This post has been edited by cybpsych: Oct 18 2019, 08:55 PM

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Oct 18 2019, 08:45 PM Oct 18 2019, 08:45 PM

Return to original view | IPv6 | Post

#601

|

All Stars

65,371 posts Joined: Jan 2003 |

This post has been edited by cybpsych: Oct 18 2019, 08:55 PM |

|

|

|

|

|

Oct 18 2019, 08:49 PM Oct 18 2019, 08:49 PM

Return to original view | IPv6 | Post

#602

|

All Stars

65,371 posts Joined: Jan 2003 |

* Important Notes for Terms Investment Account-i (TIA-i)

1. TIA-i campaign is open to new and existing customers. 2. Special indicative rate of 4.00% p.a. on a 6 month TIA-i is applicable with a minimum placement of RM10,000 from 3 September 2019 to 31 October 2019. This rate is only applicable for 6 months tenure. Thereafter any renewals shall be subject to the prevailing CIMB Islamic indicative board rate. 3. Customers who place minimum RM50,000 on 23 October 2019 will be entitled for an AirAsia e-gift voucher worth RM50. Limited to one voucher per customer. 4. Customer is required to update their valid e-mail address in order to receive the AirAsia e-gift voucher. 5. Eligible customer will receive the AirAsia e-gift voucher within 6-8 weeks after the date of placement. 6. Click here for more information on Term Investment Account-i.  |

|

|

Oct 24 2019, 03:57 PM Oct 24 2019, 03:57 PM

Return to original view | Post

#603

|

All Stars

65,371 posts Joined: Jan 2003 |

QUOTE(spursman_forever @ Oct 24 2019, 03:47 PM) QUOTE(spursman_forever @ Oct 24 2019, 03:47 PM) https://www.hsbc.com.my/advance/offers/time-deposits/ |

|

|

Oct 26 2019, 10:26 AM Oct 26 2019, 10:26 AM

Return to original view | Post

#604

|

All Stars

65,371 posts Joined: Jan 2003 |

|

|

|

Oct 26 2019, 05:56 PM Oct 26 2019, 05:56 PM

Return to original view | Post

#605

|

All Stars

65,371 posts Joined: Jan 2003 |

QUOTE(cybpsych @ Aug 2 2019, 09:01 PM) Notice for Stop Issuing Receipt for New Fixed Deposit Placement [ HLB | T&Cs ] Kuala Lumpur, 2 August 2019 Dear Valued Customers, To complement our efforts in promoting environmental sustainability, we will stop issuing Receipt for all new Fixed Deposit placement effective 26 August 2019. Customers may subscribe for electronic statements via Hong Leong Connect to view / download e-statement or update email address to receive e-statement. Effective 1 October 2019, partial and full withdrawal of receipt-less Fixed Deposit can be performed via Hong Leong Connect for Individuals with single or joint either-one-to-sign who have registered for Hong Leong Connect. For more details, please refer to the revised Terms and Conditions. QUOTE(Xaser_3 @ Oct 26 2019, 05:38 PM) |

|

|

Nov 1 2019, 07:55 AM Nov 1 2019, 07:55 AM

Return to original view | Post

#606

|

All Stars

65,371 posts Joined: Jan 2003 |

QUOTE(MakcikLum @ Nov 1 2019, 01:05 AM) Ya, noted, just trying my luck see whether still can only CIMB officer said rates change every week, ask me to check again this week before I place. Affin officer try to explain to me the new policy for FD but not really get what he mean, it is something like place FD only can up to RM50K for 12mth & above if place more than RM50k , bank only allow us to do 1 - 11mths tenure Hah ?! board rate also got limit the placement amount, I first time heard this type policy, hehe ... new knowledge for me though infor : 12mths is 3.9%, 11mths is 3.25%  |

|

|

|

|

|

Nov 1 2019, 05:59 PM Nov 1 2019, 05:59 PM

Return to original view | IPv6 | Post

#607

|

All Stars

65,371 posts Joined: Jan 2003 |

|

|

|

Nov 3 2019, 06:26 PM Nov 3 2019, 06:26 PM

Return to original view | Post

#608

|

All Stars

65,371 posts Joined: Jan 2003 |

QUOTE(tiptop3999 @ Nov 3 2019, 05:44 PM) you need hlconnectrequirements >> https://www.hlb.com.my/en/personal-banking/...t/overview.html |

|

|

Nov 3 2019, 06:42 PM Nov 3 2019, 06:42 PM

Return to original view | Post

#609

|

All Stars

65,371 posts Joined: Jan 2003 |

|

|

|

Nov 4 2019, 01:40 PM Nov 4 2019, 01:40 PM

Return to original view | Post

#610

|

All Stars

65,371 posts Joined: Jan 2003 |

QUOTE(FDInvestor @ Nov 4 2019, 09:02 AM) QUOTE(FDInvestor @ Nov 4 2019, 09:14 AM) rm20k cumulative transfer limit. rm10k per transfer limit (per PAC request), so need to do 2x times.for the excess amount, try transfer the extra to another PBe account? not sure this is counted together with the rm20k daily limit. |

|

|

Nov 4 2019, 06:18 PM Nov 4 2019, 06:18 PM

Return to original view | Post

#611

|

All Stars

65,371 posts Joined: Jan 2003 |

QUOTE(Giant @ Nov 4 2019, 05:52 PM) existing promo, nothing new |

|

|

Nov 5 2019, 03:14 PM Nov 5 2019, 03:14 PM

Return to original view | Post

#612

|

All Stars

65,371 posts Joined: Jan 2003 |

QUOTE(wym6977 @ Nov 5 2019, 03:10 PM) I think the max limit still RM20K per day. hence the verb "try" From PBB website:- The daily third party fund transfer limit per customer is shared between all fund transfers performed on the same day to other PBB accounts, Instant Transfer (IBFT), Interbank GIRO (IBG), DuitNow, RENTAS, PB Visa Direct, PB eGift, Remittance and Western Union services. |

|

|

Nov 5 2019, 03:27 PM Nov 5 2019, 03:27 PM

Return to original view | Post

#613

|

All Stars

65,371 posts Joined: Jan 2003 |

BNM maintains OPR at 3%

|

|

|

|

|

|

Nov 14 2019, 07:55 PM Nov 14 2019, 07:55 PM

Return to original view | Post

#614

|

All Stars

65,371 posts Joined: Jan 2003 |

read the T&C carefully and thoroughly.

01 NOVEMBER 2019-30 NOVEMBER 2019 https://www.hlb.com.my/en/personal-banking/...n-nov-2019.html   01 NOVEMBER 2019-30 NOVEMBER 2019 https://www.hlb.com.my/en/personal-banking/...-promotion.html  |

|

|

Nov 14 2019, 08:17 PM Nov 14 2019, 08:17 PM

Return to original view | Post

#615

|

All Stars

65,371 posts Joined: Jan 2003 |

|

|

|

Nov 15 2019, 08:05 AM Nov 15 2019, 08:05 AM

Return to original view | Post

#616

|

All Stars

65,371 posts Joined: Jan 2003 |

Standard Chartered: Revision to Board Rates effective 15 November 2019

https://av.sc.com/my/content/docs/revision-...board-rates.pdf   |

|

|

Nov 15 2019, 03:39 PM Nov 15 2019, 03:39 PM

Return to original view | Post

#617

|

All Stars

65,371 posts Joined: Jan 2003 |

|

|

|

Nov 16 2019, 10:40 AM Nov 16 2019, 10:40 AM

Return to original view | IPv6 | Post

#618

|

All Stars

65,371 posts Joined: Jan 2003 |

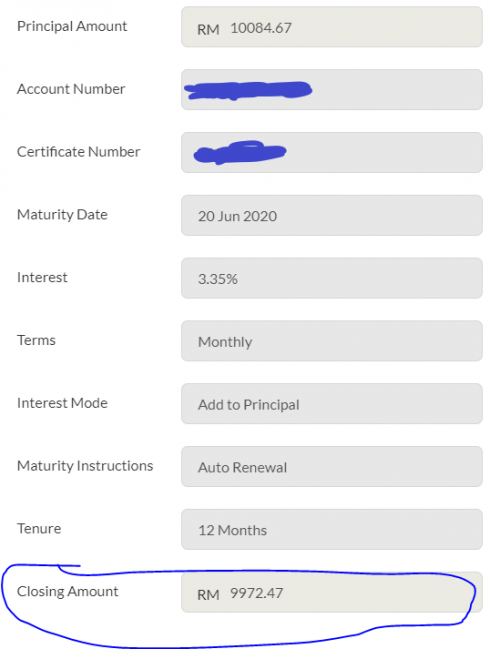

QUOTE(CyberKewl @ Nov 16 2019, 07:50 AM) Does GIA now charge people for uplifting? I'm expecting to only not give me a single interest. So if i put in 10k, then I uplift it - at most i won't get a single interest, but it shouldn't go lower than what I put in (lower than my initial 10k). From this picture it shows differently, i put in 10k kept it since June 2019, mature on June 2020 when now i want to take it out it becomes RM9972. forgotten you already gotten the month interest credited to you prior to your premature withdrawal?This doesn't make sense unless i'm missing something? 31 days uplift notice makes it slightly better, but still lower than my initial 10k FD. Is this GIA's "tricks" ? I have another FD cert that expiring in 3 days, it's a similar story with uplifting that one - I get less than what I put in. Can someone advise is this normal or its just how GIA works lately?  |

|

|

Nov 16 2019, 11:15 AM Nov 16 2019, 11:15 AM

Return to original view | Post

#619

|

All Stars

65,371 posts Joined: Jan 2003 |

|

|

|

Nov 20 2019, 07:26 PM Nov 20 2019, 07:26 PM

Return to original view | IPv6 | Post

#620

|

All Stars

65,371 posts Joined: Jan 2003 |

// RM0.00 CIMB Bank: Enjoy 3.85%p.a. on 6mths eFixed Deposit @ www.cimbclicks.com.my! Click on the eFD promo banner to make your placement. Till 31 Dec. T&C apply. //

https://www.cimbclicks.com.my/efd-nov19-mass.html Important Notes: 1. Single placement in eFixed Deposit (eFD) via CIMB Clicks with a minimum amount of Ringgit Malaysia Five Thousand (RM5,000) for the tenure of 6 months is required. 2. Special rates are applicable for one cycle only. Upon maturity, the 6 months eFD will be automatically renewed to its respective tenure and the prevailing CIMB Bank board rate applicable at the time of renewal shall apply. Terms and Conditions apply. EN | BM Member of PIDM. Protected by PIDM up to RM250,000 for each depositor.  This post has been edited by cybpsych: Nov 20 2019, 08:41 PM |

| Change to: |  0.7037sec 0.7037sec

0.22 0.22

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 04:30 AM |