QUOTE(kazekage_09 @ Jan 19 2017, 09:37 AM)

So no right or wrong then?

What skills and knowledge do I need to DIY my own portfolio? Reading market outlook, fund fact sheet, lippers table?

Because I dont want to DIY and later find it annualized return is same or lower than ASB. If like that better I leave my money in ASB which is capital protected. But ASB has it limit.

Because focus portfolio require luck and timing, for example if you know trump will win and invest purely in US market prior election, you will obviously earn more

But prior election result, many expect clinton to win, so you can see that betting at the wrong horse will drown you

Is hard to say whether a diversified portfolio will actually outperform ASB all the time due to several factor (e.g. global economic crisis)

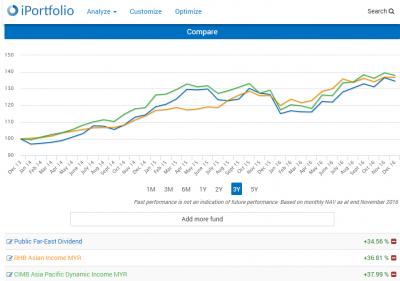

The best I can say is that, invest in diversified region, for each category, select the best among the peers, FSM have such a tool to compare as well as a portfolio simulator you can construct to visualize its performance based on past results.

And also spend the time to read the selected fund's prospect, FFS and annual report to understand the fund breakdown and see whether the fund holds the potential future in short term or long term

Just bear in mind that past performance dont necessary represent future performance, but compare among peers may show which fund is resilient

This post has been edited by AIYH: Jan 19 2017, 09:47 AM

This post has been edited by AIYH: Jan 19 2017, 09:47 AM

Jan 13 2017, 11:32 PM

Jan 13 2017, 11:32 PM

Quote

Quote

0.4760sec

0.4760sec

1.10

1.10

7 queries

7 queries

GZIP Disabled

GZIP Disabled