Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

cklimm

|

Jul 31 2017, 10:29 PM Jul 31 2017, 10:29 PM

|

|

QUOTE(DIYHOMEFIX @ Jul 31 2017, 08:02 PM) If need KPI better higher the FD RATE. minimum place like 10k if can  Any FD got 5 %intrest but minimum 10k placement ?  There is, minimum 5k only yo  http://www.hsbc.com.my/1/2/personal-bankin...ac=HBMY_ADV_5TD http://www.hsbc.com.my/1/2/personal-bankin...ac=HBMY_ADV_5TD |

|

|

|

|

|

cklimm

|

Jul 31 2017, 11:51 PM Jul 31 2017, 11:51 PM

|

|

QUOTE(ProxMatoR @ Jul 31 2017, 10:49 PM) but to maintain HSBC Advance account... you need min RM30k maintained, else got charges tho.... it will not be worthwhile to maintain, after the 3 months 5%p.a fd matured, unker will recommend downgrade to basic account afterwards |

|

|

|

|

|

cklimm

|

Aug 24 2017, 08:02 PM Aug 24 2017, 08:02 PM

|

|

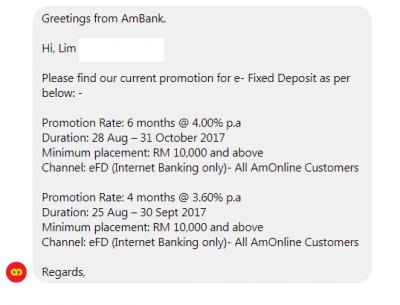

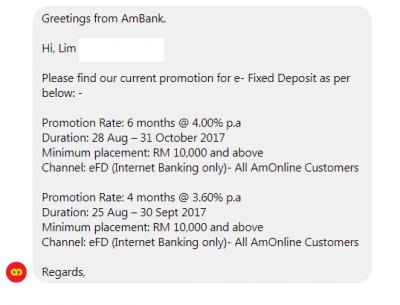

Kids, ambank e-promo is appeared in their portal, 4% for 6 months, 3.6% for 4 months

This post has been edited by cklimm: Aug 24 2017, 09:09 PM

This post has been edited by cklimm: Aug 24 2017, 09:09 PM |

|

|

|

|

|

cklimm

|

Aug 28 2017, 08:23 PM Aug 28 2017, 08:23 PM

|

|

QUOTE(Kamen Rider @ Aug 28 2017, 08:15 PM) latest FD rate, Affin giving 4.25% for 2 years and Muamalat giving 4.3% for 1 year, and why people not putting money there..., instead they are looking for MBB, HLB, CIMB and others.... which probably giving around 4%-4.1%, not really fully understand why....?  Unkers aunties have less worries with bigger banks mar. |

|

|

|

|

|

cklimm

|

Sep 15 2017, 03:28 PM Sep 15 2017, 03:28 PM

|

|

QUOTE(BoomChaCha @ Sep 15 2017, 03:23 PM) I found out the cheapest banker's check should be from Am Bank: RM 2.80 HLB priority, RM 0.68  |

|

|

|

|

|

cklimm

|

Sep 15 2017, 04:34 PM Sep 15 2017, 04:34 PM

|

|

QUOTE(BoomChaCha @ Sep 15 2017, 03:37 PM) Mr. Kim, sorry, I was talking about to use money to buy banker's check, not matured FD converts to banker's check. you were right, its RM 0.68 for all pb banker cheque purchases; RM5.30 for common folks. |

|

|

|

|

|

cklimm

|

Sep 16 2017, 08:15 AM Sep 16 2017, 08:15 AM

|

|

QUOTE(mephyll @ Sep 15 2017, 11:48 PM) Any here are solely `invest` on FD only? Of course, and they are generally able to save more than those insurance and UT agents 😏 |

|

|

|

|

|

cklimm

|

Oct 5 2017, 06:10 PM Oct 5 2017, 06:10 PM

|

|

QUOTE(siawyent @ Oct 5 2017, 05:22 PM) I scared if I asked for 4.3% they will think that u only RM100k also want to bargain so much, looks so greedy! My FD maturing next week is in Mbsb, that's why I hope they can give better rates, so that I don't have the hassle to move around. and for the Hong Leong eFD, it needs to do with the FPX, right? if withdraw from Mbsb cannot do Fpx, can only use cheque, not viable also. Back in 80s, unker RM 1k also haggle till noon  |

|

|

|

|

|

cklimm

|

Oct 13 2017, 06:22 PM Oct 13 2017, 06:22 PM

|

|

QUOTE(bbgoat @ Oct 12 2017, 12:52 PM) See the below.  [attachmentid=9229813] Uncle Lim, how is yours, matured already ? matured dah, came with peanut interest  |

|

|

|

|

|

cklimm

|

Nov 1 2017, 05:25 PM Nov 1 2017, 05:25 PM

|

|

Regarding the HLB DC 4.88% promo,

Unker applied there today, sign dulu, the FD will be generated 3 Nov.

Before you ask, unker ok with two days interest lost.

|

|

|

|

|

|

cklimm

|

Nov 1 2017, 05:46 PM Nov 1 2017, 05:46 PM

|

|

QUOTE(okuribito @ Nov 1 2017, 05:37 PM) Unker CKLimm, apa itu DC 4.88% promo? Sound like it only start on Friday 3/11, ka? I search oredi this thread but can't find DC promo details. Can share please? Yeah, it officially starts at 3/11, but it will be huge crowd that day, so unker go there, leave them a signed cheque, they will process it on 3/11. https://www.hlb.com.my/en/personal-banking/...ning-promo.html |

|

|

|

|

|

cklimm

|

Nov 3 2017, 02:49 PM Nov 3 2017, 02:49 PM

|

|

Sounds chaotic out there at DC. Glad I did my placement 2 days ago  |

|

|

|

|

|

cklimm

|

Nov 9 2017, 09:24 AM Nov 9 2017, 09:24 AM

|

|

QUOTE(cybpsych @ Nov 9 2017, 08:40 AM) Before Singles Day, be sure to have a HLB Current/Savings account, and register for Connect Internet Banking, because we’ve got something special for our Connect customers. Come back for the big announcement on Friday!  Unker's wild guess: 4.11%p/a for 11 months |

|

|

|

|

|

cklimm

|

Nov 10 2017, 03:26 PM Nov 10 2017, 03:26 PM

|

|

QUOTE(bbgoat @ Nov 10 2017, 02:20 PM) Checked HL online, previously the add'l 0.1% bonus FD interest has been credited in. This is for the previous 8 mth 4% FD promo.   yeah, i seen this today too, so what was the interest credited months ago?  |

|

|

|

|

|

cklimm

|

Nov 15 2017, 02:55 PM Nov 15 2017, 02:55 PM

|

|

QUOTE(newbiz2008 @ Nov 15 2017, 02:19 PM) No matter what happen to the data, I still have my original FD cert. I can claim bank my monies Wild card: what if they say that your cert is fake, and they cant see your information in database?  |

|

|

|

|

|

cklimm

|

Nov 16 2017, 01:57 PM Nov 16 2017, 01:57 PM

|

|

QUOTE(PJusa @ Nov 16 2017, 11:22 AM) Before I waste my time - does anyone know the amount in FD required to be able to negotiate the interest rate with Alliance Bank specifically? I am tired of moving the FD around for promo rates and would like to keep the tenure flexible (i.e. 1-3 months). 100k can raise 0.05%, 1m above can raise bout 1%, subject on approval |

|

|

|

|

|

cklimm

|

Nov 16 2017, 02:09 PM Nov 16 2017, 02:09 PM

|

|

QUOTE(PJusa @ Nov 16 2017, 02:06 PM) Thanks - I will get in touch with them to request a better rate. Sadly I dont have 1M to play but if I had I would not place it in short term FDs  update us about the outcome, its been years since my last banking with alliance.  *it was called french bank or something back then |

|

|

|

|

|

cklimm

|

Nov 17 2017, 10:46 AM Nov 17 2017, 10:46 AM

|

|

QUOTE(JLHC @ Nov 16 2017, 04:43 PM) Is that based on the promotional FD rate or the board rate? +1 on board rate lar, boy. but the good part is, its perpertually +1%, you dont have to chase promo rate around QUOTE(bbgoat @ Nov 16 2017, 05:48 PM) U are talking about 1996, >21 yrs ago ?  I did not even know about them at that time. The 1m that can get 1% (not typo ??) is because of high interest rate at that time ?  So uncle lim 1m has inflated a lot already. Now 1m probably can get 0.1 to 0.15% extra (of FD promo rate). 2 or 3 yrs ago, may be can get 0.2 or 0.3% more.  But not all banks are tempted by it. Some will insist to stick with the FD promo rate.  how time flies  |

|

|

|

|

|

cklimm

|

Nov 29 2017, 12:57 PM Nov 29 2017, 12:57 PM

|

|

QUOTE(JLHC @ Nov 29 2017, 11:30 AM) Yeah, that's one of the worst misconception around.  EPF is one of the most secure investment you can have in Malaysia with good return (so far). If they go under, you can bet that the whole country will go bankrupt and all of your assets including FD, properties, shares, insurance, unit trust, etc and most importantly Ringgit will be worthless anyway. I find that the hoax is mainly perpetrated by insurance and unit trust agents who wants to convince / deceive the older folks to move their funds from EPF to them.  EPF was the one who allows withdrawal for UT investment, ever think about reasons behind this?  |

|

|

|

|

|

cklimm

|

Nov 30 2017, 02:30 PM Nov 30 2017, 02:30 PM

|

|

QUOTE(Prop.Observer @ Nov 30 2017, 12:47 PM) I interested on it. Can I placing efd without saving account? Of course I have HL connect account. Remaks* It seems like placing new e-FD doesn't work if don't have saving account. Correct me if am wrong. good thing is, you can open a savings account online |

|

|

|

|

Jul 31 2017, 10:29 PM

Jul 31 2017, 10:29 PM

Quote

Quote

0.7732sec

0.7732sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled