FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Aug 28 2023, 09:51 AM Aug 28 2023, 09:51 AM

Return to original view | Post

#21

|

Junior Member

302 posts Joined: Mar 2010 |

|

|

|

|

|

|

Sep 1 2023, 09:35 AM Sep 1 2023, 09:35 AM

Return to original view | Post

#22

|

Junior Member

302 posts Joined: Mar 2010 |

|

|

|

Sep 1 2023, 05:15 PM Sep 1 2023, 05:15 PM

Return to original view | Post

#23

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(Sitting Duck @ Sep 1 2023, 02:10 PM) Eh? I thought processing fee would be 0% until end of the 2024 or all new and existing subscriptions. Based on the picture, seems like new subscriptions after 30th September would no longer enjoy the 0% processing fee SMH for semicon? semicon is the new oilEdited: Just spoken to FSM customer service, and got this reply "The promotion will only applies to those ETFs that you have applied earlier. Those after the campaign will not eligible to the 0% processing fees". So it applies to ETF RSP applied earlier, which is awesome Anyone has any other good ETF under RSP list to recommend apart of VOO? I was thinking to add SPY or QQQ but both are almost identical to VOO. Sitting Duck liked this post

|

|

|

Sep 2 2023, 11:20 PM Sep 2 2023, 11:20 PM

Return to original view | Post

#24

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(smallydupe @ Sep 2 2023, 09:04 PM) ARKK top holdings are full of shitty companies,And she sold nvidia and missed the whole nvidia rally this year https://fortune.com/2023/05/26/cathie-wood-...idia-shares-ai/ |

|

|

Sep 4 2023, 08:48 AM Sep 4 2023, 08:48 AM

Return to original view | Post

#25

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(victorian @ Sep 3 2023, 12:55 AM) Anyone know what does the 0% ETF RSP entails to? 0.08% processing or min USD3.8Normal charge: 0.08% processing or min USD3.8 - is this waived? 0.08% processing or min USD 1- is this waived? Rm1 for every 1,000 contract value- if I RSP RM200, how much is the stamp duty 0.08% processing or min USD 1 - processing fee waived Rm1 for every 1,000 contract value- if I RSP RM200, how much is the stamp duty - RM1 for every RM1,000 contract value, mean that if u RSP RM200, u will be charged RM1 for stamp duty, if u RSP RM1,000, u will be charged RM1 for stamp duty, if u RSP RM1,001, u will be charged RM2 for stamp duty |

|

|

Sep 4 2023, 04:49 PM Sep 4 2023, 04:49 PM

Return to original view | Post

#26

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(victorian @ Sep 4 2023, 03:06 PM) Thanks bro. Have you compared the latest ETF promo from FSM vs IBKR in terms of the fee? i believe the best part is we can just set it and forget it, which allow us to invest regularly every month regardless of market low/high, Assuming I have 500 to be DCA into VOO every month, is FSM the cheapest way ATM? in addition to being the cheapest ATM Sitting Duck and victorian liked this post

|

|

|

|

|

|

Oct 18 2023, 02:02 PM Oct 18 2023, 02:02 PM

Return to original view | Post

#27

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(coyouth @ Oct 18 2023, 11:31 AM) yea. i believe the reason they're diversifying so much into other areas like bonds, stocks, ETFs, insurance coz unit trust funds tak laku already. anyway, i don't really care. personally, i'm getting older and just prefer something more steady like EPF. all the other excitements from the ups and downs of investments, can leave to those kids/teenagers. yea, u should just put your money into EPF if you are not good in investing or knowing what you are investing into |

|

|

Oct 19 2023, 09:10 AM Oct 19 2023, 09:10 AM

Return to original view | Post

#28

|

Junior Member

302 posts Joined: Mar 2010 |

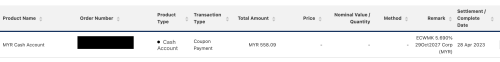

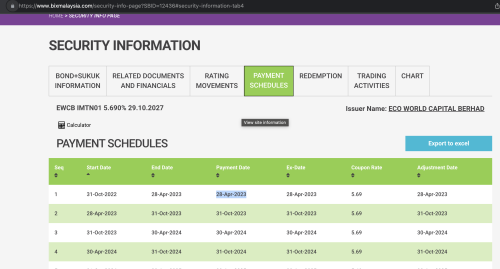

QUOTE(contestchris @ Oct 18 2023, 11:04 PM) Has anyone used Bond Express to purchase bonds before? How's your experience? it will be sent to ur FSM cash account, i got it within the same day from the coupon payment dayIn the case of coupon payments, will they be sent to FSM cash account or direct bank transfer? How soon are these payments effected?   |

|

|

Oct 19 2023, 09:53 AM Oct 19 2023, 09:53 AM

Return to original view | Post

#29

|

Junior Member

302 posts Joined: Mar 2010 |

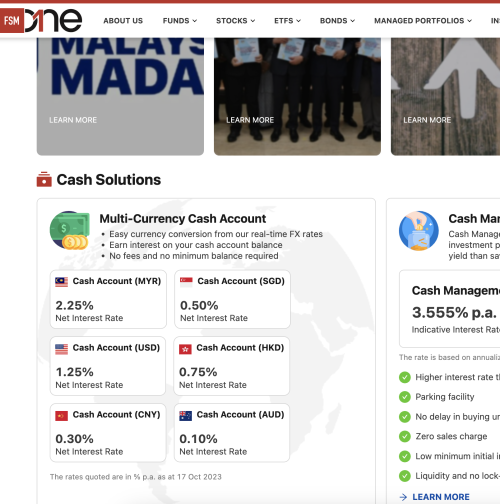

QUOTE(contestchris @ Oct 19 2023, 09:30 AM) 1. How long to cash out to bank account? 1. so far from my experience cashing out from cash account to bank account, is instant within few min.2. Any interest rate earned on cash balances? 3. Can set instruction to automatically trf to bank account? https://www.fsmone.com.my/support/frequentl...tUniqueKey=2475 2. the interest rate of the cash account is on their homepage, it changed a few time this year due to OPR changes. 3. dont think there is such feature  contestchris liked this post

|

|

|

Oct 21 2023, 08:52 AM Oct 21 2023, 08:52 AM

Return to original view | IPv6 | Post

#30

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(contestchris @ Oct 20 2023, 11:30 PM) Hi may I ask about the bond platform fees of 0.045% per quarter. https://www.fsmone.com.my/support/frequentl...tUniqueKey=2507I just purchased a bond today. I see that the platform fees are notified on 15th of the quarter month (in this case October 2023) and then charged on the 25th. Will I need to pay platform fees this time then? What happens if got zero money to pay the platform fees? They will do forced selling? 33. When and how to I pay for the platform fee? The quarterly platform fee will be calculated during the 25th of the months of January, April, July and October. Payment of the platform fee will follow this sequence. Cash Acc (bond currency) on quarterly basis >> Cash Acc (MYR) on quarterly basis >> Coupon Payment (will be accumulated till coupon paid out) >> Upon Redemption (will be accumulated till redemption) |

|

|

Oct 24 2023, 09:20 AM Oct 24 2023, 09:20 AM

Return to original view | Post

#31

|

Junior Member

302 posts Joined: Mar 2010 |

|

|

|

Nov 1 2023, 09:53 AM Nov 1 2023, 09:53 AM

Return to original view | Post

#32

|

Junior Member

302 posts Joined: Mar 2010 |

https://www.fsmone.com.my/funds/research/ar...m1-pr?src=funds

is this now the cheapest way to invest in US ETF for long term?  |

|

|

Nov 1 2023, 11:57 AM Nov 1 2023, 11:57 AM

Return to original view | IPv6 | Post

#33

|

Junior Member

302 posts Joined: Mar 2010 |

|

|

|

|

|

|

Nov 7 2023, 04:56 PM Nov 7 2023, 04:56 PM

Return to original view | Post

#34

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(xander2k8 @ Nov 7 2023, 02:33 PM) assuming invest RM1000fsmone 0.08% or RM1 = RM1 IBKR Pro - Fixed min USD 1.00 = 1 USD ~= RM4.6 IBKR Pro - Tiered min USD 0.35 USD = 0.35 USD ~= RM1.6 rakuten Between 700.00-9,999.99 RM9.00 = RM9 mplusglobal min fee 3 USD = 3 USD ~= RM14 |

|

|

Nov 10 2023, 05:09 PM Nov 10 2023, 05:09 PM

Return to original view | Post

#35

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(xander2k8 @ Nov 10 2023, 02:33 PM) Don’t factored in cash conversion only 🤦♀️ factored including the final cost of trading instead as it will be higher 🤦♀️ of course it is not fixed, every broker fee is structured that way,Red figures for managed portfolio not due to China or REIT 🤦♀️ the whole entire portfolio selection is horrible because horrible funds that they pick which underperforms badly particularly China and US funds 🤦♀️ the only one which is still green is their bonds and healthcare funds which constitute about less than 20% of entire aggressive portfolio Processing fee is not fixed 🤦♀️ it is starting at rm1 and it goes up based on trade amount it is simple calculation, just compare it against every broker with the investment amount u are investing regularly, and u get to know which is more competitive, and please provide fact supported with data, every broker has cash conversion involved, so please enlighten us on the competitiveness of cash conversion fx rate across broker too, i believe there are replies above stated fsmone fx rate is as competitive as wise |

|

|

Nov 20 2023, 07:05 PM Nov 20 2023, 07:05 PM

Return to original view | IPv6 | Post

#36

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(xander2k8 @ Nov 12 2023, 02:48 PM) https://secure.fundsupermart.com/fsm/cash/f...-exchange-rates 🤦♀️ u do know wise has conversion fee right?No need to compare as it is already at least 1% 🤦♀️ higher live rates 🤦♀️ and no doubt it impossible to be lower than Wise |

|

|

Nov 21 2023, 12:12 AM Nov 21 2023, 12:12 AM

Return to original view | IPv6 | Post

#37

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(tadashi987 @ Nov 9 2023, 12:34 AM) Well let’s verify with fact I just tried with FSM cash account 5000MYR I can get 1059.70USD Wise (if use IBKR you gonna use Wise to convert SGD anyway), I get around 1060.69USD FSM spread is not that bad and almost on par with WISE per se QUOTE(xander2k8 @ Nov 21 2023, 12:02 AM) U did read this right? 🤦♀️ |

|

|

Nov 21 2023, 11:57 PM Nov 21 2023, 11:57 PM

Return to original view | Post

#38

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(tadashi987 @ Nov 21 2023, 11:42 PM) It seems like Wise does successfully 'trick' people by offering better rates, but incorporates the margin into the fee layer plus the transfer fee out from wisefor FX, people need to understand that the simplest way of comparison is how much you received after conversion, not merely about the rate itself. |

|

|

Nov 22 2023, 12:30 PM Nov 22 2023, 12:30 PM

Return to original view | Post

#39

|

Junior Member

302 posts Joined: Mar 2010 |

|

|

|

Dec 13 2023, 02:17 PM Dec 13 2023, 02:17 PM

Return to original view | Post

#40

|

Junior Member

302 posts Joined: Mar 2010 |

|

| Change to: |  0.0676sec 0.0676sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 05:15 AM |