QUOTE(killdavid @ Jan 29 2021, 10:31 AM)

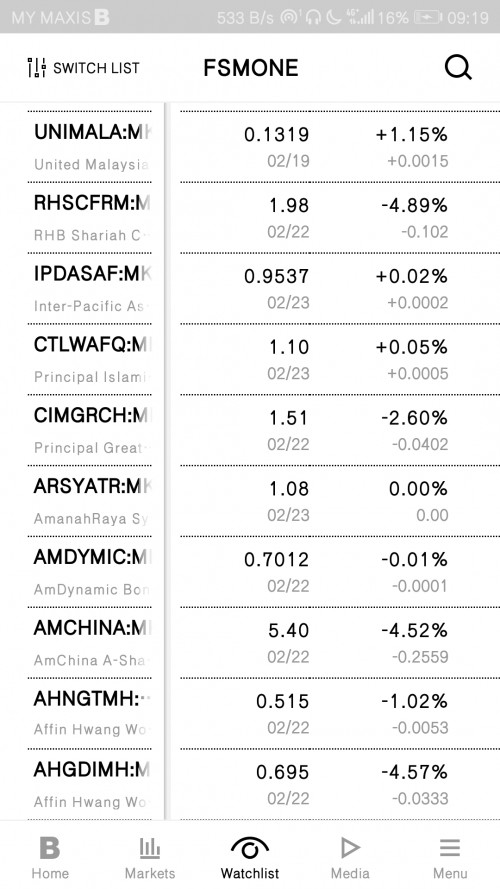

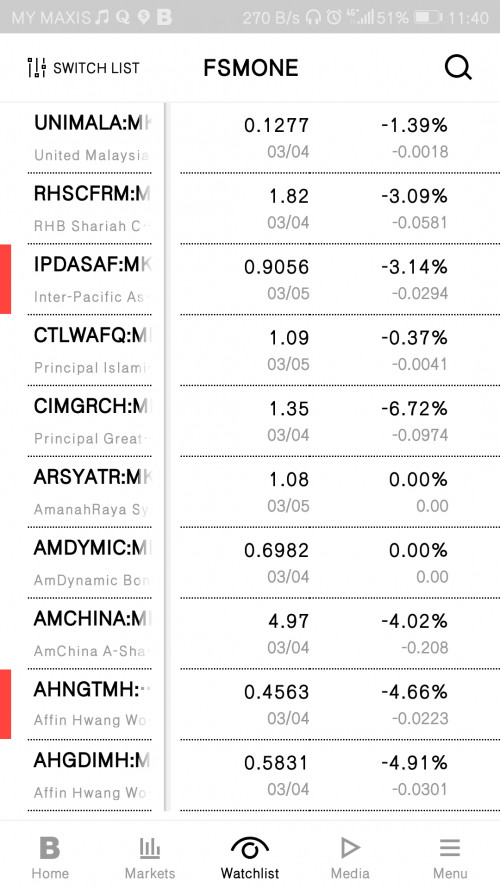

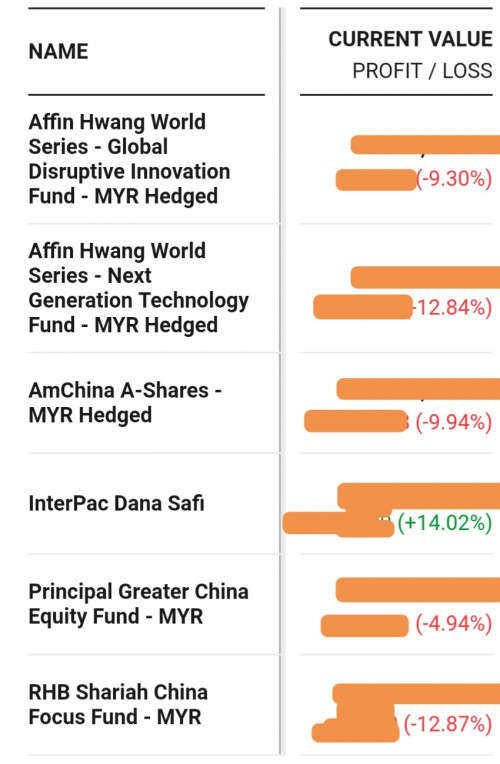

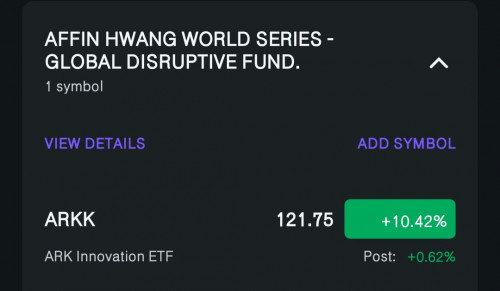

Affin Hwang Disruptive Innovation fund is the other end of spectrum. Companies that show good promise but not proven yet. This is the ARK innovation fund, tons of research material available.

The rest of the pack is somewhere in the middle.

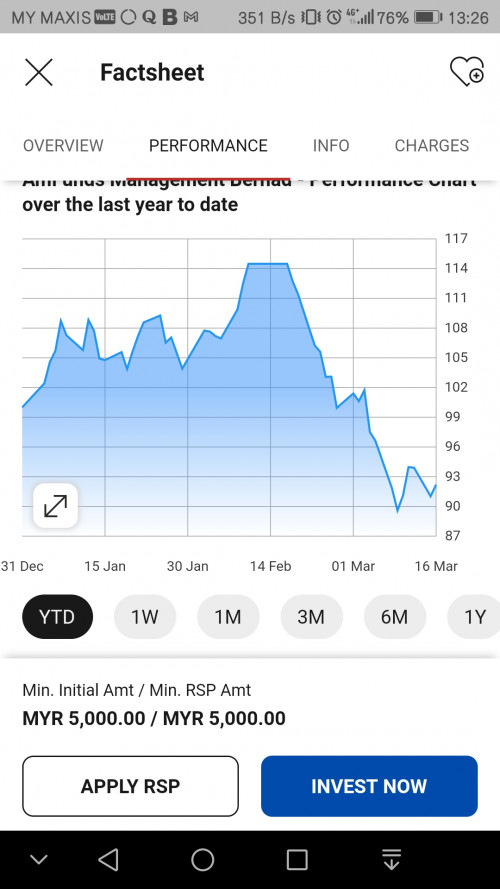

Already top up. Might top up again today, 3rd top up this week. Probably all markets has gone correction, and hope for market recovery soon.

Or is it going for more worse scenario ?

But its just me, could be wrong.

Anyways I have top some equity fund and switch more of MALAYSIA FOCUS fund into US & China equity markets. And could save few hundred bucks on SC

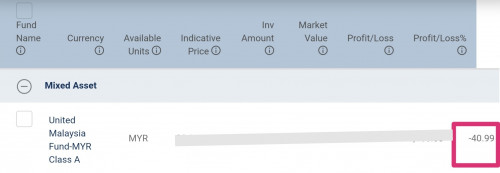

At same time , I kinda regret that I bought all these equity funds on wrong timing and now dont know what to do

Jan 27 2021, 07:51 PM

Jan 27 2021, 07:51 PM

Quote

Quote

0.2244sec

0.2244sec

0.61

0.61

7 queries

7 queries

GZIP Disabled

GZIP Disabled