Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

zebras

|

May 2 2024, 04:40 PM May 2 2024, 04:40 PM

|

|

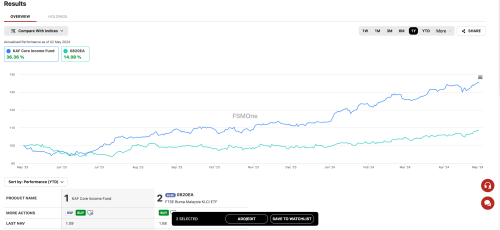

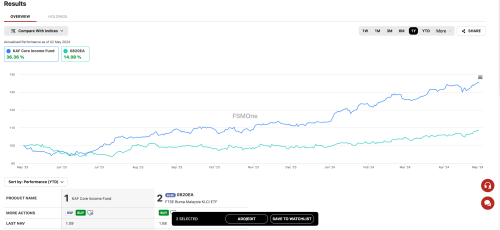

QUOTE(frankzane @ May 1 2024, 05:34 PM) The problem is most if not all UT beat the index (at least my portfolio). Apparently nobody knows whether an UT is appropriately benchmarked to an index. What if the benchmark is an 'easy' one, hence the UT can easily outperformed it..... kind of easy to compare if u know what the market/sector etf is   This post has been edited by zebras: May 2 2024, 04:47 PM This post has been edited by zebras: May 2 2024, 04:47 PM |

|

|

|

|

|

zebras

|

May 14 2024, 08:53 AM May 14 2024, 08:53 AM

|

|

Hi, I thought you would like this article, Receive RM10 Bonus Units for every RM1,000 invested in Technology or Semiconductor unit trust URL: https://www.fsmone.com.my/funds/research/ar...technology-or-s |

|

|

|

|

|

zebras

|

May 14 2024, 01:48 PM May 14 2024, 01:48 PM

|

|

QUOTE(buffa @ May 14 2024, 12:30 PM) I dont think fsmone FX rate is high. At this moment FSM rm to usd is 0.2103 Sunway money is 0.2107 Ya, there is platform fees. I don't think there are platform fees for ETF or Equity Unit Trust |

|

|

|

|

|

zebras

|

Jun 21 2024, 08:47 AM Jun 21 2024, 08:47 AM

|

|

|

|

|

|

|

|

zebras

|

Jul 5 2024, 12:17 PM Jul 5 2024, 12:17 PM

|

|

|

|

|

|

|

|

zebras

|

Jul 5 2024, 05:35 PM Jul 5 2024, 05:35 PM

|

|

QUOTE(luciuswks @ Jul 5 2024, 04:52 PM) Just transfer 10k to the usd auto sweep for testing. Terus hilang 1.27 % current exchange.  try to go to money changer or wise to change your RM to USD, and then immediately change back to RM |

|

|

|

|

|

zebras

|

Sep 9 2024, 10:31 PM Sep 9 2024, 10:31 PM

|

|

|

|

|

|

|

|

zebras

|

Oct 15 2024, 05:43 PM Oct 15 2024, 05:43 PM

|

|

|

|

|

|

|

|

zebras

|

Nov 10 2024, 10:20 PM Nov 10 2024, 10:20 PM

|

|

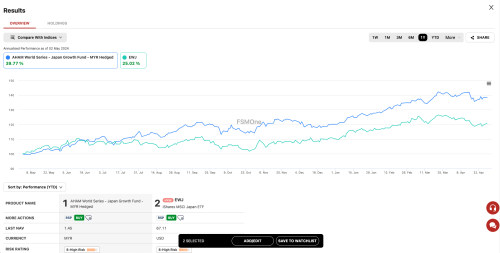

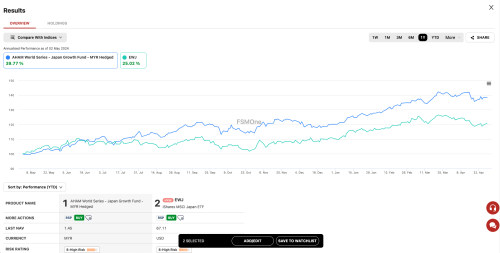

QUOTE(rankiba @ Nov 8 2024, 10:01 AM) @ramjade Do you know what are some good UT right now available in EPF with high US exposure? I know previously have global titans fund but not sure about right now I don’t see there are fund with high US exposure on EPF approved fund list, but if you are willing to take risk in Malaysia or Japan, there are recommended funds by fsmone Personally I invest in US with cash, Invest in non US with EPF |

|

|

|

|

|

zebras

|

Nov 12 2024, 09:09 PM Nov 12 2024, 09:09 PM

|

|

QUOTE(Takudan @ Nov 11 2024, 05:51 PM) Haha thanks for clarifying on Versa side cuz I think I'll go there too. RM 100 this year is nice, and since I can't tell which one will perform better, might as well grab the cold hard cash... this is the PRS fund with the highest exposure to US market |

|

|

|

|

|

zebras

|

Nov 13 2024, 05:35 PM Nov 13 2024, 05:35 PM

|

|

QUOTE(Ramjade @ Nov 12 2024, 09:17 PM) Highest doesn't mean have the best returns. You can see over 6 months, 1 year return. ya, but long term, i still believe in the US market |

|

|

|

|

|

zebras

|

Dec 26 2024, 12:01 AM Dec 26 2024, 12:01 AM

|

|

QUOTE(YoungMan @ Dec 20 2024, 08:53 AM) Yes the return is net, already calculated management fee etc. Sales charge is charge when you bought the fund. Some fund do have redemption fee, so be ware of that when you sell. just buy when fsm is having promo, they always have 0%-0.5% sales charge promo |

|

|

|

|

|

zebras

|

Jan 6 2025, 12:27 PM Jan 6 2025, 12:27 PM

|

|

|

|

|

|

|

|

zebras

|

Jan 20 2025, 09:21 AM Jan 20 2025, 09:21 AM

|

|

|

|

|

|

|

|

zebras

|

Jan 20 2025, 12:03 PM Jan 20 2025, 12:03 PM

|

|

QUOTE(tifosi @ Jan 20 2025, 11:41 AM) This is the result of competition. You can never imagine a month long of 0% for so many products few years back. Even in Klang valley, I receive like few days before CNY. So imagine if post to East Malaysia. they always have month long of 0% on jan every year updated: seems like this year promotion is really longer than few years back This post has been edited by zebras: Jan 20 2025, 12:14 PM |

|

|

|

|

|

zebras

|

Jan 20 2025, 01:20 PM Jan 20 2025, 01:20 PM

|

|

QUOTE(Avangelice @ Jan 20 2025, 01:01 PM) Ever since people are more aware of investment brokers like ikbr and moo moo, they have shifted from UT to stocks to ETFs. No brained FSM is now facing competition nevertheless, it is good for investors, very little US UT that beat US ETF, should invest in UT on malaysia or emerging market for equity and in ETF for US equity |

|

|

|

|

|

zebras

|

Feb 13 2025, 05:11 PM Feb 13 2025, 05:11 PM

|

|

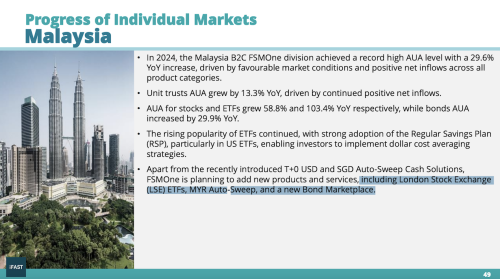

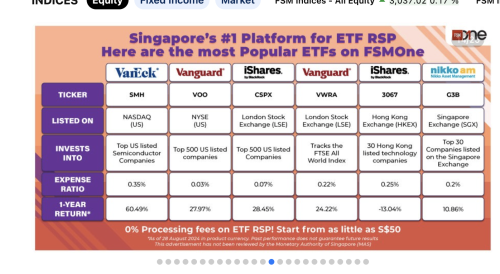

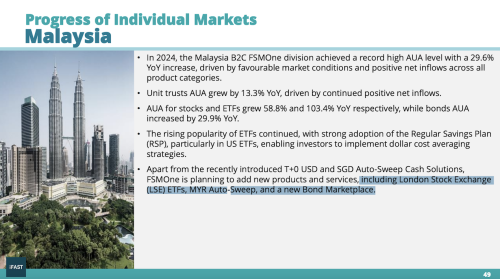

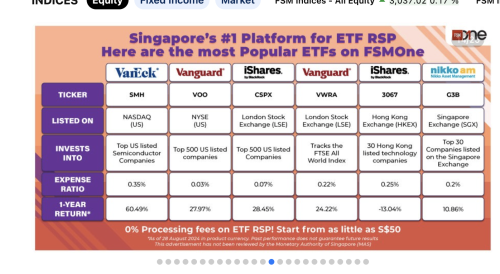

seems like LSE ETF RSP is coming this year |

|

|

|

|

|

zebras

|

Feb 14 2025, 09:10 AM Feb 14 2025, 09:10 AM

|

|

QUOTE(zasxkok9 @ Feb 13 2025, 11:08 PM) I see. That's too bad  LSE ETF RSP is available on SG FSM  |

|

|

|

|

|

zebras

|

Apr 14 2025, 04:48 PM Apr 14 2025, 04:48 PM

|

|

QUOTE(batman1172 @ Apr 14 2025, 02:54 PM) Why is it so hard to get LSE for a Malaysian brokerage ? brokers wan you to trade as much as possible, not to buy and hold |

|

|

|

|

|

zebras

|

May 16 2025, 06:30 PM May 16 2025, 06:30 PM

|

|

|

|

|

|

|

May 2 2024, 04:40 PM

May 2 2024, 04:40 PM

Quote

Quote

0.0659sec

0.0659sec

1.23

1.23

7 queries

7 queries

GZIP Disabled

GZIP Disabled