Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

GrumpyNooby

|

Jun 27 2020, 09:21 PM Jun 27 2020, 09:21 PM

|

|

QUOTE(Vickyle @ Jun 27 2020, 09:20 PM) uob 3.3% 12m, 10% CASA earmark 3m, only new customer. I placed one early this month. It's some kind of monthly promotion. Every month has different rate. Obviously last month's rate is higher. Dunno about next month.  So next month, you can get "special rate' from UOB FD? Since you're new customer or can be new customer again? |

|

|

|

|

|

GrumpyNooby

|

Jun 27 2020, 09:23 PM Jun 27 2020, 09:23 PM

|

|

QUOTE(Vickyle @ Jun 27 2020, 09:22 PM) Yeah, I asked the finance manager. It will change next month. New customer = no account in UOB Close the current account and open again the next day can be considered new customer right? This post has been edited by GrumpyNooby: Jun 27 2020, 09:24 PM |

|

|

|

|

|

GrumpyNooby

|

Jun 30 2020, 03:51 PM Jun 30 2020, 03:51 PM

|

|

QUOTE(BboyDora @ Jun 30 2020, 03:50 PM) No need. |

|

|

|

|

|

GrumpyNooby

|

Jul 1 2020, 07:56 AM Jul 1 2020, 07:56 AM

|

|

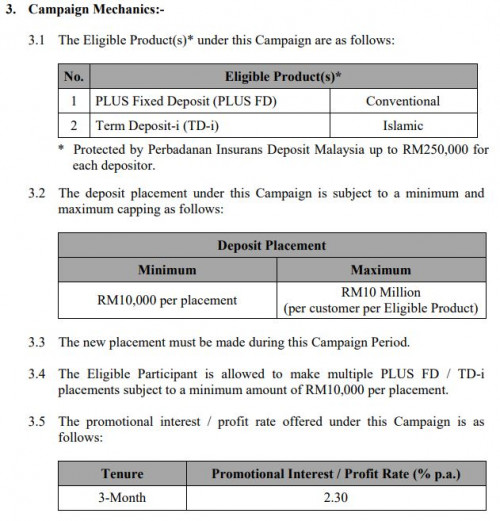

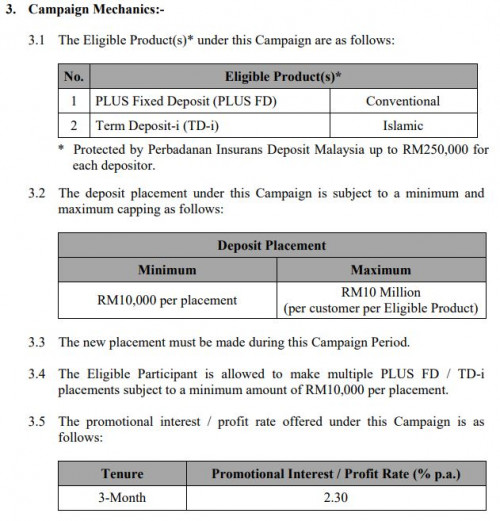

PB 3-Month FD / TD-i CampaignPlease be informed that Public Bank is launching a new “PB 3-Month Fixed Deposit / Term Deposit-i” Campaign starting from 1 July 2020 to 31 July 2020.  Click here for the Campaign’s Terms & Conditions in English. https://www.pbebank.com/pdf/Banking/tc_3m-fdtdi-en.aspxEnhancement of PLUS FD Partial WithdrawalDear Valued Customers, Please be informed that the Bank will enhance the partial withdrawal features under PLUS Fixed Deposit Account (PLUS FD) with effect from 1 August 2020. The revised “Terms and Conditions Governing Fixed Deposit Account” will be made available from 1 August 2020 onwards. Thank you.

|

|

|

|

|

|

GrumpyNooby

|

Jul 1 2020, 08:35 AM Jul 1 2020, 08:35 AM

|

|

eFIXED DEPOSIT: Save the savvy way with eFixed Deposit via CIMB Clicks. This campaign is only applicable for conventional Current Account and Savings Account (CASA) holders. This campaign is only available on Clicks web/desktop view (not available via CIMB Clicks App). Campaign valid from 1 July until 7 July 2020. Placement link: https://www.cimbclicks.com.my/clicks/#/wps/...k/ecFdPromo?r=1Campaign link: https://www.cimbclicks.com.my/efd-may20.htm...FD%20May%202020

|

|

|

|

|

|

GrumpyNooby

|

Jul 1 2020, 11:52 AM Jul 1 2020, 11:52 AM

|

|

|

|

|

|

|

|

GrumpyNooby

|

Jul 2 2020, 06:02 PM Jul 2 2020, 06:02 PM

|

|

QUOTE(babysotong @ Jul 2 2020, 06:00 PM) UOB don't provide eFD. Only OTC placement but can withdraw online I have placed eFD with UOB before from UOB PIB. Nothing to brag about their eFD as they don't really do promo with eFD. |

|

|

|

|

|

GrumpyNooby

|

Jul 3 2020, 02:50 PM Jul 3 2020, 02:50 PM

|

|

Bank Negara seen cutting key rate again as pandemic persistsBank Negara Malaysia (BNM) will cut its overnight policy rate (OPR) by at least 25 basis points (bps) to 1.75%, according to seven out of the 12 economists polled, with two of them betting on a bigger 50 bps rate reduction. https://www.thestar.com.my/business/busines...ndemic-persists

|

|

|

|

|

|

GrumpyNooby

|

Jul 7 2020, 08:48 AM Jul 7 2020, 08:48 AM

|

|

Will another OPR cut be of much help?After three successive rate cuts, the marginal benefit of further rate cuts starts to diminish. KUALA LUMPUR (July 7): Will the overnight policy rate (OPR) dip below 2%? Both households and business owners are waiting to see if Bank Negara Malaysia at its Monetary Policy Committee meeting today will trim OPR further to stimulate growth in current economic trying times. Furthermore, lower interest rates will ease the debt burdens on companies and consumers. While the OPR is already at a low never seen since the Global Financial Crisis in 2009, economists are divided on what BNM will do next. https://www.theedgemarkets.com/article/will...ut-be-much-help

|

|

|

|

|

|

GrumpyNooby

|

Jul 7 2020, 06:16 PM Jul 7 2020, 06:16 PM

|

|

QUOTE(Angelpoli @ Jul 7 2020, 06:13 PM) Will bank directly stop promo and update the rate tomorrow or will give a few day for the rate to be updated? Some campaign has expiry date of today such as Affin and OCBC. Some campaign has longer expiry like RHB (till 31/8/2020). Some may revise the existing campaign with new rate. How soon? Depends on the bank speed. This post has been edited by GrumpyNooby: Jul 7 2020, 06:17 PM |

|

|

|

|

|

GrumpyNooby

|

Jul 9 2020, 10:31 AM Jul 9 2020, 10:31 AM

|

|

QUOTE(Human Nature @ Jul 9 2020, 10:29 AM) I hope this is merely pure speculations Business research firm Fitch Solutions has forecast that Bank Negara will slash the Overnight Policy Rate (OPR) to 1 percent to spur the economy. https://www.malaysiakini.com/news/533614That is an old analysis done by Fitch. It is merely their own opinions. |

|

|

|

|

|

GrumpyNooby

|

Jul 10 2020, 10:10 AM Jul 10 2020, 10:10 AM

|

|

QUOTE(BacktoBasics @ Jul 10 2020, 10:09 AM) PBB eFD 2.28 for one month. not sure if other banks can top that? btw i wonder if money market fund is better than 2.28% but usually MM is less than FD right? because MM is more flexible and liquid Simple™ from StashAway is projected to offer 2.4% pa (daily interest). It's a MMF collaborated with Eastspring Investments. |

|

|

|

|

|

GrumpyNooby

|

Jul 10 2020, 10:20 AM Jul 10 2020, 10:20 AM

|

|

QUOTE(BacktoBasics @ Jul 10 2020, 10:19 AM) OPR rate cut but will it still be 2.4% projected? or is there a new projection? No changes announced yet: https://www.stashaway.my/simple |

|

|

|

|

|

GrumpyNooby

|

Jul 10 2020, 10:35 AM Jul 10 2020, 10:35 AM

|

|

QUOTE(BacktoBasics @ Jul 10 2020, 10:33 AM) yeah thats what i found out also.... let me try to ask CS see if they have a revised projected number. QUOTE How is StashAway Simple™ Projected Rate Calculated?

StashAway Simple™’s projected returns are driven by the rate of returns of its underlying investments, net of all expenses and rebates. The math on the projected rate of returns is quite straightforward: StashAway Simple™ projected returns are the sum of the amortised yield from the underlying fund, minus fees charged by the underlying fund managers, plus any rebates. Eastspring Investments rebates StashAway, and we distribute this full rebate to you when we receive it each month.

We will update the projected rate should the stated projected rate change. Should the underlying fund's projected returns change, we may decide to rebate you an additional amount in order to deliver the stated projected rate (in 3 decimals) at the time.

The Total Expense Ratio (TER) for the fund includes the Management Fee charged by the Fund Manager, as well as other expenses incurred by the Fund (e.g., custody, marketing, compliance, shareholder services); as the TER includes fixed costs, it may slightly vary depending on the size of the fund.

Could the Simple projected rate ever change?

Yes, depending on economic conditions, your StashAway Simple™’s projected rate may change, as its underlying fund is affected by Malaysia's economic health and trajectory. We will always notify you in the case of a change in the projected rate. The risk level to which your money is exposed will never change within StashAway Simple™. |

|

|

|

|

|

GrumpyNooby

|

Jul 10 2020, 05:33 PM Jul 10 2020, 05:33 PM

|

|

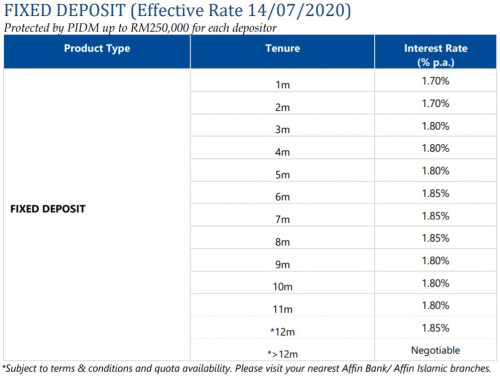

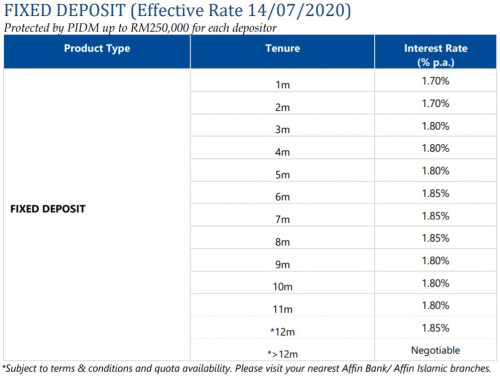

QUOTE(datolee32 @ Jul 10 2020, 09:32 AM) The 2.28% you refer to bank FD promotion? Any bank offer that? I understand Affin bank 2.1% for 1 month consider high.  Revised to 1.7% pa for 1m now |

|

|

|

|

|

GrumpyNooby

|

Jul 10 2020, 06:56 PM Jul 10 2020, 06:56 PM

|

|

Revision of Product Board Rates and Profit-Sharing Ratio [for SC] Fixed Deposit and Term Deposit-i* (Applicable for Retail Individuals and Business Banking clients only) Kindly be informed that the board rates and profit-sharing ratio (PSR) for the following products will be revised effective 14 JULY 2020 and 1 AUGUST 2020 as per details below. All other product features, fees and charges will remain unchanged. The new rates are also available on the Standard Chartered website.  https://av.sc.com/my/content/docs/Homepage_...ate_and_PSR.pdf https://av.sc.com/my/content/docs/Homepage_...ate_and_PSR.pdf

|

|

|

|

|

|

GrumpyNooby

|

Jul 13 2020, 10:14 AM Jul 13 2020, 10:14 AM

|

|

QUOTE(cocolala @ Jul 13 2020, 10:09 AM) Hi anyone know if affin still offer 2.88%? If I wanna transfer 6 figure amount to other bank by banker’s cheque is there any charges? Not sure about OTC. It is better you call and ask the respective branch. |

|

|

|

|

|

GrumpyNooby

|

Jul 13 2020, 01:44 PM Jul 13 2020, 01:44 PM

|

|

QUOTE(??!! @ Jul 13 2020, 01:11 PM) Affin 6 months 2.6% still valid today .(last day) OTC? |

|

|

|

|

|

GrumpyNooby

|

Jul 14 2020, 06:33 AM Jul 14 2020, 06:33 AM

|

|

For UOB  |

|

|

|

|

|

GrumpyNooby

|

Jul 14 2020, 10:00 AM Jul 14 2020, 10:00 AM

|

|

QUOTE(BoomChaCha @ Jul 14 2020, 09:54 AM) Affin Bank FD Promo Update [attachmentid=10537302] OTC? Not eFD right? |

|

|

|

|

Jun 27 2020, 09:21 PM

Jun 27 2020, 09:21 PM

Quote

Quote

0.0463sec

0.0463sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled