Bbbbb lo

Multiple Signs of Malaysia Property Bubble V20

Multiple Signs of Malaysia Property Bubble V20

|

|

Apr 12 2021, 09:56 PM Apr 12 2021, 09:56 PM

|

Senior Member

600 posts Joined: Jun 2014 |

Bbbbb lo

|

|

|

|

|

|

Apr 13 2021, 03:27 PM Apr 13 2021, 03:27 PM

Show posts by this member only | IPv6 | Post

#3482

|

All Stars

21,458 posts Joined: Jul 2012 |

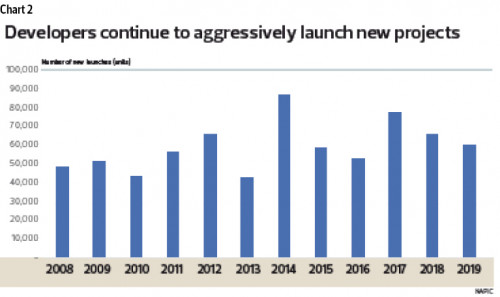

Are some homebuyers in Malaysia paid to borrow and buy?

https://www.edgeprop.my/content/1824379/are...-borrow-and-buy |

|

|

Apr 13 2021, 03:37 PM Apr 13 2021, 03:37 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(icemanfx @ Apr 13 2021, 04:57 PM) Are some homebuyers in Malaysia paid to borrow and buy? Where is 2020. Need a long candle chart.   https://www.edgeprop.my/content/1824379/are...-borrow-and-buy |

|

|

Apr 16 2021, 12:29 PM Apr 16 2021, 12:29 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

Apartment Freehold @198K. alexkos alexkos liked this post

|

|

|

Apr 16 2021, 05:48 PM Apr 16 2021, 05:48 PM

Show posts by this member only | IPv6 | Post

#3485

|

Senior Member

2,275 posts Joined: Jun 2010 |

|

|

|

Apr 16 2021, 05:49 PM Apr 16 2021, 05:49 PM

Show posts by this member only | IPv6 | Post

#3486

|

Senior Member

2,275 posts Joined: Jun 2010 |

|

|

|

|

|

|

Apr 16 2021, 06:18 PM Apr 16 2021, 06:18 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

|

|

|

Apr 18 2021, 10:43 AM Apr 18 2021, 10:43 AM

|

All Stars

21,458 posts Joined: Jul 2012 |

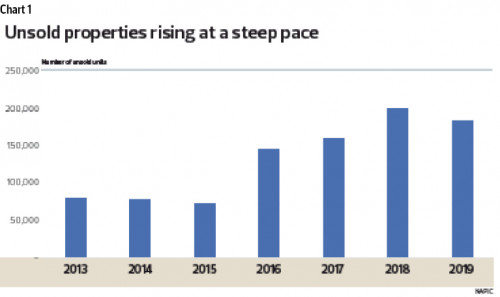

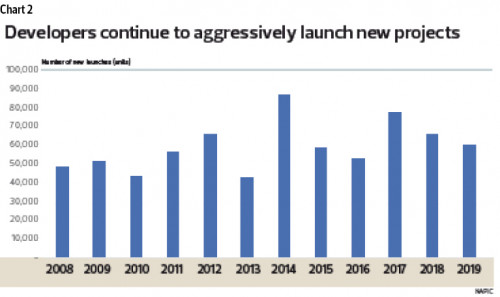

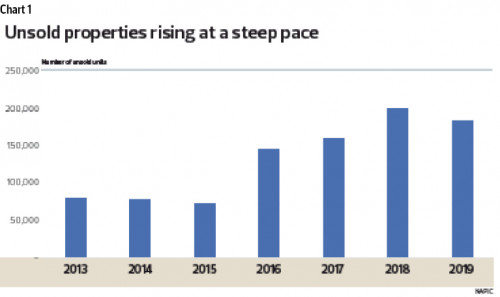

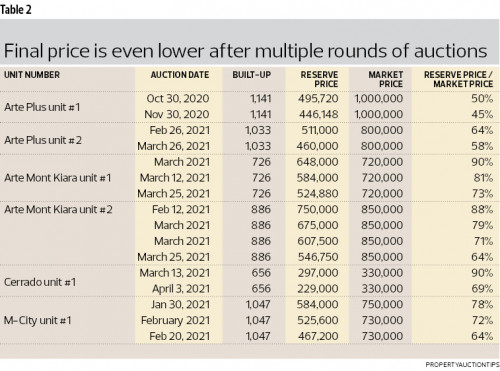

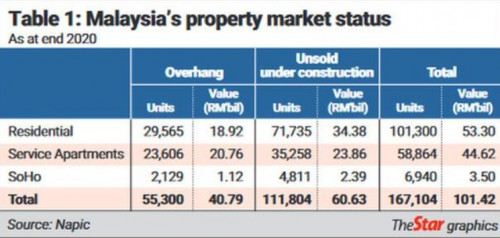

QUOTE(HereToLearn @ Apr 17 2021, 06:22 PM) If NET rental yield cannot get above 5%, chill, continue waiting only, no rush to buy, let BBB UUU catching falling knife players go in 1st. Cause rental rate might continue dropping. https://www.thestar.com.my/business/busines...rm101bil-burden The grossly oversupplied property market is not only weighing on developers in the primary market segment, anecdotal evidence from the secondary market tells almost the same story. Secondary prices have generally been weak in most geographical areas while rentals too have been poor with rental rates at best staying at previously contracted rates or worse, trending down. You might find this data useful. With so many incoming supplies (faster than market demand, overhand units will increase further), fiercer rental war will be there, hence rental yield is likely to drop further. If rental yield cannot go up, logically property prices will remain suppressed Year - number of overhang residential units 2017 - 24k units 2018 - 32k units 2019 - 48k units 2020 - 55k units 2021 - still waiting for data  |

|

|

Apr 18 2021, 10:50 AM Apr 18 2021, 10:50 AM

Show posts by this member only | IPv6 | Post

#3489

|

Senior Member

9,616 posts Joined: Dec 2013 |

Ppl talking about this since 2000?

Not tired? |

|

|

Apr 18 2021, 10:52 AM Apr 18 2021, 10:52 AM

|

All Stars

21,458 posts Joined: Jul 2012 |

|

|

|

Apr 18 2021, 07:36 PM Apr 18 2021, 07:36 PM

|

All Stars

21,458 posts Joined: Jul 2012 |

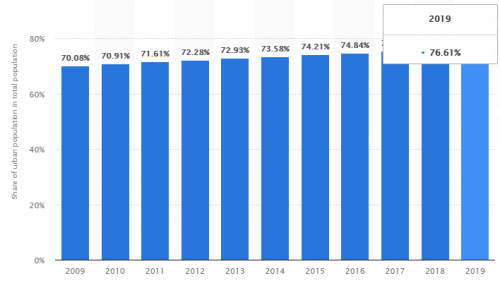

QUOTE(white_ra @ Apr 18 2021, 07:08 PM) 1. If the urbanisation continues, more people continues flow from rural area to city It seems malesia is among the highest urbanization in asia. there are few people left in villages for migration to kv. 2. Only when BNM tighten the control + increase the BR will cool down the market. 3. Lelong units needs to have a look at its segregation, whether this is from below 500K or 1Mil above unit, this would justify the market purchasing trend. |

|

|

Apr 30 2021, 02:19 PM Apr 30 2021, 02:19 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

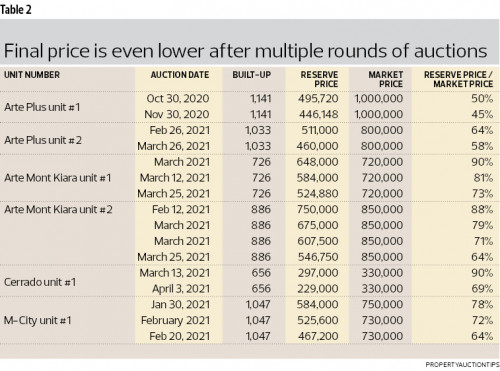

So cheap this auction

https://www.ngchanmau.com/property/44101?ut...mpaign=20210430 Freehold, serviced apartment @270K This post has been edited by Syie9^_^: Apr 30 2021, 02:19 PM |

|

|

Apr 30 2021, 02:23 PM Apr 30 2021, 02:23 PM

Show posts by this member only | IPv6 | Post

#3493

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

QUOTE(Syie9^_^ @ Apr 30 2021, 02:19 PM) So cheap this auction not cheap. less than 600sqft need to drop below 200khttps://www.ngchanmau.com/property/44101?ut...mpaign=20210430 Freehold, serviced apartment @270K michaelchang liked this post

|

|

|

|

|

|

Apr 30 2021, 02:57 PM Apr 30 2021, 02:57 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

|

|

|

Apr 30 2021, 03:16 PM Apr 30 2021, 03:16 PM

Show posts by this member only | IPv6 | Post

#3495

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

|

|

|

Apr 30 2021, 04:08 PM Apr 30 2021, 04:08 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

|

|

|

Apr 30 2021, 04:19 PM Apr 30 2021, 04:19 PM

Show posts by this member only | IPv6 | Post

#3497

|

Senior Member

3,833 posts Joined: Oct 2006 From: Shah Alam |

|

|

|

Apr 30 2021, 04:41 PM Apr 30 2021, 04:41 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

|

|

|

Apr 30 2021, 05:22 PM Apr 30 2021, 05:22 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

150k 500sqft studio KL got?

|

|

|

Jun 1 2021, 03:15 PM Jun 1 2021, 03:15 PM

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(joeblow @ May 31 2021, 05:30 PM) My humble view, last 20 years easier to do leverage. Mainly due to Malaysia still developing at fast pace with real rising income. Nowadays harder unless you buy with cash. If not you are just helping the bank. My humble view is property is still for long term, due to the current crisis you need to have holding power. Even now those who can buy cash will reconsider due to the over supply plus ecommerce. So many shops nowadays become a luxury due to online commerce. But property will always be a good hedge against inflation since raw materials price will always increase. You made the valid point, property price will go up in future. But maybe other better investments might give better return. To me though I feel buying property is safer, but also depends on how many more years you think you will live (unless u don't mind giving it to your children or siblings etc). Selling a house is so much trouble plus maintaining it. I just sold a terrace house last year Nov. Now I still haven't get my money despite way overdue. Also properties of more than 15 years you really need to maintain it. But lucky for us we will manage to sell it at a profit, but considering the return over the years not really up a lot. Maybe if we keep another 10 years we can sell at a higher price, but do consider the opportunity costs. I still have another house that's not rented out. The grass etc requires tons of maintenance, trust me it is a nightmare. If you are young, yes property is somewhat a safer investments. For me the hassle is too much. Especially when you can't rent out your property, worse is when you get tenants from hell.... trust me you rather earn less with money in FD. QUOTE(joeblow @ May 31 2021, 05:35 PM) I think price drop maybe not so much now. Already a lot down 10 to 30% from peak. But most buyers do have holding power. They rather see their property get lelong than sell at 50% discount. Don't ask me why, kind of human behaviour. And yes, due to the pandemic plus oversuppy, rental is going to drop and drop. So many empty properties now and so many people do not dare to start new business now. And we lack the foreigners to come in to rent, just the student market drop tons. IMHO hunting for a good deal in real estate is seriously tough work. Go see and see and the owner all will not want to decrease the price. So now I would only buy a property if it is really good deal or for own stay. Your money can be put to better use at other investment instruments. |

| Change to: |  0.0365sec 0.0365sec

0.69 0.69

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 11:07 PM |