Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

ganesh1696

|

Jan 17 2021, 01:52 PM Jan 17 2021, 01:52 PM

|

Getting Started

|

QUOTE(YoungMan @ Jan 17 2021, 10:46 AM) Hi, Is the newly launched fund will be feeding into "target fund"(blackrock global funds - next generation technology fund) as the =(Affin Hwang World Series-Next Generation Technology Fund) does? Thanks. |

|

|

|

|

|

ganesh1696

|

Jan 19 2021, 01:38 PM Jan 19 2021, 01:38 PM

|

Getting Started

|

QUOTE(ironman16 @ Jan 19 2021, 10:19 AM) We would really like to see you at the virtual event (on 23 january 2021), but do you know what else we would also like for you to have? Don't miss this chance to enjoy 0% Sales Charge Promotion for ALL Participating Fund House Unit Trusts. This promotion expires on 29th January 2021 - so you have ample time to research and choose your favourite funds to purchase from. Yes!!! Is 0% sales charge but until 29 January only, too short 😂😂😂 Hi, 0% sales charges promo looks interesting. But do I need to register for virtual event to be eligible for 0% sales charge? Or the promo is entitled to all investors from 23 to 29 JAN ? Thanks. |

|

|

|

|

|

ganesh1696

|

Jan 21 2021, 07:27 AM Jan 21 2021, 07:27 AM

|

Getting Started

|

Biden has sworn in as PRESIDENT OF UNITED STATES.

Will there be any significant changes in performance of USA based UNIT TRUSTS?

|

|

|

|

|

|

ganesh1696

|

Jan 21 2021, 06:11 PM Jan 21 2021, 06:11 PM

|

Getting Started

|

Hi Can we expect crypto based unit trust in future maybe in ONE YEAR period?  |

|

|

|

|

|

ganesh1696

|

Jan 22 2021, 01:13 PM Jan 22 2021, 01:13 PM

|

Getting Started

|

QUOTE(Pewufod @ Jan 21 2021, 01:59 PM) its actually a feeder fund Hi may I know what is TARGET FUND? As I read their article, they are investing in WELLINGTON MANAGEMENT SINGAPORE PTE LTD as their investment adviser . |

|

|

|

|

|

ganesh1696

|

Jan 22 2021, 07:22 PM Jan 22 2021, 07:22 PM

|

Getting Started

|

Hi guys,

these are my current portfolio.

Looking to more diversify my allocation.

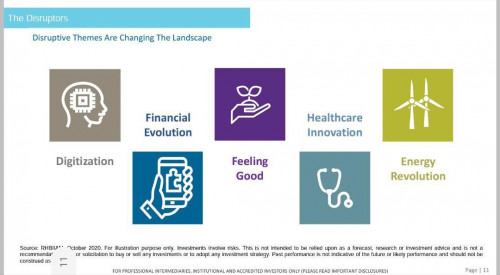

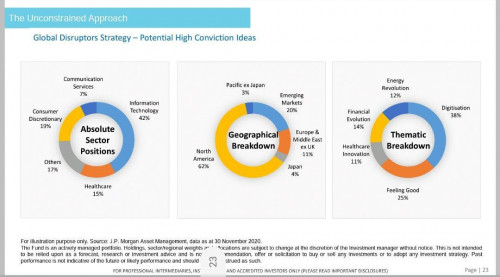

1) Affin Hwang World Series - Global Disruptive Innovation Fund

MYR Hedged

2)United malaysia fund

3)amdynamic bond

4)amanahraya syariah trust fund

5)am china a shares myr-hedged

6)principal islamic lifetime enhanced sukuk fund

7)interpac dana safi.

Planning to more diversify my allocation . planning to add on some cash.

waiting for (Affin Hwang World Series-Next Generation Technology Fund) but it seems FSMONE will launch this fund sometime later .

Any other suggestions guys?

|

|

|

|

|

|

ganesh1696

|

Jan 23 2021, 08:38 PM Jan 23 2021, 08:38 PM

|

Getting Started

|

QUOTE(yklooi @ Jan 22 2021, 07:29 PM) to be able to view and understand better, can you put in the current % of allocation to each of them in relation to your portfolio 1) Affin Hwang World Series - Global Disruptive Innovation Fund MYR Hedged = 12.5% 2)United malaysia fund=19.25% 3)amdynamic bond=16.635% 4)amanahraya syariah trust fund=14.45% 5)am china a shares myr-hedged=12.5% 6)principal islamic lifetime enhanced sukuk fund=16.41% 7)interpac dana safi =7.5% |

|

|

|

|

|

ganesh1696

|

Jan 24 2021, 12:14 AM Jan 24 2021, 12:14 AM

|

Getting Started

|

Any dividend declaring unit trusts no matter at what risk ?

But I think mostly higher risk funds don't declare any dividend.

|

|

|

|

|

|

ganesh1696

|

Jan 24 2021, 05:00 PM Jan 24 2021, 05:00 PM

|

Getting Started

|

Hi guys,

My allocation based in MALAYSIA is nearly 75%.

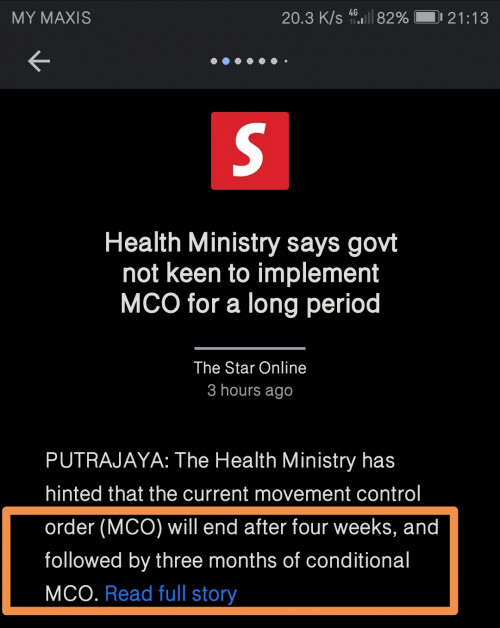

If there's a complete lockdown like how was implemented back in March 2020, hope there's a major pullback/downfall in unit trust prices.

Thinking of withdrawing all MALAYSIA based UT this week and buy back after MCO implemented OR hold and top up once there's a major drawback in prices.

I didn't make use of last MCO as I worried my funds are all about crash to worse, but in weeks prices of almost all UT rebound to normal level.

HOLDINGS.

1) Affin Hwang World Series - Global Disruptive Innovation Fund

MYR Hedged = 12.5%

2)United malaysia fund=19.25%

3)amdynamic bond=16.635%

4)amanahraya syariah trust fund=14.45%

5)am china a shares myr-hedged=12.5%

6)principal islamic lifetime enhanced sukuk fund=16.41%

7)interpac dana safi =7.5%

What's your thoughts guys?

Thank you.

|

|

|

|

|

|

ganesh1696

|

Jan 25 2021, 12:04 PM Jan 25 2021, 12:04 PM

|

Getting Started

|

Just now saw this fund. AFFIN HWANG GLOBAL SUSTAINABILITY FUND.

Target fund= ALLIANZ GLOBAL SUSTAINABILITY FUND.

but sales charge still 1.5%.

Anyway still waiting for affin hwang next generation tech fund.

|

|

|

|

|

|

ganesh1696

|

Jan 25 2021, 08:26 PM Jan 25 2021, 08:26 PM

|

Getting Started

|

QUOTE(TOS @ Jan 25 2021, 08:22 PM) Anyone got this?  No, maybe for " priviliged" customers. |

|

|

|

|

|

ganesh1696

|

Jan 25 2021, 09:18 PM Jan 25 2021, 09:18 PM

|

Getting Started

|

Hopefully this is good for malaysia based UT. I was worried of "rumoured" MCO 3.0 as I couldn't decide whether to sell my MALAYSIA based UT or hold and top up when price face a major pullback. Maybe this news could be safe for all MALAYSIA FOCUS UT.  |

|

|

|

|

|

ganesh1696

|

Jan 26 2021, 09:27 AM Jan 26 2021, 09:27 AM

|

Getting Started

|

Almost everyday new funds appear on FSMONE. FUND: Affin Hwang World Series - Long Term Global Growth Fund. TARGET FUND: Baillie Gifford Worldwide Long Term Global Growth Fund. But why not affin hwang next gen-tech fund.   |

|

|

|

|

|

ganesh1696

|

Jan 26 2021, 04:39 PM Jan 26 2021, 04:39 PM

|

Getting Started

|

QUOTE(ironman16 @ Jan 26 2021, 03:42 PM) Hi, Will there be any unit split for UNITED MALAYSIA FUND ? |

|

|

|

|

|

ganesh1696

|

Jan 26 2021, 07:50 PM Jan 26 2021, 07:50 PM

|

Getting Started

|

QUOTE(T231H @ Jan 26 2021, 04:49 PM) goto that fund info page.... Can I expect a minor price downfall within 1 to 2 %. Or will split shares will affect the price of the fund ? As yesterday,I noticed my AMDYNAMIC BOND fund's price fall due to income distribution. Is it the same goes to UNITED MALAYSIA FUND? |

|

|

|

|

|

ganesh1696

|

Jan 27 2021, 09:25 AM Jan 27 2021, 09:25 AM

|

Getting Started

|

Hi, I have a doubt . I own units in (Affin Hwang World Series - Global Disruptive Innovation Fund - MYR Hedged). Just now I noticed ARKK ETF share price fell nearly 3% on 26/1/2021"USA"time. I'm planning to top up my fund more during this dip which I believe it would reflect to my fund's holdings. Little confused when this "price fall" will reflect on my fund holdings, or when the UT price will be updated based on (26 JAN "USA")? 27 or 28 JAN? Just want to make use of this chance. Hope u guys understand what am I trying to convey. Thanks .  |

|

|

|

|

|

ganesh1696

|

Jan 27 2021, 09:38 AM Jan 27 2021, 09:38 AM

|

Getting Started

|

QUOTE(MUM @ Jan 27 2021, 09:29 AM) is this Affin Hwang World Series - Global Disruptive Innovation Fund - MYR Hedged buying/investing in ARKK ETF ? Their TARGET FUND = Nikko AM ARK Disruptive Innovation Fund[I][U] Nikko AM ARK Disruptive Innovation Fund's Investment adviser is "ARK Investment Management LLC" |

|

|

|

|

|

ganesh1696

|

Jan 27 2021, 10:03 AM Jan 27 2021, 10:03 AM

|

Getting Started

|

QUOTE(ericlaiys @ Jan 27 2021, 09:46 AM) Yes I do read the factsheet before investing. When reading about their target fund 's factsheet I noticed ARK ETF was their investment adviser. That's why I raised this question. So those changes in "ARK ETF prices" will not reflect in Affin Hwang World Series - Global Disruptive Innovation Fund. Am I right ? I'm actually new to UT investment. Need some of your opinions. Thank you. |

|

|

|

|

Jan 17 2021, 01:52 PM

Jan 17 2021, 01:52 PM

Quote

Quote

0.0609sec

0.0609sec

1.08

1.08

7 queries

7 queries

GZIP Disabled

GZIP Disabled