QUOTE(BoomChaCha @ May 18 2023, 03:05 PM)

Oh.. Thank you so much Bro Joe for the rocket speed clarification..

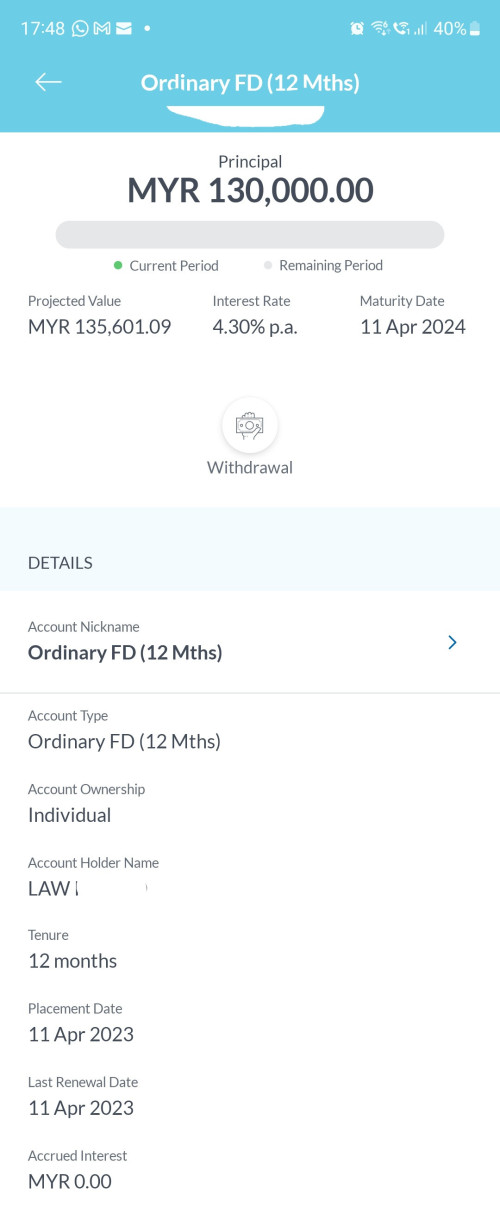

The FD interest calculate by days.

But some years have less than 365 days, please google..

So, for the year which less than 365 days, we will earn slightly less interest.

I suspected so since Feb is short month. Anyway I lazy to go compute and can only trust the bank not to miscalculate.

QUOTE(sirius2017 @ May 18 2023, 03:08 PM)

I had just placed BI 12mth 4.5% fd.

Placement date today, 18/5/2023

Maturity date is 20/5/2024 as 18/5/2024 which is a Saturday.

Expected profit(int) is calculated as Placement Amount x 4.5% x 368/365

I had verified calculated profit/int amount printed on the FD cert to be exactly correct.

Extra 3 days is because of Sat & Sun and the fact 2024 is a leap year (29Feb, so another additional day)

Since, this is a OTC placement with certificate, I did asked the teller whether I can redeem this FD at another BI branch on maturity. She say can, redemption can be at another branch, need to bring along the cert.

However, she did mentioned that I can redeem on maturity ONLINE if I choose to.

Thank you for the info. This is an interesting point. Previously when I placed, the maturity date fell on Sat and I can only suck thumb. But today I placed 1 FD and instructed them to make the maturity date on 20th May 2024. Initially they claim it is system generated, but I think can be manually override. Depends on the person who key in the system I think. So yeah please instruct them and check for the dates yourself. For your case I think you either use Rentas or Bank Cheque right?

Today I used my own personal cheque, so I can only get the certificate after cheque clears. But I was promised effective date today and maturity at 20th May. So let's see next week.

I need to ask the branch people to give me some gifts as I have placed almost 50% of all my FDs at Bank Islam. Anyone has received gifts from Bank Islam lately?

This post has been edited by joeblow: May 18 2023, 04:17 PM

Apr 7 2023, 02:05 PM

Apr 7 2023, 02:05 PM

Quote

Quote

0.0833sec

0.0833sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled