QUOTE(zebras @ Apr 16 2024, 03:21 PM)

many people are still looking at product (UT/ETF) instead of

- asset class (Equity/Fixed Income/etc)

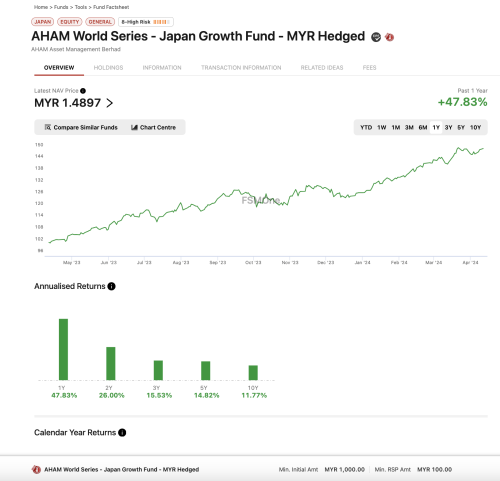

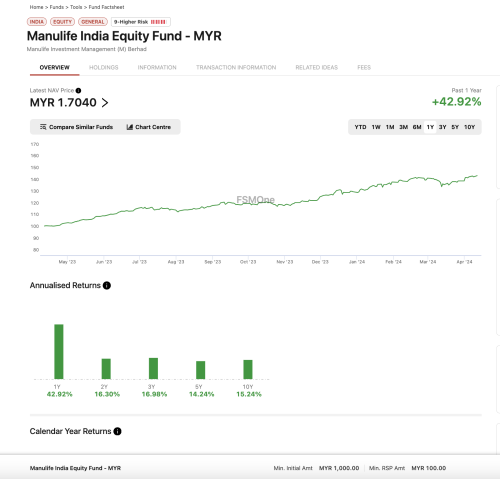

- market (US/China/Japan/India/etc)

- sector (Tech/Semicon/etc)

personally I invest in both UT and ETF,

there are asset class/market/sector that UT normally outperform ETF, eg: Malaysia, Asia, Fixed Income

meanwhile there are market that UT hardly beat passive index ETF in long term, eg: US

thats why i was bring this out, utilise both UT and ETF for different market/sector/asset class

management fee is included into the NAV calculation and the UT returns are after deduction of management fee

utilise UT for market/sector/asset class that can outperform the index

utilise index ETF for market like US because it is very hard to outperform US index in long term

and for

EPF I-Invest and PRS tax incentive,

you can only invest in UT, unless 1 day EPF allow us to invest in US ETF, then it will be no brainer to invest into US index ETF with EPF money

This post has been edited by zebras: Apr 17 2024, 03:34 PM

Dec 13 2023, 02:57 PM

Dec 13 2023, 02:57 PM

Quote

Quote

0.0711sec

0.0711sec

0.31

0.31

7 queries

7 queries

GZIP Disabled

GZIP Disabled