QUOTE(dasecret @ Oct 27 2016, 10:04 AM)

So what's the conclusion? Forget about AIF and Amasia REITs and head back to APDI (aka Ponzi 2.0) where the returns are?

Edited to a more familiar nickname to the fund

Nobody seem to respond to your concern.Edited to a more familiar nickname to the fund

I guess those invested in whatever fund they invested, they continue to hold them. Still hold hopes in them.

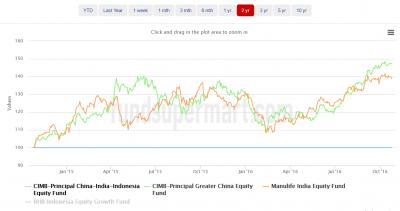

Recently there have more red than green in the world stock market.

Not sure if it is an indication of storm is coming.

Oct 27 2016, 11:23 AM

Oct 27 2016, 11:23 AM

Quote

Quote

0.0315sec

0.0315sec

0.54

0.54

6 queries

6 queries

GZIP Disabled

GZIP Disabled