QUOTE(ironman16 @ Jan 15 2021, 11:12 AM)

why not

but i takut

if really want, i will consider ASEAN fund only.......mostly ASEAN fund major in Msia/Sing/Indo ....

You might as well buy 30% Indon fund, 30% Asia etc.

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jan 15 2021, 01:45 PM Jan 15 2021, 01:45 PM

Return to original view | Post

#81

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

|

|

|

Jan 15 2021, 08:27 PM Jan 15 2021, 08:27 PM

Return to original view | Post

#82

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(ironman16 @ Jan 15 2021, 03:07 PM) i oledi got a few single country/sector fund..... your portfolio macam ok, if want to put an Indon or Viet fund, don't dilute it to ASEAN based already! Let them attack!As FSM describe, portfolio is like a team of soccer: Goalkeeper Msia centric Emergency fund/MMF exclude EPF bcoz i cant touch it Defender (FI) Msia centric FI/Amanah saham FP/ PRS Midfield (Regional fund) Asia Pacific/ Asia ex Japan/ Global i just serve my robo advisor as wing attack (all my risk is aggresive) Stricker (single country/ sector) China A share/ Gold/ Tech beside regular topping, this year i try to polish my defender line bcoz every time kena bolos (tangan yg gatal use it for others purpose) May b add a bit foreign expose bond or equity expose bond.... after this tangan gatal lagi, macam mahu tambah ASEAN fund liao..... ironman16 liked this post

|

|

|

Jan 15 2021, 08:51 PM Jan 15 2021, 08:51 PM

Return to original view | Post

#83

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(ironman16 @ Jan 15 2021, 08:43 PM) just dont feel quite confident with indon n viet....... it really is up to individual risk appetite. Just go for it.if got budget , just add ASEAN fund......still ok la although not quite aggresive but still can attack ma..... yklooi liked this post

|

|

|

Jan 16 2021, 02:39 PM Jan 16 2021, 02:39 PM

Return to original view | Post

#84

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

Jan 16 2021, 08:49 PM Jan 16 2021, 08:49 PM

Return to original view | Post

#85

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

Can try this for black rock next gen technology fund : https://secure.fundsupermart.com/fsm/admin/...sheetBGF144.pdf Looks extremely diversified with broad technology companies. In spite of that, a 100% return in a year is very impressive. whirlwind liked this post

|

|

|

Jan 16 2021, 10:45 PM Jan 16 2021, 10:45 PM

Return to original view | Post

#86

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(ironman16 @ Jan 16 2021, 10:15 PM) just weird lo If the fund NAV keep going up, many ppl will said now is All Time High (ATH), wait for the dip (or bubble pop) i baru in when the fund NAV keep going down, many ppl will said now the fund seen not perform well , wait a moment or find others fund that perform better. this two scenario keep rotating, sampai bila baru mahu in le.... ......................................................................................................................................... If the NAV keep going up, when u top up, the unit that u get become less n less....when NAV drop, u afraid n stop top up, at the end ur accumulate unit become lesser compare to if NAV up i top up regularly as normal, if NAV starting drop, i top up again, dip again, i top up again, so the accumulate unit will become more. At that time just wait the fund perform well then u can harvest liao..... that why must spare some $$$$ for u to top up that why we select the fund that we forseen good in future , if not perform well u cant blame ppl ma bcoz is ur choice.... ......................................................................................................................................... if cant sleep well, try put ur money 50% in MMF, 30% in FI, 20% in EQ (select 4 regional + Tech fund with each 5% /Asia ex japan,Msia,Global,Tech) like this combination, sure u every night happy my opinion only...... I always say follow your risk appetite. But keep some powder dry. A little bit of cash will never hurt. Maybe even 20% cash is fine. |

|

|

|

|

|

Jan 17 2021, 12:26 AM Jan 17 2021, 12:26 AM

Return to original view | Post

#87

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

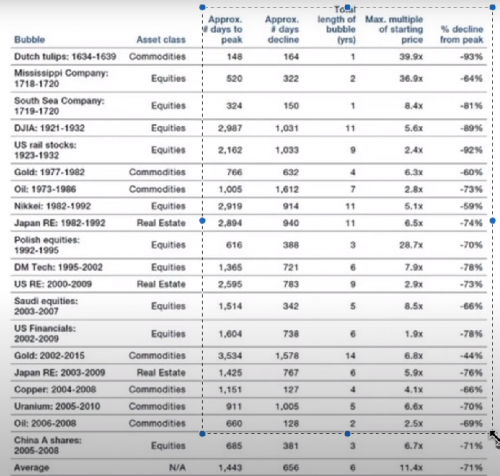

QUOTE(killdavid @ Jan 16 2021, 10:39 PM) not implying anything. just sharing statistics which i found interesting. Need to add tesla, us tech and gloves.Are we investing based on fundamentals or chasing performance ?  But in most cases listed, fed wasn't printing money or fed wasn't supporting it. WhitE LighteR liked this post

|

|

|

Jan 18 2021, 10:35 AM Jan 18 2021, 10:35 AM

Return to original view | Post

#88

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

|

|

|

Jan 19 2021, 10:19 PM Jan 19 2021, 10:19 PM

Return to original view | Post

#89

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

something that I don't understand even after years of investing in funds. What do they really mean when take money off the table but retain some exposure? Do they mean to rebalance? Suppose you have only 5% in tech funds and they make a lot of money, say 40%, do you mean to cut it to 3%?

Another weird thing is, if you look at the composition of almost every single fund, exposure is highest towards tech companies. Be it alibaba, tencent, jd, and telecoms in China, vs Apple, MSFT, AMZN FANGS, tesla etc in US. While, I do wholehearted agree with the fact that Tech is far too expensive and should come down, I wonder how to play it with funds, especially mutual funds. ETF's are not so difficult. |

|

|

Jan 19 2021, 10:35 PM Jan 19 2021, 10:35 PM

Return to original view | Post

#90

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(ironman16 @ Jan 19 2021, 10:23 PM) in the context of mutual funds, switch to what???I am wondering now, switch to bond funds, or switch to other themes? Because, as I suggest most equity funds have an abundance of tech in composition. Its more easy for me to go to share market and select Public bank than find an equity fund that does not so much tech in it. |

|

|

Jan 19 2021, 11:07 PM Jan 19 2021, 11:07 PM

Return to original view | Post

#91

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(ironman16 @ Jan 19 2021, 10:44 PM) i know.....no place to run..... ya lo, in my case I may just reduce or cut the dca for a while. but in long term generally it will be a loss of opportunity, IMHO.if is me, i switch other fund , no fund, i switch bond fund, no place just let it ...... i not need to think bcoz ikan bilis, portfolio still rolling..... since last year oledi perform well......hope it continue the steam WhitE LighteR liked this post

|

|

|

Jan 22 2021, 01:20 PM Jan 22 2021, 01:20 PM

Return to original view | Post

#92

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(leesw2263 @ Jan 22 2021, 01:09 PM) Hi All Sifu, The best time to invest is always when u you have money. The best way to reduce risk at the expense of more gain is spread out the investment over time, ie DCA. I bougut last year (follow my FC advice) 1) Principal Greater china, as per today 55% gain 2) A Hwang AP ex Japan Dividen Fund - 29% gain 3) A Hwang Aiiman Asia ex Japan Growth Fund - 29% gain 10K each He suggests me to top up some, is it the right time to top it up? thank you and your input is highly appreciated. Lee If your FC(what is that? Fund collector?) Gives good advice, why doubt? |

|

|

Jan 22 2021, 05:21 PM Jan 22 2021, 05:21 PM

Return to original view | Post

#93

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(vanitas @ Jan 22 2021, 04:33 PM) Just a word of advice, a lot of believers like that across US ETF, bitcoin, or even now UT (??).. If you don't do something rash, even lump summing all your investible money right now, into basket of funds should return you something sensible in the long run (>10 years).The reality is future is not guaranteed despite how many believers talk the same thing. You might wait forever (within your lifetime) and the price never went back, although the chance is very very low. But the chance getting higher if you doesn't have much time to wait (getting older, need to spend for house or kids, accidental and emergency expense, lose job forced retired etc). US etf was once lagged since subprime mortgage crisis till the rise of Apple / smartphone. That's around 10 years. Bitcoin was lagged since 2017 till 2020. 3 years. But it is still new, if you compare Gold which similar to bitcoin as store of value, I think previously rise for 10 to 20 years, which at that point everyone also talk about buy gold, then drop and lagged for like 10 years. For UT, Malaysia market once having the longest bull market in the world, like 12 years, until now soon longest bear in the world. You may find a lot of stories in public mutual thread since they serve the longest business in UT, how many people doesn't make money after 10 years. Just for anyone to reference, since everyone was talk about how much they made in various investments easily, and recently, but never zoom out. In this time, just make sure you don't withdraw (because that will seriously lock in your losses, if any) and make sure you add more investment as matter of DCA'ing. Because if you are investing from your regular income it is hard to imagine your lump sum today is going to be more significant than your regular payments for say next 10 years. In these 10 years, you should also do some homework and rebalance, look for alpha and vary your strategy a little. (come in here are talk cock sing song with us). With both of these on your side (time, and regular money), one just has to maintain a good portfolio balance every few quarters or even every year, it should not be so risky as to make you poor, or make you lose sleep. As and example and zoomed out, with UT I have been investing for 15 years now, and with regular + irregular investment it is around 8 to 9% IRR as of today. It did dip to below 0 in 2018 and now its back up. All I had to do was more or less stay invested and, rebalance some poor performance funds. It wasn't that hard and risky. This also includes some rather poor choices of funds at one point (thank you, Tan Sri Teh Hong Piow for your wonderful company that made me lose a few years worth of returns), call it school fees. But they did not make me lose principal. Only 2009 and 2018 and now Covid made me lose money. The only thing I can advise others who are starting out or having a long term outlook, is don't expose too much to Malaysia / political stocks and never down rate US economy. As long as you keep at strategy between these 2 and diversify a little you should be fine. |

|

|

|

|

|

Jan 22 2021, 08:06 PM Jan 22 2021, 08:06 PM

Return to original view | Post

#94

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(WhitE LighteR @ Jan 22 2021, 07:35 PM) i always wonder, asking recommendation like this works meh? without seeing a correlation table between each fund, how to know if the portfolio is balance or not. what is their risk to reward ratio. etc Not everyone is privy to correlation and risk reward tools. Generally speaking most recent variation tables are recently invalidated by the Covid dip.So hence here we just kopitiam it and wing it. Lol. Eventually if we are talking about mutual funds perhaps it should not be as complicated as building the portfolio matrix. I would really recommend that for passive indexing though. WhitE LighteR liked this post

|

|

|

Jan 22 2021, 08:15 PM Jan 22 2021, 08:15 PM

Return to original view | Post

#95

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(jj_jz @ Jan 22 2021, 06:42 PM) Hi bro, its been a while since we last chat. Hang tight, most believe correction coming soon. So, keep on buying. Right now I am also looking for avenues but all are tech heavy and as many have said too concentrated.Thank you for the advices previously and just to share with you for the past month, both my FSM and SAMY are doing a 6% growth which is quite surprisingly for me as a newbie. Btw, just curious that if you are looking at any certain fund, for the upcoming once-a-year event. Thinking to make my portfolio more diversify other than China and Tech. |

|

|

Jan 23 2021, 04:03 PM Jan 23 2021, 04:03 PM

Return to original view | Post

#96

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

Gila, almost all fund house hard sell China. We haven't even known how Biden will treat China. I think some calmer heads are required here. Of course this time around, China is much more internal consumption focused.. WhitE LighteR liked this post

|

|

|

Jan 23 2021, 04:36 PM Jan 23 2021, 04:36 PM

Return to original view | Post

#97

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(koo89 @ Jan 23 2021, 04:22 PM) haha same for me. Seems to be quite agressive butif he has 2million ringgit in EPF account then no problem. We shall let him updating us whether this strategy will work or not after 5 years. ^^ I was about 80% done typing something similar to your post and deleted it. I think it is difficult to replicate the return because: a) how many funds are there able to generate return more than 10%PA for the last 10 years? Many can generate exceptional return for few years but consistently to get 10%PA for 10 years is pretty difficult. b) Are we overly optimistic on the market? can we expect the fund price to go up 10-20% every few months? Is it realistic? Even individual stock hardly able to achieve it. c) What happens if the fund price goes down by 5 or 10%? Cut loss of mutual fund? This is totally new to me. So in March 2020 I should cut loss all my stock and mutual funds? I would then lose the chance enjoying the gain post March 2020. Time in the market beats timing the market. d) 2020 is an unprecedented year. If you buy before early 2020, you are likely still having a decent gain till now. If you lucky to time the market by buying after COVID 19 and enjoyed the quick and super profit due to excess liquidity, would it be the same for the next few years? e) Check out the talk by FSM Malaysia general manager Wong WeiYi this morning. Many new investors are overly optimistic (greedy) recently. They haven't "taste" the downside of the market yet. I dont get a share if you gain but I feel sorry if you lose money and thats why I share my humble opinion here. Don't shoot me please. peace Personally I am doing "boring investing style" - DCA monthly aiming return of 8-10% PA. I figured, actually why bother. He make money we benefit in some way (we are on the same boat, just he get down earlier). If he lose money he has a fat account to back. In fact, we are the ones who should listen to his advice..... |

|

|

Jan 23 2021, 04:45 PM Jan 23 2021, 04:45 PM

Return to original view | Post

#98

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(genesic @ Jan 23 2021, 04:20 PM) If Biden don't disturb China is considered good enough; both shall concentrate on own country's recovery. not going to happen. Even Obama himself has stated that he wanted to be confrontational towards China due to trade imbalance, Yuan devaluation, unfair practices, IP stealing. And remember Biden was VP. Obama didn't go through with it because it was 2009 and US was in the sub prime mortgage crisis recoveries. Whatever I disagree with Trump, confrontation with China is something I mostly agree with. Its a matter of hard they want to drive it. Sure, we won't get so much bluster from Orange man but I believe the stage, objectives and game has been set. Only the player is new and maybe the rules are being re-addressed slightly.QUOTE(xcxa23 @ Jan 23 2021, 04:21 PM) "Politically" and "stability" in US are more volatile as compared to China. Yes, China has indeed found ways to survive. It always does and always will. The question that I try to bring up is to temper the expectations a bit....I mean most fund managers with China funds are like "Come, bet your house and coffin money", we'll return you 2 houses and 2 coffins! lol.If not mistaken, Congress and senate are controlled by democrat. Which means, taxation hike higher chance to pass. Given how previous POTUS acted, declaring trade wars even with their allies, some of them allegedly "sided" with china So Regardless how the US will continue or harder sanction china or not, china found "loophole". Anyway I am also bullish. My allocation to greater china and AAXJ is actually higher than any other region, but that has been built up over time. WhitE LighteR liked this post

|

|

|

Jan 24 2021, 04:47 PM Jan 24 2021, 04:47 PM

Return to original view | Post

#99

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

full lock down means poor people will be even more affected. But Government will be fully expected to do blanket moratorium and reduce OPR at the least.

And then perhaps, people will be baying for more cash-y handouts. So, expect the market to go up for certain classes (surely glove will rally again). While those dependent on reopening will die further.... |

|

|

Jan 24 2021, 04:58 PM Jan 24 2021, 04:58 PM

Return to original view | Post

#100

|

Senior Member

3,117 posts Joined: Jul 2005 From: Penang |

QUOTE(WhitE LighteR @ Jan 24 2021, 04:52 PM) I doubt blanket moratorium will come back. Bank has 1 year to figure out targeted moratorium. They have perfected it. No longer need a cleaver when they have surgical knife now to use. OPR might take a cut sooner or later. I also hope they give tax cut in light of this. Cash handout don't effect most investors here. It has smaller effect compared to US handout. ya, maybe not blanket blanket per se but still will widen the coverage?Tax cut - almost no way in hell. Why? if you are affected then it is already reduced. If you are healthily making money you are the correct person to tax, even more so if possible (if you are taxable person then you sure don't like to hear this but it is truth). Cash handout wont at all help investors who already have money to invest....agree... which is why I think in nett only gloves will get heat up. It is a nett loss to the country if we full MCO. |

| Change to: |  0.0751sec 0.0751sec

0.73 0.73

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 12:46 PM |