QUOTE(strace @ Nov 18 2016, 01:49 PM)

some of our brightest politicians will say, "not the worst, we are better than mexico and south africa la... USD/MYR v4

USD/MYR v4

|

|

Nov 18 2016, 02:14 PM Nov 18 2016, 02:14 PM

Return to original view | Post

#201

|

All Stars

24,454 posts Joined: Nov 2010 |

|

|

|

|

|

|

Nov 18 2016, 04:22 PM Nov 18 2016, 04:22 PM

Return to original view | Post

#202

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(nexona88 @ Nov 18 2016, 03:29 PM) The most brilliant one was when it first started to fall 2 yrs ago, some acused a media owner of speculating currency, many believed.Even now, many are still thinking if it is soros or dr m or lge sabotaging the rm. Mo1 and band of thieves, 100pc innocent, somemore got donation in billions, surely strengthen rm. This is the world around us now. |

|

|

Nov 18 2016, 06:08 PM Nov 18 2016, 06:08 PM

Return to original view | Post

#203

|

All Stars

24,454 posts Joined: Nov 2010 |

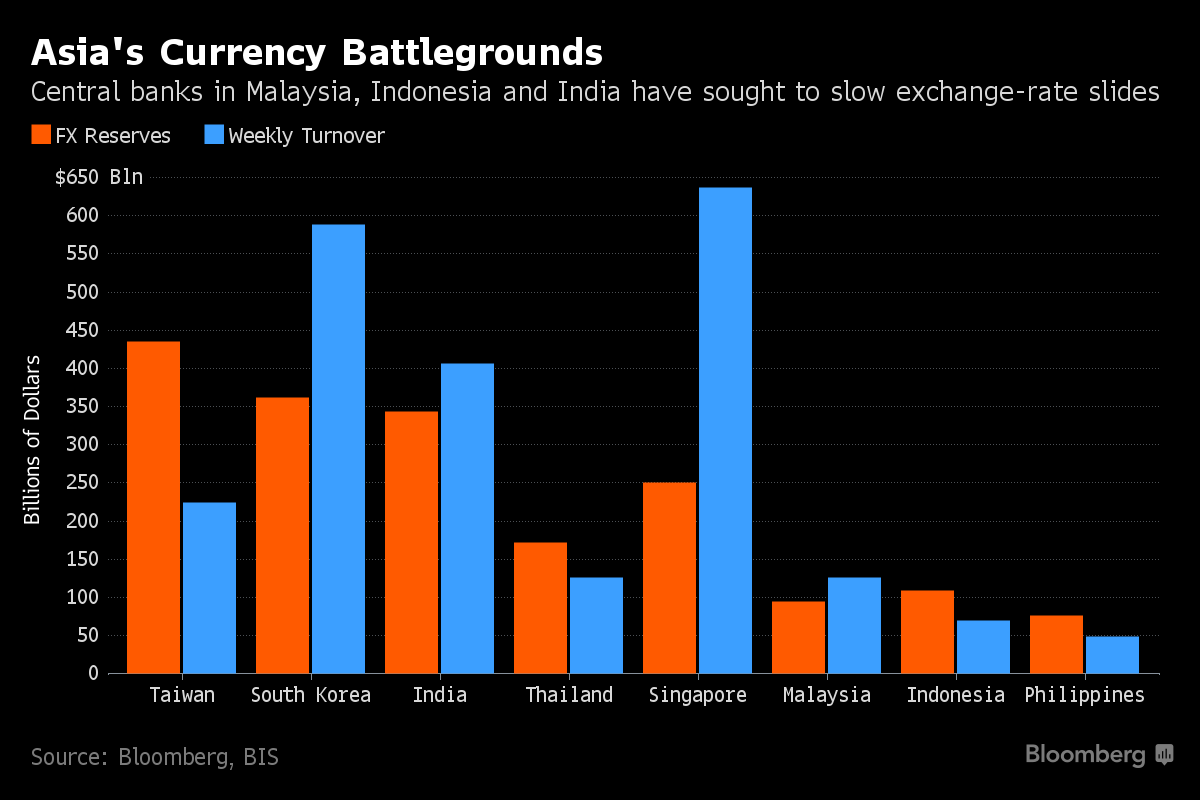

QUOTE “We think Asian central banks will not be worried about seeing their currencies depreciate against the U.S. dollar,” said Enrique Diaz-Alvarez, chief risk officer at foreign-exchange broker Ebury in New York, Asia’s most-accurate forecaster last quarter. “They may smooth out spikes in volatility, but this is far less expensive in terms of foreign-exchange reserves and they have more than plenty for that. We think that the story now is not so much a flight from Asian currencies but as a pure dollar rally.” http://www.bloomberg.com/news/articles/201...urrency-markets  |

|

|

Nov 18 2016, 06:58 PM Nov 18 2016, 06:58 PM

Return to original view | Post

#204

|

All Stars

24,454 posts Joined: Nov 2010 |

for future reference:

QUOTE The USDMYR increased 0.0113 or 0.26% to 4.4058 on Friday November 18 from 4.3945 in the previous trading session. The USDMYR changed +2.94% during the last week, +5.15% during the last month and +2.89% during the last year. Historically, the Malaysian Ringgit reached an all time high of 4.71 in January of 1998 and a record low of 2.10 in October of 1978. 17 Nov 2016 10:50 UTC - 18 Nov 2016 10:55 UTC USD/MYR close:4.42807 low:4.36925 high:4.42807http://www.tradingeconomics.com/malaysia/currency |

|

|

Nov 18 2016, 09:12 PM Nov 18 2016, 09:12 PM

Return to original view | Post

#205

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(langstrasse @ Nov 18 2016, 09:04 PM) That'll be a huge impact on confidence, my guess is BNM would be resorting to some severe steps if that happens or if it seems likely to happen. what do u think bnm can do that will make it better?Also, politically that would be a major risk to the ruling govt, especially since rumours of elections are coming up. mgs yield.. ooo... touched 4.46% today. http://www.bnm.gov.my/index.php?tpl=2014_govtsecuritiesyield all time high is 5.0%, i think. |

|

|

Nov 18 2016, 09:17 PM Nov 18 2016, 09:17 PM

Return to original view | Post

#206

|

All Stars

24,454 posts Joined: Nov 2010 |

|

|

|

|

|

|

Nov 19 2016, 11:07 AM Nov 19 2016, 11:07 AM

Return to original view | Post

#207

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(Hansel @ Nov 19 2016, 06:55 AM) Well, there is one more way - borrow from the IMF or the World Bank, but this way comes with its price to pay, namely must abide by the demands of the world body. QUOTE(xpmm @ Nov 19 2016, 10:39 AM) good education, hard work and production has been thrown out.debt, free money and theft in full swing. for decades. now, there are only 2 ways to deal with the consequences - borrow or pawn. borrowing from IMF won't happen as the terms and conditions will not be accepted. pawning and selling major national assets is the only way out now. already happening. |

|

|

Nov 20 2016, 04:07 PM Nov 20 2016, 04:07 PM

Return to original view | Post

#208

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(Hansel @ Nov 20 2016, 02:52 PM) Relationship bewteen the MAS and with Bank Negara is falling apart ! BNM is accusing, publicly,... Singapore of manipulating the value of the Ringgit because of the NDF trades which are mostly traded in Sgp. Maybe,... soon,... can't send $$$ to Sgp anymore. It all boils down to confidence.http://www.thestar.com.my/business/busines...k-wipe-out-ndf/ Just my personal opinion,... Bank Negara is shivering everyday as the RM goes through the days now,.... Which is lacking at this time. We will just have to see if onshore rates will improve or worsen. I hope bnm does not push too hard to drive away money in hards aseets now owned by foreigners, foreign cos. “At the end of the day, traders will flock to markets where there is liquidity and where the prices reflect actual supply and demand. Bank Negara has to take persuasive measures to convince investors that the onshore market can meet those expectations,” he says. This post has been edited by AVFAN: Nov 20 2016, 04:23 PM |

|

|

Nov 20 2016, 06:00 PM Nov 20 2016, 06:00 PM

Return to original view | Post

#209

|

All Stars

24,454 posts Joined: Nov 2010 |

Raw deal for bnm, nightmare for governor.

Every year, billions of free money, tens of billions wasted, tens of billions stolen, tens of billions illicitly gone outside. Result is hundreds of billions, almost 1 trlllion in debt. Yet the job to strengthen currency. Mission impossible. I dont want the job. |

|

|

Nov 21 2016, 02:51 PM Nov 21 2016, 02:51 PM

Return to original view | Post

#210

|

All Stars

24,454 posts Joined: Nov 2010 |

Trouble, trouble...

https://www.bloomberg.com/gadfly/articles/2...cy-intervention Also saw on bloomberg, indonesia and philippines planning to borrow a few billion in dollar debt market. Will be expensive. |

|

|

Nov 21 2016, 05:57 PM Nov 21 2016, 05:57 PM

Return to original view | Post

#211

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(Hansel @ Nov 21 2016, 04:37 PM) Looks like the whole world is trying to tell BNM that what they are doing is wrong,... but,... BNM just couldn't be bothered. ... They just continued doing the same thing everyday mkt opens. what is scary is the harder it tries, the worse it may get.sometimes i think it is a fundamental problem of the attitude of not preparing for tough times, assuming all is always hunky-dory, the world is kind, handicaps and privileges are global. while plundering, wastage and stealing have no consequences. (here's a new one:) http://www.malaysiakini.com/news/363616 if the combined trump-fed-oil-mo1 mix drags for another year, i see a worrisome scenario. it will not be about aussie steaks or iphones but imported onions, sugar and other daily essentials. This post has been edited by AVFAN: Nov 21 2016, 05:57 PM |

|

|

Nov 21 2016, 06:43 PM Nov 21 2016, 06:43 PM

Return to original view | Post

#212

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(Hansel @ Nov 21 2016, 06:39 PM) There is a hostage situation here. if foreign bond-holders wish to exit and convert back their funds to the home currencies, the BNM wants them to sign an undertaking saying that these parties are never to do ndf transactions again in future. These requests have already been sent to the COMPLIANCE DEPTS of the respective foreign banks. if this is true, PARIAH in the making. So,... they can't exit ! |

|

|

Nov 21 2016, 07:56 PM Nov 21 2016, 07:56 PM

Return to original view | Post

#213

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(Hansel @ Nov 21 2016, 06:51 PM) maybe shy... there was talk criticizing him as "incompetent" as he said "intervention" when it was a capital control (about NDF's)i think he is doing BOTH. how badly has the RM done? last 1 month: GAINED against mexican peso, south african rand, turkish lira. LOST to all others. Lost even to rupiah. new reads: http://www.themalaymailonline.com/opinion/...stopher-langner http://www.cnbc.com/2016/11/21/why-malaysi...mp-tantrum.html http://www.bloomberg.com/news/articles/201...ringgit-sellers This post has been edited by AVFAN: Nov 21 2016, 08:40 PM |

|

|

|

|

|

Nov 22 2016, 03:46 PM Nov 22 2016, 03:46 PM

Return to original view | Post

#214

|

All Stars

24,454 posts Joined: Nov 2010 |

Anyone noticed...

The thai baht is now 8 to 1. Think at money changer, u get less than 8 for rm1. China rmb 1.5 to rm1. Happy year end holidays. |

|

|

Nov 22 2016, 06:18 PM Nov 22 2016, 06:18 PM

Return to original view | Post

#215

|

All Stars

24,454 posts Joined: Nov 2010 |

|

|

|

Nov 22 2016, 10:09 PM Nov 22 2016, 10:09 PM

Return to original view | Post

#216

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(Shanglin @ Nov 22 2016, 09:21 PM) May I know what website you are using to get the 4.43 figure? I'm using xe.com which for the past 24 hours the graph is virtually flat and the max is 4.4164 most of the time http://www.bnm.gov.my/?tpl=exchangeratesthis raises something interesting. is the offshore NDF now seeing a stronger RM due to rising oil prices but onshore rates say otherwise? an unintended consequence of an unnecessary BNM distortion? new read: QUOTE Malaysian Ringgit’s Drop Toward Lowest Since 1998 Resumes: Chart  https://www.bloomberg.com/news/articles/201...8-resumes-chart This post has been edited by AVFAN: Nov 22 2016, 10:20 PM |

|

|

Nov 23 2016, 11:00 AM Nov 23 2016, 11:00 AM

Return to original view | Post

#217

|

All Stars

24,454 posts Joined: Nov 2010 |

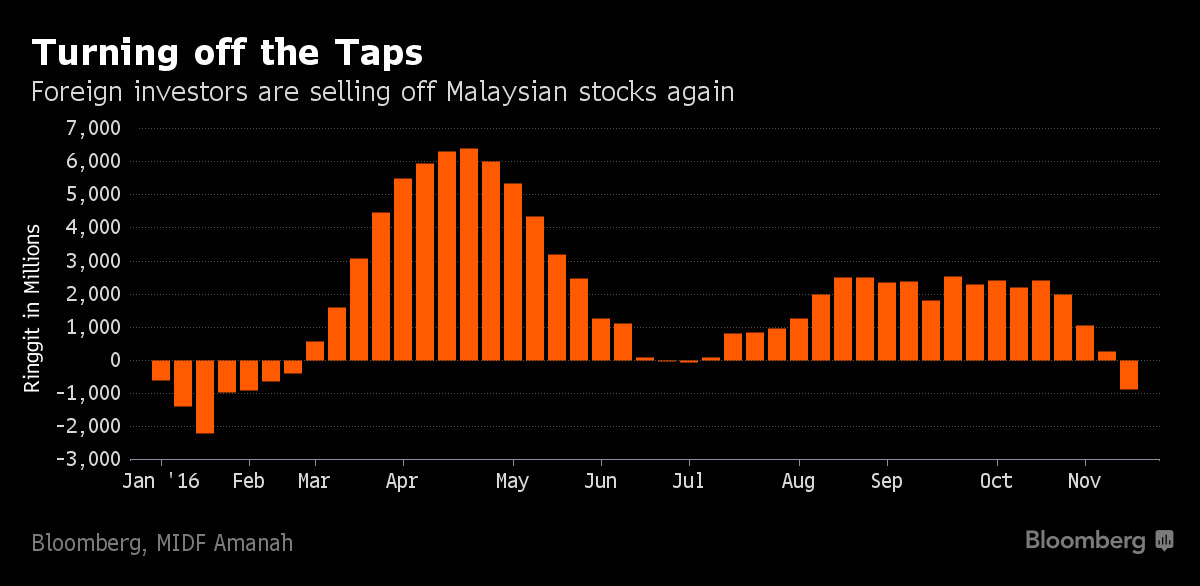

QUOTE(prophetjul @ Nov 23 2016, 09:13 AM) it will be surprising if otherwise.no support for RM; only arrests, hudud talk and more plundering. QUOTE In the post-Trump era, emerging markets have been feeling the heat. Malaysia's ringgit plunged on Tuesday to be less than 1 percent from the 4.48 per dollar it reached in September of last year, the weakest level since the Asian financial crisis in the late 1990s. Sentiment is little different in the country's equities market, where investors sold 1.1 billion ringgit ($248 million) of shares through Friday in the biggest weekly exodus since June. https://www.bloomberg.com/news/articles/201...back-to-markets Asia’s Worst Currency Slump Takes Malaysian Rate Cut Off Table http://www.bloomberg.com/news/articles/201...l-bank-on-guard Malaysia stand to lose with demise of TPP http://www.freemalaysiatoday.com/category/...-demise-of-tpp/ This post has been edited by AVFAN: Nov 23 2016, 11:04 AM |

|

|

Nov 23 2016, 11:47 AM Nov 23 2016, 11:47 AM

Return to original view | Post

#218

|

All Stars

24,454 posts Joined: Nov 2010 |

|

|

|

Nov 23 2016, 04:06 PM Nov 23 2016, 04:06 PM

Return to original view | Post

#219

|

All Stars

24,454 posts Joined: Nov 2010 |

QUOTE(limeuu @ Nov 23 2016, 03:36 PM) bnm doesn't have much of an option anyway...reducing rate would be suicide at this point....raising rate will also be killing a lot of businesses and people, who are highly geared...so no brainer staying put.... I am sure the richest and most powerful elite are already well prepared well, usd or diamonds or swiss banks.however, come next month, after the fed raise rates, then they are really in trouble...who to defend?...the myr value and the bigger economy?....or local geared businesses and individuals...many may be malay/umno linked... the sensible move is raise rates too...debts can be restructured and mitigated...but politically may not be acceptable... So, can expect bnm to cut rates eventually if threat of recession looms. Latest read... http://www.wsj.com/articles/malaysia-strug...lide-1479803968 |

|

|

Nov 23 2016, 04:37 PM Nov 23 2016, 04:37 PM

Return to original view | Post

#220

|

All Stars

24,454 posts Joined: Nov 2010 |

what bull is this - inflation will still be that low, prices will not go up much?!

QUOTE Malaysia Keeps Rates on Hold as Currency Tumbles Once among Southeast Asia’s powerhouses, Malaysia’s economy is forecast to expand at a seven-year low of 4 percent to 4.5 percent in 2016. The central bank said inflation will probably be at the lower end of the 2 percent to 2.5 percent forecast range for this year and is “expected to remain relatively stable in 2017.” https://www.bloomberg.com/news/articles/201...urrency-tumbles  |

|

Topic ClosedOptions

|

| Change to: |  0.0920sec 0.0920sec

0.35 0.35

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 08:35 AM |