Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

GrumpyNooby

|

May 7 2020, 07:55 PM May 7 2020, 07:55 PM

|

|

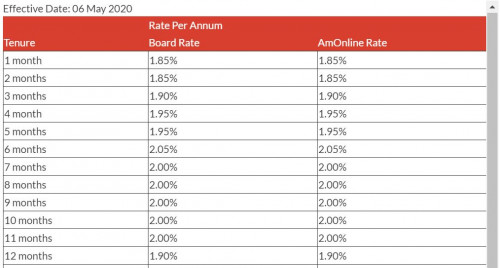

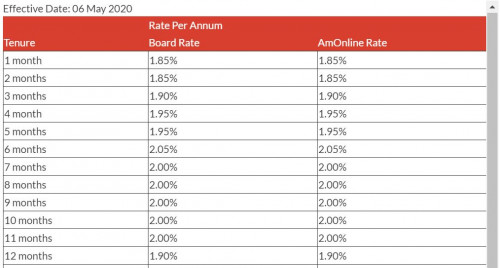

QUOTE(Boomwick @ May 7 2020, 07:52 PM) Hi all.. I nid some confirmation becuz i received a forwarded message from my friend on ambank rates Pls be reminded this is forwarded to me and i had yet to check the authenticity. Would like forumer to help me verify New FD board rate at Ambank as below: 1 mth FD@1.85% 3 mths FD@1.90% 6 mths FD@2.05% 9 mths FD@2.00% 12 mths FD@1.90% Correct!  Source: AmBank Portal (https://www.ambank.com.my/eng/rates-fees-charges) |

|

|

|

|

|

GrumpyNooby

|

May 7 2020, 07:58 PM May 7 2020, 07:58 PM

|

|

QUOTE(Boomwick @ May 7 2020, 07:57 PM) But these are board rates right Not promo rates Promo rates shud be higher abit Your forwarded message mentioned board rate: QUOTE New FD board rate at Ambank as below:

1 mth FD@1.85%

3 mths FD@1.90%

6 mths FD@2.05%

9 mths FD@2.00%

12 mths FD@1.90% Their previous eFD promo has ended on 30/4/2020 This post has been edited by GrumpyNooby: May 7 2020, 07:59 PM |

|

|

|

|

|

GrumpyNooby

|

May 7 2020, 08:02 PM May 7 2020, 08:02 PM

|

|

QUOTE(Boomwick @ May 7 2020, 08:00 PM) Ah thanks.. very sharp eyes u have there.. So.. Promo rate shud be able to see some above 2% to 2.5% ? Please visit the branch or contact your RM. OTC promo usually varies from branch to branch. Appreciate if you could share here afterward. I don't want to go the branch now. They ask this, ask that. |

|

|

|

|

|

GrumpyNooby

|

May 7 2020, 08:07 PM May 7 2020, 08:07 PM

|

|

QUOTE(!@#$%^ @ May 7 2020, 08:05 PM) 1. Check body temperature, 2. Name, NRIC, back from overseas in the past 14 days, back from China/Europe/Middle East/Singapore in the past 14 days, got COVID-19 symptoms, got contact with any COVID-19 positive friends/relatives/families, got being contacted by MOH during MCO or past 14 days 3. Business of coming to the branch All details put into the app. This post has been edited by GrumpyNooby: May 7 2020, 08:09 PM |

|

|

|

|

|

GrumpyNooby

|

May 8 2020, 03:11 PM May 8 2020, 03:11 PM

|

|

QUOTE(Micky78 @ May 8 2020, 03:07 PM) some country like Japan is negative interest.. mean bank in charging u interest for keeping money in the bank. If FD interest become 1%, banks will lose out as it not enough for them to earn profit on high loan interest to cover their mgt expenses. In Eurozone, it is already negative interest rate for deposits. The ECB doesn't want people to save but instead to spend the money. As for Japan, it has been negative interest rate for decades right if I remembered correctly. But Japanese rather keeps their money under the pillow rather than deposit them to the bank. This post has been edited by GrumpyNooby: May 8 2020, 03:12 PM |

|

|

|

|

|

GrumpyNooby

|

May 8 2020, 03:50 PM May 8 2020, 03:50 PM

|

|

QUOTE(Micky78 @ May 8 2020, 03:49 PM) YUP, that is why PH govt immediately goto Japan to raise money (bond with low interest) to pay off existing debts with high-interest commitment  . Tun M is always pro-Japan.  This post has been edited by GrumpyNooby: May 8 2020, 03:50 PM This post has been edited by GrumpyNooby: May 8 2020, 03:50 PM |

|

|

|

|

|

GrumpyNooby

|

May 8 2020, 07:27 PM May 8 2020, 07:27 PM

|

|

QUOTE(arsenal @ May 8 2020, 07:26 PM) Indian i think better keep in ASM 3. Higher rate than fd. Max 30k. Indian? |

|

|

|

|

|

GrumpyNooby

|

May 8 2020, 08:21 PM May 8 2020, 08:21 PM

|

|

QUOTE(Syracuse @ May 8 2020, 08:20 PM) The Public Bank 3.08% p.a. 4 months promotion is only valid for fresh funds only? I tried to deposit the savings in my CASA into the eFD account, only to be prompted to enter the details of other banks for FPX transfer. Fresh fund via FPX only. Fresh fund from CASA is not permissible. |

|

|

|

|

|

GrumpyNooby

|

May 9 2020, 11:07 AM May 9 2020, 11:07 AM

|

|

QUOTE(rocketm @ May 9 2020, 11:05 AM) Anyone know is OCBC online fixed deposit 3.25% pa for 10months is still valid? Ended on 30/4/2020. https://www.ocbc.com.my/personal-banking/ac...0Promo%20TC.pdf |

|

|

|

|

|

GrumpyNooby

|

May 10 2020, 01:46 PM May 10 2020, 01:46 PM

|

|

QUOTE(cocolala @ May 10 2020, 01:39 PM) Hi guys I'm trying to open a Public Bank efd account and facing this problem as well. I browsed through the thread but did not find a definite answer. Should the answer be 'yes' for all? Please help, thanks. Everybody needs to go through the same set of questions. It's under US FATCA and CRS compliance. Just answer them honestly if certain clause applicable to you. |

|

|

|

|

|

GrumpyNooby

|

May 10 2020, 02:21 PM May 10 2020, 02:21 PM

|

|

QUOTE(WaCKy-Angel @ May 10 2020, 02:19 PM) Those questions seems weird.. The only question i encountered normally is just "are you a US citizen" something like that. Never so many questions before If you submitted W-8BEN-E form before, questions are roughly similar. |

|

|

|

|

|

GrumpyNooby

|

May 10 2020, 08:15 PM May 10 2020, 08:15 PM

|

|

QUOTE(cocolala @ May 10 2020, 08:14 PM) Thanks! The reason I asked is because I was not really understand about the questions, now that you have mentioned this and I looked back at the questions and understood. If you don't have any "business" at US or with US, obviously you can tick "No" confidently. This post has been edited by GrumpyNooby: May 10 2020, 08:17 PM |

|

|

|

|

|

GrumpyNooby

|

May 11 2020, 10:43 AM May 11 2020, 10:43 AM

|

|

QUOTE(piscesslyw @ May 11 2020, 10:36 AM) Just sharing. Cimb preferred 3M 2.45% 6M 2.55% 12M 2.6% Is this before or after OPR revision? CIMB new BR and BLR will only commence starting 13/5/2020 This is exactly similar to conventional board rate.  |

|

|

|

|

|

GrumpyNooby

|

May 12 2020, 03:53 PM May 12 2020, 03:53 PM

|

|

QUOTE(Micky78 @ May 12 2020, 03:50 PM) when is the next meeting to discuss OPR rate? Aug 2020? going down again? July 2020. I'm expecting another 25 basis point cut. Stay tune! |

|

|

|

|

|

GrumpyNooby

|

May 14 2020, 09:26 AM May 14 2020, 09:26 AM

|

|

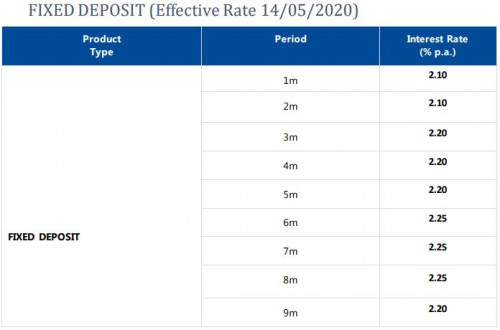

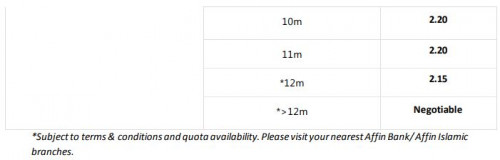

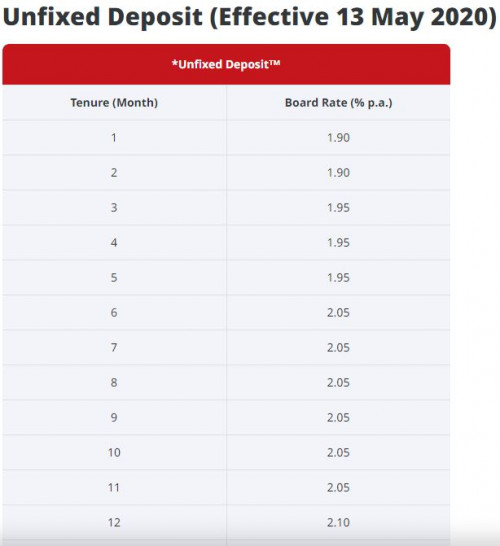

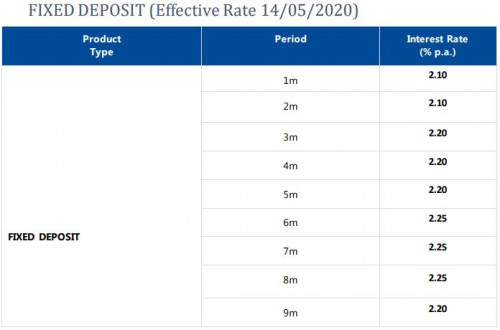

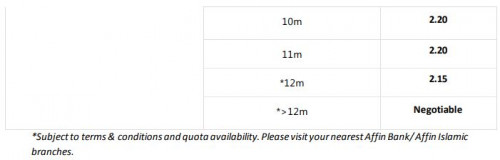

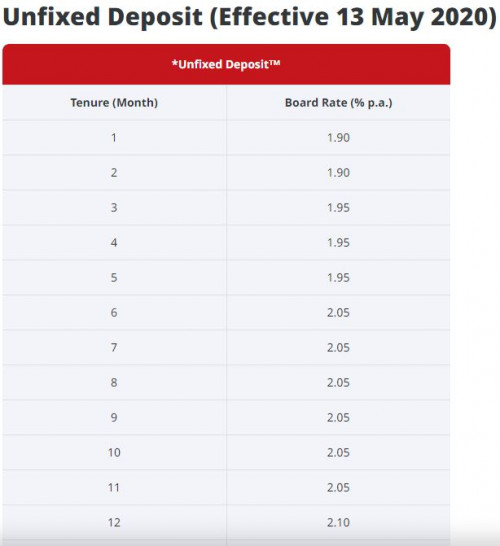

Revision of Deposits Rates Effective 14 May 2020 [Affin Bank]13 May 2020 We wish to inform that effective 14 May 2020, the revised deposits rates are as follows: Revision of Deposits Rates Effective 14 May 2020: https://www.affinonline.com/AFFINONLINE/med..._140520_ENG.pdfFor more information, contact our Call Centre at 03-8230 2222, visit your nearest AFFINBANK branch or log on to www.affinonline.com FD board rate is impacted too!   This post has been edited by GrumpyNooby: May 14 2020, 09:28 AM This post has been edited by GrumpyNooby: May 14 2020, 09:28 AM

|

|

|

|

|

|

GrumpyNooby

|

May 14 2020, 10:18 AM May 14 2020, 10:18 AM

|

|

QUOTE(gchowyh @ May 12 2020, 12:23 PM) I just got some clarification today. In summary, there is no special rate for CIMB preferred. The new FD rates should be announced tomorrow 13/5/2020 as they still do not know what it is and there might be a fresh promo for CIMB preferred. I believe at best the promo can only be the current board rates. On a side note, there is a CIMB Islamic account (Fixed Return Income Account-i (Monthly Returns)) similar to Bank Rakyat where one can get monthly interest with the same FD interest rates. CIMB FD board rate as effective 13/5/2020  https://www.cimb.com.my/en/personal/help-su...it-account.html https://www.cimb.com.my/en/personal/help-su...it-account.htmlNot sure how much higher for CIMB Preferred FD board rate. |

|

|

|

|

|

GrumpyNooby

|

May 14 2020, 10:41 AM May 14 2020, 10:41 AM

|

|

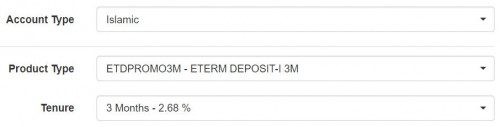

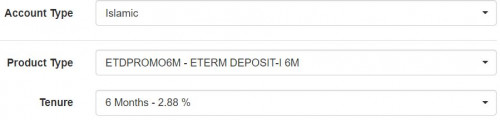

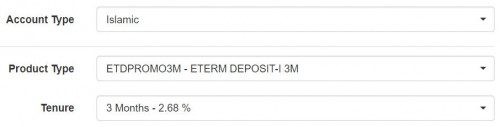

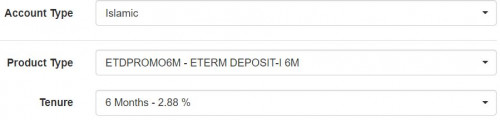

Found this after logging into Affin Online: 2 eFD promo: A. eFD 3m @ 2.68% pa B. eFD 6m @ 2.88% pa B. eFD 6m @ 2.88% pa Couldn't find the T&C. I don't know if there's a min amount for placement too as I didn't place any. I think they're the highest now for 3m to 6m range. This post has been edited by GrumpyNooby: May 14 2020, 10:50 AM |

|

|

|

|

|

GrumpyNooby

|

May 14 2020, 02:46 PM May 14 2020, 02:46 PM

|

|

QUOTE(fishmango @ May 14 2020, 02:43 PM) No problem at all! Main website can access and load. Affin Online can login also. Buttery smooth loading. This post has been edited by GrumpyNooby: May 14 2020, 02:48 PM |

|

|

|

|

|

GrumpyNooby

|

May 14 2020, 04:21 PM May 14 2020, 04:21 PM

|

|

QUOTE(fishmango @ May 14 2020, 04:19 PM) now ok. how much min max deposit? Don't know. I didn't place. You tried? |

|

|

|

|

May 7 2020, 07:55 PM

May 7 2020, 07:55 PM

Quote

Quote

0.0530sec

0.0530sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled