Outline ·

[ Standard ] ·

Linear+

STOCK MARKET DISCUSSION V150

|

Boon3

|

May 20 2022, 01:40 PM May 20 2022, 01:40 PM

|

|

QUOTE(billy_overheat @ May 20 2022, 01:30 PM) There are a lot more but it's in a choppy market. Up one day few days down. It doesn't hurt to wait till sentiment turns. Qes seems leading in price but biz wise, it's not that impressive. They boasted about getting into manufacturing and now it's slowing down. Some fans even cheered for it to be the next vitrox.  Market leader? Fansi? Hohoho...you must be in a secret gang.  |

|

|

|

|

|

SUSYH1234

|

May 20 2022, 02:22 PM May 20 2022, 02:22 PM

|

|

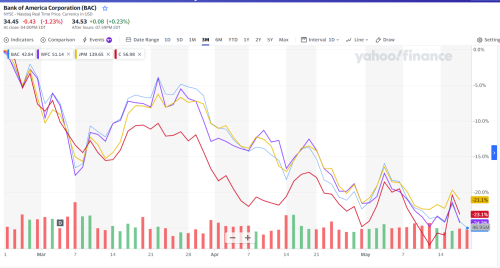

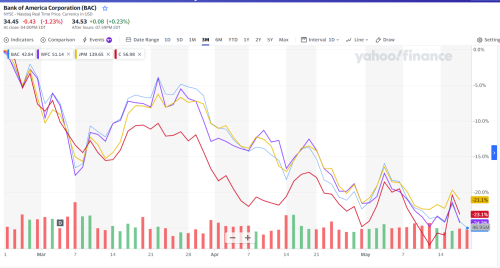

QUOTE(Boon3 @ May 20 2022, 12:36 PM) here is the comparison... Bank of America Wells Fargo JPM Citi this is how they have fared since March 2022  but almost every stock in usa have the same pattern since march, is bank stock drop the most? malaysia bank stock is uptrend since last six month, i doubt if this short term trend really tell anything. my interpretation is merely from a commoner emotional aspect, i really have no idea how interest movement impact bank profitability. in my exchange with bankers along the years, i noticed most are very secretive and refuse to divulge much their costing and how they make money, or big money. since our bnm can close both eyes on 1mdb, i suspect many centrai bank in the world might also have the habit of closing at least one eye sometimes or most of the times. |

|

|

|

|

|

criticalbomb

|

May 20 2022, 02:24 PM May 20 2022, 02:24 PM

|

New Member

|

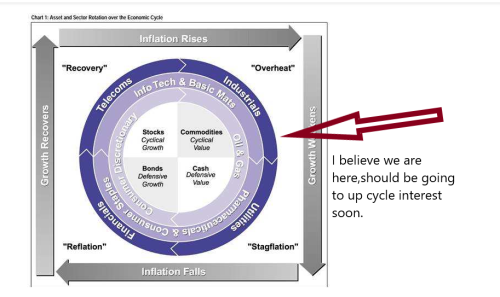

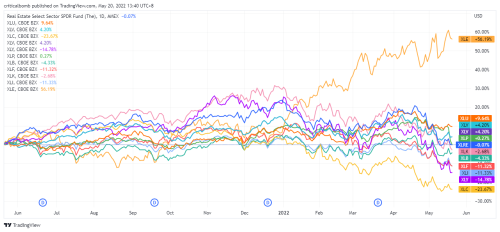

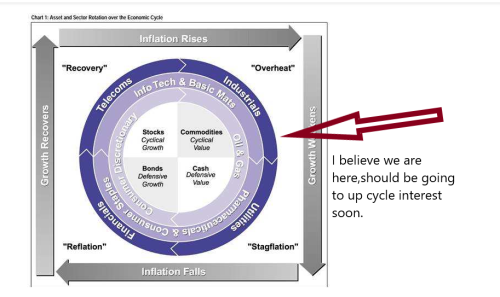

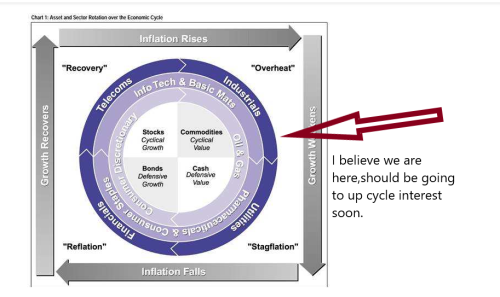

QUOTE(YH1234 @ May 20 2022, 12:12 PM) is interest spread a transparent information? bank not necessarily gain more when interest rate hike, but they are in better shape compare to rest relatively speaking, most choose to park their fund in bank or bank stock during slow down and inflation, thats the main reason i guess why bank stock goes up. recession could be another story.   For me,i hold same cash now while waiting opportunity to came. Oil/commodity counter both should be at peak earning,i believe inflation should be peak as we move though interest up cycle. |

|

|

|

|

|

SUSYH1234

|

May 20 2022, 02:42 PM May 20 2022, 02:42 PM

|

|

QUOTE(criticalbomb @ May 20 2022, 02:24 PM)   For me,i hold same cash now while waiting opportunity to came. Oil/commodity counter both should be at peak earning,i believe inflation should be peak as we move though interest up cycle. oil counter is still low if we compare against the previous surge, most probably due to too many conman in our oil and gas industry, hence investor scared while speculator hesitate. if oil price remain above 90 for another 3 to 6 months, we might see further upswing. buy when stock is down, i thought this is the opportunity one is waiting for? This post has been edited by YH1234: May 20 2022, 02:43 PM |

|

|

|

|

|

Boon3

|

May 20 2022, 02:47 PM May 20 2022, 02:47 PM

|

|

QUOTE(YH1234 @ May 20 2022, 02:22 PM) but almost every stock in usa have the same pattern since march, is bank stock drop the most? malaysia bank stock is uptrend since last six month, i doubt if this short term trend really tell anything. my interpretation is merely from a commoner emotional aspect, i really have no idea how interest movement impact bank profitability. in my exchange with bankers along the years, i noticed most are very secretive and refuse to divulge much their costing and how they make money, or big money. since our bnm can close both eyes on 1mdb, i suspect many centrai bank in the world might also have the habit of closing at least one eye sometimes or most of the times. For me, I think banks should do okay. I just don't see the boom factor. Many would really want to borrow more when borrowing just became more expensive? The earnings won't boom if the loan growth doesn't boom. That's what I am thinking. |

|

|

|

|

|

pub_yu

|

May 20 2022, 03:58 PM May 20 2022, 03:58 PM

|

Getting Started

|

QUOTE(YH1234 @ May 20 2022, 12:12 PM) is interest spread a transparent information? bank not necessarily gain more when interest rate hike, but they are in better shape compare to rest relatively speaking, most choose to park their fund in bank or bank stock during slow down and inflation, thats the main reason i guess why bank stock goes up. recession could be another story. well, another way we can see is the fixed versus floating rate composition, i.e. mortage versus hire purchase/PL type. Floating definitely gives more upside or control power for the bank to manage the NIM |

|

|

|

|

|

billy_overheat

|

May 21 2022, 07:06 AM May 21 2022, 07:06 AM

|

|

QUOTE(Boon3 @ May 20 2022, 01:40 PM)  Market leader? Fansi? Hohoho...you must be in a secret gang.  I have no idea why do some comments say that.  Sometimes you just sort of accidentally read some funny comments when you're digging around  |

|

|

|

|

|

Boon3

|

May 21 2022, 08:14 AM May 21 2022, 08:14 AM

|

|

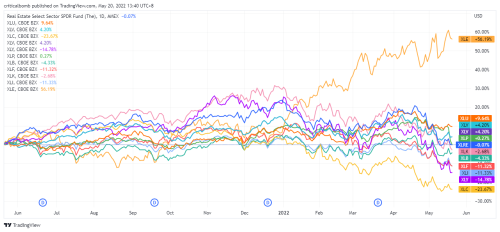

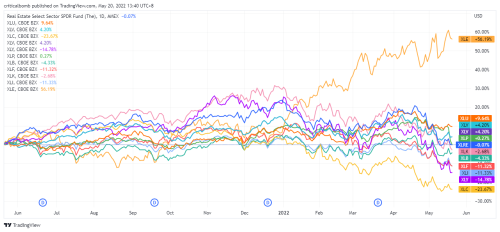

QUOTE(billy_overheat @ May 21 2022, 07:06 AM) I have no idea why do some comments say that.  Sometimes you just sort of accidentally read some funny comments when you're digging around  Old uncle taught me once that if you dig too much, your nose will get too big! What are the charts telling..? .... and yeah, old uncle also say what one own is always the best and it has no faults one. |

|

|

|

|

|

howyoulikethat

|

May 21 2022, 05:24 PM May 21 2022, 05:24 PM

|

|

QUOTE(Boon3 @ May 18 2022, 04:28 PM) Well... you want to look for the known and tested master or you want to discover a new one? In current market, where do you think you will find success? Look at this Panda.. last 10 years.. okay it did well but after that? If you have one and only one bet... would you dare say... this is it, this is the one I bet my house on? since Panda has continued expansion of its factory in Batu Kawan, some branch in Yokohama & Jiangsu plant on the way, it must be confident of its future. Its huge cash pile serves as a good backup for future expansion or used for miniscule dividends too. Revenue is still growing. Cash from operations have been increasing. Vitrox may seem to have better growth, but Panda is catching up... What do you think ah, Boon3?  |

|

|

|

|

|

billy_overheat

|

May 21 2022, 06:56 PM May 21 2022, 06:56 PM

|

|

QUOTE(Boon3 @ May 21 2022, 08:14 AM) Old uncle taught me once that if you dig too much, your nose will get too big! What are the charts telling..? .... and yeah, old uncle also say what one own is always the best and it has no faults one. Endowment effect with confirmation bias. Big no no. Chart just shows a possibility of reversal but it is easily to go north, or south and betting based on TA solely is just gambling with lines which can be redrawn easily  |

|

|

|

|

|

Boon3

|

May 21 2022, 07:34 PM May 21 2022, 07:34 PM

|

|

QUOTE(billy_overheat @ May 21 2022, 06:56 PM) Chart just shows a possibility of reversal but it is easily to go north, or south and betting based on TA solely is just gambling with lines which can be redrawn easily  Hadn't this always been the case when you trade base soley on the charts? So which brings the question... lu apa? Trader or Investor?  So what else do you really see in your fav tech stock chart? |

|

|

|

|

|

OngMaliOng69

|

May 22 2022, 01:06 AM May 22 2022, 01:06 AM

|

New Member

|

QUOTE(square2 @ May 20 2022, 12:56 PM) i asked you to wait then buy, not buy then wait  Haha no la, i already entered last last week, will reload again once there are good news  |

|

|

|

|

|

OngMaliOng69

|

May 22 2022, 01:07 AM May 22 2022, 01:07 AM

|

New Member

|

Very difficult to be a trader in Bursa..will just buy in the dump for the established companies

|

|

|

|

|

|

OngMaliOng69

|

May 22 2022, 01:08 AM May 22 2022, 01:08 AM

|

New Member

|

Got sum in magnum and genm for some sweet dividends  |

|

|

|

|

|

zstan

|

May 22 2022, 12:25 PM May 22 2022, 12:25 PM

|

|

QUOTE(Boon3 @ May 20 2022, 02:47 PM) For me, I think banks should do okay. I just don't see the boom factor. Many would really want to borrow more when borrowing just became more expensive? The earnings won't boom if the loan growth doesn't boom. That's what I am thinking. Banks don't need to boom la. Just need to grow their share price 5% every year and pay it as dividend I syukur liao  |

|

|

|

|

|

Boon3

|

May 22 2022, 12:41 PM May 22 2022, 12:41 PM

|

|

QUOTE(zstan @ May 22 2022, 12:25 PM) Banks don't need to boom la. Just need to grow their share price 5% every year and pay it as dividend I syukur liao   Got ah? |

|

|

|

|

|

Boon3

|

May 22 2022, 12:56 PM May 22 2022, 12:56 PM

|

|

QUOTE(zstan @ May 22 2022, 12:25 PM) Banks don't need to boom la. Just need to grow their share price 5% every year and pay it as dividend I syukur liao  Die hard Tiger Bank fansi... nah... I posted the below chart on May 11th... and this is Maybank today... the circled area was Oct 2019 (that's where I posted and asked where's the meat?)  as you can clearly see... that 5% is NOT a 100% gimme... buy wrong price, where got 5%??  |

|

|

|

|

|

Boon3

|

May 22 2022, 05:19 PM May 22 2022, 05:19 PM

|

|

QUOTE(zstan @ May 22 2022, 12:25 PM) Banks don't need to boom la. Just need to grow their share price 5% every year and pay it as dividend I syukur liao  Tiger Bank net earnings since its Fy2018 : 8.1b - > 8.2 b-> 6.5b - > 8.1b How la.. Okay la... Say the fy2020 net earnings of 6.5b is a one off blip.. you still have a company's earnings which is stagnant...  How la? Is the company really performing? Most recent quarter, net earnings is only 2 b. If no pickup in earnings, net earnings for the next fiscal year will only be 8 billion.... again. Good meh? |

|

|

|

|

|

zstan

|

May 22 2022, 10:37 PM May 22 2022, 10:37 PM

|

|

QUOTE(Boon3 @ May 22 2022, 05:19 PM) Tiger Bank net earnings since its Fy2018 : 8.1b - > 8.2 b-> 6.5b - > 8.1b How la.. Okay la... Say the fy2020 net earnings of 6.5b is a one off blip.. you still have a company's earnings which is stagnant...  How la? Is the company really performing? Most recent quarter, net earnings is only 2 b. If no pickup in earnings, net earnings for the next fiscal year will only be 8 billion.... again. Good meh? i don't care about the growth man. as long as the share price remains above my buying price and continue to give dividends i'm good  |

|

|

|

|

|

Boon3

|

May 22 2022, 11:00 PM May 22 2022, 11:00 PM

|

|

QUOTE(zstan @ May 22 2022, 10:37 PM) i don't care about the growth man. as long as the share price remains above my buying price and continue to give dividends i'm good  LOL!!! 5% where got enough la.. might as well put in Epf. |

|

|

|

|

May 20 2022, 01:40 PM

May 20 2022, 01:40 PM

Quote

Quote

0.0649sec

0.0649sec

1.15

1.15

6 queries

6 queries

GZIP Disabled

GZIP Disabled