QUOTE(Phoenix5175 @ Oct 7 2016, 03:34 PM)

Now what?

Fundsupermart.com v15, 基金超市第十五章 - Rise the Dragon

|

|

Oct 7 2016, 03:38 PM Oct 7 2016, 03:38 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

|

|

|

Oct 7 2016, 07:49 PM Oct 7 2016, 07:49 PM

|

Senior Member

3,541 posts Joined: Mar 2015 |

QUOTE(xuzen @ Oct 7 2016, 01:28 PM) Now you tok kok! Mana ada kan cheong bro. 15 years or even 10 years ago there was no FSM. Online trading for unit trusts pun tarak. How to check NAV and what not on a daily basis? I bet my last penny when you were much younger and newer to investing, you too were also very kan cheong about IRR, ROI, high NAV and low NAV wan, right? Don't bluff! Day in day out want to buy at the lowest NAV right? Then you realized now, 10 years ago NAV seems so low compared to today's NAV. Whatever a few days fluctuation at a small few % up and down, seems so insignificant liao hor.... Xuzen Now I see everything so canggih already. How times have changed! |

|

|

Oct 7 2016, 08:17 PM Oct 7 2016, 08:17 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

testing tag Avangelice Ramjade puchongite

edit: how to tag people post edit: testing yeah This post has been edited by AIYH: Oct 7 2016, 08:39 PM |

|

|

Oct 7 2016, 08:24 PM Oct 7 2016, 08:24 PM

|

All Stars

33,683 posts Joined: May 2008 |

|

|

|

Oct 7 2016, 09:03 PM Oct 7 2016, 09:03 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

Avangelice Ramjade puchongite

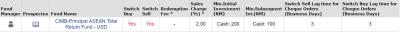

I asked FSM about the switch sell and siwtch buy time frame I will take these 2 funds and some variables to illustrate it as well as the attachment for both funds for reference. a) Switch Sell Fund : Affin Hwang AIIMAN Asia (Ex Japan) Growth Fund - MYR b) Switch Buy Fund : CIMB-Principal ASEAN Total Return Fund - USD c) Switch Sell Lag time for Cheque Orders (Business Days) : X (Affin switch sell days) d) Switch Buy Lag time for Cheque Orders (Business Days) : Y (CIMB switch buy days) Take this scenario: I switch sell from Affin fund on T (Monday 10/10 10:10), so it will transact on the day itself and priced on T (MOnday 10/10). They will receive the sales proceed from Affin on T+X, in this case, X = 5 days, so is T+5 (Monday 17/10). Then They will switch buy CIMB fund and priced on T+X+Y, in this case, Y = 3 days, so is T+5+3 = T+8 (Thursday 20/10). Finally, FSM will take 4 more days to show your holdings, so in total you gotta wait T+X+Y+4 = T+12 ( Wednesday 26/10). ***In summary, your switch sell price will be based on T and switch buy price will be based on T+X+Y Using the concept above, will take Ramjade case for, say switch sell Libra Asnita and switch buy kenanga growth fund. Switch sell Libra Asnita will priced at T and switch buy KGF will priced at T+2, and holding will be shown on T+6. Hope this make switch sell and switch buy understandable to those who want to know. Edit: Avangelice I made some correction to it, ps This post has been edited by AIYH: Oct 7 2016, 09:14 PM Attached thumbnail(s)

|

|

|

Oct 7 2016, 09:08 PM Oct 7 2016, 09:08 PM

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(AIYH @ Oct 7 2016, 09:03 PM) Avangelice Ramjade puchongite thank you!! that was informative and I will be sure to take this into consideration before doing a switch sell and switch buy in the future. I asked FSM about the switch sell and siwtch buy time frame I will take these 2 funds and some variables to illustrate it as well as the attachment for both funds for reference. a) Switch Sell Fund : Affin Hwang AIIMAN Asia (Ex Japan) Growth Fund - MYR b) Switch Buy Fund : CIMB-Principal ASEAN Total Return Fund - USD c) Switch Sell Lag time for Cheque Orders (Business Days) : X (Affin switch sell days) d) Switch Buy Lag time for Cheque Orders (Business Days) : Y (CIMB switch buy days) Take this scenario: I switch sell from Affin fund on T (Monday 10/10 10:10), so it will transact on the day itself and priced on T (MOnday 10/10). They will receive the sales proceed from Affin on T+X, in this case, X = 5 days, so is T+5 (Monday 17/10). Then They will switch buy CIMB fund and priced on T+X+Y no , in this case, Y = 3 days, so is T+4+5 = T+9 (Thursday 20/10). Finally, FSM will take 4 more days to show your holdings, so in total you gotta wait T+X+Y+4 = T+13 ( Wednesday 26/10). ***In summary, your switch sell price will be based on T and switch buy price will be based on T+X+Y Using the concept above, will take Ramjade case for, say switch sell Libra Asnita and switch buy kenanga growth fund. Switch sell Libra Asnita will priced at T and switch buy KGF will priced at T+2, and holding will be shown on T+6. Hope this make switch sell and switch buy understandable to those who want to know. pinky spider request this to be placed in the first post to all future threads and this particular version. |

|

|

|

|

|

Oct 7 2016, 09:16 PM Oct 7 2016, 09:16 PM

|

All Stars

33,683 posts Joined: May 2008 |

QUOTE(AIYH @ Oct 7 2016, 09:03 PM) Avangelice Ramjade puchongite This will mean FSM needs to correct their footnote document which generalized all switch-buy to be transacted on T+2 :-I asked FSM about the switch sell and siwtch buy time frame I will take these 2 funds and some variables to illustrate it as well as the attachment for both funds for reference. a) Switch Sell Fund : Affin Hwang AIIMAN Asia (Ex Japan) Growth Fund - MYR b) Switch Buy Fund : CIMB-Principal ASEAN Total Return Fund - USD c) Switch Sell Lag time for Cheque Orders (Business Days) : X (Affin switch sell days) d) Switch Buy Lag time for Cheque Orders (Business Days) : Y (CIMB switch buy days) Take this scenario: I switch sell from Affin fund on T (Monday 10/10 10:10), so it will transact on the day itself and priced on T (MOnday 10/10). They will receive the sales proceed from Affin on T+X, in this case, X = 5 days, so is T+5 (Monday 17/10). Then They will switch buy CIMB fund and priced on T+X+Y, in this case, Y = 3 days, so is T+4+5 = T+9 (Thursday 20/10). Finally, FSM will take 4 more days to show your holdings, so in total you gotta wait T+X+Y+4 = T+13 ( Wednesday 26/10). ***In summary, your switch sell price will be based on T and switch buy price will be based on T+X+Y Using the concept above, will take Ramjade case for, say switch sell Libra Asnita and switch buy kenanga growth fund. Switch sell Libra Asnita will priced at T and switch buy KGF will priced at T+2, and holding will be shown on T+6. Hope this make switch sell and switch buy understandable to those who want to know. For example :- https://www.fundsupermart.com.my/main/buyse...do?code=MYHWDBS The footnote says T+2 for switch-buy. Which is wrong. T+2 will be common but not applicable to all. |

|

|

Oct 7 2016, 09:19 PM Oct 7 2016, 09:19 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

I am about to make some changes to my portfolio...then I noticed.

ex originally I have only Ponzi 2.0 allocated 20.90% is having profit of 7.35% ROI and 4.54% ROI since Mid Jan if I switched out 8.31% of value in RMx of this 20.90% to Cimb Bond fund (buy with RMx) my Ponzi 2.0 allocation from 20.90% >>12.60% my Ponzi 2.0 profits from 7.35% >> 12.81% my Ponzi 2.0 profits since mid Jan 4.54% >> 10% my total available balance are SAME my IRR remains the SAME my ROI since invest remains the SAME the money is in circulation in the portfolio, no service charges... if my EXCEL file correct? I think something WRONG with my excel file... if it is correct....if I were to "play switching around".....my individual ROI & IRR of PONZI 2.0 just goes up.... SIFUs sekelian.... ever notice or experienced this before? pls teach..where did I go wrong. oohh. I think I am using calculation as EXAMPLE original invest value RM 20000 = 20000 units original NAV = 1 now NAV = 2 I sell 10000 units x 2 = RM 20000 invested value is RM 20000 - sell RM 20000 = 0 Balance unit available is 10000 with "0" cost.... looks funny....how should I do it.....?? This post has been edited by yklooi: Oct 7 2016, 09:29 PM Attached thumbnail(s)

|

|

|

Oct 7 2016, 09:22 PM Oct 7 2016, 09:22 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(puchongite @ Oct 7 2016, 09:16 PM) This will mean FSM needs to correct their footnote document which generalized all switch-buy to be transacted on T+2 :- I think the footnote is illustrating an example similar to my one For example :- https://www.fundsupermart.com.my/main/buyse...do?code=MYHWDBS The footnote says T+2 for switch-buy. Which is wrong. T+2 will be common but not applicable to all. |

|

|

Oct 7 2016, 09:39 PM Oct 7 2016, 09:39 PM

|

All Stars

24,382 posts Joined: Feb 2011 |

|

|

|

Oct 7 2016, 09:48 PM Oct 7 2016, 09:48 PM

|

All Stars

33,683 posts Joined: May 2008 |

|

|

|

Oct 7 2016, 09:51 PM Oct 7 2016, 09:51 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Oct 7 2016, 09:39 PM) If you want parking for money, just directly invest via fpx and wait until few days before you need the money then you sell, that will just be T+4.After all, it is not for emergency liquidity fund, that belongs to eGIA On the other hand, if you want park for very short term future potential investment, just sell to CMF or directly to ur banking account and reinvest later through either platform will do I think the switch system is still ok for normal transfer between funds but not for dynamic "taking advantage of maket fluctuation" type, you will die just for waiting them to show up after each switch Nope,not to spark any argument on it |

|

|

Oct 7 2016, 10:01 PM Oct 7 2016, 10:01 PM

|

All Stars

24,382 posts Joined: Feb 2011 |

QUOTE(puchongite @ Oct 7 2016, 09:48 PM) I will never use CMF as long as eGIA-i rates beat it. QUOTE(AIYH @ Oct 7 2016, 09:51 PM) On the other hand, if you want park for very short term future potential investment, just sell to CMF or directly to ur banking account and reinvest later through either platform will do That's my parkong definition for FSM Nope,not to spark any argument on it For now I will use eGIA-i as parking. |

|

|

|

|

|

Oct 7 2016, 10:06 PM Oct 7 2016, 10:06 PM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Ramjade @ Oct 7 2016, 10:01 PM) I will never use CMF as long as eGIA-i rates beat it. But if you have some not so emergency fund and can take a bit risk, libra asnita still provide better returns compare to eGIA and ASNBThat's my parkong definition for FSM For now I will use eGIA-i as parking. Diversify some money to it ma, not a replacement of eGIA also I used all of them for different purposes No harm trying it, experience at least once with minimum money, you might have different opinion after trying it This post has been edited by AIYH: Oct 7 2016, 10:09 PM |

|

|

Oct 8 2016, 08:50 AM Oct 8 2016, 08:50 AM

|

Senior Member

5,272 posts Joined: Jun 2008 |

looks like I need to really set up an instant liquidity account and also a bridge to fsm while balancing the rates of eGIA-i and fixed income.

after seeing AIYH post on down time and lag and ramjade for chiming in I have been neglecting to create a real instant emergency fund. so let me get this straight. rates of eGIA-i > cash management account >savings account three of which are able to liquid cash ASAP. to cut short the switch sell and buy of T12 days which we found out, it is better to sell the fund first then on the same day buy the intended fund with your other savings parked in your eGIA-i? I always thought the fixed income fund will be my ammo storage. guess not. |

|

|

Oct 8 2016, 08:58 AM Oct 8 2016, 08:58 AM

|

All Stars

24,382 posts Joined: Feb 2011 |

QUOTE(Avangelice @ Oct 8 2016, 08:50 AM) looks like I need to really set up an instant liquidity account and also a bridge to fsm while balancing the rates of eGIA-i and fixed income. I can only answered you the bolded part.after seeing AIYH post on down time and lag and ramjade for chiming in I have been neglecting to create a real instant emergency fund. so let me get this straight. rates of eGIA-i > cash management account >savings account three of which are able to liquid cash ASAP. to cut short the switch sell and buy of T12 days which we found out, it is better to sell the fund first then on the same day buy the intended fund with your other savings parked in your eGIA-i? I always thought the fixed income fund will be my ammo storage. guess not. Yes. The interest of eGIA-i > cash management account >savings account. Liquidity wise it's very liquid however note that eGIA-i can only be access from 6am-10pm. One cannot uplift it in the middle of the night. So if you want emergency fund in the middle of the night, then eGIA-i won't be able to help you. eGIA-i depends on OPR. If OPR is reduced further, it will drop. Whether it drop > CMF, I don't know. But seeing that CMF invest in FDs, it should also drop. For me personally, I won't use the switch-buy feature to get best NAV (eg india incident). I will use my instant liquidity stock i.e eGIA-i. Don't listen to me. I am noob. Just starting out. |

|

|

Oct 8 2016, 09:31 AM Oct 8 2016, 09:31 AM

|

Senior Member

1,166 posts Joined: Jul 2016 |

QUOTE(Avangelice @ Oct 8 2016, 08:50 AM) looks like I need to really set up an instant liquidity account and also a bridge to fsm while balancing the rates of eGIA-i and fixed income. Depending on which fixed income fund you put as your ammo, you might need to check the difference between their switch sell lag time (transfer fund to fund) and sell off time (transfer to CMF or bank).after seeing AIYH post on down time and lag and ramjade for chiming in I have been neglecting to create a real instant emergency fund. so let me get this straight. rates of eGIA-i > cash management account >savings account three of which are able to liquid cash ASAP. to cut short the switch sell and buy of T12 days which we found out, it is better to sell the fund first then on the same day buy the intended fund with your other savings parked in your eGIA-i? I always thought the fixed income fund will be my ammo storage. guess not. Refer these below to understand more. Switching Fund FAQ Intra Switch Table Inter Switch Table Selling Funds FAQ Depends on your investment amount and how much you reserve in your liquid assets vs fixed income fund. If your planned investment amount is < 10k, then i think the method of selling fixed income fund and investing same day via eGIA is a good method But fixed income fund selling will still need 4 working days (mostly, depend on funds, refer to selling FAQ) to reach CMF/bank, so you might need to ensure your emergency amount will still be sufficient for the following 4 days after you invest with your emergency fund |

|

|

Oct 8 2016, 10:00 AM Oct 8 2016, 10:00 AM

|

All Stars

33,683 posts Joined: May 2008 |

QUOTE(Ramjade @ Oct 8 2016, 08:58 AM) I can only answered you the bolded part. Inter switch will generally have 2 days lag. But intra switch will generally have zero lag ( there is a list of exceptions ).Yes. The interest of eGIA-i > cash management account >savings account. Liquidity wise it's very liquid however note that eGIA-i can only be access from 6am-10pm. One cannot uplift it in the middle of the night. So if you want emergency fund in the middle of the night, then eGIA-i won't be able to help you. eGIA-i depends on OPR. If OPR is reduced further, it will drop. Whether it drop > CMF, I don't know. But seeing that CMF invest in FDs, it should also drop. For me personally, I won't use the switch-buy feature to get best NAV (eg india incident). I will use my instant liquidity stock i.e eGIA-i. Don't listen to me. I am noob. Just starting out. So if I am targeting to invest in cimb equity fund, may be can consider parking into cimb bond fund in the mean time ? LOL. This post has been edited by puchongite: Oct 8 2016, 10:00 AM |

|

|

Oct 8 2016, 10:07 AM Oct 8 2016, 10:07 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

a "friend of mine"...always has a minimum

1) 1/2 month expenses in CASH lying around the house 2) 1 monthly expenses in Saving a/c of EACH of the 3~4 different banks with ATM cards 3) 3 months of saving in FDs on monthly renewal mode that is "his" 1st pockets of Emergency fund that is to be "VERY" liquid. there is really no right or wrong methods to have in an emergency fund. just that don't be too annalistic in "concerning" too much about the "losses" of some % of interest on this emergency fund....not to the extend of calculating to the precise "lag" time in days of the x% of emergency cash in the said a/c.... concentrate more into how/where to position one funds in the portfolio; be it includes among other things like; Vanguard credit ninja trick, RSP ninja trick, abit of timing (buy lower |

|

|

Oct 8 2016, 10:14 AM Oct 8 2016, 10:14 AM

|

Senior Member

5,272 posts Joined: Jun 2008 |

QUOTE(T231H @ Oct 8 2016, 10:07 AM) a "friend of mine"...always has a minimum 1/2 half month expenses lying around the house. wah like that the officer who kept millions on millions of cash in the house took this literally. 1) 1/2 month expenses in CASH lying around the house 2) 1 monthly expenses in Saving a/c of EACH of the 3~4 different banks with ATM cards 3) 3 months of saving in FDs on monthly renewal mode that is "his" 1st pockets of Emergency fund that is to be "VERY" liquid. there is really no right or wrong methods to have in an emergency fund. just that don't be too annalistic in "concerning" too much about the "losses" of some % of interest on this emergency fund....not to the extend of calculating to the precise "lag" time in days of the x% of emergency cash in the said a/c.... concentrate more into how/where to position one funds in the portfolio; be it includes among other things like; Vanguard credit ninja trick, RSP ninja trick, abit of timing (buy lower jokes aside. Thank you for the information and yes I was anal over it as there are days I feel I am really broke as I don't have much physical money when everything is in accounts, properties, unit trusts and fixed deposits |

|

Topic ClosedOptions

|

| Change to: |  0.0481sec 0.0481sec

0.87 0.87

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 01:12 AM |