QUOTE(Kaka23 @ Jan 2 2017, 09:01 PM)

Yes....moving to a more diverified portfolio...increased fi by 10% , moving 35% away from scap, going fir reits n ei globa leaders l fundsWhat abt you?

This post has been edited by yklooi: Jan 2 2017, 09:12 PM

FundSuperMart v17 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jan 2 2017, 09:11 PM Jan 2 2017, 09:11 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(Kaka23 @ Jan 2 2017, 09:01 PM) Yes....moving to a more diverified portfolio...increased fi by 10% , moving 35% away from scap, going fir reits n ei globa leaders l fundsWhat abt you? This post has been edited by yklooi: Jan 2 2017, 09:12 PM |

|

|

|

|

|

Jan 2 2017, 09:25 PM Jan 2 2017, 09:25 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(wodenus @ Jan 2 2017, 08:50 PM) Exactly.. if you only remember two things about mutual funds, it would be this : er.. it depends.(1) Diversify as much as you can (2) Wait for as long as you can That's it for more volatile ETFs / UTs or stocks, the simple timing method may be better looking @ S&P 500 ETF, Nestle & PBank earlier - PBank is "more volatile" VS S&P 500 ETF, and look at it's results Yet to test on small cap / Emerging Market ETFs - data issue from Yahoo Finance for KLSE & STI indices since Q3+/- 2016 |

|

|

Jan 2 2017, 09:29 PM Jan 2 2017, 09:29 PM

|

Senior Member

5,558 posts Joined: Aug 2011 |

So ETF are bought from Bursa? That so? Since they are "exchange traded"? Or in Malaysia's case, is it a whole different exchange?

|

|

|

Jan 2 2017, 09:34 PM Jan 2 2017, 09:34 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(yklooi @ Jan 2 2017, 09:11 PM) Yes....moving to a more diverified portfolio...increased fi by 10% , moving 35% away from scap, going fir reits n ei globa leaders l funds I will still stick with current portfolio.. This year will focus top up on asia ex japan, reits and specific malaysia fund..What abt you? |

|

|

Jan 2 2017, 09:45 PM Jan 2 2017, 09:45 PM

|

All Stars

24,380 posts Joined: Feb 2011 |

QUOTE(contestchris @ Jan 2 2017, 09:29 PM) So ETF are bought from Bursa? That so? Since they are "exchange traded"? Or in Malaysia's case, is it a whole different exchange? Malaysian ETFs are useless and not worth. He is taking about US S&P500. Bought using Interactive broker. Am I right wongmunkeong? |

|

|

Jan 2 2017, 09:57 PM Jan 2 2017, 09:57 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(contestchris @ Jan 2 2017, 09:29 PM) So ETF are bought from Bursa? That so? Since they are "exchange traded"? Or in Malaysia's case, is it a whole different exchange? QUOTE(Ramjade @ Jan 2 2017, 09:45 PM) Malaysian ETFs are useless and not worth. He is taking about US S&P500. Bought using Interactive broker. Am I right wongmunkeong? 1. Note that ETFs were used for the test as they are a composite of stocks, just like mutual funds.2. Yes, "exchange traded" = listed in KLSE, SGX, NASDAQ, NYSE,etc 3. er..generally ETF on KLSE is "useless" unless one has specific niche/plans for them in one's portfolio reason = Malaysia's total market capitalization isn't that big for ETFs to be created "isn't that big" comparatively to EU, US, JP, etc la heheh I do use CIMBX25, now called CIMBC50 & CIMBA40 as ETFs for China & ASEAN though - niche & specific reasons. Since EPF cut off that route, now forced to go to NYSE / ARCA-listed for my FXI but no equivalent for CIMBA40 sorry ar Mods & TS - off topic a bit coz used ETF to relate to UTs / MFs earlier & now clearing the air on it This post has been edited by wongmunkeong: Jan 2 2017, 09:57 PM |

|

|

|

|

|

Jan 2 2017, 10:03 PM Jan 2 2017, 10:03 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(wongmunkeong @ Jan 2 2017, 09:57 PM) 1. Note that ETFs were used for the test as they are a composite of stocks, just like mutual funds. Don't worry, in fact the TS was glad you introduced these new terms and knowledge to him as TS is just a 90s brat 2. Yes, "exchange traded" = listed in KLSE, SGX, NASDAQ, NYSE,etc 3. er..generally ETF on KLSE is "useless" unless one has specific niche/plans for them in one's portfolio reason = Malaysia's total market capitalization isn't that big for ETFs to be created "isn't that big" comparatively to EU, US, JP, etc la heheh I do use CIMBX25, now called CIMBC50 & CIMBA40 as ETFs for China & ASEAN though - niche & specific reasons. Since EPF cut off that route, now forced to go to NYSE / ARCA-listed for my FXI but no equivalent for CIMBA40 sorry ar Mods & TS - off topic a bit coz used ETF to relate to UTs / MFs earlier & now clearing the air on it He is very grateful about what the forummers here share here bringing different perspective for the TS to begin his investment journey, a fruitful 2016 for him p/s: Just gotta hope other casual/silence forummers or the mods wont get annoyed by this This post has been edited by AIYH: Jan 2 2017, 10:04 PM |

|

|

Jan 2 2017, 10:04 PM Jan 2 2017, 10:04 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(iampokemon @ Jan 2 2017, 05:38 PM) I've just withdrawn from Affin hwang select bond last 2 weeks which is managed under Citibank cuz the chart doesn't look promising as of December 2016, as I'm not very good in analyzing if it is a good fund or not. And another thing is because my relationship manager has resigned which leaves me on my own now. So i'm just thinking which fund I should allocate in besides FD. QUOTE(iampokemon @ Jan 2 2017, 06:38 PM) They do gave me a brochure which states the charges for it, but if I remember correctly it is just 2% sales charge and the other charges is 0%. As I already lost the brochure since it was some time ago. I'll try to inquire it from the bank this week and find out more about it. for a start, Citibank did not manage that fund.....it is under Affin hwang asset mgmt. bhd...your relationship mgr is partial right...she only charge you 2% sales charge and 0% on other fees.... but the other charges are not informed b'cos they are charged by the fund house not Citibank and it will be reflected in the NAVs. see page # 6 of attached for the fees and charges of this fund https://www.fundsupermart.com.my/main/admin...ceMYHWSBOND.pdf |

|

|

Jan 2 2017, 10:12 PM Jan 2 2017, 10:12 PM

|

Junior Member

391 posts Joined: Jun 2010 |

QUOTE(wodenus @ Jan 2 2017, 08:49 PM) OK are you sure we're still talking about mutual funds? or some sort of endowment policy? you don't get policies with mutual funds. It's just funds placement. They do not call it mutual funds. And once you have inputted money into the funds you want, it will show you the daily earning/lose that you have accumulated from your citibank online account, pretty similar to FSM. |

|

|

Jan 2 2017, 10:19 PM Jan 2 2017, 10:19 PM

|

Junior Member

391 posts Joined: Jun 2010 |

QUOTE(Avangelice @ Jan 2 2017, 09:04 PM) I think he signed up for an endowment fund and the RM explained it to him by using unit trust jargon which explains why he has a little understanding on how it works. same with my girlfriend at ocbc. the RM knows about TA Global and what fund to do and etc. Nope, confirm is unit trust. Citibank don't give policy. The one that I say policy is from Great Eastern with a projected return of 5-7%. Which 5% is guaranteed return under "Lion's income fund". But they have a sales charge of 2%. Not sure if endowment is a correct term for this as I could withdraw the money anytime I want as well.Just saying this as a comparison between bank, insurance company and FSM. |

|

|

Jan 2 2017, 10:26 PM Jan 2 2017, 10:26 PM

|

Senior Member

2,081 posts Joined: Mar 2012 |

QUOTE(yklooi @ Jan 2 2017, 08:50 PM) Ur ROI and IRR calculation so big difference.Prior years sure got huge loss making I believe? QUOTE(Kaka23 @ Jan 2 2017, 09:34 PM) I will still stick with current portfolio.. This year will focus top up on asia ex japan, reits and specific malaysia fund.. Which region reits?This post has been edited by TakoC: Jan 2 2017, 10:27 PM |

|

|

Jan 2 2017, 10:29 PM Jan 2 2017, 10:29 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jan 2 2017, 10:31 PM Jan 2 2017, 10:31 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(iampokemon @ Jan 2 2017, 10:19 PM) Nope, confirm is unit trust. Citibank don't give policy. The one that I say policy is from Great Eastern with a projected return of 5-7%. Which 5% is guaranteed return under "Lion's income fund". But they have a sales charge of 2%. Not sure if endowment is a correct term for this as I could withdraw the money anytime I want as well. this is INTERESTING.....Just saying this as a comparison between bank, insurance company and FSM. anyone can share the link to the prospectus/info of this fund that can see the word "5% GUARANTEED" returns?? |

|

|

|

|

|

Jan 2 2017, 10:46 PM Jan 2 2017, 10:46 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

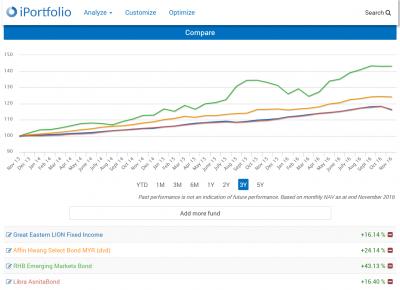

QUOTE(iampokemon @ Jan 2 2017, 10:12 PM) It's just funds placement. They do not call it mutual funds. And once you have inputted money into the funds you want, it will show you the daily earning/lose that you have accumulated from your citibank online account, pretty similar to FSM. I guess you are confused Lets rearrange a bit Affin Hwang Select Bond Fund is a Mutual funds/unit trust that you purchased through citibank which act as an agent and your RM is the human agent that serves you like other UT agents, and you used citionline as the platform to view your unit trust investment same like FSM So like buying from other UT agents (the conventional method), you are paying an upfront sales charge upon investing via them. This is the same with FSM, is just that FSM sales charge is lower compared to via citibank All the so called management expense and trustee fees are incurred daily and already reflected in the NAV of the fund, so doesnt matter u buy from bank agent or FSM, is the fund itself that charged it, not the intermediaries QUOTE(iampokemon @ Jan 2 2017, 10:19 PM) Nope, confirm is unit trust. Citibank don't give policy. The one that I say policy is from Great Eastern with a projected return of 5-7%. Which 5% is guaranteed return under "Lion's income fund". But they have a sales charge of 2%. Not sure if endowment is a correct term for this as I could withdraw the money anytime I want as well. If you understand what mutual funds/unit trusts are and if you read through your GE policy, you will see that the projected returns are not guaranteed (otherwise there wont be best case and worse case scenario Just saying this as a comparison between bank, insurance company and FSM. The "Lion's income fund" is where part of your premium portion goes to, a unit trust investment, which you then pay sales charge and the other indirect expense like what a normal UT investment look like, to sustain your policy. Unfortunately, Great Eastern did not publish it funds details like PHS, Prospectus, Annual eport and fund fact sheet, unlike allianz and ammetlife, at least they provide some info about their funds You can browse through iportfolio.com.my to review its performance and compare it with other funds, i.e. libra asnita bond fund, affin hwang select bond fund and rhb emerging bond fund Give you an example of the 3 years performance chart generated from iportfolio, you can utilize it from there To annualized the 3 year performance, Great Eastern LION Fixed Income = 5.11% p.a. Libra AsnitaBond = 5.19% p.a. Affin Hwang Select Bond MYR = 7.47% p.a. RHB Emerging Markets Bond = 12.70% p.a. This post has been edited by AIYH: Jan 2 2017, 10:56 PM Attached thumbnail(s)

|

|

|

Jan 3 2017, 12:33 AM Jan 3 2017, 12:33 AM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(xuzen @ Jan 2 2017, 02:31 PM) Specially for those a little thick in the skull: Happy new year! Dividend from stocks are specifically from profits. Anything else are called capital repayment. Dsitribution don't give a Jack Sh1t, it can come from profit / surplus or from pool of capital. Hence it is called distribution and not dividend. Can some bean counter verify this? Hint hint to auntie dasecret. my long winded post went MIA, so this is the summarised version: Not sure what I'm supposed to verify, but distribution is supposed to come from profits also la, so conceptually same as dividends from stocks. Just that stock trading as you rightly pointed out, is on a willing buyer willing seller basis, so the willing buyer or seller may not be so smart to fully price in the dividends; or feels that the profits announced indicates good/bad news that needs to be reflected in their ask/bid price Whereas for UT, it's purely based on the value of the underlying assets, so there's no sentiments involved in distribution. So you wont gain/loss just from distribution, you gain/lose from how the underlying stocks are performing QUOTE(iampokemon @ Jan 2 2017, 05:02 PM) Just some questions here, I am actually looking into a fixed income funds that could provide me around 6% annual return. But upon clicking the recommended fund list, "RHB Emerging Markets Bond Fund" seems to have a nice chart that provides an average 10% PA with a balanced risk rating of 5. You may want to look up on the previous discussions on RHB Asian Total Return fund; the fund is similar but not the same as EM bond. While "RHB Asian Income Fund" provides a 7.93% projected annual return at a risk rating of 6. Does that means taking "RHB Emerging Markets Bond Fund" is a better choice since it has lower risk with better returns? And they don't seems to implement any sales charge for it as well. TLDR: Forex is the main cause for the gains for this fund. EM Bonds may not do as well as historical performance due to - forex and US fed rate will increase further Noticed you didn't think highly of Affin Hwang select bond. As such, what makes you think EM bond would do well? In the most simplistic manner, you can compare the sharpe ratio or risk return ratio of different funds. Higher means you get more returns from the same risk you undertake. EM bond and RHB ATR's volatility/risk is off the roof in the context of fixed income funds. Not all fixed income funds are the same |

|

|

Jan 3 2017, 05:47 AM Jan 3 2017, 05:47 AM

|

All Stars

14,990 posts Joined: Jan 2003 |

QUOTE(wongmunkeong @ Jan 2 2017, 09:25 PM) er.. it depends. Nestle and PBBANK aren't mutual funds?for more volatile ETFs / UTs or stocks, the simple timing method may be better looking @ S&P 500 ETF, Nestle & PBank earlier - PBank is "more volatile" VS S&P 500 ETF, and look at it's results Yet to test on small cap / Emerging Market ETFs - data issue from Yahoo Finance for KLSE & STI indices since Q3+/- 2016 |

|

|

Jan 3 2017, 05:52 AM Jan 3 2017, 05:52 AM

|

All Stars

14,990 posts Joined: Jan 2003 |

QUOTE(T231H @ Jan 2 2017, 10:04 PM) for a start, Citibank did not manage that fund.....it is under Affin hwang asset mgmt. bhd... It's a bond fund, that explains the 2℅, it's free of commission on FSM your relationship mgr is partial right...she only charge you 2% sales charge and 0% on other fees.... but the other charges are not informed b'cos they are charged by the fund house not Citibank and it will be reflected in the NAVs. see page # 6 of attached for the fees and charges of this fund https://www.fundsupermart.com.my/main/admin...ceMYHWSBOND.pdf |

|

|

Jan 3 2017, 08:16 AM Jan 3 2017, 08:16 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(wodenus @ Jan 3 2017, 05:47 AM) hehe - of course not.those are 2 of the only 10-ish KLSE stocks i track/filtered for & since i've the data on hand, just throw into blender to test lor Didn't clean up before ZIPPING & sharing the basic idea of yearly DCA vs simple timing |

|

|

Jan 3 2017, 08:49 AM Jan 3 2017, 08:49 AM

|

Senior Member

5,272 posts Joined: Jun 2008 |

Not sure if any of you follow Fund Sui or invest base on luck but I think some of you may find these Chinese Animal Horroscopes for 2017 interesting.

Funny I was planning for a engagement and my dragon year stated i should avoid lavish weddings. oh good enough more money in my portfolio then! https://m.facebook.com/story.php?story_fbid...100002494366950 |

|

|

Jan 3 2017, 11:53 AM Jan 3 2017, 11:53 AM

|

All Stars

14,927 posts Joined: Mar 2015 |

QUOTE(Kaka23 @ Jan 2 2017, 09:01 PM) you asked......FSM shows you..... Dear Investors, Are Your Investment Combinations Ready For The New Year? [30 December 2016] https://www.fundsupermart.com.my/main/resea...mber-2016--7854 |

|

Topic ClosedOptions

|

| Change to: |  0.0314sec 0.0314sec

0.78 0.78

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 11:39 PM |