DCA method got few risks.....

1. If the stock for some unfortunate reason goes into a severe downtrend, the DCA becomes a deadly averaging down strategy.

I did a posting on PBBank before. Used old data to back track on the assumption what if I had bought PBBANK on the high and I decided to average down .....

>>>>>>

Ok,

how about the case of buying at the wrong price for a good company? Can average down save the bad poor investment?

I will choose PBBank as an example.

1. I won't use the top most price. Just 25.00 will do.

Now for obvious reason, assume I bought PBBank at 25.00.

Now since this is a good 'fundamentally strong' company, I decided to average down la.

PBBank pays dividends also...

surely I won't die cow cow yes?

So the ORIGINAL SIN IS BUY 1000 SHARES OF pbbANK AT 25.00

2. The strategy employed.

Now obviously, since this test is based on back test data,

I have to cheat a bit...

The strategy is to buy ONLY 1,000 shares to average down.

Let's be realistic here.

it's 25,000 a pop for the original investment.

any other average down purchases, increases my capital involvement exponentially...

and I cannot cheat myself by saying I have UNLIMITED capital where I can average down forever and ever until I register a gain or recover all my initial losses(this way, also, I cannot cheat by say i averaged down at the lowest point with more shares, yes?)

so every low of the stock cycle movement, I purchase 1,000 shares to average down.

Fair?

Ok, here we go... (* I yet to count atm honestly... just writing as I go)

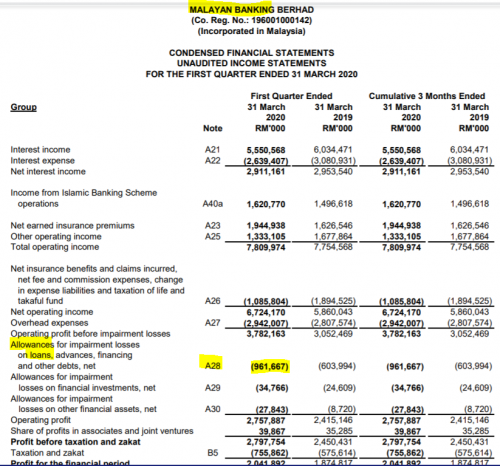

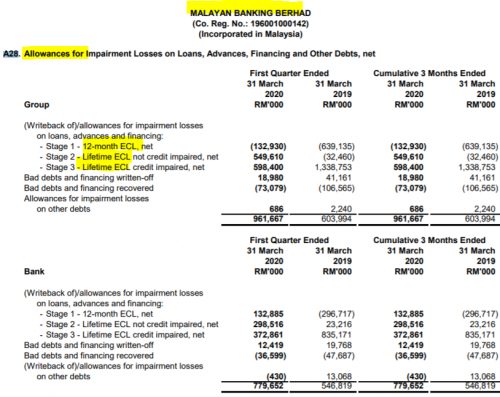

The chart and the average points...

ORIGINAL SIN 25,000

May 2019 22,480

Oct 2019 19,080

Dec 2019 18,800

Feb 2020 17,700

Mar 2020 12,600

May 2020 15,200

Jun 2020 16,200

total purchases = 8,000 shares

total invested = 147,060

* time to reflect here ..

from 1,000 shares => 8,000 shares

from 25,000 => 147,060

What did the average down strategy just did?

The investment grew exponentially!!!

Average cost = 147,080 / 8 = 18.38

PBBank reference price at today's opening is 17.00

(today PBBank closed at 16.98.. so let's leave it at 17)at market value, these 8,000 shares is now worth 136,000

Current 'paper' loss = 11,080 (dun like the term 'paper loss' A loss is a loss.

)

Now .... how much can the dividends help. (A bit of work here cos need to check the ex date and see which shares qualified for which dividends)

PBBANK dividend of 0.37 went ex on March 2019. Original Sin of 1,000 shares qualified for it. (0.37x1=0.37)

PBBANk next dividend of 0.33 went ex on 29 Aug 2019 Only 2,000 shares qualified for it. (0.33x2 = 0.66)

PBBANK next dividend of 0.40 went ex on 12 March 2020. Only 6,000 shares qualified for it. (0.40x6 = 2.40)

Total dividends received = 3.43

So paper loss = 11,080

dividend received = 3430

Therefore ... current loss = rm7,650

dump in extra 100k plus to average down and now still lose money!!

** after thoughts?

this example clearly showed that average down did not help at all (despite PBBank being a top fundamentally company)

Average down 8 times, meant increasing our investment 8 times...

we need to address this issue, yes?

we not into some fantasy game where we can average down and average down...

we have $$$ limit la

we can buy a good stock at a bad price.average down might not help us recover our initial mistake!

>>>>

Yes, the biggest thing about DCA or Averaging Down is ... 'the investment' explodes exponentially.....

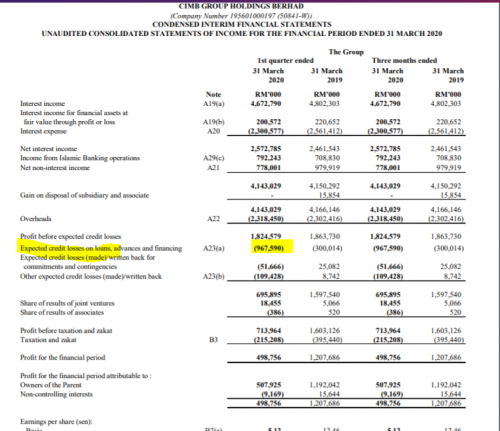

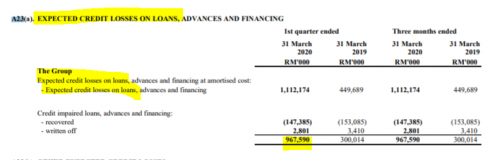

Think of Maybank now...

it's about 7.5k a pop of 1,000 shares....

how many times can you play the game of DCA?

Last but not least again ....

is there really meat in the investment?

I see. But not long enough time frame I suppose for your thought experiment.

Not enough capital to buy 1k shares every month. Haha.

Slowly top up maybank and tenaga.

)

)

Aug 24 2020, 04:29 PM

Aug 24 2020, 04:29 PM

Quote

Quote

0.0854sec

0.0854sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled