QUOTE(allenpee85 @ Apr 18 2016, 08:09 AM)

Possible, but you can't predict it. So don't waste your time.Fundsupermart.com v14, Happy 牛(bull!) Year

Fundsupermart.com v14, Happy 牛(bull!) Year

|

|

Apr 18 2016, 01:50 PM Apr 18 2016, 01:50 PM

Show posts by this member only | IPv6 | Post

#341

|

Senior Member

3,806 posts Joined: Feb 2012 |

|

|

|

|

|

|

Apr 18 2016, 02:28 PM Apr 18 2016, 02:28 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

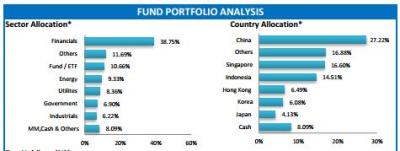

QUOTE(dasecret @ Apr 18 2016, 11:50 AM) Wow, what a drastic move Yeah, I liked Ponzi 2.0 for its low volatility, which was around 8.XX% back in 2015. Now its volatility has creeped up to almost 11.0%, it has exceeded my risk appetite, hence I change it to RHB Asian Income where its volatility is around 7.XX%. I'm actually thinking to dump Asian total return - main reason - the exposure to China corporate bond is 27% and 38% in financial services in terms of sector I'm quite wary of the debt bubble in china.... Between the 3 funds my fav is Asian income but the fund it feeds into is not top notch also, but it's mixed assets including REITs, so it's more stable What you say about RHB Asian Total Return is purely perception and personal opinion because the numbers presented are still ok. Xuzen This post has been edited by xuzen: Apr 18 2016, 02:29 PM |

|

|

Apr 18 2016, 02:37 PM Apr 18 2016, 02:37 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(allenpee85 @ Apr 18 2016, 08:09 AM) Hi I m new and noob here Back in mid 2015, I bought into TA Global Tech and sold it 3 months later for a 15% gain. However, these type of trade is not easily repeatable and it happens because I so happen to be already in the market. Thinking to invest to kinda unit trusts seeking for some guidances. How to create account in Fundsupermart? What is IRR? What is the charges of a single transaction? E.g. RM 5k Have anyone making more than 8 pct from single fund in a short period? Let's say 6 months. That is why the old adage; "investing gain is not about timing the market but the time you are in the market". Ponder on this you must. Xuzen |

|

|

Apr 18 2016, 02:39 PM Apr 18 2016, 02:39 PM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(xuzen @ Apr 18 2016, 02:28 PM) Yeah, I liked Ponzi 2.0 for its low volatility, which was around 8.XX% back in 2015. Now its volatility has creeped up to almost 11.0%, it has exceeded my risk appetite, hence I change it to RHB Asian Income where its volatility is around 7.XX%. Hmm.... facts vs perceptionWhat you say about RHB Asian Total Return is purely perception and personal opinion because the numbers presented are still ok. Xuzen Actually I'm just parroting what the fund manager says .... http://www.fundsupermart.com.my/main/admin...eetMYRHBATR.pdf

But anyway, choice of funds and asset allocation is personal to a certain extend Just expressing my surprise with the sudden move from a pure equity fund to pure bond fund albeit in the same geographical market This post has been edited by dasecret: Apr 18 2016, 02:42 PM |

|

|

Apr 18 2016, 02:44 PM Apr 18 2016, 02:44 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(dasecret @ Apr 18 2016, 02:39 PM) Hmm.... facts vs perception Actually I'm just parroting what the fund manager says .... http://www.fundsupermart.com.my/main/admin...eetMYRHBATR.pdf But anyway, choice of funds and asset allocation is personal to a certain extend Just expressing my surprise with the sudden move from a pure equity fund to pure bond fund albeit in the same geographical market I decided to go with RHB Asian Income instead.... mixed asset fund, the so called "middle path". RHB ATRF volatility is even higher than RHB AIF Xuzen |

|

|

Apr 18 2016, 03:11 PM Apr 18 2016, 03:11 PM

|

Senior Member

5,750 posts Joined: Jan 2012 |

QUOTE(xuzen @ Apr 18 2016, 02:28 PM) Yeah, I liked Ponzi 2.0 for its low volatility, which was around 8.XX% back in 2015. Now its volatility has creeped up to almost 11.0%, it has exceeded my risk appetite, hence I change it to RHB Asian Income where its volatility is around 7.XX%. Yea. Its really depend how long you in that specific market....What you say about RHB Asian Total Return is purely perception and personal opinion because the numbers presented are still ok. Xuzen Take me as an example. I save myself from -8% to +6% in asx.. Some people just still stay (-). Thankfully I pull out to cut lost at the right time. They rhb total return seems good. 3m 6m also showing good sign. 0% sc. Seems good... But I guess I will wait a little bit longer since the 0% |

|

|

|

|

|

Apr 18 2016, 09:22 PM Apr 18 2016, 09:22 PM

|

Junior Member

95 posts Joined: May 2010 |

Does anyone know what's the differences between public mutual and Fundsupermart?

Can give some comparisons in terms of pro and con? |

|

|

Apr 18 2016, 09:50 PM Apr 18 2016, 09:50 PM

|

Junior Member

303 posts Joined: May 2010 From: Kurau Stone |

CHINA SAYS "NO DOLLARS" FOR NEW YUAN

Post by U.S.Reporter- Apr 13, 2016 In a shocking move likely to crush the US economy overnight, China is refusing to make its new gold-backed Yuan, convertible from or to US Dollars. The new Yuan will be introduced next Tuesday, April 19. When the International Monetary Fund (IMF) agreed to add the Yuan to the basket of world currencies used for Global Reserves and International Trade, they wanted China to make the Yuan more reliable as a currency. Since then, China has almost un-pegged its Yuan from the Dollar, allowing its value to fluctuate on world markets. But for years, China has been amassing huge amounts of gold bullion; some have said their appetite for bullion has been "staggering." And with a new gold-backed Yuan to be issued next Tuesday, the entire world will have a choice of a new currency to use for international trade: The old US Dollar which is backed by nothing, or the new Chinese Yuan, which is backed by gold. Which currency would YOU use? When this new currency is issued, countries that have been forced to use US Dollars for decades, and have had to keep billions of dollars in their foreign currency reserves, will be free to dump those dollars. But they won't be able to dump them to China for the new gold-backed, Yuan! China has reportedly decided"there can be no conversion of gold-backed Yuan to or from US dollars." What China fears is that many countries around the world will want to trade their reserve US dollars for the new Yuan, leaving China with mountains of worthless US dollars. China already has several trillion in US dollar reserves and does not want or need more. If news of this decision by China is correct, then countries around the world may just have to decide whether or not they wish to continue trading with the USA at all? The upheaval this could cause as early as next week, would be staggering. https://www.superstation95.com/index.php/world/1152 http://bbs.chinadaily.com.cn/forum.php?mod...ead&tid=1844662 http://engforum.pravda.ru/index.php?/topic...ed-by-macaense/ China's big four banks, StanChart, ANZ to join yuan gold benchmark http://reut.rs/1qofAqj |

|

|

Apr 19 2016, 10:40 AM Apr 19 2016, 10:40 AM

|

Senior Member

669 posts Joined: Jan 2005 From: Kandang Lembu, KL |

QUOTE(allenpee85 @ Apr 18 2016, 09:22 PM) Does anyone know what's the differences between public mutual and Fundsupermart? public mutual are generally sold through agent, in which the sales charge is usually 6% , even though you buy through their public mutual online the service charge is the same . They only sell public mutual funds. They are pioneer in unit trust industry and thus can claim they are the biggest unit trust company.Can give some comparisons in terms of pro and con? FSM is a online platform that sells unit trust from various company like cimb, kenanga, eastspring and etc . being online they do not rely on agent and thus save on commision fee, thus their sales charges are 2% or below. the cons is that you need to monitor and manage your own fund. They do not sell public mutual fund. |

|

|

Apr 19 2016, 06:21 PM Apr 19 2016, 06:21 PM

|

Senior Member

664 posts Joined: Jun 2009 |

i think the 1MDB news is really shaking the faith of investors in KLCI. today's market seems to be affected by it.

|

|

|

Apr 19 2016, 06:41 PM Apr 19 2016, 06:41 PM

|

Junior Member

95 posts Joined: May 2010 |

Any recommendations for buying which fund?

|

|

|

Apr 19 2016, 06:48 PM Apr 19 2016, 06:48 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(allenpee85 @ Apr 19 2016, 06:41 PM) http://www.fundsupermart.com.my/main/resea...tormaincode=All http://www.fundsupermart.com.my/main/resea...ober-2013--3983 |

|

|

Apr 20 2016, 12:09 AM Apr 20 2016, 12:09 AM

|

Senior Member

2,525 posts Joined: Sep 2013 |

I'm curious regarding index funds. Low cost index funds can be bought in malaysia ? Any platforms?

|

|

|

|

|

|

Apr 20 2016, 06:00 AM Apr 20 2016, 06:00 AM

|

Junior Member

95 posts Joined: May 2010 |

QUOTE(T231H @ Apr 19 2016, 06:48 PM) http://www.fundsupermart.com.my/main/resea...tormaincode=All http://www.fundsupermart.com.my/main/resea...ober-2013--3983 If such recommended funds, usually gain most of the time than loss? (based on your past experiences) |

|

|

Apr 20 2016, 07:46 AM Apr 20 2016, 07:46 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

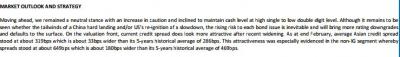

QUOTE(allenpee85 @ Apr 20 2016, 06:00 AM) I just make up my mind to Kenanaga Growth Fund.. just a reminder, recommended funds are not sure win.....If such recommended funds, usually gain most of the time than loss? (based on your past experiences) their selection selection criteria are based on..... Recommended Fund Methodology http://www.fundsupermart.com.my/main/resea...tormaincode=All QUOTE(allenpee85 @ Apr 18 2016, 08:09 AM) ....What is IRR? seems like Kenanga Growth fund cannot meet your criteria this time round.....Have anyone making more than 8 pct from single fund in a short period? Let's say 6 months. Attached image(s)  |

|

|

Apr 20 2016, 07:58 AM Apr 20 2016, 07:58 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Apr 20 2016, 08:32 AM Apr 20 2016, 08:32 AM

|

Senior Member

669 posts Joined: Jan 2005 From: Kandang Lembu, KL |

The low cost index fund are those ETF that are available on sale in KLSE , there are several fund such ETF in m'sia

FTSE Bursa Malaysia KLCI ETF CIMB FTSE ASEAN 40 MALAYSIA (0822EA) CIMB FTSE China 50 (0823EA) Equity ETF (Shariah Compliant) MyETF-DJIM25 (0821EA) MyETF MSCI Malaysia Islamic Dividend (0824EA) MYETF MSCI South East Asia Islamic Dividend (0825EA) MyETF Thomson Reuters Asia Pacific Ex-Japan Islamic Agribusiness (0826EA) http://www.bursamalaysia.com/market/securi...aded-funds-etfs the cost to buy is your brokerage fee which is min rm8 or 0.42% (depending on which broker you use) . management fee is 0.5% , ETF not popular in msia yet, daily volume is low . Cost wise is cheaper than unit trust but performance wise is so so |

|

|

Apr 20 2016, 08:51 AM Apr 20 2016, 08:51 AM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(T231H @ Apr 20 2016, 07:46 AM) just a reminder, recommended funds are not sure win..... I am having this for EPF investment... their selection selection criteria are based on..... Recommended Fund Methodology http://www.fundsupermart.com.my/main/resea...tormaincode=All seems like Kenanga Growth fund cannot meet your criteria this time round |

|

|

Apr 20 2016, 10:39 AM Apr 20 2016, 10:39 AM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(kkk8787 @ Apr 20 2016, 12:09 AM) There are no low cost funds domiciled in Malaysia. They are mainly US products. Some forumers here open online trading with some foreign stock-broking account to buy US ETFs (DIY option). If you like hand-holding, then seek a License Financial Planner to open an account with some offshore trust (e.g. Premier Assurance Trust domiciled in British Virgin Island) to buy into Vanguard / Spyder / IShare low cost index mutual funds. Xuzen This post has been edited by xuzen: Apr 20 2016, 10:40 AM |

|

|

Apr 20 2016, 12:28 PM Apr 20 2016, 12:28 PM

Show posts by this member only | IPv6 | Post

#360

|

Senior Member

1,498 posts Joined: Nov 2012 |

https://www.imoney.my/articles/how-to-achie...our-30s-40s-50s

This is such a badly written piece... All the expected returns plug from sky. How to consistent achieve 10% returns from fixed income and 22% returns from global funds. And I blame CIMB Principal since the article is written in partnership with them The only good about the article is the infographic, which I wish FSM can do more *to the FSM staff who is lurking here |

|

Topic ClosedOptions

|

| Change to: |  0.0389sec 0.0389sec

0.60 0.60

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 04:58 PM |