QUOTE(killdavid @ Dec 16 2020, 11:22 AM)

got vietnam fund? FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Dec 16 2020, 11:59 AM Dec 16 2020, 11:59 AM

Return to original view | IPv6 | Post

#221

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

|

|

|

Dec 16 2020, 12:22 PM Dec 16 2020, 12:22 PM

Return to original view | IPv6 | Post

#222

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Dec 19 2020, 09:32 AM Dec 19 2020, 09:32 AM

Return to original view | IPv6 | Post

#223

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Dec 19 2020, 11:36 PM Dec 19 2020, 11:36 PM

Return to original view | IPv6 | Post

#224

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(xuzen @ Dec 19 2020, 03:38 PM) A quick glance of my port in Dec 2020 looks very nice, makes me feel like wanna do some extra last minute X'mas Shopping liao. Ho ho ho, merry X'mas. I though u said AmMalaysia is better 🤔🤔🤔Omputeh side ( US ) looks very green. Tongsan side ( China ) also look very Ong! Gold also recovered a bit. Have not done any in depth analysis yet, but at a quick glance KAF Tactical Fund ( M'sia centric ) looks promising. Xuzen |

|

|

Dec 21 2020, 12:34 PM Dec 21 2020, 12:34 PM

Return to original view | IPv6 | Post

#225

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Dec 21 2020, 12:01 PM) Foreign fund outflow hits RM25bil u got any APAC fund ?.......wanna move my principal APAC fund , try find not bad one ..... KUALA LUMPUR: The outflow of foreign funds continued as offshore investors were net sellers of RM178.8mil in equities on Bursa Malaysia over the previous week, bringing year-to-date net selling to RM25bil. MIDF Research said in its weekly fund flow report that foreign investors turned net buyers on Wednesday and Thursday after the passing of Budget 2021 at its third reading but were quick to take profit on Friday. "In comparison to another three South East Asian markets that we tracked last week; Malaysia recorded the least foreign net outflow while Thailand experienced the biggest inflow compare to the others," it said. https://www.thestar.com.my/business/busines...ow-hits-rm25bil Selling pressure continues UALA LUMPUR: The FBM KLCI began on a weak footing as consolidation pressures continued to weigh on the market. At 9.05am, the key index had slipped 1.94 points to 1,650.55. Investors are in a profit-taking mood in the closing days of 2020, with Bursa Malaysia coming under selling pressure last week, which brought it to a low of 1,645 and trading close of 1,652. https://www.thestar.com.my/business/busines...ssure-continues |

|

|

Dec 21 2020, 12:54 PM Dec 21 2020, 12:54 PM

Return to original view | IPv6 | Post

#226

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Dec 21 2020, 12:36 PM) I got these: this is big cap? .....in my list is dividend punya ... 1. Principal Asia Pacific Dynamic Growth Fund - MYR 2. Principal Asia Pacific Dynamic Income Fund - MYR 3. Affin Hwang Select Asia (Ex Japan) Opportunity Fund - MYR Pick whichever relevant to your taste bud, |

|

|

|

|

|

Dec 21 2020, 01:00 PM Dec 21 2020, 01:00 PM

Return to original view | IPv6 | Post

#227

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Dec 21 2020, 01:03 PM Dec 21 2020, 01:03 PM

Return to original view | IPv6 | Post

#228

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Dec 21 2020, 01:08 PM Dec 21 2020, 01:08 PM

Return to original view | IPv6 | Post

#229

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Dec 21 2020, 01:06 PM) I didn't spend much time for Affin Hwang Select Asia Pacific (Ex Japan) Dividend Fund - MYR as I know that I already covered for this fund under Affin Hwang PRS Moderate Fund. thanks for the info......i do some home work first...... As for Affin Hwang Select Asia (Ex Japan) Quantum Fund - MYR, fund mandate changed and its hand has no longer tied to small & mid caps. |

|

|

Dec 21 2020, 07:00 PM Dec 21 2020, 07:00 PM

Return to original view | IPv6 | Post

#230

|

Senior Member

2,437 posts Joined: Sep 2016 |

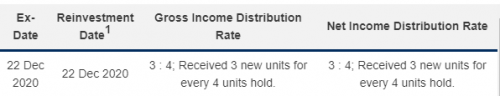

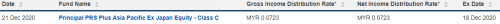

QUOTE(GrumpyNooby @ Dec 21 2020, 06:37 PM) Unit split declared for Principal Asia Pacific Dynamic Income Fund - MYR -> 3 : 4; Received 3 new units for every 4 units hold.  Interestingly that the PRS fund declared its first time distribution first:  Wondering if that unit split will alter the PRS fund NAV too? i make the intra switch today.... |

|

|

Dec 22 2020, 06:28 PM Dec 22 2020, 06:28 PM

Return to original view | IPv6 | Post

#231

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Dec 24 2020, 12:10 PM Dec 24 2020, 12:10 PM

Return to original view | IPv6 | Post

#232

|

Senior Member

2,437 posts Joined: Sep 2016 |

Here's 5 Low Risk Shariah Funds with at least 4.25% profit in 2020 AmanahRaya Syariah Trust Fund (+9.2% Year to Date) The Fund aims to provide regular income and capital growth over the medium to long-term through investments predominantly in Syariah-approved debt securities, money market instruments and Trust Accounts. The Fund will invest a minimum of 70% of the Fund’s NAV in Ringgit and foreign currency sukuk rated at least ‘A’ or ‘P2’ by RAM or its MARC equivalent rating or A- by S&P, or its Moodys and Fitch equivalent rating. Maybank Malaysia Sukuk Fund (+6.2% Year to Date) The Fund aims to provide investors with annual income through investing in a portfolio of Sukuk. To achieve the Fund’s objective, the Fund will invest between 70% - 98% of the Fund’s NAV in a portfolio of Ringgit Malaysia denominated sukuk issued and/or offered in Malaysia with a minimum sukuk rating of ‘AA-’ by RAM or equivalent rating by MARC. Kenanga ASnitaBOND Fund (+5.5% Year to Date) The Fund aims to provide capital preservation with regular income over the short to medium-term period by investing in Islamic money market instruments and other Shariah-approved fixed income securities. With respect to sukuk, the fund manager will focus on consistent, above-average returns (relative to the Fund’s performance benchmark) from fundamental research. Emphasis is placed on credit-worthy issuers of sukuk and investment-grade sukuk. A disciplined application of the top-down investment process is therefore applied, with due consideration given to the credit standing of individual issuers. The fund manager will seek to diversify the investments of the Fund across sectors and individual sukuk in order to mitigate the risk profile of the portfolio. KAF Sukuk Fund (+5.1% Year to Date) The fund aims to achieve capital growth in the medium to long-term through investing in securities listed in the Malaysian equities market whilst abiding by Shariah principles. The Fund will only invest in sukuk issued or guaranteed by issuers or guarantors with a minimum short term credit rating of P2 (by RAM) or MARC2 (by MARC) or a long term credit rating of A3 (by RAM) or A- (by MARC) or an equivalent rating by any other recognized foreign credit rating agencies. AmBon Islam (+4.7% Year to Date) This is a medium to long-term Islamic bond fund that aims to provide investors with a stream of 'halal' income. The Fund seeks to achieve its objective by investing primarily in Sukuk and Islamic money market instruments with the following minimum credit rating: Short-term credit rating of P2 or Long-term credit rating of BBB3 by RAM or its equivalent as rated by a local or global rating agency. https://www.fsmone.com.my/funds/research/ar...Insurance=false This post has been edited by ironman16: Dec 24 2020, 12:11 PM |

|

|

Dec 24 2020, 07:01 PM Dec 24 2020, 07:01 PM

Return to original view | Post

#233

|

Senior Member

2,437 posts Joined: Sep 2016 |

iFAST 2021 Outlook: Emerging from the Valley of Virus As the global economies shake off the traumas of a Covid-19 induced recession heading into 2021, where should investors place their money ahead? Global Macro Outlook – Our stance for the global economy next year While economic uncertainties persist heading into 2021, we believe global economies around the world have begun their recovery process from the Covid-19 shock this year, albeit at differing pace. In the bigger picture, we have past the trough of the global economic cycle. The expansion witnessed in both global PMIs and positive surprises in economic data strongly reinforces the aforementioned view. We believe the recession will be over for most economies in 4Q 2020 - 1Q 2021. Given its lagging nature, upcoming GDP data should shed more light and confirm that we are past the trough (chart 3). It is our belief that we are at an early economic expansion phase right now. This means a cyclical recovery is very likely to burgeon, uplifting global economic recovery and asset prices next year. Our eyes are also fixed at a potential wide approval of the vaccine, which will amplify the recovery in 2H 2020. We opine that global recovery may still be bumpy at the start of 2021 as Covid-19 still has its grip on western economies. Nonetheless, global recovery momentum should strengthen throughout 2021 and growth headwinds are likely to be dealt with further stimulus weaponry. All things considered, we are constructive on 2021’s macro outlook and expect above consensus year-on-year GDP growth of 6%. The vaccine-led macro recovery story in 2021 is bright as we round off 2020 and emerge from the valley of Covid-19. Global Equity Outlook – Where to find value and robust earnings? With valuations across equity markets now propped to heady levels, we argue that earnings and fundamentals will start to matter again once the global outlook regains clarity in 2021. We believe it pays to be more selective and FY21/22’s earnings will provide guidance into our search for value. In our opinion, equity markets which can deliver robust earnings rebound in FY21/22 should (i) minimize de-rating risks and ii) drive further equity returns. With the virus uncertainties and peak Covid-19 fears hopefully behind us, we increasingly expect investors to focus on corporate earnings. Rounding the bend into 2021, we favour Asia (particular China, Taiwan and South Korea) and Emerging markets (EMs) over developed markets like US and Europe. Cyclical Asian EM markets offers a good risk-reward profile, given that they have yet to catch up to global equities. Although Latin America and EMEA equities offers potentially higher upside, investor should note that they will be taking on a higher risk should they choose to invest in them as fundamentals of Latin America and EMEA equities are not as strong relative to Asian equities in the prevailing environment. Overall, our top five markets for 2021 are China, S. Korea, Taiwan, Indonesia, Brazil. https://www.fsmone.com.my/funds/research/ar...Insurance=false |

|

|

|

|

|

Dec 25 2020, 10:21 AM Dec 25 2020, 10:21 AM

Return to original view | IPv6 | Post

#234

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(YoungMan @ Dec 25 2020, 10:15 AM) What is the quickest way to search for fund in FSM now? Last time we can type in the name within the homepage but that function has disappear since the new website came. that function still available, right?at the upper corner, just beside OPEN ACCOUNT button.... |

|

|

Dec 25 2020, 01:18 PM Dec 25 2020, 01:18 PM

Return to original view | IPv6 | Post

#235

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(YoungMan @ Dec 25 2020, 12:40 PM) hmmm... need to click on it only will come out search box. Thank you. at first, i oso cant find it......suddenly saw it beside OPEN ACCOUNT button baru tahu Thank you. Want to adjust my port... Too heavy on Amanah Syariah since I took profit off after the April rebound. Thank you. |

|

|

Dec 25 2020, 01:37 PM Dec 25 2020, 01:37 PM

Return to original view | IPv6 | Post

#236

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Dec 25 2020, 05:40 PM Dec 25 2020, 05:40 PM

Return to original view | IPv6 | Post

#237

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(YoungMan @ Dec 25 2020, 05:33 PM) For those feeder fund you mentioned, how to check the percentage of allocation of the target fund into specific sector? fundfacsheet encikbuta liked this post

|

|

|

Dec 25 2020, 08:18 PM Dec 25 2020, 08:18 PM

Return to original view | IPv6 | Post

#238

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

|

|

Dec 26 2020, 11:29 AM Dec 26 2020, 11:29 AM

Return to original view | IPv6 | Post

#239

|

Senior Member

2,437 posts Joined: Sep 2016 |

QUOTE(GrumpyNooby @ Dec 26 2020, 11:21 AM) Any difference to this article? Ur post one only emerging market,  EM Outlook 2021: Tides are turning. EM equities to take the lead Link: https://www.fsmone.com.my/funds/research/ar...Insurance=false I post one got a few outlook of difference county/sector like recommendations for health care, tech, china, us, apac,.... But not recommended msia equity, which against xuzen Got time u read n bg i next year suggest la. Now i wait master xuzen msia recommends fund. See same with me or not 😁😁😁 |

|

|

Dec 26 2020, 11:36 AM Dec 26 2020, 11:36 AM

Return to original view | IPv6 | Post

#240

|

Senior Member

2,437 posts Joined: Sep 2016 |

|

| Change to: |  0.0519sec 0.0519sec

0.33 0.33

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 01:51 AM |