QUOTE(Optizorb @ Jun 13 2024, 08:14 PM)

to be fair.. you cant say you getting 3.99% or whatever also what..

cause their tnc clearly stated they use either 365 or 366 divisor.

and as 2024 is leap year, so they follow 366 divisor..

Whether you want to argue if placement after 29th Feb to the next year is no longer "leap" days cause it will be 365 total days only.. Well too bad, as a whole we still under 2024, which is designated as a leap year already.. So any placements made this year, the bank can still say we are in leap year, thus follow leap year formula..

So if follow 366 divisor, they really give you 4% right.. If you want to say you get 3.99% then clearly its misleading and can even be looked as slander, cause you refuse to acknowledge the calculation stated in TNC..

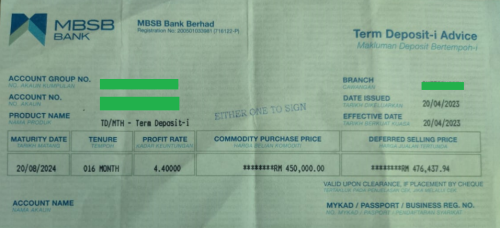

You seem to be objective and speaks from TnC. Yes I am never disputing the fact that MBSB if they use 366 divisor give me 4%. No question about that. I am speaking from the immediately reaction I get when I see the expected interest rate divided by principle which gives me 3.9925% effective. Have you guys recently placed FD with MBSB and BI?

Now why can't I say that? I am not saying MBSB cheated me or whatever. Effective rate based on 365 days return is 3.9925%. Or is it because I omitted the "effective" word?

I give you a real life example but I am not going to spend more time on this topic by posting my FDs.

I placed both MBSB and Bank Islam in May period, both same 365 days period 1 year. Based on rm10000. MBSB gives me effective only rm399.25 after 1 year (365 days). Real example. So I can't say MBSB give me only 3.9925%? Is it ok to you and guy9288 I say effective rate 3.9925%? Or I must say MBSB give me 4%? If MBSB give me 4% but only give me rm399.25. BI give me the full rm400, so BI give me 4.xx%?

Using the example above I disagree it is slandar and I do acknowledge based on the TnC the effective rate of 3.9925% is calculative based on the 4% on a leap year.

Why you guys need to get so technical about that? So next time I want to share information in this forum, I must be so technical? Tell people I get MBSB 4% and BI also 4% but MBSB follows 366 days? Is that it? I might as well don't post. People want to know the effective return over the same 1 year period right?

OK even though I get rm399.25 from MBSB, they give me also 4%. Now BI gives me rm400, also 4%. Next time write like this happy?

Wow I never expect something so trivial can turn into such laborious discussion. Again don't confuse me with others who might infer MBSB is wrong or cheating. That's not my purpose.

The notion effective rate is gone and I feel my points are being twisted. Would it be ok to put effective rate 3.9925?

Whatever lah. Let's move on and stop here.

Jun 8 2024, 04:15 PM

Jun 8 2024, 04:15 PM

Quote

Quote

0.0599sec

0.0599sec

0.24

0.24

7 queries

7 queries

GZIP Disabled

GZIP Disabled