Outline ·

[ Standard ] ·

Linear+

Credit Cards Standard Chartered Bank Credit Cards V4, Everything About SC Credit Cards

|

GrumpyNooby

|

Oct 15 2020, 07:16 AM Oct 15 2020, 07:16 AM

|

|

QUOTE(Dexter @ Oct 15 2020, 07:12 AM) Top up Rm100 to Boost, hope to get early bird RM10. 😉 Thx for early reminder. Campaign Mechanics

1. During the Campaign Period, Customers who top up minimum of RM 100 into Boost e-wallet using selected Standard Chartered Bank Malaysia Berhad’s credit cards will get RM 10 cashback.

2. The Campaign will be divided into four (4) rounds (“Round”) as stipulated below:

i. First Round: 15 August 2020 until 14 September 2020;

ii. Second Round : 15 September 2020 until 14 October 2020; and

iii. Third Round: 15 October 2020 until 14 November 2020.

iv. Fourth Round: 15 November 2020 until 14 December 2020Don't worry. Based on the previous 2 rounds, it can last longer that we thought. |

|

|

|

|

|

GrumpyNooby

|

Oct 15 2020, 10:54 AM Oct 15 2020, 10:54 AM

|

|

QUOTE(synical @ Oct 15 2020, 10:52 AM) Just remembered to reload (brain fart), dunno still got chance or not :/ Haven't see "Fully Redeemed" in Boost FB yet, perhaps still got qutoa. |

|

|

|

|

|

GrumpyNooby

|

Oct 15 2020, 12:08 PM Oct 15 2020, 12:08 PM

|

|

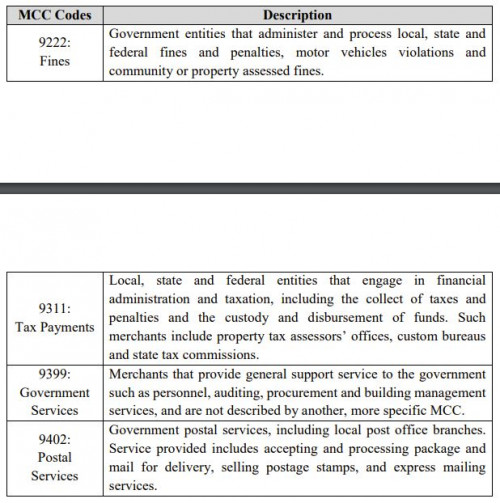

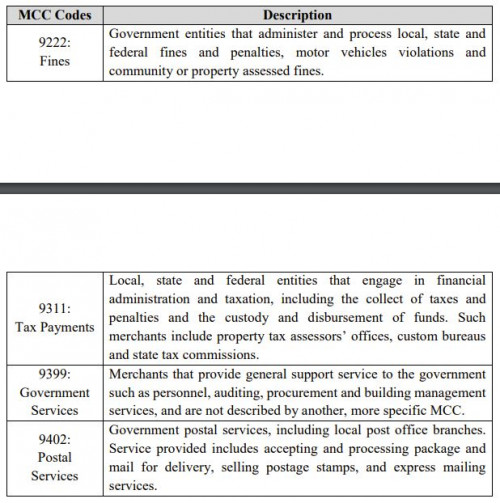

QUOTE(??!! @ Oct 15 2020, 12:04 PM) Standard Chartered CS said that while Government-related transactions are a part of spending for JOP, tax related transactions eg Income Tax payment will not count as part of total spending. Has anyone tried paying LHDN with JOP and knows if transaction is excluded from total spend calculations? As we all know, sometimes, CS also gives us incorrect answers  From JOP T&C: QUOTE Government Spend is define as transaction with MCC of 9211, 9222, 9223, 9311, 9399, 9402 & 9405. https://av.sc.com/my/content/docs/my-client...credit-card.pdf |

|

|

|

|

|

GrumpyNooby

|

Oct 15 2020, 01:58 PM Oct 15 2020, 01:58 PM

|

|

QUOTE(enterthefatdragon @ Oct 15 2020, 01:56 PM) just got my SCB Platinum, telemarketer die2 promo to me will top up Boost soon Which Platinum? |

|

|

|

|

|

GrumpyNooby

|

Oct 15 2020, 01:59 PM Oct 15 2020, 01:59 PM

|

|

QUOTE(enterthefatdragon @ Oct 15 2020, 01:58 PM) haiz, just got my platinum card this month, just saw statement oredi charging me rm 25 service tax first month itself?? New card will be charged for RM 25 card service tax. Your acquisition gift should cover this cost. |

|

|

|

|

|

GrumpyNooby

|

Oct 15 2020, 04:08 PM Oct 15 2020, 04:08 PM

|

|

QUOTE(taiping... @ Oct 15 2020, 04:03 PM) RM0.00 StanChart: Purchase for MYR4.00 from a/c **2878 @ 15Oct20 15:55:59 is successful at BOOST APPEC. Did not perform? Pls contact the bank This is the first time I top up rm100 thru boost. What is the rm4? Hmmm Pre-authorization amount and will be reversed almost instantly. |

|

|

|

|

|

GrumpyNooby

|

Oct 15 2020, 06:00 PM Oct 15 2020, 06:00 PM

|

|

QUOTE(naruko85 @ Oct 15 2020, 05:53 PM) i just top up boost, not sure still can get cashback or not No "Fully Redeemed" announcement made in FB. You may take the risk. |

|

|

|

|

|

GrumpyNooby

|

Oct 16 2020, 09:25 AM Oct 16 2020, 09:25 AM

|

|

QUOTE(enterthefatdragon @ Oct 16 2020, 09:23 AM) wait there are quota daily?? Not daily quota. The whole round quota. QUOTE Campaign Mechanics

1. During the Campaign Period, Customers who top up minimum of RM 100 into Boost e-wallet using selected Standard Chartered Bank Malaysia Berhad’s credit cards (“Transaction”) will get RM 10 cashback (“Cashback”).

2. The Campaign will be divided into four (4) rounds (“Round”) as stipulated below:

a. First Round: 15 August 2020 until 14 September 2020;

b. Second Round : 15 September 2020 until 14 October 2020; and

c. Third Round: 15 October 2020 until 14 November 2020.

d. Fourth Round: 15 November 2020 until 14 December 2020

3. Each Customer will only receive a maximum of one (1) Cashback for each Round.

4. Cashback is limited to a total limit of RM30,000 per Round, on a first come-first served basis. This post has been edited by GrumpyNooby: Oct 16 2020, 09:28 AM |

|

|

|

|

|

GrumpyNooby

|

Oct 16 2020, 09:33 AM Oct 16 2020, 09:33 AM

|

|

QUOTE(enterthefatdragon @ Oct 16 2020, 09:30 AM) alright tq  been using SC cards for some time used to take their cash back to redeem items and last was cash back now i have RM 500 plus and just realised now is point system items redemptions

so the RM 500 can only cash back??Sorry, I don't really get you. The only I shared earlier is SC x Boost campaign. Not related to card benefits cash back/rewards/points. |

|

|

|

|

|

GrumpyNooby

|

Oct 16 2020, 10:54 PM Oct 16 2020, 10:54 PM

|

|

QUOTE(kennywee92 @ Oct 16 2020, 10:50 PM) Would like to know retail transaction meaning spending at physical store only ? No. Both online and offline except those under exclusion list. QUOTE Retail transactions exclude cash advances, cash withdrawals, charges for cash advance or cash withdrawals, annual fees, interest, finance charges, late payments fees, disputed transactions, Balance Transfer/ Balance Transfer Plus, Flexi-on-Balance/ Flexi-on-Balance Plus, FlexiPay/FlexiPay Plus, Cheque-On-Call and Cheque-On-Call Plus. |

|

|

|

|

|

GrumpyNooby

|

Oct 17 2020, 07:00 PM Oct 17 2020, 07:00 PM

|

|

QUOTE(WaCKy-Angel @ Oct 17 2020, 06:50 PM) Just activated my card today. Anyone can point me which posts the i can refer how to get best value cashback? I'm (have always) confused about the tiered % cashback and also the category based cashback. Plan accordingly using the below chart developed by the forumer here:  |

|

|

|

|

|

GrumpyNooby

|

Oct 17 2020, 07:58 PM Oct 17 2020, 07:58 PM

|

|

QUOTE(WaCKy-Angel @ Oct 17 2020, 07:41 PM) Meaning for the cashback of RM30 (excluding RM30 online) is tagged under "others" category at 0.2% ? Thats abit sad because UOB One and Citibank gives 0.5% cashback. The remaining RM 30 should come from Petrol, Auto-billing and/or other categories of 0.2% if RM 30 comes from online/e-commerce. This post has been edited by GrumpyNooby: Oct 17 2020, 08:01 PM |

|

|

|

|

|

GrumpyNooby

|

Oct 18 2020, 08:31 PM Oct 18 2020, 08:31 PM

|

|

QUOTE(icelander85 @ Oct 18 2020, 08:26 PM) I'm a SCB JOP card holder. Want to ask if anyone knows if Pay Direct using Setel is eligible for cashback or I will have to swipe the physical credit card for the cashback? QUOTE(ClarenceT @ Sep 25 2020, 05:32 PM) You shall have been notified by Setel on 17/9. (check your Setel App) Setel Wallet is no longer Petrol MCC. If you want to get Petrol MCC, you must use Setel CardTerus. |

|

|

|

|

|

GrumpyNooby

|

Oct 19 2020, 10:30 AM Oct 19 2020, 10:30 AM

|

|

QUOTE(Vex86 @ Oct 19 2020, 10:30 AM) when's the right time to ask for AF waiver yea? once annual fee appeared in statement? The CS can only waive or submit for waiver (or management review) on things that has been posted into online ledger. This post has been edited by GrumpyNooby: Oct 19 2020, 10:31 AM |

|

|

|

|

|

GrumpyNooby

|

Oct 20 2020, 12:42 PM Oct 20 2020, 12:42 PM

|

|

QUOTE(lilsunflower @ Oct 20 2020, 12:39 PM) I don't think its limited to high spenders only. I've been getting waiver / rebate for AF and SST since forever, but I only spend RM1,500 (LFC) and RM2,500 (JOP) per month, just to maximise cashback. I think this is what most people do, but seems like not everyone is lucky. But you're a member of their Premium/Priority Banking right? |

|

|

|

|

|

GrumpyNooby

|

Oct 20 2020, 02:41 PM Oct 20 2020, 02:41 PM

|

|

QUOTE(lilsunflower @ Oct 20 2020, 02:40 PM) Lol, their "Priority Banking" is a meaningless status that many people have. I've never even spoken to my RM before. All I have is max 100k inside just to make use of the PSA rate (which is better than most FDs). Also I only got PB recently. Prior to that, AF and SST also "waived" immediately upon request.Different bank, different policy for handling AF and SST. |

|

|

|

|

|

GrumpyNooby

|

Oct 20 2020, 06:17 PM Oct 20 2020, 06:17 PM

|

|

QUOTE(fense @ Oct 20 2020, 06:14 PM) Hi, new to LFC. may I ask is boost top up eligible for cashback? as I saw my statement no cashback. but term and condition does not excluded it. Yes. Cash back is not automatically credited into statement on statement date. QUOTE We will credit the amount of the Cashback to your credit card account or any other account we designate within the 60 days after the end of the relevant transaction months. All Cashback earned will not be automatically credited in the form of cash to your account. Cashback earned will only be redeemable via https://360rewards.standardchartered.com/my. Please refer to the Cashback Programme terms in the Rewards Terms. https://av.sc.com/my/content/docs/my-client...credit-card.pdfCash back for September spending is not ready for redemption yet. This post has been edited by GrumpyNooby: Oct 20 2020, 06:19 PM |

|

|

|

|

|

GrumpyNooby

|

Oct 20 2020, 06:25 PM Oct 20 2020, 06:25 PM

|

|

QUOTE(mamamia @ Oct 20 2020, 06:22 PM) How to become PB with 100k in the bank? I thought PB only if u have AUM of 250k Premium Banking: 100k Priority Banking: 250k This post has been edited by GrumpyNooby: Oct 20 2020, 06:26 PM |

|

|

|

|

|

GrumpyNooby

|

Oct 20 2020, 06:29 PM Oct 20 2020, 06:29 PM

|

|

QUOTE(fense @ Oct 20 2020, 06:29 PM) I know it don't credit automatically. But It don't show in statement as well? As I saw the statement having a cashback earn column, which is zero Have you redeemed it? |

|

|

|

|

|

GrumpyNooby

|

Oct 20 2020, 06:30 PM Oct 20 2020, 06:30 PM

|

|

QUOTE(mamamia @ Oct 20 2020, 06:27 PM) I thought she mentioned priority banking.. so suppose need 250k In May time, she has attained Premium Banking membership: QUOTE(lilsunflower @ May 13 2020, 04:55 PM) Wow, you're right. My statement 9 May still says "Personal Banking", but my internet banking portal says "Standard Chartered Premium" and even live chat is "Premium Executive". I guess the change just happened these few days. Gonna wait for my premium dude to call me so I can ask him WHAT'S IN IT FOR ME? |

|

|

|

|

Oct 15 2020, 07:16 AM

Oct 15 2020, 07:16 AM

Quote

Quote

0.0491sec

0.0491sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled