QUOTE(Afterburner1.0 @ Sep 10 2022, 12:32 PM)

No. 6mths if you put 13 mths or moreFixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Sep 10 2022, 12:35 PM Sep 10 2022, 12:35 PM

Return to original view | Post

#41

|

Senior Member

1,354 posts Joined: Sep 2021 |

|

|

|

|

|

|

Sep 12 2022, 04:15 PM Sep 12 2022, 04:15 PM

Return to original view | Post

#42

|

Senior Member

1,354 posts Joined: Sep 2021 |

|

|

|

Sep 12 2022, 04:17 PM Sep 12 2022, 04:17 PM

Return to original view | Post

#43

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(ManutdGiggs @ Sep 12 2022, 11:29 AM) *AmBank FD Promotion* Well.*Only for Priority customers* 🔥🔥 from 12 Sep - 30 Sep *APPLICABLE FOR both ISLAMIC TD-i & CONVENTIONAL FD* *Fresh funds only* *3 months @ 3.00% p.a* *6 months @ 3.30% p.a* *12 months @ 3.50% p.a* Offer validity: *valid till 30 September 2022* Terms & Conditions 1. Placement criteria : min RM 10k CASA balance is COMPULSORY Ambank still playing with casa even thou it's small amount but still lose a bit to affin at least for now Because most of them are just working slaves without a brain on their own that's all. |

|

|

Sep 12 2022, 04:18 PM Sep 12 2022, 04:18 PM

Return to original view | Post

#44

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(nexona88 @ Sep 12 2022, 04:16 PM) Asking someone to put 500kPpl with that money would have put that monies elsewhere a long time ago already. Unless every month i earn 300k. Just give la ppl put in 50k. or even if they are priviledge customers. This post has been edited by BrookLes: Sep 12 2022, 04:19 PM |

|

|

Sep 12 2022, 04:23 PM Sep 12 2022, 04:23 PM

Return to original view | Post

#45

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(nexona88 @ Sep 12 2022, 04:22 PM) Actually... Corporate bonds are too risky unless you know the company well.With 500k Can already buy corporate bonds... Which the coupon rate is way higher than FD.... Just the risk is little higher.... mavistan89, LoTek, and 2 others liked this post

|

|

|

Sep 13 2022, 01:02 PM Sep 13 2022, 01:02 PM

Return to original view | Post

#46

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(??!! @ Sep 13 2022, 01:00 PM) You are right. Checked my past statements, no half yearly charge on my Invikta account. The one kena charged is my other current account before I closed it. What is the benefits of invikta cc?'Invikta' is Affin's version of premier/ privilege banking. Need minimum AUM and need to open a "Invikta" CASA. Similar to CIMB's Preferred Acct and Alliance's Privilege. I suspect the Invikta credit card is just additional product the RM tries to push but not absolutely necessary. I have since cancelled the Invikta credit card which was never activated. |

|

|

|

|

|

Sep 13 2022, 09:23 PM Sep 13 2022, 09:23 PM

Return to original view | Post

#47

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(a.lifehacks @ Sep 13 2022, 03:51 PM) Affin Bank Invikta, they should just give invikta rates as long as ppl put in 10k.FD Promotion- Over The Counter Placement Campaign Period: 10 SEPT 2022 - 30 SEPT 2022 Normal Customer (Min: RM8,000) 4-months: 2.90%pa 6-months: 3.00%pa 9-months: 3.25%pa 12-months: 3.35%pa 18-months: 3.35%pa 24-months: 3.20%pa Avance Customer (Min: RM10,000) 4-months: 2.95%pa 6-months: 3.05%pa 9-months: 3.30%pa 12-months: 3.40%pa 18-months: 3.40%pa 24-months: 3.25%pa Ivikta Customer (Min: RM50,000) 4-months: 3.05%pa 6-months: 3.15%pa 9-months: 3.40%pa 12-months: 3.50%pa 18-months: 3.50%pa 24-months: 3.35%pa Not everyone has 50k in their savings. |

|

|

Sep 13 2022, 09:24 PM Sep 13 2022, 09:24 PM

Return to original view | Post

#48

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(Sonnet Porky @ Sep 13 2022, 06:51 PM) Is this the norm? Does eFD always get a lower rate compared to over the counter? I've been using eFD for so many years I never even bothered with over the counter FD rates, maybe I should reconsider. Not necessary. HL bank always gives pretty attractive rate. Sonnet Porky liked this post

|

|

|

Sep 17 2022, 11:52 PM Sep 17 2022, 11:52 PM

Return to original view | Post

#49

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(15cm @ Sep 17 2022, 11:48 PM) i was of the opinion that interest rates are only going to go lower for the foreseeable future Any of the 1 year promos are probably better then 2.1%completely didnt know that the ukraine war could happen last year its hard to predict things , i know CommodoreAmiga and guy3288 liked this post

|

|

|

Sep 17 2022, 11:56 PM Sep 17 2022, 11:56 PM

Return to original view | Post

#50

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(15cm @ Sep 17 2022, 11:48 PM) i was of the opinion that interest rates are only going to go lower for the foreseeable future Arrrr the Ukrane war has got nothing to do with higher interest rates.completely didnt know that the ukraine war could happen last year its hard to predict things , i know No one ask why instead of increasing interest rates gradually, they decide to increase interest rates by so much at one go after having almost zero interest rates for so long. It's not as if they could not see that there would be inflation from a long time ago. I have the answer to this but then it's going to sound conspiratorial. |

|

|

Sep 18 2022, 12:03 AM Sep 18 2022, 12:03 AM

Return to original view | Post

#51

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(MystiqueLife @ Sep 18 2022, 12:01 AM) I can pm you on this because I doubt ppl here can handle the truth.Actually inflation has always been transfered across the globe. That is why you do not see much inflation in US despite the fact that they print so much. I have not followed the economy for quite a long time but then do you know that US has a lot of oil and yet the government refused to release the oil and so US are forced to use expensive oil which contributes a lot to their inflation? This post has been edited by BrookLes: Sep 18 2022, 12:07 AM |

|

|

Sep 18 2022, 12:20 AM Sep 18 2022, 12:20 AM

Return to original view | Post

#52

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(15cm @ Sep 18 2022, 12:18 AM) inflation did, and the war in ukraine was part of the reason why inflation went up US have their own oil. Why they did not open up their oil wells.when energy price go up, everything goes up, because energy is required to do everything That is why you did not see much inflation in Malaysia yet because Malaysia oil price is kept low. |

|

|

Sep 18 2022, 02:07 AM Sep 18 2022, 02:07 AM

Return to original view | Post

#53

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(15cm @ Sep 18 2022, 12:23 AM) those oil wells in US are private, government cant force them to drill. private companies are sitting on drilling permits without drilling. Any last reply.well thanks for confirming that inflation is caused at least in part by energy price Money printing has been around for many years. And I really think structurally it's damage. All the thing that is happening is just an opportunity to "fill in the blanks". Bankers gained when economy goes up and also when economy goes down. There are many reasons as to why inflation is going up. And it's not just related to Ukraine. Ukraine affects the natural gas side but how about oil? Its the decision by Saudi side that cause the oil price to go up. It's related to how many barrels they want to release. With the sudden inflation, the Fed is being "forced" to increase rates very quickly. But why such the drastic increase? As for the oil from the oil wells, I really believe the US government could have release it if they really want. I know you say it is private but from what I heard, the current government refuse to release the oil. Actually if you are willing to go and find out you will know. For example there is even disruption in the shipping lines etc. I am not actively finding out what is happening but I do know roughly. This post has been edited by BrookLes: Sep 18 2022, 02:09 AM |

|

|

|

|

|

Sep 18 2022, 03:04 PM Sep 18 2022, 03:04 PM

Return to original view | Post

#54

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(guy3288 @ Sep 18 2022, 01:37 PM) That guy is pretty ignorant after the "mistake" he makes. Ignorance is actually more then not just knowing. It's still being defiant even after being shown their mistakes.To be honest, with the amount of ignorance shown after the "mistakes", he really is no different then the typical ah peks on the streets(No disrespect to the alert ones but you know what I mean) Of course he still pointed out my faults on the supply chain issue even though I stated earlier that I have not been following the economy for a while but then I know what is probably happening behind. |

|

|

Sep 18 2022, 03:36 PM Sep 18 2022, 03:36 PM

Return to original view | Post

#55

|

Senior Member

1,354 posts Joined: Sep 2021 |

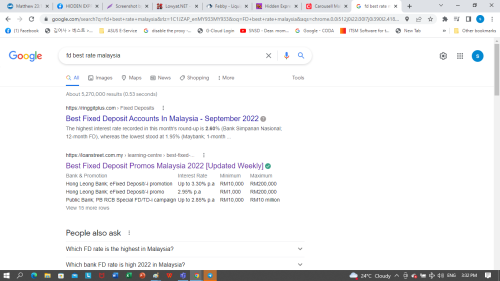

QUOTE(15cm @ Sep 18 2022, 12:03 PM) are you one of those crypto guys? because i know those people are obssess with money printing lol. either that or you listen to peter schiff.. If I were one of those crypto guys, why would I put my monies into FD.bankers dont gain when the economy goes down bruh. You remember lehman brothers? probably not because they dont exists anymore. AIG (not a bank but functioned like one in this instance) requires massive bailout during the 2008 financial crisis. Banks are also victims of economic failure because they give out loans and if the loans are non performing, they die. I think you are referring to hedge fund /portfolio managers, on the buy side of things, that can have positions to the upside or downside. Actually russia also export oil , and coal. because the CPI is also increasing drastically lol where? old story, the evergreen ship that stuck in the suez canal has been solved long time ago. shipping is not disrupted it just became more unfeasible due to high fuel price. Some people realise they can build things cheaper locally than source from other countries because of high transport costs. I think what you read in the news is supply chain disruption not shipping disruption. that is also one of the cause of inflation When I \am talking about bankers, I am talking about those rich elites. Obviously, when there is a depression, prices of assets goes down and of course they can be bought at a cheap. When the economy is doing well, they make as well because their assets is going up. Timing when the interest rate is going to go up or go down is key but they have inside information. You talk as if you know a lot but yet you decide to put your monies into a 5 year FD when interest rates is at it's lowest. That's smart. Even if i do not know about promotion rates, I would probably do some research before putting my monies long term. Actually have you even look at those financial plans where they claim to give more then FD rates if you put long term? And if you are going to put money into FD, shouldn't you at least research where is the best place to put your monies at? I mean if you are putting 10-50k. Maybe, you can afford to be ignorant but i am pretty sure it's more then that. I am sure if you actually tried searching for the best rates, you wouldn't be putting your monies at 2.2% for 5 years. Something like this?  As for crypto. It just show the mind control because every transaction in crypto can be tracked. The only reason why it went up is because it was being pumped. But I am never the person who would buy when it's on the top anyway. Of course I do blame myself for not buying when it started out or something. See the difference between you and me? This post has been edited by BrookLes: Sep 18 2022, 03:39 PM |

|

|

Sep 18 2022, 03:37 PM Sep 18 2022, 03:37 PM

Return to original view | Post

#56

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(15cm @ Sep 18 2022, 03:09 PM) not sure who you refering to just in case it was me. It's ok for you to insult me indirectly by saying that I am following Peter Schiff or that I am a crypto currency advocate right?actually i accepted that it wasnt my best decision and i made it known that i am going to uplifted it (with 31 days notice). What else should i do? commit sepukku? if you want to call others ignorant, even tho there is no obligation to, well then what goes around comes around..... can dish out then must be able to accept it yo. as of your supply chain issue, i know you stated that you are not following , thats why i gave you a little help in following it. your welcomed. There is a proverb in the Bible “There is treasure to be desired and oil in the dwelling of the wise; but a foolish man spendeth it up.” (Proverbs 21:20 KJV) This post has been edited by BrookLes: Sep 18 2022, 03:42 PM |

|

|

Sep 18 2022, 03:52 PM Sep 18 2022, 03:52 PM

Return to original view | Post

#57

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(15cm @ Sep 18 2022, 03:45 PM) rich elites are not necessily bankers, you should just say rich elites then your point would have been solid. politicians also seem to be a recession proof job It's ok. I really do not want to waste my time. Because ignorant people stays ignorant all the timeno comment actually what i just told you are mainstream knowledge. any year 1 economics student can tell you that. It wasnt my intention to sound smart, even if it has that effect. as of FD, you know FD rarely outperforms inflation ,if at all right? I never considered FD until last year. well in hindsight i should have just asked in this thread but given the kind of people in this thread... i dont believe in crypto so no comment. btw whats the conspiratorial thing you wanted to say? maybe worth a shot at listening Of course FD does not perform inflation. Let's see. So now there is most likely going to be a deflation and FD rates is going up. So I guess this applies even now? So you admit that you are an economics student. Then it's even worst right your common sense level. Well rich elites are also often referred to as bankers but maybe you probably do not know anything. All I am saying is just common sense. If you are going to put your money long term into something, shouldn't you at least do some basic research first? Like I showed you, a basic google search and you will at least not be so foolish to go and put your monies long term at something that is 2.1 percent. Of course basic economics, but yet you go and put that monies into FD at the lowest rate for 5 years. So what is the point of your economics degree then? |

|

|

Sep 18 2022, 04:03 PM Sep 18 2022, 04:03 PM

Return to original view | Post

#58

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(15cm @ Sep 18 2022, 03:59 PM) i dont mind wasting a few min of my time but i am concern we are going off topic and the mod will come in and ban us all. It's ok. Your ignorance level is for everyone to see. ... where did you read about deflation? i never said i am an economic student. i said an economic student can tell you what i said. its mainstream knowledge wrong, the richest people in the world are not bankers. jeff bezos is not, elon musk is not, bill gates is not. in malaysia they are property tycoon, casino owners, etc etc, but not bankers because of this thing called opportunity costs. and i never had an economic degree. jesus. Never seen someone so ignorant in my life. Of course rich people do not necessary need to be bankers. But everyone know that bankers are the ones that controls the interest rates and determine how much money can be print etc. But ignorant people like you probably think when someone talks about bankers, they are only talking about ppl who owns the banks.. Like I said, if you were competent, you would at least research on the best rates that banks can give and it will lead you to the promotional rates eventually. Do not even need to know about promotional rates to eventually find out about promotional rates. But then this is your level lah. This post has been edited by BrookLes: Sep 18 2022, 04:06 PM |

|

|

Sep 18 2022, 04:49 PM Sep 18 2022, 04:49 PM

Return to original view | Post

#59

|

Senior Member

1,354 posts Joined: Sep 2021 |

|

|

|

Nov 30 2022, 03:24 PM Nov 30 2022, 03:24 PM

Return to original view | Post

#60

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(Human Nature @ Nov 30 2022, 01:41 PM) My wishlist for BR is to allow matured FD to be credited automatically to CASA. If interest can be credited into CASA upon maturity, I don't see why principal cant. No eFD facility tak apa. Simple. Because there is no motivation for them to do so.I mean I went to PBB to open account. I said I do not need the Debit Card. But then, they insist that I need the Debit Card. End up I have to just pay up. Even CIMB dun need to pay. It's just incredible that for someone who is going to put a significant amount into PBB, I still need to pay a "fee" to do that. Even CIMB does not charge for the card. Actually come to think about it. Why is it that banks cannot just open on weekends. I mean they can even open the banks for say 4 days a week. Whereby 2 days is on a weekend. But they just cannot do that. And funny. When I open PBB account. I need to provide electric bills etc. Luckily I already have an account in Affin, otherwise cannot open PBB account also. Really incredible. Also, I just realized that if you open FD OTC more then a certain amount. You can only withdraw your FD at home branch for PBB. So many stupid rules. Also only able to close your account at the home branch. I know it's only RM20 but still. And you cannot make it up. PBB internet hotline you cannot call in yesterday and their website is so slow. This post has been edited by BrookLes: Nov 30 2022, 03:29 PM |

| Change to: |  0.0596sec 0.0596sec

0.35 0.35

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 12:50 PM |