QUOTE(Ramjade @ Jan 24 2017, 09:43 PM)

Since you have access to SG UT, better you take Fidelity America over Manulife US. Fidelity America is able to beat the S&P500. Alternatively, you can buy VUSD (to save cost). Manulife US cannot beat the benchmark and incur a 2% fees. Btw, Phillip SG is now offering 0% SC, 0% platform fees to counter FSM.

FSM SG still want to charge 0.4%pa platform fees

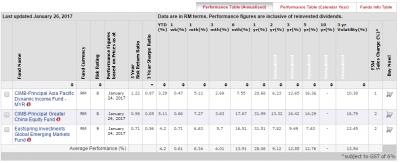

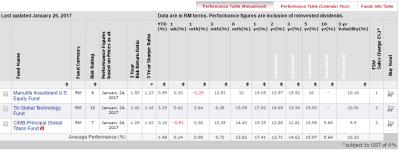

For reference

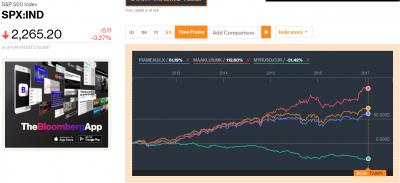

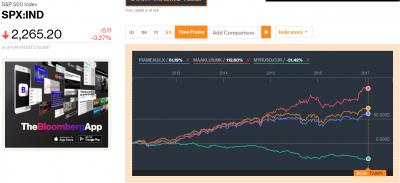

First chart:

Orange = S&P 500

Blue = Pioneer US (Manulife US target Fund)

Red = Manulife US

Green = MYRUSD forex

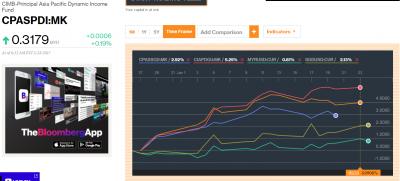

Second chart:

Orange = S&P 500

Blue = Fidelity America USD

Red = Fidelity America SGD

Green = SGDUSD forex

contestchris, recalling about currency difference and hedge, here is the examples:

Third chart (fund with currency hedge) (bloomberg only have 1 year and 5 years, sgd hedge class dont have full 5 years data, so using 1 year data):

same lgend with second chart with one extra:

Yellow: Fidelity America SGD Hedged

Notice that SGD hedged and USD class have same performance, with SGD class (without hedge) influence by SGDUSD forex

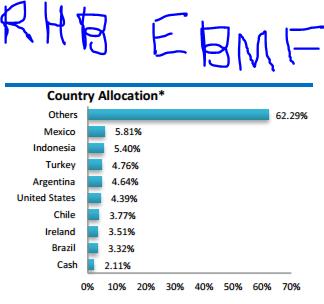

Fourth chart (fund without currency hedge) (USD class release less than a year, so apologize for using one month data

) (original asset based in USD)

Orange : ponzi 2 MYR

Blue: ponzi 2 SGD

Red: ponzi 2 USD

Green: MYRUSD forex

Yellow: SGDUSD forex

Notice as currency appreciate/depreciate against USD, MYR and SGD class fluctuate because there is no hedging protect against forex risk

QUOTE(puchongite @ Jan 24 2017, 09:47 PM)

I would be interested in this. Is this a promotional thing or a permanent feature ? No restriction on minimum purchase ?

QUOTE(Ramjade @ Jan 24 2017, 09:55 PM)

I have no idea. Will contact them to find out. Practically FSM SG, Phillip SG and DollarDex are engage in a price war.

It all started with FSM offering 0% SC...

DollarDex SC used to be 1%, now they also make it 0% but I think have platform fees (trailer fee)

Phillip SG SC used to be 0.75% SC now 0% SC, 0% platform fees.

0% SC and 0% platform fee, standard feature, usual initial purchase and top up amount applies

Don't divert too much, if want discuss SG feature, better go FSM SG there to discuss

This post has been edited by AIYH: Jan 24 2017, 10:21 PM Attached thumbnail(s)

Jan 24 2017, 09:36 PM

Jan 24 2017, 09:36 PM

Quote

Quote

0.0232sec

0.0232sec

0.66

0.66

7 queries

7 queries

GZIP Disabled

GZIP Disabled