QUOTE(MUM @ Mar 18 2021, 01:40 PM)

how much % is this A-share fund is in your portfolio?

how much "total" % of CHINA alone is in your portfolio?

how much "total" % of Greater China region is in your portfolio?

for if the total % is not alot in relation to your risk appetite, then can top up same amount to help the fund "recover" 50% of the current paper losses of 15%....

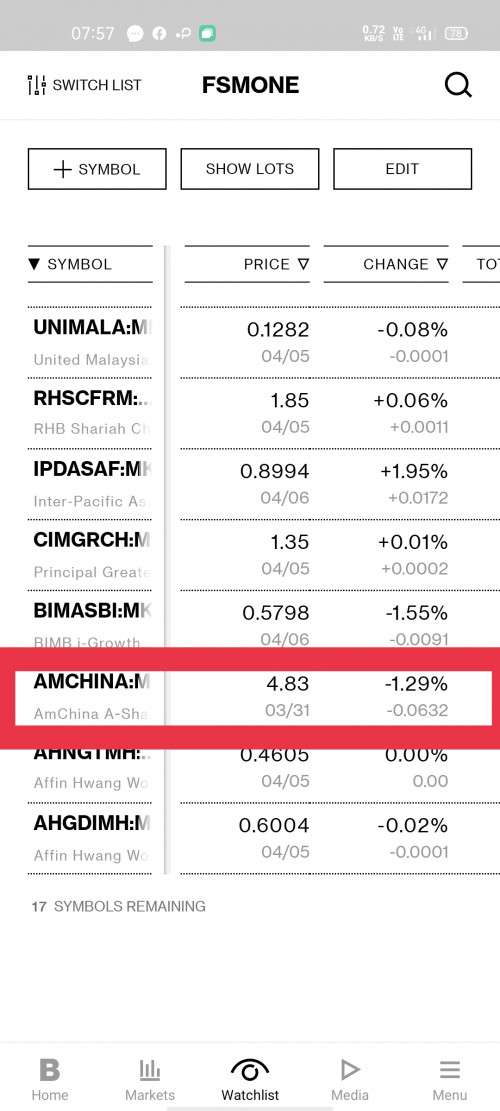

1)AM CHINA A SHARES MYR HEDGED=16.7%(loss=12.97%)

2)RHB SHARIAH CHINA FOCUS FUND=12.67%(loss=12.29%)

3)PRINCIPAL GREATER CHINA EQUITY FUND=2%(loss=1.43%).

Is there any sign of rebound?

Most of news are likely downgrading CHINA's stock market performance as CHINA government is interfering in china stock valuation and so on.

Can we hope for recovery anytime soon?

Or we should use this "dip" to top up more.?

Still considering to top up.

Thanks.

Mar 19 2021, 07:53 AM

Mar 19 2021, 07:53 AM

Quote

Quote

0.0808sec

0.0808sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled