Buy at 6 to 7, collect dividend - win

Buy more than 9-10, dividend only cover loss.

Conclusion, need to buy at average low to win.

STOCK MARKET DISCUSSION V150

STOCK MARKET DISCUSSION V150

|

|

May 23 2022, 05:32 PM May 23 2022, 05:32 PM

|

Junior Member

897 posts Joined: May 2019 |

Buy at 6 to 7, collect dividend - win

Buy more than 9-10, dividend only cover loss. Conclusion, need to buy at average low to win. |

|

|

|

|

|

May 23 2022, 05:39 PM May 23 2022, 05:39 PM

Show posts by this member only | IPv6 | Post

#60402

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

May 23 2022, 05:43 PM May 23 2022, 05:43 PM

|

Junior Member

897 posts Joined: May 2019 |

|

|

|

May 23 2022, 06:03 PM May 23 2022, 06:03 PM

Show posts by this member only | IPv6 | Post

#60404

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(wayton @ May 23 2022, 05:43 PM) Since 2015,Mayban traded once briefly at around 7.This is a chart posted in June 2020. It's an unadjusted stock price chart.  As can be seen, buying at 7 is pure handpicking the sweet spots. Anyway, with that chart, one can do own study. Calculate the dividends as per dates. Choose one study. Buy at lowest price EACH year. Another study, buy at the highest price EACH year. See the end result. Ask if there's meat or not? Can it beat Kwsp dividends to us? |

|

|

May 23 2022, 06:27 PM May 23 2022, 06:27 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(wayton @ May 23 2022, 05:43 PM) Found my old post. Addressed to Billy. post #2254 Price of Mayban then was 7.62. Tolday,Mayban much higher. Wasn't it almost 9.10 when the rates were raised. What was the factor behind the share price increase? Well Mayban earnings increased to 8 Bil from 6.5 Bil. Some called it earnings growth. Fantastic. That's why price went from 7.62 to 9. Some call it? Nonsense. Cause that 6.5 billion earnings the previous year was a massive disaster. Yup, pick ur poison but the earnings improvement is why the share is finally back to 9 bucks. Clearly earnings growth is a much bigger factor than just dividends. |

|

|

May 23 2022, 06:54 PM May 23 2022, 06:54 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

So which price reference to use? 7.62 or 9 bucks (today price) to use?

Me? I would use maybe 7.50. Why? Risk is important for me. So instead of staring at the potential castles in the air, I prefer to keep my feet on the ground and stare at the possible shit case scenario. Yup, ask myself, what if shit happen today... how would the 'investment of the share' I bought since 2015 or 2016 or 2017 have fared if I held on and the price today, due to current worldwide economics, the share fell to 7.50. How useful was the dividends I had collected all this while? Yup. DO the bloody stress test. Yes exactly! How good is dividend investing? Could it survive the bad times? Yup... my 9 sen opinion on this. This post has been edited by Boon3: May 23 2022, 06:55 PM |

|

|

|

|

|

May 24 2022, 12:55 AM May 24 2022, 12:55 AM

Show posts by this member only | IPv6 | Post

#60407

|

Junior Member

63 posts Joined: Feb 2021 |

So guys just a hypothetical question;

If someone gave you RM1K and you could only invest it in stocks (bursa). How many companies would you buy? If just one, which company(ies) or what type of stock(s)? Assume all your other personal finance priorities are sorted and this money is simply extra. Personally I would probably get just one stock. Maybe Maybank. Mainly cz the drip would help you grow your stake in there too while avoiding trading fees. What would you guys do? Just a hypothetical scenario. |

|

|

May 24 2022, 08:24 AM May 24 2022, 08:24 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

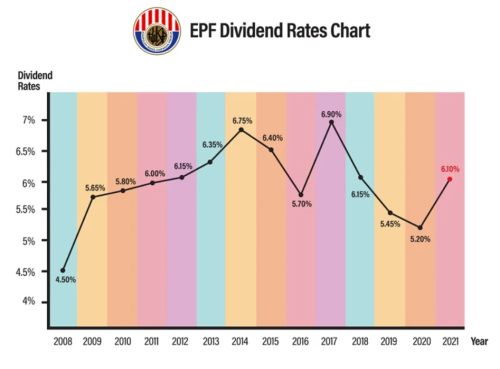

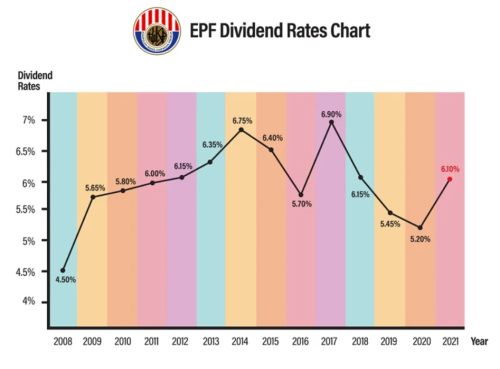

QUOTE(george_dave91 @ May 24 2022, 12:55 AM) So guys just a hypothetical question; Here's a simple exercise. Assume one bought Maybank 10 years ago and held it today.If someone gave you RM1K and you could only invest it in stocks (bursa). How many companies would you buy? If just one, which company(ies) or what type of stock(s)? Assume all your other personal finance priorities are sorted and this money is simply extra. Personally I would probably get just one stock. Maybe Maybank. Mainly cz the drip would help you grow your stake in there too while avoiding trading fees. What would you guys do? Just a hypothetical scenario. Dividends collected from 2013 till today = 0.33 + 0.535 + 0.57 + 0.54 + 0.52 + 0.55 + 0.57 + 0.64 + 0.52 + 0.58 = 5.355 (or RM5335.00 per 1,000 shares) Maybank traded at a high of 10.80 and low of 8.90 in 2013. Buy at lowest price in 2013 at 8.90. Share price today (yesterday closing price) = 8.98 Total dividends collected = 5.335 Total share value + dividends collected = 14.315 And this works out to a CAGR gain of only 4.81%.  Source: https://ringgitplus.com/en/blog/Personal-Fi...dend-Rates.html Average last 10 year dividend rates from KWSP = 6.15%. Which means if we invested in KWSP a sum of 8.9k, in 10 years that investment would be worth 16.1k So clearly investing in Maybank wasn't as good as leaving the money in KWSP and collect dividends. Now logically it's hard to buy at lowest price. In real life, buying at the years high is likely scenario many a times for many people. But let's use average. Year high in 2013 was 10.80. Year low 8.90. So average price would would 9.85. So same exercise. Using average price of 9.85. Price today 8.98. Sudah rugi there.... total value + dividend = 14.315. And this works out to a CAGR gain of only 3.81%. If that 9.85k was invested in KWSP, right now the investment would be worth 17.89k. Massive difference. Clearly investing for dividends in Maybank and holding it for 10 years isn't as profitable. The returns is kacang putih. ** yeah imagine if one was 'unlucky' and bought at 10.80? ** which comes back to the main question: Where's the meat? ** Dividends investing is way over rated. Dividends is not constant. Share price isn't either. When profits falls, dividends fall, share price will fall too! ** and yeah... previous data does not guarantee future... but if past is below average, what guarantee that the future is much better? george_dave91, tbgreen, and 1 other liked this post

|

|

|

May 24 2022, 08:41 AM May 24 2022, 08:41 AM

Show posts by this member only | IPv6 | Post

#60409

|

Junior Member

192 posts Joined: Feb 2022 |

QUOTE(george_dave91 @ May 24 2022, 12:55 AM) So guys just a hypothetical question; My opinion, if you were to die die pick a stock. My vote goes to United Plantation. Dividends are far more superior than maybank, top notch management (Some may argue wth they are doing with forward contract selling) eager to increase production efficiency and reputable company that many MNCs like to deal with.If someone gave you RM1K and you could only invest it in stocks (bursa). How many companies would you buy? If just one, which company(ies) or what type of stock(s)? Assume all your other personal finance priorities are sorted and this money is simply extra. Personally I would probably get just one stock. Maybe Maybank. Mainly cz the drip would help you grow your stake in there too while avoiding trading fees. What would you guys do? Just a hypothetical scenario. It's trading at RM14. so you need to top up rm460 to buy it. And to repeat. It's only my own analysis. Anyone can share their opinion too. And today best company may not be best for tomorrow. Do your own due diligent! This post has been edited by thkent91: May 24 2022, 08:50 AM george_dave91 liked this post

|

|

|

May 24 2022, 09:06 AM May 24 2022, 09:06 AM

|

Senior Member

4,499 posts Joined: Mar 2014 |

QUOTE(Boon3 @ May 23 2022, 05:05 PM) LOL!! I remember that. I remembered. You were the one I mentioned, where is the meat for Maybank back in 2019. Anyway, back to the issue of comparison. It's a random 5 year back comparison. And that's what I always do and will continue to do. Why? Cause it's random and I am not handpicking the prices. So if say, end Oct, if someone asks me the same thing, the process is still the same. Open the chart, say Maybank, I will then just the stock I want to compare with. Set the time frame to 5 years. That's it. That's my sop for comparison. Randomly as possible. That's how I do it. So in a sense it's not buta buta buy at whatever prices. ps.. Dig up my old posting. You will lose money if you simply buta buta buy at wherever prices, despite the dividends. Dividend investing is a fallacy. You cannot simply buta buta buy and pray and hope that the stock market is forgiving. It was in 2H2019, Maybank has dropped to/below RM9 from high of 10+ in 2018. N I say can start accumulating/average down as I was seeing a recovery. I think it would have been a decent call, if not for Covid. But then Covid came n price collapsed to a low of RM7.02 (if not mistaken). Now, even if one doesn't average down/cut loss after the first purchase, let say, average price is RM9.00, one would still be about flat now price wise, and got RM1.49 in dividends total (5 dividends since 2H2019) It's not a great return, but not horrible, considering one went through covid, , much political uncertainty within that time period. At least one comply with Buffet Rule 1 of Investing: Not Lose Money. Averaging down in March 2020 would give much better results. QUOTE(Boon3 @ May 23 2022, 06:54 PM) 9 sen..opinion price gone up coz of Inflation? 😆This post has been edited by Cubalagi: May 24 2022, 09:07 AM |

|

|

May 24 2022, 09:11 AM May 24 2022, 09:11 AM

|

Senior Member

4,499 posts Joined: Mar 2014 |

|

|

|

May 24 2022, 09:37 AM May 24 2022, 09:37 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Cubalagi @ May 24 2022, 09:06 AM) I remember that. What to expect? It was in 2H2019, Maybank has dropped to/below RM9 from high of 10+ in 2018. N I say can start accumulating/average down as I was seeing a recovery. I think it would have been a decent call, if not for Covid. But then Covid came n price collapsed to a low of RM7.02 (if not mistaken). Now, even if one doesn't average down/cut loss after the first purchase, let say, average price is RM9.00, one would still be about flat now price wise, and got RM1.49 in dividends total (5 dividends since 2H2019) It's not a great return, but not horrible, considering one went through covid, , much political uncertainty within that time period. At least one comply with Buffet Rule 1 of Investing: Not Lose Money. Averaging down in March 2020 would give much better results. 9 sen..opinion price gone up coz of Inflation? 😆 inflation la... roti canai up... opinion must also up... .... and doesn't this still reflect what I had been saying all this while for Maybank? Where's the meat? Look at the return after taking on that risky daredevil move of averaging down? Satisfied with it? And the other most important thing is Maybank is not cheap. 8k or 9k per 1,000 shares? That's a lot of money. So how many things could one have average down? 4 times? 5 times? That's at least another 40k or 50k dumped in, just because one had bought at a high price of 10. Yup 50k to salvage an initial mistake that one could easily rid off by paying a couple hundred bucks. So when 7.00 come, it was only up for grab for a day or two only... as it rebounded off that rather quickly... how many would actually made that bid? Esp when the market was crashing? and meanwhile... the most important thing... when all these big money is used to salvage this initial lousy idea of putting money into Maybank..... the biggest once in a life time opportunity occured. Yup... then the sunshine days for gloves came. And yes, there are more than a few I knew, who could not buy all because their investment money was tied up. that's the very important lesson. how could they buy stocks like TG or SM when their money is stuck in stocks like Maybank? Just like in war, one needs to understand (and leave ego aside) and learn to choose which battle to fight. Just like in stock market, one does not get bonus money investing in a difficult investment decision where the rewards is minimal at best. Learning and choosing the big fat pitch to swing is far more important. Will never ever agree with you on average down. That's why many 'investors' lose money in the long run. Can't blame cos the utmost important rule is having conviction in one's reasoning... but conviction has always been an extreme thin line...... cos this is where Mr. Stubborn comes to play and the gravest danger is the inability to admit that perhaps their reasoning could be wrong.......... and when they are so convinced that they are correct.... they will never admit they are wrong despite the stock market clearly telling them they are wrong.... hence they will always do the kamikaze averaging down... and they buy more and more and more of their mistake...... Yup... how many times Uncle Buffett must teach to stop digging when in a hole? my 9 sen la ( better not raise my price again today tbgreen and criticalbomb liked this post

|

|

|

May 24 2022, 12:54 PM May 24 2022, 12:54 PM

Show posts by this member only | IPv6 | Post

#60413

|

Senior Member

2,992 posts Joined: Feb 2015 |

QUOTE(Boon3 @ May 24 2022, 09:37 AM) What to expect? After so long, you slowly raising your sen. Inflation ka? 👀🤭inflation la... roti canai up... opinion must also up... .... and doesn't this still reflect what I had been saying all this while for Maybank? Where's the meat? Look at the return after taking on that risky daredevil move of averaging down? Satisfied with it? And the other most important thing is Maybank is not cheap. 8k or 9k per 1,000 shares? That's a lot of money. So how many things could one have average down? 4 times? 5 times? That's at least another 40k or 50k dumped in, just because one had bought at a high price of 10. Yup 50k to salvage an initial mistake that one could easily rid off by paying a couple hundred bucks. So when 7.00 come, it was only up for grab for a day or two only... as it rebounded off that rather quickly... how many would actually made that bid? Esp when the market was crashing? and meanwhile... the most important thing... when all these big money is used to salvage this initial lousy idea of putting money into Maybank..... the biggest once in a life time opportunity occured. Yup... then the sunshine days for gloves came. And yes, there are more than a few I knew, who could not buy all because their investment money was tied up. that's the very important lesson. how could they buy stocks like TG or SM when their money is stuck in stocks like Maybank? Just like in war, one needs to understand (and leave ego aside) and learn to choose which battle to fight. Just like in stock market, one does not get bonus money investing in a difficult investment decision where the rewards is minimal at best. Learning and choosing the big fat pitch to swing is far more important. Will never ever agree with you on average down. That's why many 'investors' lose money in the long run. Can't blame cos the utmost important rule is having conviction in one's reasoning... but conviction has always been an extreme thin line...... cos this is where Mr. Stubborn comes to play and the gravest danger is the inability to admit that perhaps their reasoning could be wrong.......... and when they are so convinced that they are correct.... they will never admit they are wrong despite the stock market clearly telling them they are wrong.... hence they will always do the kamikaze averaging down... and they buy more and more and more of their mistake...... Yup... how many times Uncle Buffett must teach to stop digging when in a hole? my 9 sen la ( better not raise my price again today |

|

|

|

|

|

May 24 2022, 01:22 PM May 24 2022, 01:22 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(AthrunIJ @ May 24 2022, 12:54 PM) Hush! Got complain already.... AthrunIJ liked this post

|

|

|

May 24 2022, 02:25 PM May 24 2022, 02:25 PM

Show posts by this member only | IPv6 | Post

#60415

|

All Stars

12,273 posts Joined: Oct 2010 |

QUOTE(Boon3 @ May 24 2022, 08:24 AM) Here's a simple exercise. Assume one bought Maybank 10 years ago and held it today. DAMN! Now you tellme! Dividends collected from 2013 till today = 0.33 + 0.535 + 0.57 + 0.54 + 0.52 + 0.55 + 0.57 + 0.64 + 0.52 + 0.58 = 5.355 (or RM5335.00 per 1,000 shares) Maybank traded at a high of 10.80 and low of 8.90 in 2013. Buy at lowest price in 2013 at 8.90. Share price today (yesterday closing price) = 8.98 Total dividends collected = 5.335 Total share value + dividends collected = 14.315 And this works out to a CAGR gain of only 4.81%.  Source: https://ringgitplus.com/en/blog/Personal-Fi...dend-Rates.html Average last 10 year dividend rates from KWSP = 6.15%. Which means if we invested in KWSP a sum of 8.9k, in 10 years that investment would be worth 16.1k So clearly investing in Maybank wasn't as good as leaving the money in KWSP and collect dividends. Now logically it's hard to buy at lowest price. In real life, buying at the years high is likely scenario many a times for many people. But let's use average. Year high in 2013 was 10.80. Year low 8.90. So average price would would 9.85. So same exercise. Using average price of 9.85. Price today 8.98. Sudah rugi there.... total value + dividend = 14.315. And this works out to a CAGR gain of only 3.81%. If that 9.85k was invested in KWSP, right now the investment would be worth 17.89k. Massive difference. Clearly investing for dividends in Maybank and holding it for 10 years isn't as profitable. The returns is kacang putih. ** yeah imagine if one was 'unlucky' and bought at 10.80? ** which comes back to the main question: Where's the meat? ** Dividends investing is way over rated. Dividends is not constant. Share price isn't either. When profits falls, dividends fall, share price will fall too! ** and yeah... previous data does not guarantee future... but if past is below average, what guarantee that the future is much better? |

|

|

May 24 2022, 02:42 PM May 24 2022, 02:42 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

May 24 2022, 02:57 PM May 24 2022, 02:57 PM

Show posts by this member only | IPv6 | Post

#60417

|

All Stars

12,273 posts Joined: Oct 2010 |

|

|

|

May 24 2022, 02:59 PM May 24 2022, 02:59 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

May 24 2022, 03:04 PM May 24 2022, 03:04 PM

Show posts by this member only | IPv6 | Post

#60419

|

All Stars

12,273 posts Joined: Oct 2010 |

QUOTE(Boon3 @ May 24 2022, 02:59 PM) That's why la... I say yours don't count. Thanks to my friend. He said: Sai lang! All IN! He bought around Rm2.50 as i remember.RM3+ ?? chop leg, chop hand also don't sell lo... Don't say don't sell. i bought HSBC 1989 HKD2.50 during Tianamen. Sold GBP9 2009 because scared of US Sub prime lending. Lucky me! |

|

|

May 24 2022, 10:50 PM May 24 2022, 10:50 PM

Show posts by this member only | IPv6 | Post

#60420

|

Junior Member

626 posts Joined: Jul 2020 From: Land of Honah Lee |

QUOTE(george_dave91 @ May 24 2022, 12:55 AM) So guys just a hypothetical question; it's a hypothetical question, but there are also many considerations. If someone gave you RM1K and you could only invest it in stocks (bursa). How many companies would you buy? If just one, which company(ies) or what type of stock(s)? Assume all your other personal finance priorities are sorted and this money is simply extra. Personally I would probably get just one stock. Maybe Maybank. Mainly cz the drip would help you grow your stake in there too while avoiding trading fees. What would you guys do? Just a hypothetical scenario. I don't recommend buying stocks if only RM1000 is available. If you want me to answer, if I could only invest in 1 stock, to hold long term,, without looking at share price, I'd go for Public Bank. (coz I'm impressed with their long track record & conservative approach in business) PBBANK is an established bank with conservative lending, with no shortage of talents going there. It is also the bellwether for Msia's economy. I believe Msia's economy will recover after all lockdowns & opening of all businesses. If you want the answer of companies that I like: Public Bank, Hartalega, QL |

| Change to: |  0.0448sec 0.0448sec

0.47 0.47

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 05:51 AM |