QUOTE(ironman16 @ Mar 22 2017, 11:24 AM)

https://cforum.cari.com.my/forum.php?mod=re...0&pid=130430600U also read chinese?

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Mar 22 2017, 11:30 AM Mar 22 2017, 11:30 AM

Return to original view | Post

#41

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(ironman16 @ Mar 22 2017, 11:24 AM) https://cforum.cari.com.my/forum.php?mod=re...0&pid=130430600U also read chinese? |

|

|

|

|

|

Mar 22 2017, 11:35 AM Mar 22 2017, 11:35 AM

Return to original view | Post

#42

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Drian @ Mar 22 2017, 10:48 AM) We discussed this last week. Main issue I have with this fund is the crazy volatility. It did increased by 2.4% in a day last week; but maybe today will fall by the same quantum seeing how asia markets are tumbling downCrystal ball does not approve this fund Speaking of which xuzen, does ponzi 1.0 still not in crystal ball's good books? |

|

|

Mar 22 2017, 11:37 AM Mar 22 2017, 11:37 AM

Return to original view | Post

#43

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(tonytyk @ Mar 22 2017, 11:33 AM) Don't know, I don't have crystal ball I think it depends on the markets it's in. If you think ASEAN markets have potential then this fund is for you although the mandate is bigger than just ASEAN. At the moment the fund is heavy ASEAN and does better than other ASEAN funds |

|

|

Mar 22 2017, 02:10 PM Mar 22 2017, 02:10 PM

Return to original view | Post

#44

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

Mar 27 2017, 09:39 AM Mar 27 2017, 09:39 AM

Return to original view | Post

#45

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(contestgeek @ Mar 26 2017, 11:52 PM) Ok but can you confirm I will be able to get them at tomorrow's prices? (i.e. priced dated 27/3, and yes I know forward pricing applies so this price will only be known on Tuesday). Yeah, if you paid by 27/3 3pm you would get 27/3 price. FSM MY always honor thatBut my 'confirmation' has not much value since I don't work for FSM. The best way is still to ping live help for such assurance QUOTE(T231H @ Mar 27 2017, 12:18 AM) QUOTE(Avangelice @ Mar 27 2017, 07:18 AM) Guys, be nice. Have a fresh and hopefully better start with our "new" forummer k? He sounds nicer also ma |

|

|

Mar 27 2017, 02:00 PM Mar 27 2017, 02:00 PM

Return to original view | Post

#46

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(killdavid @ Mar 27 2017, 01:34 PM) I have AH select bond in my portfolio. Didn't received any notification from FSM about it. When did this happen ? QUOTE(Ramjade @ Mar 27 2017, 01:49 PM) Before AH Select Bond fund was opened back to public. I think it was closed to FSM buyers for years. Those who bought initially can only sell it. That time, you still can buy but have to buy from branch/agents. Nola, I don't think Select bond was ever closed. AmDynamic Bond yesFSM stopped distributing select bond for a while after FSM introduce 0% SC for all bond funds and Hwang disagree to that. that was the official answer i got from live help. So after we kept talking about select bond and buying it elsewhere other than FSM they finally re-introduce this fund on their platform This post has been edited by dasecret: Mar 27 2017, 02:02 PM |

|

|

|

|

|

Mar 30 2017, 03:43 PM Mar 30 2017, 03:43 PM

Return to original view | Post

#47

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(kukuray @ Mar 30 2017, 03:36 PM) fundsupermart shoudnt sms us right? is like go grab it before is too late. like this influence people to buy typical ut they prefered FSM is at the end of the day a UT distributor aka sales company. so what makes you think they won't try to influence ppl from buying ler?This is very similar to the limited time opening of Public Small Cap few months back. All PM agents were rushing ppl to buy before they close again |

|

|

Mar 30 2017, 03:50 PM Mar 30 2017, 03:50 PM

Return to original view | Post

#48

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

Mar 31 2017, 10:07 AM Mar 31 2017, 10:07 AM

Return to original view | Post

#49

|

Senior Member

1,498 posts Joined: Nov 2012 |

Glad to see that the experienced forumer stepped up to remind people to stick to their course.

I have ponzi 1.0, I like the fund very much, but I'm not buying this month. Why? Because the fund been doing well, so even if I rebalance I should be selling instead of buying the fund Since ppl start sharing specific returns; I do that also la IRR 17.24%; ROI 39.38% Now you know why I like this fund. It's <10% of my portfolio though This post has been edited by dasecret: Mar 31 2017, 10:40 AM |

|

|

Apr 3 2017, 10:31 AM Apr 3 2017, 10:31 AM

Return to original view | Post

#50

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(j.passing.by @ Apr 2 2017, 02:51 PM) ============== Now, I give my 2 sens - to other readers - why you don't bother to top up. "Because the fund been doing well, so even if I rebalance I should be selling instead of buying the fund... IRR 17.24%; ROI 39.38%" 1. She has more or less reached her desired portfolio investment amount. Any future top-ups or investment is tiny or insignificant when compare to her current invested amount. 2. She is actually 'trading' more than she thinks she is. If the fund is good, as shown by her gains, why even think of selling? If the thinking is to maintain the profit, and then seeking another opportunity and time to invest the money into the same fund or another fund is 'trading'... as 'trading' is the action to continuously seek growth; this is oppose to 'buy-and-hold' investor who flows with the dips and swells of the fund. 3. IRR is 17.24%, should you top up or not? Yes; unless of course you have reached your invested objective as mentioned in (1). If you are thinking not to because the top-up could lower the IRR, then you have the wrong reason not to top-up becuase you have a different perspective than I do. (No doubt further investments or top-ups at the market peak will often lower the IRR, because the market will more likely to decline or flatten out after the peak, and will take a longer time to give the same returns as previous investments/purchases/top-ups... IRR is a measurement of profits over time, same % gains over a longer time = average down the IRR.) But we should also view each top-ups, each new purchases as a new investment on its own. So if the previous batch of investments/purchases was giving a 17.24% IRR, then it is good and fine. (Actually 17.24% is better than fine, it is an excellent and fantastic IRR to have.) Period. Full stop. Don't link it to the new batch of money/investment that we are now having in our hands and are about to decide where to invest it. So now the market is at the peak, and maybe the returns of the current top-up will not be so fantastic as the previous batch of investments, is it better to allow the money to languish in 'cash' instead of seizing the moment and the last opportunity to top-up before the fund closes? I dont' think so. Unless of course there is another better fund which I could put the money into next week. ------------------------------------------- Thought I'd clarify some of the points to provide some context I supposed I'm arguably more "trader" than those who diligently RSP, but I'd like to think I'm not as "trader" as those who would liquidate the entire position in anticipation of a crash. When I say if I rebalance I'd be selling instead of buying, what it really means is to trim the position on this fund to my intended ratio Besides, like I've shared openly previously, I topped up in Feb when it was fund of the month and enjoys a 10% ROI for that top up; so rushing to top up in March is really unnecessary If you read the first line of that comment - basically I'm advising ppl to stay their course; and that was exactly what I did; maybe I don't do things in the exact same way as the text book or anyone else, that's my plan so I stick to it Btw, I think this soft close is a bit different from the PM style for Public Ittikal or even Public Small Cap fund; it is likely that the fund would reopen quite soon after they utilise the cash and stabilise the portfolio. But of course, that's purely my speculation |

|

|

Apr 3 2017, 05:11 PM Apr 3 2017, 05:11 PM

Return to original view | Post

#51

|

Senior Member

1,498 posts Joined: Nov 2012 |

Well, holding bonds are like holding stocks, you pay brokerage and no management fee and all

In this case, the fees FSM charge is 0.35% sales charge and 0.2% platform fee per annum. A lot cheaper than bond fund considering management charge is at least 1% + all the expenses probably 1.2% or more. On top of that you still pay platform fees So yeah, those ppl who wants low cost, mali mali |

|

|

Apr 3 2017, 05:37 PM Apr 3 2017, 05:37 PM

Return to original view | Post

#52

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Ramjade @ Apr 3 2017, 05:27 PM) Avangelice You have some valid point there. In the end the returns shown in funds are net of expenses; so if it's still higher it's better despite higher costAffin hwang select bond can give min 6% (already including management fees). Can this do the same? Paying 0.35% sales charge and 0.2% platform fee p.a and cannot beat 0% service charge + 0.2% platform fees p.a with lower risk (takkan all bonds in affin hwang select bond fund default For bond default risk; i think it depends on what perspective you are looking at For a bond fund, yes, it reduces the hit if one of the many bonds held in the bond fund defaults. But if bond fund has some bond default vs the 1 bond that you hold did not default; arguably the latter is better lor. Also, bond fund usually will hold some high yield bonds in order to give you better returns than just investment grade bonds, that's where the default risk comes in The previous comment is very valid, this product is for the deep pockets. Until and unless they offer retail bonds, the concentration risk is a bit too high for the usual retail investors |

|

|

Apr 7 2017, 11:28 AM Apr 7 2017, 11:28 AM

Return to original view | Post

#53

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(yklooi @ Mar 31 2017, 09:05 PM) Time for my EGO boasting again.... long time did not have this feeling.... this is for my own ego boasting only... have to boast it now BEFORE it crashes again Disclaimer: This data does not constitute an investment recommendation. No person should rely on the content and/or act on the basis of any matter contained in this document without obtaining specific professional advice. Investment involves risk. The price of securities may go down as well as up, and under certain circumstances an investor may sustain a total or substantial loss of investment. Past performance is not necessarily indicative of the future or likely performance of the fund. Investors should read the relevant fund's prospectus for details before making any investment decision. An Investor should make an appraisal of the risks involved in investing in these products and should consult their own independent and professional advisors, to ensure that any decision made is suitable with regards to their circumstances and financial position. QUOTE(yklooi @ Apr 7 2017, 10:57 AM) Yes...i won't care for now.....infact tis is the only 1st chance i got since i revamped my portfolio in Jan 2017....to see if my portfolio can withstand tis faraway noises.....if my port can swing more than comfortable....then i will hv to review n make some chances agaon in Dec Uncle Looi, very glad to see the new portfolio is working out great. Out of curiosity, did you backtest the old portfolio you had, if you did not revamp, would you be in a better position or worse off? That will give you some indication as to whether or not revamping was the right move |

|

|

|

|

|

Apr 10 2017, 12:08 PM Apr 10 2017, 12:08 PM

Return to original view | Post

#54

|

Senior Member

1,498 posts Joined: Nov 2012 |

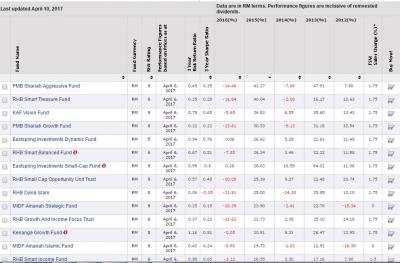

QUOTE(Ramjade @ Apr 10 2017, 11:56 AM) It depends on how and when you are measuring really. RHB is a big fund house compared to KGF or EI. Some of their balanced or blended funds are doing quite well (pre-Aug 2016 of course)As usual, I prefer to support my POV with numbers, the chart is sorted by 2015 returns for all Msian funds; 5 of RHB funds made the list and neither EISC nor KGF top the list

Of course, one would argue that it's just one year, which I tend to agree too. But there are many perspectives in life and we should not just be looking at one *that's the monday blues talking |

|

|

Apr 11 2017, 03:23 PM Apr 11 2017, 03:23 PM

Return to original view | Post

#55

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

Apr 11 2017, 04:52 PM Apr 11 2017, 04:52 PM

Return to original view | Post

#56

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(weilik @ Apr 11 2017, 04:40 PM) Hi all FSM sifus, A fav bond fund around here is Affin Hwang Select bond. I would like to do some asset allocation because I noticed that I am 100% heavy on equity side. What I have in mind is to invest some in bond funds.  The above is the screenshot of bond funds I have shortlisted based on “Recommended” indicator by FSM. From what I can see, Libra Asnita seems to be the best bet with fair return and considerably lower 3 yr volatility. Can anyone here suggest some other bond funds not in the list or I have missed? Thank you! It's not on the recommended list *I speculate* because it was suspended from FSM distribution for a while cos they could not agree on zero sales charge. After "some" forummer hard sell this fund so much on this thread including telling people how to buy outside of FSM, then FSM finally sell this fund again. By then the 2016/2017 recommended fund list already out. I suspect the fund would make the 2017/2018 recommended list considering they recommend it on some of the research articles lately Personally I like RHB Islamic bond. The fund size also grown quite a bit so the risk of default causing havoc is reduced |

|

|

Apr 14 2017, 10:56 AM Apr 14 2017, 10:56 AM

Return to original view | Post

#57

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Ramjade @ Apr 14 2017, 10:26 AM) I believe this is to cater for bonds, and maybe in the future for MAPS equivalent. You see, bonds get coupon payments and some of the bonds are not denominated in ringgit. So there is a need for cash account to cater for them |

|

|

Apr 17 2017, 09:29 AM Apr 17 2017, 09:29 AM

Return to original view | Post

#58

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(shankar_dass93 @ Apr 14 2017, 10:57 PM) QUOTE(Ramjade @ Apr 14 2017, 11:00 PM) Ask dasecret she subscribe to MAPS in FSM SG. But need to keep in mind, FSM SG havr more funds than what FSM MY have. Funds are funds; MAPS is another choice for investors like how they have insurance and bondsMAPS is auto-pilot while Funds are DIY. Pricing structure would likely be different too. I kind of doubt FSM MY can move to platform fee so soon. MAPS on the other hand would likely take wrap account structure, just hope it's not as expensive as 1% p.a. |

|

|

Apr 17 2017, 04:03 PM Apr 17 2017, 04:03 PM

Return to original view | Post

#59

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(Ramjade @ Apr 17 2017, 02:11 PM) Er rather not. Sorry. The trailer fees is an incentive that all distributors will get including the Public Mutual (aka career benefits), or banks. It comes out from the management fee charged by the fund. So one can argues that FSM SG is greedy to charge both sides. It reminds me of Airbnb actually, they also charge use of platform to both hosts and visitors and hence why they are the few disruptive players that are not losing moneyI have FSM MY. Was thinking between FSM SG/POEMS SG/Dollardex. Decide to go with POEMS SG as I don't like paying unnecessarily for platform fees as every cent/dollar save = more money for investment. Platform fees is basically an excuse to suck extra money from you. FSM SG is the only one out of the 3 which charge platform fees FSM SG 0% Service charge + 0.4%pa platform fees POEMS SG 0% service charge + 0% platform fees Dollardex 0% service charge + 0% platform fees + ~0.25% pa trailer fees (which they said already counted into the NAV.) I already did a calculation showing that SC at 0.75% and 1% (this was the service charge by POEMS SG (0.75%)and Dollardex (1%) before they decide to cancel the service charge to bring the fight to FSM SG) vs FSM SG 0.4% platform fees and the service charge is way cheaper than paying for annual platform fees. This is because you are paying a one time charge vs recurring annual charges. People never miss what's small. Hence it's easier to suck/siphon off small amount every year. QUOTE(Ramjade @ Apr 17 2017, 03:29 PM) Sorry. If you don't don't value your privacy so be it. I do. I answered her question. Please elaborate where did I post falsehood? Auntie beancounters can find loads out here... so not exactly individually identifiable information But yeah, young Chinese DC in Kuching should be not so many. But don't think there's much reason to kidnap him also |

|

|

Apr 17 2017, 05:41 PM Apr 17 2017, 05:41 PM

Return to original view | Post

#60

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

| Change to: |  0.0401sec 0.0401sec

0.31 0.31

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 08:51 PM |