Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

Ramjade

|

Feb 20 2017, 10:07 PM Feb 20 2017, 10:07 PM

|

|

QUOTE(contestchris @ Feb 20 2017, 09:56 PM) How come no platform fee for SG? How they make money if no fee? You sure switching is free for intra AND inter fund? I read the pamphlet for some CIMB SG funds and they all got 1% built-in switching fee wor... Here you go https://www.poems.com.sg/utzerofees/Why no fees? Good question 1) They are having price war with FSM SG. FSM SG thought they are smart by making all their funds with 0% SC so Phillip and Dollardex foughtback by offering 0% SC also plus )% platform fees. 2) 3 is a crowd. With 3 companies fighting for customers, there is no monopoly unlike in Malaysia. Because of 3 companies, SG banks also lower their price. Some banks SC are 1%/0.75%  How Phillip earn money? Good question. 1) They are one of SG main broker. SG brokerage is not cheap unlike Malaysia. Then also have margin trading. 2) FSM have where and what to invest. Phillip SG also have and they charge people for those wishing to attend SGD40/person. But if got promo it's SGD10/person. These are what I found out. This post has been edited by Ramjade: Feb 20 2017, 10:08 PM |

|

|

|

|

|

Ramjade

|

Feb 20 2017, 10:16 PM Feb 20 2017, 10:16 PM

|

|

QUOTE(AIYH @ Feb 20 2017, 10:11 PM) poems sg also have 0.5% switching fee, dont forget about that  I didn't see that. Last time don't have. (in January time. |

|

|

|

|

|

Ramjade

|

Feb 21 2017, 09:57 AM Feb 21 2017, 09:57 AM

|

|

QUOTE(David83 @ Feb 21 2017, 09:51 AM) Is it wise to take out EPF Account i and invest into Ponzi 2.0? It's not recognised by EPF, can do that? |

|

|

|

|

|

Ramjade

|

Feb 21 2017, 10:11 AM Feb 21 2017, 10:11 AM

|

|

QUOTE(David83 @ Feb 21 2017, 09:58 AM) Oh really, sorry I didn't check the list yet. If that's the case, please ignore my question. Btw, EPF did loosen up. Not sure if now can buy Ponzi 2 with EPF or not. Best to ask FSM customer service. This post has been edited by Ramjade: Feb 21 2017, 10:15 AM |

|

|

|

|

|

Ramjade

|

Feb 21 2017, 01:02 PM Feb 21 2017, 01:02 PM

|

|

QUOTE(TaintedSoul @ Feb 21 2017, 12:56 PM) Because he is using warp account kind of normal account with higher platform fees. |

|

|

|

|

|

Ramjade

|

Feb 21 2017, 04:30 PM Feb 21 2017, 04:30 PM

|

|

QUOTE(cjseng @ Feb 21 2017, 03:49 PM) Quite complicated: Libra AsnitaBond Fund - 10% Eastspring Investments Bond Fund - 5% RHB Emerging Market Bond Fund - 15% AFFIN HWANG SELECT BOND FUND - 15% Affin Hwang Select Asia (Ex Japan) Quantum Fund - 8% CIMB-Principal Asia Pacific Dynamic Income Fund - 12% ABERDEEN ISLAMIC WORLD EQUITY FUND - CLASS A - 12.5% KENAGA GROWTH FUND - 12.5% AMASIA PACIFIC REITS - CLASS B (MYR) - 10% target for 10 years monthly saving between balance to aggressive portfolio I guess. Open for advice and comments, many thanks! Why so many bond fund?  Replace aberdeen with manulife US/TA Global tech/Cimb titans. |

|

|

|

|

|

Ramjade

|

Feb 21 2017, 07:21 PM Feb 21 2017, 07:21 PM

|

|

QUOTE(puchongite @ Feb 21 2017, 07:09 PM) Want to switch out my Am Reits. Maybe switch to bond first to get some credit. Any recommendation ? Manulife AP REITS  |

|

|

|

|

|

Ramjade

|

Feb 21 2017, 10:20 PM Feb 21 2017, 10:20 PM

|

|

QUOTE(puchongite @ Feb 21 2017, 08:00 PM) TA is the best, I will get the most recent NAV for TA GTF the fastest, both in TA web and FSM. But TA takes the longest for the fund to appear if you sell. This post has been edited by Ramjade: Feb 21 2017, 10:20 PM |

|

|

|

|

|

Ramjade

|

Feb 22 2017, 01:08 PM Feb 22 2017, 01:08 PM

|

|

QUOTE(nick_linz @ Feb 22 2017, 12:55 PM) I'm still doing some readings before I buy my first unit trust. Why do you guys use FSM instead of getting it directly from the bank itself? I take this as an example: CIMB-PRINCIPAL ASIA PACIFIC DYNAMIC INCOME FUND FSMCIMBThe management and trustee fees offered by both CIMB and FSM are the same. Is the only difference here is the FSM 2% sales charges and the CIMB 6.5% application fees? Just trying to figure out which is platform would offer the lower management fees. Thanks. Fsm you kena charge only 2% for service charge. Sometimes even 0.5%. Cimb you kena charge 5%+. That's min 3% saving. |

|

|

|

|

|

Ramjade

|

Feb 22 2017, 06:14 PM Feb 22 2017, 06:14 PM

|

|

QUOTE(Nemozai @ Feb 22 2017, 05:45 PM) Both sifus, can I know your personal finance general portfolio? Not only UT, I mean how many % in KLSE, how many % in UT, how many % in FD or etc. Hope to learn a thing or two from you, thank you  Not sifu. But let me share with you my story. Used to be 100% promo FD, then move 30% into Amanah saham fixed price. Was planning to move 100%. Found out about FSM so decide to divert the remaining 70% into FSM. Got as far as 30% then realise RM is dropping like dead flies against all currency. Switch my remaining 40% into SGD for SGX. Will move out my FSM portion to Singapore UT. Additionally 10% from amanah saham each into SGX and Singapore UT. Reason for moving 1) I am trying to make sure inflation don't eat into my money 2) Protect my RM from continuous and futrue decline. No point earning 5-7% (dividends) in KLSE and see your RM depreciate. Better earn 5-7% (dividends) in SGX and have your value protected. Same with UT. No point earning 10% in MY when you can earned the same 10% in SG. As you can see it's not fixed. Up to individual prefences and need. This post has been edited by Ramjade: Feb 22 2017, 06:16 PM |

|

|

|

|

|

Ramjade

|

Feb 22 2017, 06:32 PM Feb 22 2017, 06:32 PM

|

|

QUOTE(Avangelice @ Feb 22 2017, 06:20 PM) please be aware that Ramjade has already considered moving his assets to Singapore and looking to get 10% returns after factoring in exchange rate charges and that our currency will further depreciate against Singapore dollar. it makes no sense to convert your currency to Singapore dollars then convert it back. it will have already eaten a chunk of your returns. on top of it, you need to include your traveling time to Singapore to open an account and there's a limit on how you much you can bring through each time. like he said up to individual preferences. just make sure you know and understand what you are doing lol.... how do I put it this way nicely.... looking for chickens in the middle of the night when you are hungry. some even look for chickens during day time after work.. Agreed. That's why whatever returns earned in SG stays in SG unless needed (big event eg. To further my studies).Further injection will be done once I start working. Collect as much cash as possible then head down. Going down to deposit is really a hassle  but save min SGD60/trip (aftet counting transport) Lol. Find chicken.   |

|

|

|

|

|

Ramjade

|

Feb 22 2017, 10:09 PM Feb 22 2017, 10:09 PM

|

|

QUOTE(tonytyk @ Feb 22 2017, 10:00 PM) Mind to share the source? See got Big Red D next to the fund. |

|

|

|

|

|

Ramjade

|

Feb 23 2017, 06:00 PM Feb 23 2017, 06:00 PM

|

|

QUOTE(Nemozai @ Feb 23 2017, 05:51 PM) Thanks for sharing your insights  Ramjade Ramjade You are sifus to me as well!  Will continue to learn from you all.  Side note: xuzen From what I researched, Maybank GIA-i provide higher returns(little bit) than Money Market Fund and same level of liquidity as Money Market Fund, what do you think about this? Some here use CMF because they say is convenient. For me I choose eGIA-i. My emergency cash is parked in eGIA-i. Reason for choosing eGIA-i over CMF (i) higher return when compared to CMF at extra 0.2-0.3% difference (ii) instant liquidity when compared to CMF. With CMF need to wait 2 days for the money to come back into your account. This post has been edited by Ramjade: Feb 23 2017, 06:02 PM |

|

|

|

|

|

Ramjade

|

Feb 23 2017, 07:40 PM Feb 23 2017, 07:40 PM

|

|

QUOTE(wodenus @ Feb 23 2017, 07:13 PM) EGIA min is 5000. Why would you have Rm5000 emergency cash lol. I have Rm2000 emergency cash.. soon going to be less because there was an emergency  Excuse me. Only RM1k la.  QUOTE(xuzen @ Feb 23 2017, 07:28 PM) The difference is so minimal, please choose conveneience over the small percentage gain. Choose which ever product that conmensurate with your lifestyle. 0.3% per annum is not going to make a huge lot of difference to retail participants. Unless you are a corporate client with a MYR 50M placement, then only talk. If not..... choose one which is convenient to you. Xuzen I choose eGIA-i because it's convenient to me ma. Can or not? I don't buy much UT. |

|

|

|

|

|

Ramjade

|

Feb 23 2017, 07:57 PM Feb 23 2017, 07:57 PM

|

|

QUOTE(puchongite @ Feb 23 2017, 07:39 PM) If am reits is still not performing, I am afraid she might lose her job soon. LOL. It memang don't perform.   Give only 1.2-1.3% when compare to manulife at 3.6x%. I have both. Same amount. Different time buying QUOTE(xuzen @ Feb 23 2017, 07:43 PM) Friend! It is a REITS lar... it follows the pattern of fixed income fund. You want it to go sky rocketing meh? Unless she buys assets that are outside the unit trust mandate, then she betul - betul kena lose her job baru tau! Xuzen Care to explain how manulife AP REITS is able to beat her? I hold both and manulife is giving 3.6x while Amasia is giving (-). Both same amount. Not sure if it's because of dividend (the negative return). Even if not negative, it's gave ~1.2-1.3% compare to manulife. This post has been edited by Ramjade: Feb 23 2017, 08:00 PM |

|

|

|

|

|

Ramjade

|

Feb 23 2017, 08:45 PM Feb 23 2017, 08:45 PM

|

|

QUOTE(puchongite @ Feb 23 2017, 08:33 PM) Yeah the SG one only shows the SGD class which has 1.45 volatility. In FSM MY, 3 classes are available. Assume that initial investment non issue, which class better ? The the one with SGD DIST. https://secure.fundsupermart.com/main/fundi...olnumber=UOB0463 years volatility: 5.2 This post has been edited by Ramjade: Feb 23 2017, 08:47 PM |

|

|

|

|

|

Ramjade

|

Feb 23 2017, 08:58 PM Feb 23 2017, 08:58 PM

|

|

QUOTE(puchongite @ Feb 23 2017, 08:54 PM) On the assumption that SGD performs better against MYR, then one should go for SGD class ? If you buy from Malaysia, if you choose MYR class, it cost RM10k. If you buy SGD class, it's SGD10k. If you buy the same fund from Singapore, it's only SGD1k.   This post has been edited by Ramjade: Feb 23 2017, 08:58 PM This post has been edited by Ramjade: Feb 23 2017, 08:58 PM |

|

|

|

|

|

Ramjade

|

Feb 23 2017, 09:05 PM Feb 23 2017, 09:05 PM

|

|

QUOTE(puchongite @ Feb 23 2017, 08:59 PM) Assuming initial investment non issue. Only concern is to maximize return. I think MYR. Since AIYH said fund is in USD like ponzi 2 and we all know how ponzi 2 perform, however according to FSM MY, the SGD class did fare better.  QUOTE(AIYH @ Feb 23 2017, 09:02 PM) In that case, after factoring into currency performance, IMO, the difference is negligible  Personally I will choose myr class, easier for me to top up, only requiring myr1k (sgd 1k top up for sgd class and usd 1k top up for usd class) Same here. I choose MYR class because starting cost is RM10k vs SGD10k vs USD10k.   This post has been edited by Ramjade: Feb 23 2017, 09:06 PM This post has been edited by Ramjade: Feb 23 2017, 09:06 PM |

|

|

|

|

|

Ramjade

|

Feb 23 2017, 09:18 PM Feb 23 2017, 09:18 PM

|

|

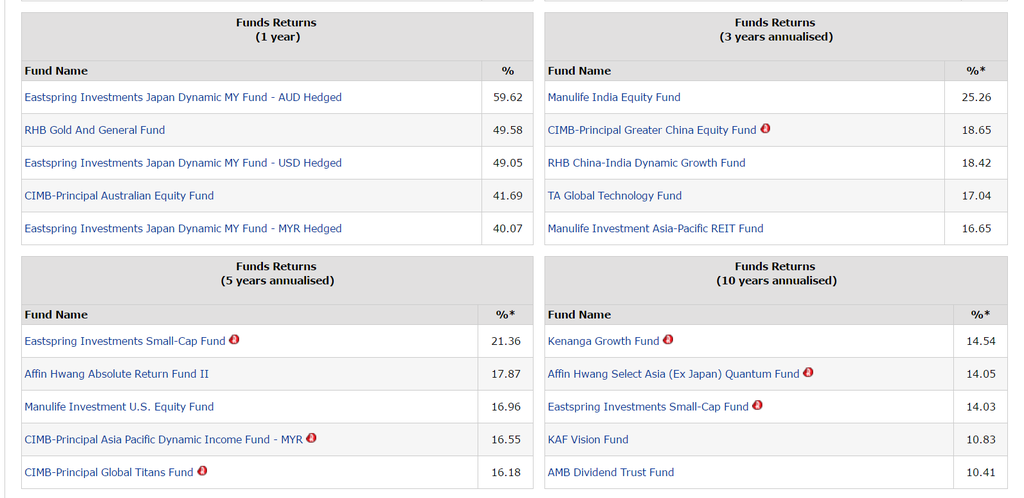

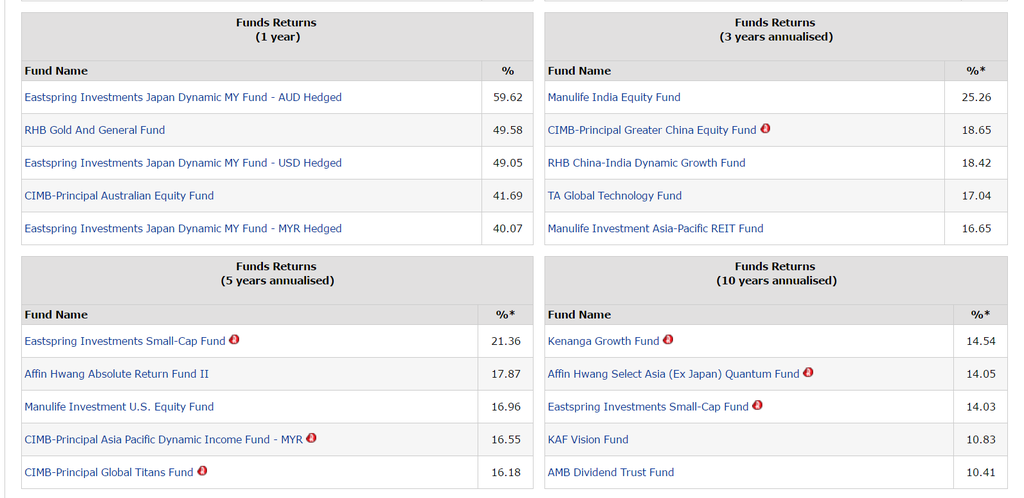

QUOTE(Nemozai @ Feb 23 2017, 09:13 PM) Hi everyone, Newbie questions. When I look through the Fund Ranking by FSM. This is the results.  Under 1 years returns, I see that certain funds offer 40++% returns. This seems unrealistic to me  Or this is how it is supposed to be?  (I don't know, need your advice) Can I assume that this is due to the facts that these funds had just launched and this is the results of volatility? No. You must see what happened. Gold and yen are considered "safe asset". So with Brexit, Trump wining, it create chaos so investors flocked to gold and yen. Gold funds can increase/decrease by ~30-75%. About australia, if you follow the AU stock exchange (ASX) thread, you will know that AUD is going up because China is recovering and so-call Trump policies increase demand for steel, etc (construction stuff) and AU being a mining country benefit from Trump "supposedly" as US can't produce all the steel, copper, hence they need to import from AU. This post has been edited by Ramjade: Feb 23 2017, 09:19 PM |

|

|

|

|

|

Ramjade

|

Feb 24 2017, 11:42 AM Feb 24 2017, 11:42 AM

|

|

QUOTE(xuzen @ Feb 24 2017, 11:24 AM) Before you compare, try to take your units in AMReits x (1.56/100) and add to your total NAV. Then compare again. There is a distribution on 20/2/2017. A noob will look through a key hole and make judgement. A non-noob will look at the ROI and risk aka volatility to make judgement. A wise one will look at ROI, the volatility and the corr-coeff to make a holistic portfolio judgement. AMReits volatility = 5.XX% Manulife Reits volatility = 8.XX% Manulife Reits over the same tracking period (that is over past three years historically) do fluctuate more wildly compared to AmReits. Xuzen I was talking about before distribution. Before distribution it was 1.2-1.3x while Manulife was at 3.6x% |

|

|

|

|

Feb 20 2017, 10:07 PM

Feb 20 2017, 10:07 PM

Quote

Quote

0.0402sec

0.0402sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled