QUOTE(ganesh1696 @ Mar 26 2021, 10:44 AM)

My updated portfolio following the "dip".

Affin global disruptive innovation fund = 29.6%

Affin Next gen tech fund = 12.1%

Am china a shares myr hedged = 20%

Interpac dana safi = 12.3%

Principal greater china equity fund= 1%

Rhb shariah china focus fund = 8.5%

United malaysia fund= 16.5%

Only interpac and United fund, is in green.

Others are bleeding "unstoppable" .

Almost every week I've top up my USA and CHINA funds to minimize my losses which drag me to "five digit" losses. But price fall is continuing with no sign of rebound.

Almost losing hope with both regions' portfolio.

But am still holding.

Thinking of use ( i sinar) funds to top up and find some better opportunities.

So much confused.

How about your portfolio friends?i don't have so much fire power to buy every week....

my plan is only top up equivalent amount when it hit -20% so as to help it recover 10% of it losses.

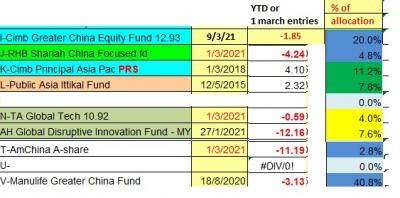

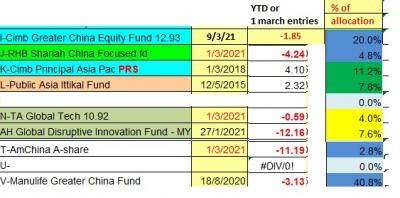

here is my current YTD ROI and % of allocation...

btw, as mentioned before, i am moving some % of my DIY to Stashaway.....

the current market volatility had somewhat impacted me....not due to the % of ROI movement but due to the amount of $$ movement...which makes me feel not comfortable....(as each 1% can be substantial for me)

thus my plan is try to "HIDE" some % of my port to SA so that the value in my DIY port is smaller.....less impact on the $$ movement....some may call it cheating oneself

This post has been edited by yklooi: Mar 26 2021, 11:14 AM Attached thumbnail(s)

This post has been edited by yklooi: Mar 26 2021, 11:14 AM Attached thumbnail(s)

Mar 10 2021, 02:16 PM

Mar 10 2021, 02:16 PM

Quote

Quote

0.0711sec

0.0711sec

1.08

1.08

7 queries

7 queries

GZIP Disabled

GZIP Disabled