QUOTE(fabu8238 @ Mar 8 2023, 02:30 PM)

US current estimate is for interest rate target to be 5.5 - 5.75%! Kita long long already mampus if want to ikut empire of lies

Back in 90s got 10%++ FD. Tak mati pun.Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Mar 8 2023, 02:47 PM Mar 8 2023, 02:47 PM

Return to original view | IPv6 | Post

#361

|

Senior Member

3,860 posts Joined: Jun 2022 |

|

|

|

|

|

|

Mar 8 2023, 03:10 PM Mar 8 2023, 03:10 PM

Return to original view | IPv6 | Post

#362

|

Senior Member

3,860 posts Joined: Jun 2022 |

|

|

|

Mar 8 2023, 04:14 PM Mar 8 2023, 04:14 PM

Return to original view | IPv6 | Post

#363

|

Senior Member

3,860 posts Joined: Jun 2022 |

|

|

|

Mar 9 2023, 02:05 PM Mar 9 2023, 02:05 PM

Return to original view | Post

#364

|

Senior Member

3,860 posts Joined: Jun 2022 |

QUOTE(winterbear @ Mar 9 2023, 01:34 PM) The branch u go, do they tell u what other criteria to become premier? So mah fan. Never like RHB. Has lots of bad experience with them. RHB=REALLY HORRIBLE BANK.I get told need to show payslip to have 20k salary , apart from deposit 200k.....they said they stricten criteria already, I don't know is this standard criteria? ikanbilis liked this post

|

|

|

Mar 10 2023, 09:46 AM Mar 10 2023, 09:46 AM

Return to original view | IPv6 | Post

#365

|

Senior Member

3,860 posts Joined: Jun 2022 |

QUOTE(guy3288 @ Mar 9 2023, 10:59 PM) Yeah Ambank recently tried hard to gather cash this new 11 month 4.5% T&C the manager also dont know yet Starts in April so still early So what can you you do other than skip that FD? 366 days paid 365, at most also lose only 1 D interest , ~RM100+ at end of 1 yr what do you mean get lesser and lesser for each day?? interest getting lesser and lesser each day compounding? if rate is 0.2% extra earn extra RM2000 more than cover why bother about losing RM100? penny wise pound foolish! QUOTE(Afterburner1.0 @ Mar 10 2023, 08:44 AM) Exactly. Some people waste so much time calculating peanuts.In the end Hokkien say LPPL. Spend a bit more time in stock market can make that back easily. SunBear1999 liked this post

|

|

|

Mar 10 2023, 10:59 AM Mar 10 2023, 10:59 AM

Return to original view | IPv6 | Post

#366

|

Senior Member

3,860 posts Joined: Jun 2022 |

|

|

|

|

|

|

Mar 10 2023, 11:51 AM Mar 10 2023, 11:51 AM

Return to original view | IPv6 | Post

#367

|

Senior Member

3,860 posts Joined: Jun 2022 |

QUOTE(ikanbilis @ Mar 10 2023, 11:04 AM) Min AUM 200k. But if you have not enough, you can topup to that amount and they will give you that Rate. But maybe not every branch lah.l, not sure. The one I went to is Damansara Uptown.One drawback is need RM10k in savings to get this. But this RM10k can withdraw next day...🤦 Not sure what purpose it serves. Topkek Ambank. This post has been edited by CommodoreAmiga: Mar 10 2023, 11:53 AM ikanbilis liked this post

|

|

|

Mar 10 2023, 02:58 PM Mar 10 2023, 02:58 PM

Return to original view | Post

#368

|

Senior Member

3,860 posts Joined: Jun 2022 |

|

|

|

Mar 10 2023, 06:40 PM Mar 10 2023, 06:40 PM

Return to original view | Post

#369

|

Senior Member

3,860 posts Joined: Jun 2022 |

QUOTE(guy3288 @ Mar 10 2023, 06:03 PM) bro you did a good job calculating the long winded way posted by old kiasu All the time old kiasu wasted doing unproductive things like this , can go stock market make 1 swing trade with a few thousand adnd make back a lot more than with RM1 mil FD whatever peanut you can squeeze.. Waste of time nonsense!it just confirmed my suspicion the whole long long post by oldkiasu only meant to say in leep year, we lose 1DAY interest. that is all this is just his other posting making FD like very complicated very long and very confusing to simple FD people end of the day his message is LOST! previously he wrote very long posts about choosing the time of the day before you go place FD choosing the day (Monday-Friay) etc etc all meant to squeeze extra profit from bank FD Just how much extra can you squeeze from bank FDs like that .....i wonder taking all the trouble for extra few RMs for a million FD? bro you are not getting the message from oldkiasu's long long post this is what i mean very long winded posting no use cant get the message across to people in here going by oldkiasu's idea bank cheated you 1 day interest in above example for him he wants bank to pay him EXTRA 1DAY interest in above example the earth completed its orbit around the sun 1 circle in 365.25 days So every 4 years we lose 1 day gaji, go claim back from your employer You worked 40 years, can claim extra 10days gaji. This post has been edited by CommodoreAmiga: Mar 10 2023, 06:41 PM |

|

|

Mar 11 2023, 08:32 AM Mar 11 2023, 08:32 AM

Return to original view | Post

#370

|

Senior Member

3,860 posts Joined: Jun 2022 |

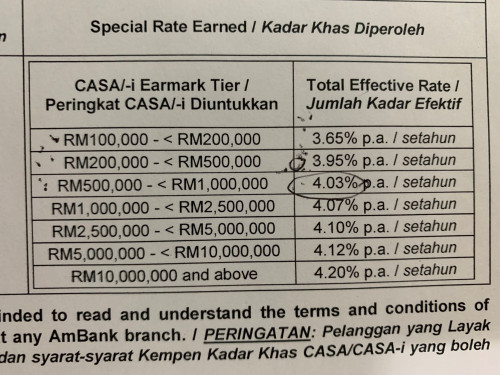

QUOTE(lawr0202 @ Mar 11 2023, 05:08 AM)  This is the interest rate for the earmarked amount in CASA and the first tier minimum amount has changed to 50k Actually this thing is quite complicated, you need to look at the total amount in your CASA on 31 January 2023, and on 31 March 2023, the amount (not including the earmarked) cannot be lower than that to be eligible for the FD This post has been edited by CommodoreAmiga: Mar 11 2023, 08:34 AM |

|

|

Mar 11 2023, 02:03 PM Mar 11 2023, 02:03 PM

Return to original view | Post

#371

|

Senior Member

3,860 posts Joined: Jun 2022 |

QUOTE(lawr0202 @ Mar 11 2023, 01:02 PM) Well, overall you still get more interest How to get more interest rates? All the E.R are lower than 4.3% in the ad posted above. Unless I am missing something here.And another interesting point, according to the branch manager the 11 month FD interest will be given upfront |

|

|

Mar 11 2023, 05:02 PM Mar 11 2023, 05:02 PM

Return to original view | Post

#372

|

Senior Member

3,860 posts Joined: Jun 2022 |

QUOTE(fabu8238 @ Mar 11 2023, 04:39 PM) The Fed's raising of interest rates resulted in the closure of SVB and many depositors potentially losing most of their deposits as many were not insured. SVB suffered huge unrealised losses when its bond holdings were revalued using current interest rates which were much higher than the coupon rates. This raises the question whether Fed will raise its interest rates at the 22 March meeting For us here, due to political pressure. I bet no raise until erection is over. Imo, just put whatever highest FD you can find for 6-12 maths. Probably rates might even go down.This post has been edited by CommodoreAmiga: Mar 11 2023, 05:07 PM Cookie101 liked this post

|

|

|

Mar 11 2023, 05:03 PM Mar 11 2023, 05:03 PM

Return to original view | Post

#373

|

Senior Member

3,860 posts Joined: Jun 2022 |

|

|

|

|

|

|

Mar 23 2023, 05:30 AM Mar 23 2023, 05:30 AM

Return to original view | Post

#374

|

Senior Member

3,860 posts Joined: Jun 2022 |

QUOTE(BoomChaCha @ Mar 22 2023, 09:55 AM) Everytime when I place FD promo, I need to park RM 10K in saving (or current account..?), but can withdraw after placing FD. You can pre sign a form for moving the cash, so no need to go back. My RM did that for me, since I will be out of the country next week.Everytime I transfer out RM 10K from saving after FD placement, so far no problem Not sure if it is for priority customer? But AM counter staff never mentioned this 4.5% is for priority customer. Min FD placement is RM 50K The answer is NO, cannot place online. Only can place OTC. You need to sign a form upon placing this 4.5% FD, then from 3 April to 7 April (go on 3 April is better), you need to go back to AM Bank again to sign one more from in order to convert the fund from saving to 4.5% FD for 11 months. This post has been edited by CommodoreAmiga: Mar 23 2023, 05:30 AM BoomChaCha liked this post

|

|

|

Mar 25 2023, 01:59 PM Mar 25 2023, 01:59 PM

Return to original view | IPv6 | Post

#375

|

Senior Member

3,860 posts Joined: Jun 2022 |

QUOTE(AVFAN @ Mar 20 2023, 11:43 AM) QUOTE(elea88 @ Mar 21 2023, 08:36 AM) Yes, very weird. Must use the link or can't get that rate. Just done one this morning. |

|

|

Apr 7 2023, 11:26 PM Apr 7 2023, 11:26 PM

Return to original view | IPv6 | Post

#376

|

Senior Member

3,860 posts Joined: Jun 2022 |

|

|

|

Apr 10 2023, 03:37 PM Apr 10 2023, 03:37 PM

Return to original view | Post

#377

|

Senior Member

3,860 posts Joined: Jun 2022 |

From Ambank

*FD rate for week of 10/4/2023* *3 month @ 3.60% p.a* *6 month @ 3.80% p.a* *11 month @ 3.80% p.a* *12 month @ 3.80% p.a* Offer validity: *10 Apr 2023 - 14 Apr 2023* Terms & Conditions 1. *Applicable for Islamic TDi / Conventional FD on FRESH FUND and RENEWAL. 2. Placement criteria : min RM 10k CASA balance is COMPULSORY 3. Applicable for *TD-i / FD > RM10k only* 4. Applicable for SPB & Retail SME This post has been edited by CommodoreAmiga: Apr 10 2023, 03:38 PM |

|

|

Apr 10 2023, 07:19 PM Apr 10 2023, 07:19 PM

Return to original view | Post

#378

|

Senior Member

3,860 posts Joined: Jun 2022 |

QUOTE(Youth City Nilai @ Apr 10 2023, 05:05 PM) Since the Dawn of Dinosaurs already like that. 😅 |

|

|

Apr 13 2023, 12:05 PM Apr 13 2023, 12:05 PM

Return to original view | IPv6 | Post

#379

|

Senior Member

3,860 posts Joined: Jun 2022 |

QUOTE(AVFAN @ Apr 13 2023, 11:21 AM) https://www.cnbc.com/2023/04/12/cpi-march-2023-.html For sure no hikes until after election. After Election, maybe US start to pause or reduce rates ..so best guess is either stagnant or reduce.https://www.cnbc.com/2023/04/12/fed-expects...nutes-show.html US inflation is slowing down; Fed alluding to a recession later in the year. meaning... incr chance of fed pausing, no more hikes, maybe cut rates by year end. so, guessing game now... will BNM hike, no change or cut in may, july..?? my take - no more hikes... just pause until year end. |

|

|

Apr 13 2023, 12:46 PM Apr 13 2023, 12:46 PM

Return to original view | Post

#380

|

Senior Member

3,860 posts Joined: Jun 2022 |

QUOTE(fabu8238 @ Apr 13 2023, 12:35 PM) I find it difficult to predict Fed's next course of action simply bcos what they have done in the past year has been ridiculous. Only thing I am certain is that Powell and Yellen are more likely to get things wrong than right. They may now say recession is not expected and will continue on their quest of rate hikes. I don't think so. With the collapse of 2 banks and Credit Suisse. It changes the equations already. |

| Change to: |  0.9293sec 0.9293sec

0.89 0.89

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 01:35 PM |