QUOTE(Prop.Observer @ Nov 30 2017, 05:17 PM)

https://www.hlb.com.my/en/personal-banking/...ve-account.htmlIt can be done online via link above, no, unker is too old and malas to guide anyone

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Dec 1 2017, 09:46 AM Dec 1 2017, 09:46 AM

Return to original view | Post

#61

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(Prop.Observer @ Nov 30 2017, 05:17 PM) https://www.hlb.com.my/en/personal-banking/...ve-account.htmlIt can be done online via link above, no, unker is too old and malas to guide anyone |

|

|

|

|

|

Dec 8 2017, 04:39 PM Dec 8 2017, 04:39 PM

Return to original view | IPv6 | Post

#62

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Dec 10 2017, 07:08 AM Dec 10 2017, 07:08 AM

Return to original view | IPv6 | Post

#63

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Jan 1 2018, 12:35 AM Jan 1 2018, 12:35 AM

Return to original view | Post

#64

|

Senior Member

2,338 posts Joined: Oct 2014 |

HLB 4.2018% for 6 months

https://www.hlb.com.my/en/personal-banking/...ar-special.html Attached thumbnail(s)

|

|

|

Jan 3 2018, 01:19 PM Jan 3 2018, 01:19 PM

Return to original view | Post

#65

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(gsc @ Jan 3 2018, 12:57 PM) https://www.rhbgroup.com/~/media/images/mal...aign-final.ashxDude, its 50k into CASA, RHB has some above 2% casa which is decent though. |

|

|

Jan 27 2018, 01:19 PM Jan 27 2018, 01:19 PM

Return to original view | Post

#66

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

|

|

|

Jan 28 2018, 07:15 PM Jan 28 2018, 07:15 PM

Return to original view | Post

#67

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Feb 6 2018, 02:26 PM Feb 6 2018, 02:26 PM

Return to original view | IPv6 | Post

#68

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(icannotevenbrain @ Feb 5 2018, 10:47 PM) Sifus, can i get advise on how you handle your fd parkings? Dont worryIs it okay to change fd bank every year (means this year i park xx amount Bank A, next year got better rate i shift to Bank B? will the bank raise eyebrow if i transfer large cash sum (>50k) from same name account from Bank A to Bank B? Or should i just park my FD at the same bank every year? Bankers are busy, they wont even bother about 7 figures transfer. |

|

|

Feb 14 2018, 11:22 AM Feb 14 2018, 11:22 AM

Return to original view | IPv6 | Post

#69

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Feb 14 2018, 08:18 PM Feb 14 2018, 08:18 PM

Return to original view | IPv6 | Post

#70

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Aug 3 2018, 02:00 PM Aug 3 2018, 02:00 PM

Return to original view | Post

#71

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Mar 5 2019, 02:51 PM Mar 5 2019, 02:51 PM

Return to original view | Post

#72

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Apr 25 2019, 11:25 PM Apr 25 2019, 11:25 PM

Return to original view | Post

#73

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

|

|

|

May 11 2019, 10:35 PM May 11 2019, 10:35 PM

Return to original view | Post

#74

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(cybpsych @ May 10 2019, 09:44 PM) PB Enterprise FD Campaign OPR drop 0.25, they drop 0.40 - 10 May 2019 Please be informed that the promotional interest rates for “PB Enterprise FD” Campaign will be revised with effect from 13 May 2019. Click here for the revised Terms and Conditions in English. PB Fixed Deposit/Term Deposit-i Campaign - 10 May 2019 Please be informed that the promotional interest / profit rates under the “PB Fixed Deposit / Term Deposit-i” Campaign will be revised with effect from 13 May 2019. Click here for the revised Terms and Conditions in English. 3-Month 3.45% (from 3.80%) 6-Month 3.60% (from 4.00%) This post has been edited by cklimm: May 11 2019, 10:36 PM |

|

|

May 13 2019, 08:54 PM May 13 2019, 08:54 PM

Return to original view | IPv6 | Post

#75

|

Senior Member

2,338 posts Joined: Oct 2014 |

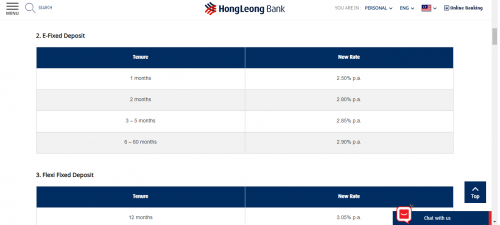

People, ever seen FD rate as low as 2.5%?

https://www.hlb.com.my/en/personal-banking/...rest-rates.html  |

|

|

Jul 1 2019, 08:40 PM Jul 1 2019, 08:40 PM

Return to original view | IPv6 | Post

#76

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Jul 2 2019, 11:20 AM Jul 2 2019, 11:20 AM

Return to original view | Post

#77

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(mamamia @ Jul 1 2019, 09:29 PM) QUOTE(Wong Kit yew @ Jul 1 2019, 09:37 PM) HLB Digital Day It turns out to be decent 7 7 2019 1 day eFD 4.07% 10k for 3 months and the rest of the day 3.77%. https://www.hlb.com.my/en/personal-banking/...l-day-2019.html |

|

|

Aug 6 2019, 09:59 AM Aug 6 2019, 09:59 AM

Return to original view | Post

#78

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Aug 23 2019, 07:45 AM Aug 23 2019, 07:45 AM

Return to original view | IPv6 | Post

#79

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(saintmikal @ Aug 22 2019, 03:21 PM) Just received additional details 1. 3 year fixed short term savings plan with Prudential 2. 4.15% first year, 4.0% second year, 4.0% third year 3. Principal and returns guaranteed from Prudential 4. If uplift early, interest forfeited 5. If uplift year 1, 95% principal returned 6. If uplift year 2, 97% principal returned 7. If uplift year 3, before maturity, 99% principal returned 8. Interest paid yearly 9. If you die before maturity, your nominated beneficiary gets 101% payout of sum deposited 10. Min RM 20k, max RM 2.0 mil Looks safer than Bank Rakyat or any other 'Bank' not protected by PIDM. Also, sum guaranteed by Prudential significantly higher than the RM 250k offered by PIDM. Attractive for long term lock in provided you do not need the Capital and wanted higher interest rates since it looks like interest rates will be falling soon. QUOTE(Free Spirit @ Aug 22 2019, 04:21 PM) With FDs, you only lose the interests if you uplift before maturity. Well, although the rate is no way better than FDs, and subject to principal losses prior to maturity, should it is purchased using Maybank Amex, it makes 100k treat points yo.With these savings plans, you lose your principal as well. Disclaimer: I have lost my Amex and have it cancelled. |

|

|

Aug 23 2019, 07:45 AM Aug 23 2019, 07:45 AM

Return to original view | IPv6 | Post

#80

|

Senior Member

2,338 posts Joined: Oct 2014 |

**duplicated post**

This post has been edited by cklimm: Aug 23 2019, 07:45 AM |

| Change to: |  0.0576sec 0.0576sec

0.42 0.42

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 10:20 PM |