Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

Ramjade

|

Apr 24 2024, 09:53 PM Apr 24 2024, 09:53 PM

|

|

QUOTE(lownet @ Apr 24 2024, 09:06 PM) I noticed FSM also has CSOP USD MMF https://www.fsmone.com.my/etfs/tools/etfs-f...HKEX&stock=9096 . Just curious, what are the pros and cons of buying this on FSM vs putting funds in FSM's USD auto-sweep? The one you saw in FSM is some kind of etf on HK. If I am not wrong. Csop offer higher returns than FSM. You may not get your money back as fast as auto sweep. |

|

|

|

|

|

Ramjade

|

Apr 25 2024, 01:00 PM Apr 25 2024, 01:00 PM

|

|

QUOTE(killeralta @ Apr 25 2024, 11:45 AM) Why don't just convert the USD and put in RHB term deposit? Can save back on the TT fees as well You lock your money up. Mmf you get FD rates without locking your money up. |

|

|

|

|

|

Ramjade

|

May 15 2024, 02:21 PM May 15 2024, 02:21 PM

|

|

QUOTE(p0pc0rn @ May 15 2024, 10:10 AM) Would you share what are the fund choices you're looking at instead of the ones in Versa? Good funds available on FSM not available in Versa 1. TA global tech 2. Manulife India fund I only use FSM to buy 2 funds for my PRS and EPF. Principal retire easy 50 (PRS) KAF core income. FSM also have chart centre to check performance of funds. You can check it out here, use the funds I mentioned above to compare with what Versa have to offer. https://www.fsmone.com.my/funds/tools/chart-centreYou will find that what is available on Fsm is superior to what is available to Versa. What I am looking for may not be suitable for you and what you are looking for may not be suitable for me. This post has been edited by Ramjade: May 15 2024, 02:31 PM |

|

|

|

|

|

Ramjade

|

May 18 2024, 08:25 PM May 18 2024, 08:25 PM

|

|

QUOTE(kiwifruit0 @ May 18 2024, 07:51 PM) now china market have potential..not reconsidering Principal PRS Plus Asia Pacific Ex Japan Equity - Class C? Sure. As long as emperor xi is there, nope. Force to do national service and what nonsense common prosperity. I was a holder of Principal PRS Plus Asia Pacific Ex Japan Equity for years. Besides principal retire easy 50 also hold this fund. Rather reduce my holdings in Principal PRS Plus Asia Pacific Ex Japan Equity than 100% in it. If no emperor xi, maybe no issue. |

|

|

|

|

|

Ramjade

|

May 23 2024, 06:42 PM May 23 2024, 06:42 PM

|

|

QUOTE(virgoguy @ May 23 2024, 03:24 PM) you reduced the existing PRS and move to where? Principal retire easy 2050. I won't reduce cause I am not going to get penalised 8% for no reasons. QUOTE(coolguy99 @ May 23 2024, 06:21 PM) That PRS fund quite good no? I am invested for a few years already portfolio still in the green. It's good fund. But you see what happen during emperor xi last year. It's not the first time and won't be last time. Property developer issue isn't solved. People still no job. Think emperor xi won't do some more "common prosperity" or "national service"? This post has been edited by Ramjade: May 23 2024, 06:43 PM |

|

|

|

|

|

Ramjade

|

Nov 8 2024, 08:11 AM Nov 8 2024, 08:11 AM

|

|

QUOTE(mynewuser @ Nov 8 2024, 07:57 AM) why Principal Lifetime Bond Fund can downtrend? Cause US interest rate. The higher the interest rate, the bond price must come down. O my if you hold to maturity you get back 100% of your principal. Also you need to see if US offer 5%p.a your Malaysian govt only give you 3%p.a, I as investor of course will park my money with US govt. If interest rate remain higher for longer, then you will see more and more people switch money to US side. That is one part. Second part is now that trump wins, it's risk on. Less regulations. That's why you see stuff like bitcoin all shoot up. |

|

|

|

|

|

Ramjade

|

Nov 12 2024, 09:17 PM Nov 12 2024, 09:17 PM

|

|

QUOTE(zebras @ Nov 12 2024, 09:09 PM) Highest doesn't mean have the best returns. You can see over 6 months, 1 year return. |

|

|

|

|

|

Ramjade

|

Nov 13 2024, 06:34 PM Nov 13 2024, 06:34 PM

|

|

QUOTE(zebras @ Nov 13 2024, 05:35 PM) ya, but long term, i still believe in the US market I don't know. I just buy the retire50. |

|

|

|

|

|

Ramjade

|

Nov 23 2024, 10:16 AM Nov 23 2024, 10:16 AM

|

|

QUOTE(RJdio @ Nov 23 2024, 08:14 AM) Nice to hear this. In the end, I went back to Kubera. At least FSM SG data ports over with no issues plsu my overseas banks. Im slowly moving all my investment to FSM SG as they have far more choices. Other ETF's etc cheaper using Interactive Brokers. Please avoid fsm sg at all cost. They have quarterly platform fees for all unit trust. In the long term, you will be paying them lots of money. Use POEMS SG. No quarterly platform fees. |

|

|

|

|

|

Ramjade

|

Nov 23 2024, 11:19 PM Nov 23 2024, 11:19 PM

|

|

QUOTE(RJdio @ Nov 23 2024, 10:55 PM) yes you are right. A few hunded $ a quater. But POEMS also have some recurring fee. No fees for unit trust. Unless they changed it. This is platform fees. You can email them and see. |

|

|

|

|

|

Ramjade

|

Dec 16 2024, 09:24 AM Dec 16 2024, 09:24 AM

|

|

QUOTE(mois @ Dec 16 2024, 08:16 AM) The 7% div yield is guaranteed? Of course no la😅 |

|

|

|

|

|

Ramjade

|

Dec 16 2024, 09:31 AM Dec 16 2024, 09:31 AM

|

|

QUOTE(GambitFire @ Dec 16 2024, 09:28 AM) Anyone still investing/invested in the TA Global Tech Fund? Thinking of investing some cash into this fund but want some opinion of the overall experience if anyone invested over the years? If you got access to QQQ, buy that instead |

|

|

|

|

|

Ramjade

|

Dec 16 2024, 09:45 AM Dec 16 2024, 09:45 AM

|

|

QUOTE(mois @ Dec 16 2024, 09:38 AM) I thought what kind of ETF give 7% guaranteed.  Hey Ramjade, what do you think of FSM malaysia platform now? I feel suddenly it become so great. Still lousy. Don't bother with it. Use interactive broker. It's only useful for buying prs and EPF UT. That's what I am using it for only. I won't use it for anything else other than for PRS and EPF UT. Thet are not Interactive broker level yet. This post has been edited by Ramjade: Dec 16 2024, 09:50 AM |

|

|

|

|

|

Ramjade

|

Dec 16 2024, 09:59 AM Dec 16 2024, 09:59 AM

|

|

QUOTE(mois @ Dec 16 2024, 09:55 AM) How about ETF? I see quite alot of ETF available inside. Don't bother. Stick with interactive broker. They are not interactive broker level of cheapness. This post has been edited by Ramjade: Dec 16 2024, 10:02 AM |

|

|

|

|

|

Ramjade

|

Jan 18 2025, 01:52 AM Jan 18 2025, 01:52 AM

|

|

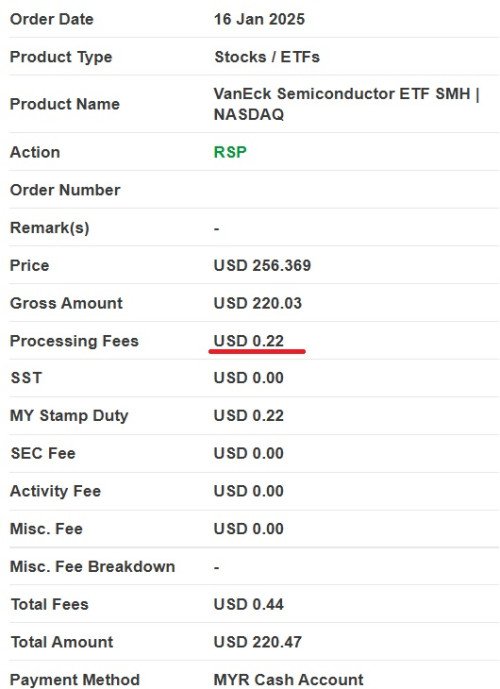

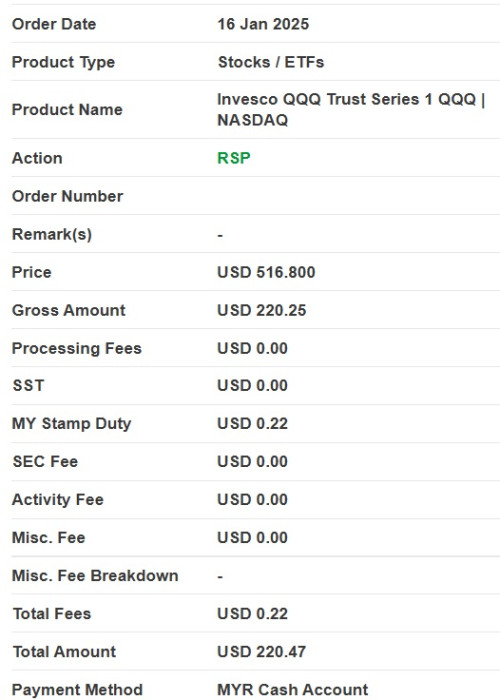

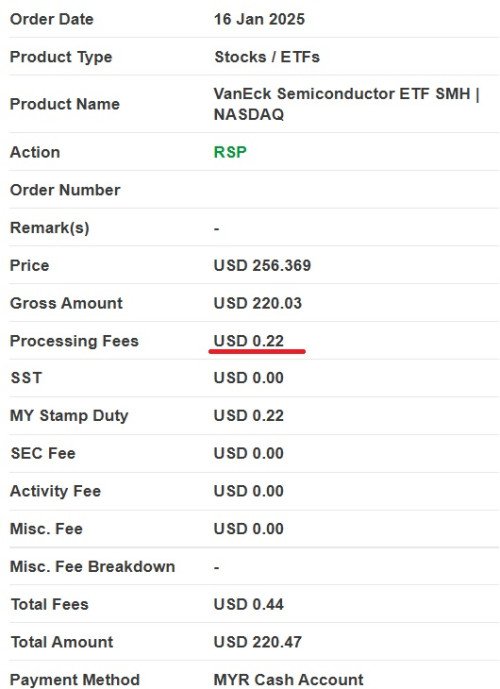

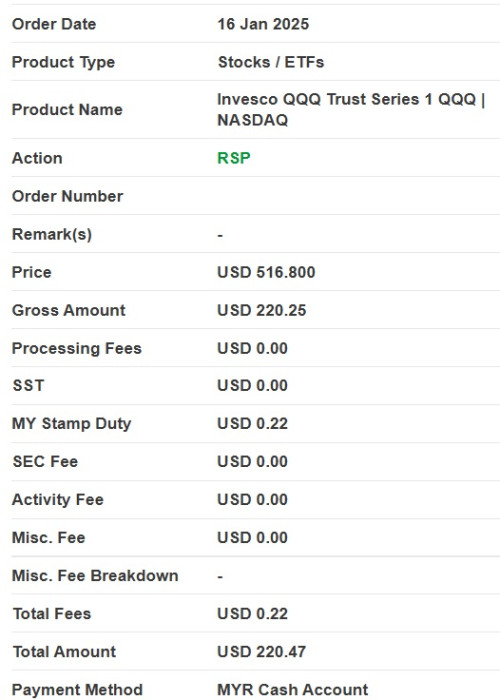

QUOTE(Fledgeling @ Jan 15 2025, 03:38 PM) Anyone tried this SGD Auto-Sweep? Don't bother. You get better rates with Tiger or Moomoo sg. Don't bother with Moomoo MY. QUOTE(Sitting Duck @ Jan 17 2025, 10:28 PM) Hi Sifus, For those that subscribing to US ETF RSP, did you notice in the Jan 2025 RSP, that FSM has started charging Processing fee of USD0.22 for every RM1,000 RSP? The weird thing is that the processing fees is charged on my VOO and SMH RSP but not on QQQ RSP with the same RM1,000 on each of the fund. Anyone has similar experience or know what's going on? Here's the screenshot of the transaction: SMH with Processing Fees:  QQQ without Processing Fees:  Just use IBKR. Don't give FSM the chance to charge you additional fees. |

|

|

|

|

|

Ramjade

|

Mar 5 2025, 12:40 PM Mar 5 2025, 12:40 PM

|

|

QUOTE(nguminhuang @ Mar 5 2025, 08:36 AM) Hi all, i have a question. I have bought PRS fund for tax relief in FSM one. Will FundSupermart release a yearly statement indicating i bought an PRS fund ? SO far my account statement only has monthly statement. Thanks in advanced. No yearly statement. Just monthly statement. But you cannot use FSM statement in case LHDN audited you. Personal experience. You need the funds house statement which FSM don't give you. |

|

|

|

|

|

Ramjade

|

Apr 3 2025, 10:13 PM Apr 3 2025, 10:13 PM

|

|

QUOTE(Thebestscammer @ Apr 3 2025, 02:01 PM) those that bought ETF via FSMone RSP account just became bag holders? i noticed ever since i used their RSP service, due to the limited time range where they action the buy i've been consistently in the red. That's not how ETF work. ETFs are for long term. Come back after 5-10 years. You need to understand that the underlying stuff are still stocks. So when stocks fall of cause ETF will also fall. Cannot escape. If you think ETF will always be green, then you got the wrong investing mindset. That's only for EPF and amanah sham fixed price fund. |

|

|

|

|

|

Ramjade

|

May 22 2025, 02:32 PM May 22 2025, 02:32 PM

|

|

QUOTE(Le Don @ May 22 2025, 01:52 PM) Reason u not buying Cspx and Vuaa on fsm is because of the 0.08% fee? Fsm is expensive Vs using IBKR This post has been edited by Ramjade: May 22 2025, 02:32 PM |

|

|

|

|

Apr 24 2024, 09:53 PM

Apr 24 2024, 09:53 PM

Quote

Quote

0.8595sec

0.8595sec

0.33

0.33

7 queries

7 queries

GZIP Disabled

GZIP Disabled