QUOTE(Cubalagi @ Oct 15 2019, 02:47 PM)

VTI is US total stock market, not the world stock market. It has 3600 US large, mid n small cap socks as opposed to 500 large cap only S&P500.

ah.. sorry. I misread as world total stock. Investors Club V10, Previously known as Traders Kopitiam

|

|

Oct 15 2019, 02:52 PM Oct 15 2019, 02:52 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

|

|

|

|

|

|

Oct 15 2019, 02:55 PM Oct 15 2019, 02:55 PM

|

Senior Member

4,490 posts Joined: Mar 2014 |

QUOTE(moosset @ Oct 15 2019, 02:52 PM) https://investorplace.com/2014/08/better-index-sp-500/I think u mixed up VTI n VT.. That's why. This post has been edited by Cubalagi: Oct 15 2019, 02:56 PM |

|

|

Oct 15 2019, 10:07 PM Oct 15 2019, 10:07 PM

Show posts by this member only | IPv6 | Post

#4703

|

Senior Member

1,744 posts Joined: Nov 2007 |

QUOTE(Cubalagi @ Oct 15 2019, 02:10 PM) This was discussed extensively in this forum. I think the conclusion was M+ is better. thanksOn Rakuten, the nice thing about Rakuten is completely online account opening. M+ u still need to drop by their branch. Second is the RT points that can convert to AirAsia etc. The not nice part about Rakuten is that it's a nominee account., which means can't apply for IPOs n attend Agms. M+ seem to have many seminars and training. |

|

|

Oct 15 2019, 10:50 PM Oct 15 2019, 10:50 PM

|

Junior Member

840 posts Joined: Apr 2014 |

QUOTE(~Curious~ @ Oct 15 2019, 11:38 AM) hrmm..can anyone elaborate on d differences between rakuten trade and mplus? I've been using Rakuten since end of 2017.- ive checked both, d brokerage fees for cash upfront account is RM7.00, sounds like up the alley of a newbie small fry like me.. - i'd prolly only need to trade less than RM5k a transaction. - i mainly communicate in English so the education links at m+ seem more attractive Feel free to PM me if you want to know more in depth experience (the pros and the cons) on using Rakuten. I don't have M+ but may consider switching in the future if attending AGMs / buying IPOs becomes relevant to me. |

|

|

Oct 16 2019, 01:35 PM Oct 16 2019, 01:35 PM

|

Senior Member

4,490 posts Joined: Mar 2014 |

|

|

|

Oct 16 2019, 01:45 PM Oct 16 2019, 01:45 PM

|

Junior Member

840 posts Joined: Apr 2014 |

QUOTE(Cubalagi @ Oct 16 2019, 01:35 PM) I would say it is good, but only at a minuscule level. I'm not familiar with AirAsia BIG but we'll take BONUSLink Points as an example, since I'm also a shell petrol user. In Bonuslink you need 1000points to convert to RM10 worth of petrol, but each Rakuten trade transaction only gives you very little point (easily single digit). "For every RM 2 brokerage paid, earn 1 RT point = 1 point on any of our affliate partners platforms." When they have promotions though it's kinda worth it (e.g. opening an account and get free 1000 points). It's only in Rakuten's favor to encourage you to perform more trades, since that's how they generate profits. Don't be tempted to trade excessively just for the sake of getting those points if you're not into short term stock trading, or should I say gambling. RT has too little emphasis on long term investment. But if you're talking about convenience plus A BIT of incentive in the form of points, then RT is the clear winner. |

|

|

|

|

|

Oct 16 2019, 03:12 PM Oct 16 2019, 03:12 PM

|

Senior Member

4,490 posts Joined: Mar 2014 |

QUOTE(Kar Weng @ Oct 16 2019, 01:45 PM) I would say it is good, but only at a minuscule level. I'm not familiar with AirAsia BIG but we'll take BONUSLink Points as an example, since I'm also a shell petrol user. In Bonuslink you need 1000points to convert to RM10 worth of petrol, but each Rakuten trade transaction only gives you very little point (easily single digit). Yes, can see that they want to push for more active trading. I see a lot of points for contra account opening and warrant trading. Dangerous stuff for newbies. "For every RM 2 brokerage paid, earn 1 RT point = 1 point on any of our affliate partners platforms." When they have promotions though it's kinda worth it (e.g. opening an account and get free 1000 points). It's only in Rakuten's favor to encourage you to perform more trades, since that's how they generate profits. Don't be tempted to trade excessively just for the sake of getting those points if you're not into short term stock trading, or should I say gambling. RT has too little emphasis on long term investment. But if you're talking about convenience plus A BIT of incentive in the form of points, then RT is the clear winner. So u get good points in the joining, but thereafter if purely based on cash upfront brokerage, it's really nothing great. To get an extra 500 RT, need to trade RM1000 worth of brokerage. That will take me several years. I guess it only make sense when you combine the points with other sources. This post has been edited by Cubalagi: Oct 16 2019, 03:13 PM |

|

|

Oct 17 2019, 10:11 AM Oct 17 2019, 10:11 AM

|

Senior Member

1,744 posts Joined: Nov 2007 |

what can u use d RT points for?

|

|

|

Oct 17 2019, 04:25 PM Oct 17 2019, 04:25 PM

|

Senior Member

4,490 posts Joined: Mar 2014 |

|

|

|

Oct 17 2019, 09:24 PM Oct 17 2019, 09:24 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

UK & EU already found a deal.

so no more recession? |

|

|

Oct 17 2019, 10:37 PM Oct 17 2019, 10:37 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

|

|

|

Oct 18 2019, 12:29 AM Oct 18 2019, 12:29 AM

|

Senior Member

4,490 posts Joined: Mar 2014 |

|

|

|

Oct 18 2019, 12:49 AM Oct 18 2019, 12:49 AM

|

Senior Member

4,490 posts Joined: Mar 2014 |

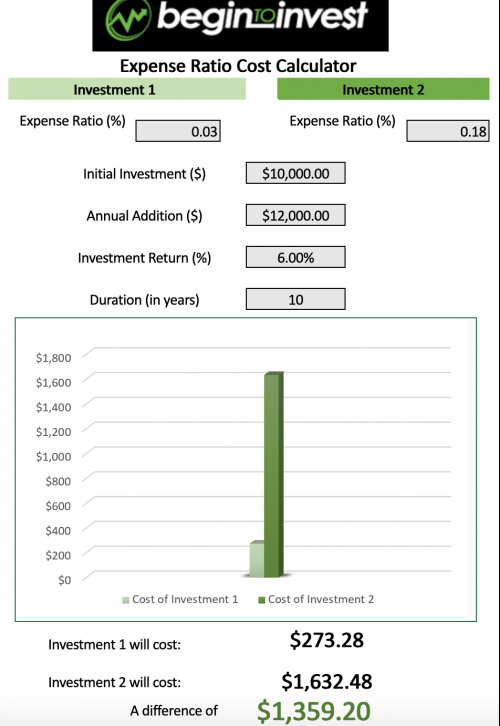

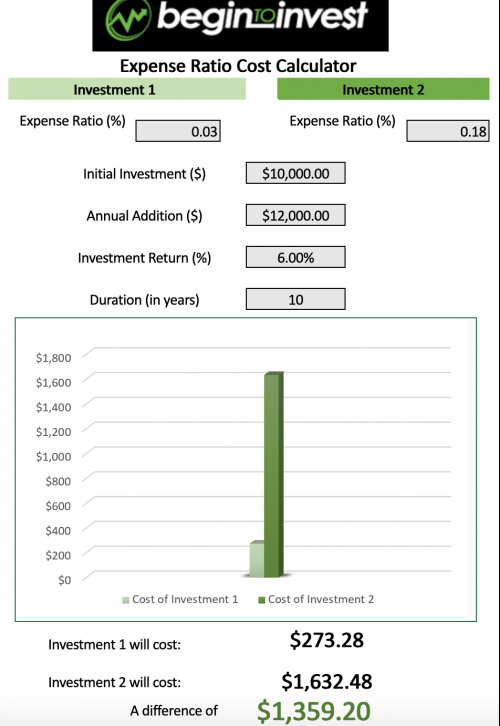

QUOTE(moosset @ Oct 17 2019, 10:37 PM) wah... can use USD, HKD or RMB. Definitely a plus. High? Hahah.. 0.18% pa is not damn high at all.but the expense ratio is 0.18%! Damn high! VOO only 0.03%. High is like the Public Mutual/FSM UT types that are still charging 1.8% per annum for foreign equity funds. N many ppl still invest in them! US etfs like VOO are super low expense nowadays is to attract those advisors such as Stashaway to use them. These guys charge like 0.8% per anum. So u add in the ETF fees, say 0.18%, then it becomes 0.98% which then this start to impact performance. But if u invest directly, then u practically won't feel the difference in performance between a 0.18% vs a 0.03% pa, unless u are the few bucks that matter person. Your selection of the right underlying and market timing are far more important. This post has been edited by Cubalagi: Oct 18 2019, 01:42 AM |

|

|

|

|

|

Oct 18 2019, 11:11 AM Oct 18 2019, 11:11 AM

|

Senior Member

1,744 posts Joined: Nov 2007 |

Cubalagi saya plankton,prolly cant rake up enough RT points to convert..haha...im more interested in the support and learning facilities?do u know of it,or its non-existent in RT?I checked out their site,not much workshops but im wondering if they show it only to registered users

|

|

|

Oct 18 2019, 11:53 AM Oct 18 2019, 11:53 AM

|

Senior Member

4,490 posts Joined: Mar 2014 |

QUOTE(~Curious~ @ Oct 18 2019, 11:11 AM) Cubalagi saya plankton,prolly cant rake up enough RT points to convert..haha...im more interested in the support and learning facilities?do u know of it,or its non-existent in RT?I checked out their site,not much workshops but im wondering if they show it only to registered users Not much on learning n workshops. |

|

|

Oct 18 2019, 04:03 PM Oct 18 2019, 04:03 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

QUOTE(Cubalagi @ Oct 18 2019, 12:49 AM) High? Hahah.. 0.18% pa is not damn high at all. I'm not sure how to calculate the fees based on expense ratio so I used an online calculator. High is like the Public Mutual/FSM UT types that are still charging 1.8% per annum for foreign equity funds. N many ppl still invest in them! US etfs like VOO are super low expense nowadays is to attract those advisors such as Stashaway to use them. These guys charge like 0.8% per anum. So u add in the ETF fees, say 0.18%, then it becomes 0.98% which then this start to impact performance. But if u invest directly, then u practically won't feel the difference in performance between a 0.18% vs a 0.03% pa, unless u are the few bucks that matter person. Your selection of the right underlying and market timing are far more important. https://www.begintoinvest.com/expense-ratio-calculator/ 10k initial, 12k annual, 6% annual return = 1359 difference. but on the other hand, dividend in HK has no tax. Hmm... still not sure which is better. Maybe just buy both.  |

|

|

Oct 18 2019, 05:12 PM Oct 18 2019, 05:12 PM

|

Senior Member

4,490 posts Joined: Mar 2014 |

QUOTE(moosset @ Oct 18 2019, 04:03 PM) I'm not sure how to calculate the fees based on expense ratio so I used an online calculator. For me 0.18% pa is good. I guess if u r thinking of 10 year+ investing in tht product, then all the small savings will look big. U can try plug in using the expenses of a normal Malaysian UT .. U will get a shock of how much it costs an investor over a long term which is why I exited UT many years ago. https://www.begintoinvest.com/expense-ratio-calculator/ 10k initial, 12k annual, 6% annual return = 1359 difference. but on the other hand, dividend in HK has no tax. Hmm... still not sure which is better. Maybe just buy both.  I also think u should also look at ur total investment portfolio costs. Since I hold directly stocks n bonds (No MER), cash (no MER) n ETFs (low MER), my total portfolio cost is still low. I hold 0 unit trusts n don't use discretionary fund services or robo advisors. N of course u need to minimize the transaction costs: brokerage, forex etc. That tends to be high as well. On the HKD ETF, u still can't avoid the WHT tax I'm afraid. I believe the dividends paid to u will be net of the WHT on the ETF itself. This post has been edited by Cubalagi: Oct 18 2019, 05:15 PM |

|

|

Oct 19 2019, 11:04 AM Oct 19 2019, 11:04 AM

|

Senior Member

1,917 posts Joined: Sep 2012 |

|

|

|

Oct 19 2019, 11:58 AM Oct 19 2019, 11:58 AM

|

Senior Member

4,490 posts Joined: Mar 2014 |

|

|

|

Oct 19 2019, 12:11 PM Oct 19 2019, 12:11 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

|

|

Topic ClosedOptions

|

| Change to: |  0.0387sec 0.0387sec

0.33 0.33

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 07:06 AM |