QUOTE(yycclin @ Feb 17 2021, 12:05 PM)

Me same,,, i sold my Eastspring dynasti also ;( ;(

Now bang balls, bang walls

See the correct response below -

QUOTE(WhitE LighteR @ Feb 17 2021, 12:15 PM)

dont feel regret. we can only make decision base on the best available data at that time. so dont fret n just move on because at that moment you have your own reason to reallocate the fund else where as you see fit. nobody can win everything, all the time. not possible.

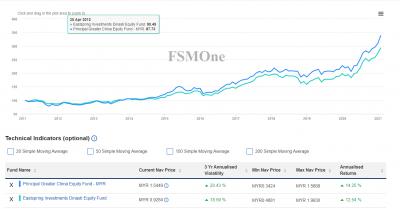

So in my case, when I sold the dinasti fund, 1/3rd went into Principal Greater China which was a yay

(to illustrate my point that you can find a better alpha and maintain beta), while 2/3rds went into Eastspring Equity income fund which was a nay

. Now why on earth did I do that? I thought, perhaps China will struggle to make it through Trump and his nonsense, hence reduce China allocation but go heavier on chinese tech (Principal greater china was at that time a bit more into tech, while dinasti was more into finance, but it didn't really matter really, had I just kept it there I'd be quite happy today nonetheless).

Next, also thought about allocating back to Malaysia since got Harapan and Guan Eng, we sure fly. This illustrates another point - Malaysia equity has too much political overtones and even undertones, and KLCI as a whole is a bad bad bad tracker. It is almost the same as investing in EPF if you put your money in Malaysia broadbased funds. Needless to say, eventually my Eastspring investment Equity income fund has also been reallocated to other funds. Eventually you start to lose track after 3-4 switches and might as well track the whole portfolio in general.

So, yeah, re-allocation and rebalancing works if you can see the future, which many of us (including myself) cannot. But reallocating during a fund's highs - now that's something I have not done until today. I have only tried reducing the DCA / fresh funds, something I am learning from Stashaway. It hardly ever sells anything during a high, it just switches fresh funds to lower performing assets to maintain a balanced portfolio.

TLDR -I now tend to track my portfolio as a whole, trying to bring it up in XIRR from all cash flows. I think that will give the best overall picture of my own management.

This post has been edited by lee82gx: Feb 17 2021, 12:38 PM

Feb 11 2021, 07:23 PM

Feb 11 2021, 07:23 PM

Quote

Quote

0.0614sec

0.0614sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled