QUOTE(2387581 @ Feb 8 2017, 02:33 AM)

Sorry to bother with a fundamental question.

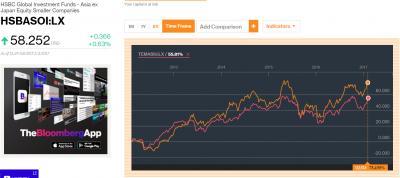

FSM publishes weekly market valuation :

https://www.fundsupermart.com.my/main/resea...ruary-2017-7957How do I read/comprehend this document?

What indicator does it tell?

Would I know/deduce if a certain general market is at a discount or at a premium from this document?

sorry, I did not answer your question.

that document is just to show the potential earning growth & in their opinion, how the market values in different markets, usually it is deemed that the higher the valuation against the historical average valuation of a market the lesser the changes of an upside.

but keep in mind that that data trends can be continued for some longer terms.

"What is high can still be high for some time.....what is low can still be low for some time....."

it is easier for one beginner like me to digest this simplified, direct, and summarized readout.....

Star Ratings For The Various Markets

https://www.fundsupermart.com.my/main/resea...tarRatings.svdo

Feb 8 2017, 12:32 AM

Feb 8 2017, 12:32 AM

Quote

Quote

0.0188sec

0.0188sec

0.23

0.23

6 queries

6 queries

GZIP Disabled

GZIP Disabled