money comes in EUR & SGD, so I was wondering if I should avoid converting to USD (avoid losing on currency exchange). Since u asked me, I was looking at some SGX etfs. I never really looked at them much before to be honest. Now I see some interesting ones, which I will consider in the future. This post has been edited by Cubalagi: Nov 6 2019, 04:59 PM |

|

|

|

|

|

moosset

|

Nov 7 2019, 09:18 AM Nov 7 2019, 09:18 AM

|

|

What do economists and analysts think of the Brexit and the trade war?

how do they affect the following currency pairs?

USD/GBP??

USD/EUR??

GBP/EUR: this one by logic should drop.

EUR/JPY??

|

|

|

|

|

|

Cubalagi

|

Nov 7 2019, 02:47 PM Nov 7 2019, 02:47 PM

|

|

QUOTE(moosset @ Nov 7 2019, 09:18 AM) What do economists and analysts think of the Brexit and the trade war? how do they affect the following currency pairs? USD/GBP?? USD/EUR?? GBP/EUR: this one by logic should drop. EUR/JPY?? I never really pay attention to those pairs. U hv to ask forex traders. But US China trade war benefits JPY, that I know. |

|

|

|

|

|

moosset

|

Nov 7 2019, 03:05 PM Nov 7 2019, 03:05 PM

|

|

QUOTE(Cubalagi @ Nov 7 2019, 02:47 PM) I never really pay attention to those pairs. U hv to ask forex traders. But US China trade war benefits JPY, that I know. because I've placed orders for SXR8. If EUR/MYR drops after Brexit, then...  and why HKD/MYR doesn't drop despite protest? This post has been edited by moosset: Nov 7 2019, 03:07 PM |

|

|

|

|

|

Cubalagi

|

Nov 7 2019, 03:08 PM Nov 7 2019, 03:08 PM

|

|

QUOTE(moosset @ Nov 7 2019, 03:05 PM) because I've placed orders for SXR8. If EUR/MYR drops after Brexit, then...  Its an S&P500 etf so actually the EUR/MYR rate is irrelevant. HKD is pegged to USD.. This post has been edited by Cubalagi: Nov 7 2019, 03:09 PM |

|

|

|

|

|

moosset

|

Nov 8 2019, 07:17 AM Nov 8 2019, 07:17 AM

|

|

QUOTE(Cubalagi @ Nov 7 2019, 03:08 PM) Its an S&P500 etf so actually the EUR/MYR rate is irrelevant. HKD is pegged to USD.. but SXR8 is denominated in EUR so when you cash out to MYR, you'd be losing money, no?? |

|

|

|

|

|

Cubalagi

|

Nov 8 2019, 01:24 PM Nov 8 2019, 01:24 PM

|

|

QUOTE(moosset @ Nov 8 2019, 07:17 AM) but SXR8 is denominated in EUR so when you cash out to MYR, you'd be losing money, no?? The underlying is USD, so doesn't matter unless after you sell u keep EUR a long time. |

|

|

|

|

|

mrbigggyyy

|

Nov 8 2019, 08:34 PM Nov 8 2019, 08:34 PM

|

Getting Started

|

haha why is this thread not talking about investing in stocks or like stocks fundamentals anymore?

|

|

|

|

|

|

danmooncake

|

Nov 13 2019, 12:02 PM Nov 13 2019, 12:02 PM

|

|

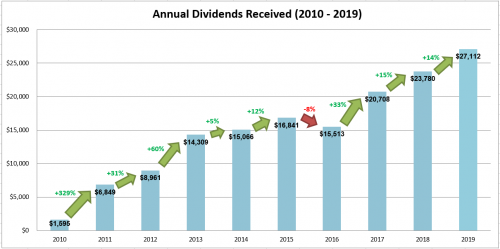

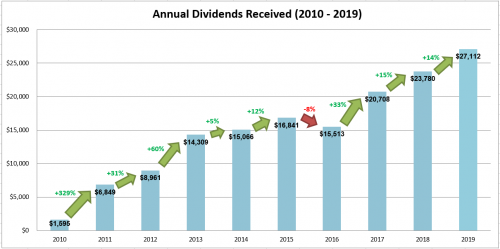

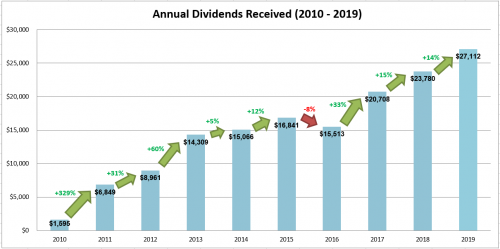

QUOTE(Dividend Warrior @ Nov 9 2019, 08:57 PM) Trade war? What trade war?   Trade war mainly affects manufacturing, agri, retail and commodity. Your portfolio with those great dividends probably not affected.  |

|

|

|

|

|

moosset

|

Nov 13 2019, 08:07 PM Nov 13 2019, 08:07 PM

|

|

QUOTE(Dividend Warrior @ Nov 9 2019, 08:57 PM) Trade war? What trade war?   wah... invested for so many years?? how old are you?? |

|

|

|

|

|

danmooncake

|

Nov 22 2019, 11:29 PM Nov 22 2019, 11:29 PM

|

|

QUOTE(moosset @ Nov 13 2019, 08:07 PM) wah... invested for so many years?? how old are you?? Age doesn't matter in investing.. but money grows over time if you've a good set of portfolio. Always start early.. the younger you are, the more time you have to accumulate wealth. |

|

|

|

|

|

nghoongen

|

Nov 29 2019, 12:32 PM Nov 29 2019, 12:32 PM

|

|

Hey guys, I know it's kind of weird to ask here but where can I look for contact of remisiers?

|

|

|

|

|

|

Purestaff

|

Dec 10 2019, 04:00 AM Dec 10 2019, 04:00 AM

|

New Member

|

It seems to me that the best time to trade stock market is the period of quarterly reporting, when the situation becomes more transparent and we have accurate figures that show what is happening in one or another area at the moment. I've noticed the tendency that some companies are running contradictory information and at a time when everything is talking about the decline in the value of their shares, they are still growing in price. Each time I find different explanations for this, for example, with large earnings the company increases the number of stocks and so on. But in general, this is an interesting format, and for those who trade on the forex market, and for those who prefer other directions in the market.

|

|

|

|

|

|

Cubalagi

|

Dec 10 2019, 01:46 PM Dec 10 2019, 01:46 PM

|

|

QUOTE(Purestaff @ Dec 10 2019, 04:00 AM) It seems to me that the best time to trade stock market is the period of quarterly reporting, when the situation becomes more transparent and we have accurate figures that show what is happening in one or another area at the moment. I've noticed the tendency that some companies are running contradictory information and at a time when everything is talking about the decline in the value of their shares, they are still growing in price. Each time I find different explanations for this, for example, with large earnings the company increases the number of stocks and so on. But in general, this is an interesting format, and for those who trade on the forex market, and for those who prefer other directions in the market. QR is a lagging indicator. For eg the current Q 2019 (Oct-Dec) report will only be out in Feb 2020.Big price movements only usually happen if there are surprises, good or bad. This post has been edited by Cubalagi: Dec 10 2019, 01:47 PM |

|

|

|

|

|

moosset

|

Dec 10 2019, 07:11 PM Dec 10 2019, 07:11 PM

|

|

If the underlying instrument is in USD, the currency of the instrument is in EUR, then do you buy this instrument when USD is weakened or when EUR is weakened, assuming my base currency is MYR? I'm confused already.

|

|

|

|

|

|

Cubalagi

|

Dec 10 2019, 07:51 PM Dec 10 2019, 07:51 PM

|

|

QUOTE(moosset @ Dec 10 2019, 07:11 PM) If the underlying instrument is in USD, the currency of the instrument is in EUR, then do you buy this instrument when USD is weakened or when EUR is weakened, assuming my base currency is MYR? I'm confused already. In this case, EUR is not relevant. As a side note, a sustained weak USD is very good to KLCI. Eg. From early 2017 to March 2018, USD weakened vs MYR from 4.45 to 3.86 (13%). In that time, KLCI was up from 1600 to 1850+ (+15%).* During same period, S&P was also up about 17%. But in MYR terms its only 4-5% returns. * n buying China may even be better. This post has been edited by Cubalagi: Dec 10 2019, 08:03 PM |

|

|

|

|

Nov 5 2019, 07:58 PM

Nov 5 2019, 07:58 PM

Quote

Quote

0.0408sec

0.0408sec

1.10

1.10

6 queries

6 queries

GZIP Disabled

GZIP Disabled