QUOTE(wil-i-am @ Sep 15 2016, 03:07 PM)

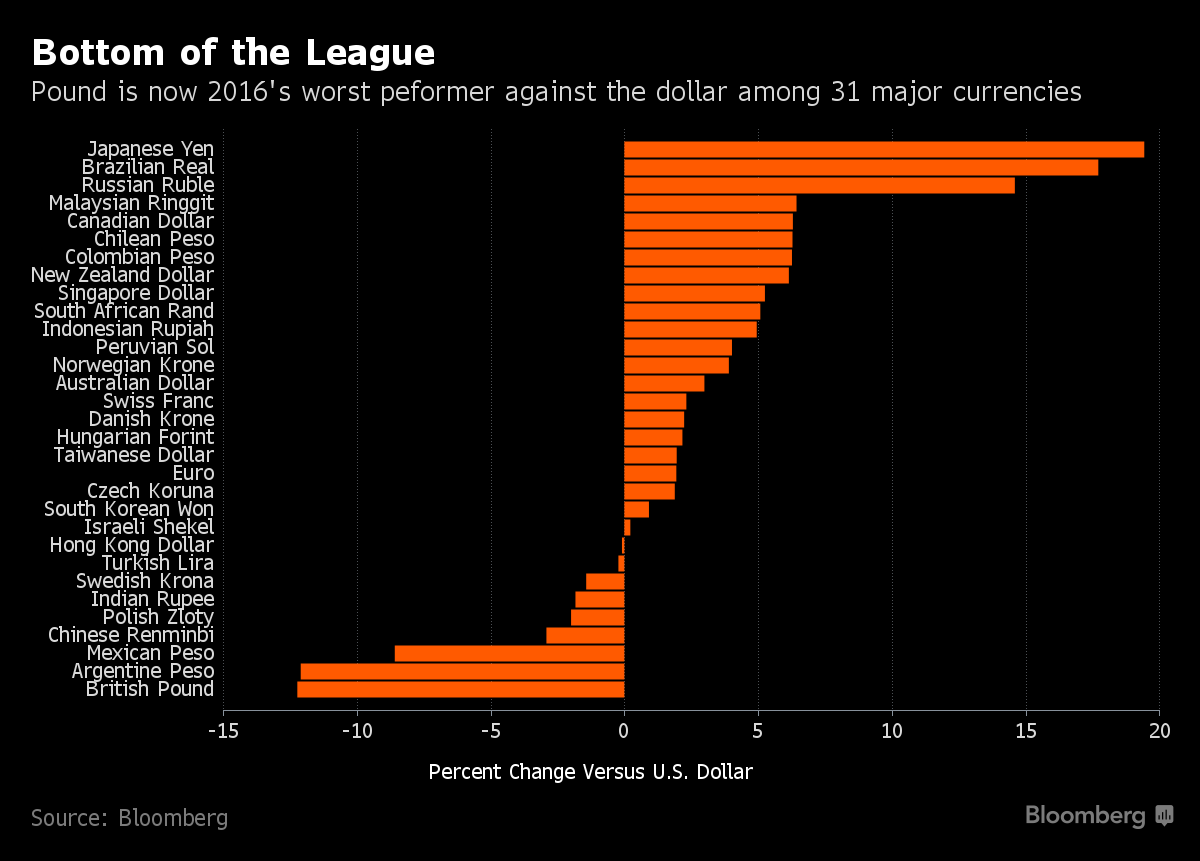

Not sure whether 2017 Budget on 21/10 could revive MYR

the tabled one will probably attempt to do that by showing a smaller deficit than budget 2016, bn mp's will just ok even if it looks unreal.

then, budget 2016 actual will need a big amendment becos of overspend.

then, amend 2017 budget with big deficit.

we see that every year, more so this time.

local people may get fooled, but int'l banking and foreign funds community will see it right through, no use.

can expect attempts to keep gdp growth with more debt and weaker currency, higher inflation.

world bank, adb have been "warning" gomen since 2 years ago that there is little room for the economy in case of a downturn and global problems. becos of high debt, low productivity, low inv, big civil service, corruption.

and here we are - low oil prices, slowing global growth... and 1mdb, incr br1m cash, high household debt.

dare not imagine what will happen if a major global financial crisis comes now.

Sep 14 2016, 11:49 AM

Sep 14 2016, 11:49 AM

Quote

Quote

0.0937sec

0.0937sec

0.36

0.36

7 queries

7 queries

GZIP Disabled

GZIP Disabled